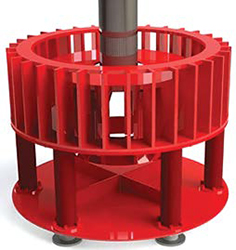

New flotation solutions help miners increase recovery, cut

costs, and improve efficiency and sustainability. Above, the

Lupromin FP A 1210 Base collector can help a customer

significantly improve recovery. (Photo: BASF)

Coarse Float Solution Demand

Drives Innovation

Other new solutions offer efficiency, sustainability improvements

By Jesse Morton, Technical Writer

Switchable Frothers for

Copper, Polymetal

In December, Solvay spun-off Syensqo,

a company that will focus on innovation

for the green transition. Solvay described

Syensqo as “a company of explorers that

will usher in breakthroughs that will advance

humanity.”

Syensqo is, in part, named after Solvay, which “has a 160-year legacy that will be passed on for generations to come,” said CEO Dr. Ilham Kadri. The new “Solvay will create and deliver essential solutions in housing, health, nutrition and mobility, which fulfill the basic needs of humanity,” she said. “It will enable vital solutions that are at the heart of people’s everyday lives.”

The mining solutions market director at Syensqo told E&MJ that the move was natural and timely. “Solvay realized that they have two very different portfolios with different needs,” said Ricardo Capanema, global marketing and business development director, mining solutions. “Syensqo is more driven by product innovation and customization of solutions to answer customers’ specific challenges,” he said. “Solvay, with a philosophy of operational excellence, is focused on innovation of the process itself. The innovation is driven to make the process more efficient to produce the product.”

Each business requires “different levels of investments, and has had different financial requirements,” Capanema said. “Trying to manage both under one set of parameters was not optimum for either of the businesses,” he said. “By separating, we believe it enables both types of business to thrive.”

The spinoff is expected to benefit the customer. “It is the same people, the same market footprint, the same products and technologies, just now with a different name,” Capanema said. “I think it will be a positive to customers of both companies because now both are better positioned to deliver on their different mandates.”

Syensqo will see comparatively more revenue going to innovation. “By having a smaller company with a very defined mandate of growth through innovation and sustainability, there is a higher level of investment and focus in executing those projects, in those opportunities,” he said. “Now it is a much more focused approach.”

Subsequently, Syensqo released three new offerings to its growing line of switchable frothers. Transfoamer frothers change strength and capabilities when pH changes, making them ideal in copper and polymetallic circuits. “We’ve recently expanded our portfolio with the introduction of the Transfoamer T-210, alongside the Transfoamer T-150 and T-220, which have also been added to our Transfoamer family,” said Genevieve Castillo, global marketing manager, mineral processing. “The T-210 is currently undergoing trials, while the T-150 and T-220 were both released earlier in August.”

The line launched last year and represented perhaps the first major innovation in frothers in six decades, she said. “The Transfoamers disrupt the flotation market.” Initially, the line featured two frothers, but then grew as customers specified exact needs that required customization and further development. The T-100 is described as a medium-strength frother that behaves like a strong alcohol in the rougher circuit. The T-120 is weaker. Both are intended to be used when clays and fines are present.

The T-210 is medium to strong, and is for plants with multiple ore sources and variable feeds. The T-220 is of a similar strength, but is a “great starter frother when working with a high presence of medium-to-coarse particles,” Syensqo literature said. The T-200 is a strong frother that behaves like strong glycol in the rougher section. It is engineered for coarse-particle copper flotation.

The T-100 and the T-200 were developed in 2022, released in 2023, and were almost immediately trialed by a major copper mine in Latin America seeking to float a coarser particle. The adoption period was rapid. Lab testing started in July and was followed by a site trial. “By October and November they incorporated the product into their system,” Castillo said. “You are talking about less than six months for the commercialization of this product.”

The results exceeded expectations. The frother increased “recovery by 3% to 5%, which is a big thing for them because they get to do coarser particle grinding into their plant and still get a good recovery overall on their copper production,” Castillo said. But increased recovery is only half the picture, Capanema said. “They produce more metal, and use less energy.” The increased recovery translated to “around $50 million of additional production,” he said. Additionally, the Transfoamer frother helped the mine cut between 2% to 10% of the energy consumed in processing the ore. “We estimate that this could be around $25 million to $30 million in additional savings.”

The intangible benefits include improved sustainability. For example, the frothers offer improved control, predictability, and stability, which combine to cut water usage and further reduce energy usage. “By having the plant more stable and by avoiding any spills, even though it might not be a major savings, the improvement of control helps to minimize the water usage,” Capanema said. “It is not just about improving recovery, but it is about improving recovery in a sustainable manner by using less of the natural resources, like water.”

Nonetheless, adoption can be rapid, which, combined with the benefits offered, is apparently appealing to the majors, Capanema said. “We do have a plan and a pipeline of customers trialing this product,” he said. “We expect a quick spike in demand and are well-prepared to respond to that.”

Collectors Enhance

Efficiency

BASF reported Lupromin FP A 1210

Base collector helped a customer improve

recovery and revenue.

The formulation is designed for use

in the direct flotation of igneous silicate-

contained phosphates and in the reverse

flotation of carbonates in sedimentary

rocks. An expert at BASF said that,

in a recent case study in the Americas, it

was adopted to answer specific challenges

and enhance flotation efficiency.

“As a result, Lupromin has improved recovery rates by 7% and consequently generated a positive financial impact of $19 million/year for the operation,” said Yoav Zuk, flotation specialist. “This product is proving to be very versatile, achieving good performance in hard water and flexibility for different flotation processes and multiple ores worldwide.”

The Lupromin flotation portfolio spans an extensive range of collectors and co-collectors designed for non-sulfide ores, including phosphate, niobium, barite, calcite, and other industrial minerals. The formulations are tailored to customer sites and, at a comparatively lower dosage, reportedly increase recovery substantially. For example, at a recent application, it achieved up to 18% higher recovery, BASF said. Company literature said that, beyond increasing recovery, the collectors decrease contaminants, increase flotation efficiency and performance, reduce energy consumption, and reduce total reagent spend.

Recent case studies show that “our solutions have helped reduce CO2 emissions and enhance health and safety by eliminating the use of hazardous chemicals, lowering energy consumption, and reducing tailings generation,” he said. “These outcomes align with our commitment to promoting sustainable mining practices and minimizing the environmental impacts.”

Currently, BASF continues researching and trialing collectors for both coarse and fine phosphate particles, as well as slimes. “We recognize that each ore has unique characteristics and requires specific froth properties for an effective flotation,” Zuk said. “Sustainability is a main driver, and our R&D team has identified an opportunity to explore new chemical solutions for phosphate tailings flotation,” he said. “Through the development of selective collectors tailored to this application, we aim to help mine operations manage their tailings in a more sustainable manner.”

BASF also announced development of “a non-fatty acid-based phosphate collector that can assist customers in meeting the requirements of specific markets, and additional non-sulfidic applications such as ilmenite, niobium and lithium,” he said. Such “innovation is at the heart of everything we do,” Zuk said. “We understand that every operation is unique and faces its own set of challenges,” he said. “Consequently, we will continue expanding our technologies and developing customized products that help our customers achieve their ambitious targets.”

Downcomers for CPF

NovaCell trials and studies continue to

prove the viability of the coarse particle

flotation (CPF) solution, an expert with

Jord International reported. “In the last

year, Jord made significant progress in

the NovaCell technology readiness level,”

said Sherwin Morgan, technology

manager, NovaCell.

NovaCell uses pressurized downcomers

and a fluidized bed to create optimal

hydrodynamic conditions for both

fine and coarse particle recovery. Feed

material is distributed across the downcomers.

In the shear zone, particles and

bubbles collide. Coarse particles fall to

the low-shear fluidized bed.

Current trials prove the design is efficient in both coarse gangue rejection and tailing scavenging applications. “A highlight has been the operation of the Nova- Cell pilot unit at a copper concentrator in the Antofagasta region of Chile,” Morgan said. “The purpose of the pilot trial was to confirm the technology benefits and provide design information for the NovaCell feed study.” The unit was packaged and delivered to the site in a 20-ft (6-m) shipping container. “It’s delivered as a completed package,” Morgan said. “Included is a classification circuit, tanks and pumps,” he said. “It also has an integrated PLC system to further reduce commissioning and mobilization.”

The trials have “given our customers the confidence that, with novel technologies like the NovaCell, ore bodies with declining feed grades can be processed economically and sustainably,” he said. “Feed studies evaluating the NovaCell technology, have increased plant revenues and lowered predicted carbon emissions per ton of metal produced.”

Based on one such study, the paper Pinto Valley Mine, Copper Recovery Study with the NovaCell, coauthored by Capstone Copper, “was awarded the CEEC High Commendations Medal in Technical Research,” Morgan said. “The paper evaluated the NovaCell in the coarse particle flotation duty, and suggested a 20% increase in plant production and a 15% reduction in carbon emissions per ton of copper produced.” Similar studies are planned for the near future. “Jord is undertaking a research program at the University of Newcastle in preparation for the NovaCell plant-scale installations in 2025/2026,” he said.

Demand for NovaCell is expected to grow alongside demand for metals for the green transition. “It is well documented that in future years there will be insufficient copper supply to meet demand,” he said. “There will be a need to increase the supply from existing operations, as well as bring new projects online.” The ore from many longtime operations is “becoming more difficult to process,” Morgan said. “The average copper grades are declining, and, in turn, the energy used in processing is increasing,” he said. “Thus, continuing to apply conventional flotation technologies to meet the copper demand is not sustainable.”

NovaCell, in contrast, is both efficient and sustainable, he said. It has separate collection zones for fine and coarse particles. It thereby reduces the number of other process units needed, cutting costs. The coarse waste can go to dry disposal, helping to improve water recovery while reducing the amount of waste going to tailings storage facilities. By reducing the amount of material requiring further processing, it cuts emissions. And with no moving parts, it is relatively easy to maintain. By checking these boxes, it can help an operation futureproof its float circuit, Morgan said. “The way forward is to adopt new innovative technologies, like the NovaCell, in CPF circuits that deliver both efficient production and reduce energy consumption.”

Mixing Solution Boosts

Efficiency

Metso introduced the FloatForce+ mixing

mechanism, a plug-and-play solution that,

the company said, maximizes metallurgical

recovery, boosts pumping efficiency,

and reduces energy consumption.

Top benefits include increased recovery

and, in turn, revenue.

The original FloatForce launched in

2006. The main components are a rotor,

stator wear parts, the stator stand, and a

wear plate. Company literature on the original

FloatForce said the mixing mechanism

“improves flotation hydrodynamics, mixing

at the same aeration rate, and maintaining

mixing at a higher air dispersion rate.”

The resulting improved hydrodynamics and aeration dispersion increases bubble area flux, improves air-hold-up volume, and increases suspension of coarse particles, Metso said. ForceFloat “gives the operator the opportunity to lower the rotation speed, contributing to lower cost of operation.” The new FloatForce+ is easily installed in existing FlorceFloat systems, an expert at Metso said. “It’s also compatible with other mixing mechanisms, needing only minimal modifications for integration,” said Christian Cardoso, product manager, mechanical flotation services.

Metso said the development is another instance of the supplier shaping the trajectory of the mechanical flotation technology industry. “Metso’s new flotation mixing mechanism marks the latest advancement in our ongoing journey of flotation innovation,” said Antti Rinne, vice president, flotation. It “represents a major milestone in our Planet Positive initiatives.”

Hub To Tweak Plant

Performance

FLSmidth announced at MINExpo that it

was officially changing its name to FLS,

the most popular and succinct moniker

for the company. The simplification

speaks to the value the company places

on efficiency, FLS said.

Separately, the supplier also launched

the Global Performance IQ Hub, a reportedly

state-of-the-art digital technology

center to help maximize mining customers’

plant potential.

Located at the FLS Global Product and Technology Center in Salt Lake City, Utah, USA, the hub is described as a collaboration space for partnering with customers on innovative, customized solutions. Data, visualizations, and insights attained and supplied by the hub aim to increase plant throughput, streamline scheduling, and improve safety and sustainability.

FLS said the development represents a significant leap forward. “By leveraging performance data, our full flowsheet expertise and advanced analytics, it enables us to further boost our customers’ performance through full-flowsheet asset optimization and reduction of the total cost of ownership,” said Joshua Meyer, service business line president. “We want to be the preferred partner for productivity enhancement, and I think this exciting offering has the potential to make a significant difference for both our customers as well for FLS.” PerformanceIQ services first launched at the PERUMIN conference in 2022.