The MDM cutterhead was transported underground on a mobile, tracked carrier to an

assembly cavern. (Photo: Robbins)

The Promise and Reality of TBMs

Mechanized boring solutions and TBMs theoretically could solve big challenges for

deepening mines. And suppliers say they will.

By Jesse Morton, Technical Writer

For example, a TBM can bore a relatively straight and sizeable access tunnel in an area that contraindicates blasting. And newer TBM designs can handle comparatively sharper turns, denser rock, and tight deadlines. Still, while the TBM star should be rising, field results show the concept has yet to prove fully viable in many seemingly suitable applications. Suppliers say, however, that recent and future innovations could be enough to tip the scale and institutionalize the TBM as standard equipment in underground mining.

Mine Development Machine

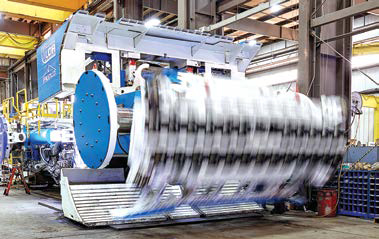

A case study by Robbins on the Mine Development Machine

(MDM) designed for and deployed at a deep silver mine in Mexico

said the unit has defeated challenges that bested predecessor

solutions.

“As of October 2024, the MDM has carried out more than

1,700 m of advance at rates up to 52 m in one week and 191 m

in a month,” the study said. “At Fresnillo, the MDM is excavating

in andesites and shales with quartz intrusions. These intrusions

have defeated earlier attempts to excavate these tunnels with

heavy roadheaders.”

An expert with the company said the MDM, first announced in September 2021, has been “fully vetted” at the mine. “The MDM is a proven technology that can work in the right mine conditions — hard rock, straight bores, with few water inflows expected,” said Javier Alcala, field service manager. Like others that have considered standard TBMs, the mine wanted the benefits offered but also needed a flat floor and less muck. “Many types of rock excavation machines have been introduced (to the industry) to cut a non-circular cross section with a flat bottom,” the study said. “Roadheaders in particular have become more capable in recent years.” Still, Roadheaders have sometimes proven less than optimal “due to low productivity or high cutter wear.”

Theoretically, the MDM seems better suited to the application due to “its ability to cut a rectangular profile in hard rock,” to provide “more usable space,” and to minimize the amount of muck produced, Robbins reported. An early rectangular model was the Reef Mole. The unit was designed by two former Robbins engineers for reef mining in deep South African platinum mines. “This machine cut a 1- x 5-m rectangle to excavate the ore,” the study said.

Fresnillo first began exploring TBM options, like the Reef Mole, to support development of a 25-km tunnel to connect four orebodies. “Robbins and their agent, Topo Machinery, worked with Fresnillo to develop a suitable MDM proposal,” the study said. “A machine concept evolved using a swinging cutterhead, similar to the Reef Mole.” The design features a 5- x 4.5-m rectangular cross section. “In this case, the cutter head swings vertically about a horizontal axis,” Robbins reported.

“Swinging the cutterhead about the horizontal axis gives the opportunity for the head to push the cut muck rearwards, onto a muck apron, much like the muck apron on a roadheader,” the study said. “The apron covers the full 5-m width. Twin loading wheel ‘propellers’ to each side of center push the muck towards the hopper in the center of the apron.” The hopper empties onto a chain conveyor that moves the muck to the rear of the MDM.

The design is front-heavy due, in part, to the overhung cutterhead. “The rear of the MDM has a ‘main beam’ that mimics the main beam of a typical hard-rock TBM,” Robbins reported. “It also has a rear gripper and thrust cylinders to advance the machine by skidding on the front fulcrum. The rear gripper and torque cylinders provide steering effect, much like on a hard-rock TBM.” The MDM tows a back-up system with seven gantries, plus three storage gantries. “The back-up gantries provide space to mount the power and control equipment, dust scrubber and ventilation system, muck removal, material, supply, and other systems,” Robbins said. “This is a real tunneling plant, that produces a finished, well-supported roadway tunnel with life-ofmine piping installed.”

An extensible high-capacity tunnel conveyor system, mounted in the center of the crown, removes the resulting muck “at fairly high gradients,” Robbins said. “This left more room for vehicles and for installation of piping and other utilities within the tunnel.” Thus centered, the tunnel conveyor belt can “be routed all of the way forward to the discharge of the MDM chain conveyor.” And as the MDM mined forward, the belt storage paid out belt. The unit was not as compact, lightweight and mobile as is typical underground mining equipment. For example, it entered the mine as three modules: the cutterhead, the front main frame, and the rear gripper section. Each was transported on a specialized, tracked carrier to the 695-m level, an 8-km trip on the main ramp tunnel. “The cross section of the assembly and launch cavern was only slightly larger than the 5- x 4.5-m dimensions of the MDM cut,” Robbins reported. “No grossly oversize excavation was needed.”

Since deployment, “new gage cutters were designed to reduce side loading,” the study said. The MDM was updated with “a more robust three-piece scraper that has a better angle of attack to allow for more efficient mucking.” Cylinders were added to the muck apron to force it down. These updates contributed to “quicker cycle times” and aid in muck removal, Robbins said. Nonetheless, “due to the cyclic, swinging cutting action, the machine has lower productivity compared to a traditional, rotary TBM that cuts a circular profile.” The study therefore shows “the MDM is not the lightweight, mobile rock excavation machine that the industry covets.”

Indeed, the unit is hefty enough to “provide effective excavation in hard rock,” it said. “Even though efforts were made to make the MDM reasonably easy to transport and assemble, it still is a large machine with significant set-up and relocation times.” A lighter, swifter design might be possible, “and development will surely be undertaken due to the demands of the mining industry,” Robbins said. “However, such a machine will surely have a penalty of decreased productivity.”

For the immediate future, and while “the MDM does not fit the application,” it is still “effective for driving longer rectangular tunnels with high productivity, such as mine access tunnels and ventilation tunnels, as well as ore-haulage tunnels for deep orebodies,” the study said. “Despite the challenges, the mine is committed to the tunneling method, which offers better safety, consistency, and a finished rectangular roadway product compared with drill-and-blast methods.”

The Mining TBM

Komatsu reported progress in trialing a mining TBM with Codelco

for Chuquicamata underground. “Since its conception, this

project has brought together professionals from Komatsu, renowned

for their extensive experience in developing and manufacturing

TBMs, and experts from Codelco, leaders in deep

mining and massive scale operations,” an expert with the supplier

said in a prepared statement.

“Throughout the various stages of the project, we have successfully integrated the discipline and results of Japanese technological development, along with Codelco’s knowledge and experience, in response to the increasing demands of deeper mining, facing adverse and complex conditions in copper porphyry deposits,” Komatsu said. “This has been achieved by applying the best practices from both companies.”

The partnership was first announced in 2022 and the trials so far have tested the unique design features that answer some of the needs of the mine and the industry. Historically, TBMs with grippers have primarily been used for straight access and infrastructure tunnels. “To enhance our TBMs flexibility and broaden use case applications, we added three new features for underground hard rock mines: small radius curve, passing intersection, and reversing capabilities based on our long-term experiences and PoC,” Komatsu said.

Compared to predecessor and competitive solutions, the mining TBM offers improved efficiencies and safety. “Providing customers with a shorter tunneling period presents the opportunity to quicken a ramp-up of underground mining projects to enable productivity and financial gains for our customers,” Komatsu said. “The Komatsu Mining TBM has been developed to meet the mantra of ‘No Blasting, No Batch, and No Diesel.’”

Komatsu described the partnership with Codelco as fundamental to the development process. “They have contributed their mining expertise and aided in shaping the design and parameters of the field trial.”

The first phase of development focused on design features required for operation in Chuquicamata. “In the second phase, elements and systems necessary for operations in Chile were added, such as refuge chambers within the TBM,” the statement said. The third phase centers on factory acceptance testing (FAT) to prove “the performance of specific operations, such as advancing speed and reversing systems, were improved and optimized.” The indoor and outdoor FAT at the Komatsu Osaka plant was completed in July 2023 and June 2024. “During these tests, Codelco was an active participant and raised observations that ultimately led product improvements,” Komatsu said. The last of the FAT will be completed in 2025. “Regarding the start of the validation test, it has been scheduled to start after 2026.”

Komatsu has been developing TBMs for 60 years, mostly for civil engineering in Japan. “The biggest reason for not expanding overseas was that a TBM is a built-to-order machine, and it is necessary for the customer and Komatsu to have a system that could specifically support a TBM operation and maintenance schedule,” the supplier said. “But we didn’t have that.” For the mining industry, however, “Komatsu has a strong support network and a mining TBM is a viable solution to offer customers.” Currently, with the mining industry increasingly regulated, Komatsu sees a future for the TBM in the industry.

“It is anticipated that the mechanical rock-cutting method will bring about significant changes in safety, working conditions, and productivity through rapid excavation in the underground industry, with the Mining TBM being one of the most promising technologies in this regard,” Komatsu said. Circular excavation supported by a TBM “will stabilize stress in the tunnel, thereby enhancing safety.”

A mining TBM can support a tunneling process that also uses drilling and blasting. “Customers can select mining methods and equipment, or use them in combination, to meet their demands and mine plans according to conditions,” the statement said. “We hope the success of the trial helps raise awareness among mining customers and acts as a proof point that the mining TBM is safer, efficient, sustainable and, eventually, automated mining methods.”

Smaller, Agile TBMs

Mines going deeper will require new shafts, drifts and tunnels,

and Akkerman said it is ready to support the boring projects.

“We surely would love to collaborate with any companies in the

mining industry to either provide our services or use their services

to enhance our products,” said Jason Holden, vice president

and revenue officer.

Headquartered in Brownsdale, Minnesota (USA), the company recently updated its smaller-dia. TBMs to handle hard rock. “Akkerman has produced pipe-jacking TBMs for more than 50 years; however, deeper tunnels and urban expansion have driven the need for more capabilities,” he said. The supplier “manufacturers several types of equipment to ensure exact-line and -grade installations from 4 in. (100 mm) to over 10 ft. (3 m) dia.,” Holden said. “Each method is highly versatile depending on the application required,” he said. “For example, we have successfully completed projects in the Middle East to secure foundations for world-record, high-rise skyscrapers, and have deployed remote-controlled slurry microtunnel boring machines that have tunneled extremely long distances with complex curves.”

The company’s biggest listed TBM is the WM960II, which delivers 550,000 foot-pounds (ft-lbf) (270 kg-force [kgf]/cm2). The customizable machine can bore a 116-in.-dia. (2.9-m-dia.) tunnel. Company literature said the model is “easy to operate,” with “on-board manual controls.” It is “accurate and reliable,” with “tunnel laser guidance” and “three-point sealed articulation,” Akkerman said. The model features an onboard methane gas detection system. “Access to the face is readily available for obstruction removal.”

The SLCs “are designed to deliver maximum power directly to the rotating cutterhead and crushing chamber where it is needed,” the supplier said. “These systems use a proprietary water- cooled, variable frequency driven motor that is horsepower rated at the motor output coupled to a robust planetary gearbox for maximum torque while maintaining cutterhead speed.” Akkerman’s solutions offer several benefits for a project that has either outgrown its original footprint or is expected to expand into highly regulated areas. “Trenchless construction minimizes social, environmental, and economic impacts to the community,” Holden said.

Three successful projects illustrate those benefits. Narragansett Bay Commissions’ Pawtucket (Rhode Island, USA) Tunnel Project tapped Akkerman for a newly built custom SL100P. The 100-in.-dia. (2.5-m-dia.) TBM with custom rock disc cutter head was supported by the AZ100 TGS system for tunneling navigation. The unit was deployed to support the construction of a connection tunnel with a 96-in.-dia. (2.4-m-dia.) pipe built of 20- ft (6-m) lengths running to the “the larger 30-ft.-dia. (9-m-dia.) storm-water tunnel under the Seekonk River,” Akkerman said. The machine launched from a 120-ft-deep (37-m-deep) shaft. The connection tunnel would pass under the Seeknok River and would bore through “rock with a UCS rating of 8,000 psi (55 megapascal),” the supplier reported. “The machine performed well even in unexpected harder ground conditions encountered at the project onset,” it said. The tunnel was accurate and completed on time. The Etobicoke Creek Sanitary Sewer tunnel project tapped Akkerman for a SL86P microtunneling system to bore a 2,000-ft (600-m) tunnel beneath runways at the Toronto Airport.

The challenges were many. Obviously, no interruptions to flights would be allowed. “Ground conditions included granular till, riverbed deposits and shale,” the supplier said. The construction would run alongside Spring Creek. The job required “complex permitting, approval, safety, security and contingency processes.” With an operating weight of 53,000 lb (24 mt), the 88-in.-dia. (2.2-m-dia.) SL86P offers 400 hp (300 kw) and 404,000 ft-lbf (270 kgf/cm2). It features an “on-board power pack with remotely selectable torque ranges,” Akkerman said. The model can be “fully remote-controlled from the surface and offers face access for cutterhead inspection, tool replacement, or obstruction removal,” it said. “The AZ100 Total Guidance System provided navigation control for the long-distance alignment accuracy.”

PCD Supermaterials

Element Six said field results show its polycrystalline diamond

(PCD) supermaterials for cutting and drilling tools show “unparalleled

performance over standard carbide solutions.”

The supplier designed and supplied PCD tools to replace

traditional tungsten-carbide bits on the Herrenknecht SBR Roadheader

building an access shaft at the Woodsmith mine in the UK.

“The diamond bits ensure precise dimensional quality, optimizing

the advance rate, and lowering operational costs, thereby improving

the efficiency and economy of the mining site,” said Thomas

Trott, global sales director for road, mining and wear products.

The supplier partnered with Redpath and Herrenknecht on the design of the tools to drive growth in its mining business, Trott said. “Leveraging E6 PCD’s unparalleled capabilities, we are looking for OEMs and end users to develop new markets with us.” Element Six collaborates with customers on carbide and PCD solutions that offer both cost savings and sustainability benefits. “We are increasingly seeing a strong drive towards more durable, longer-lasting products from our customers,” Trott said. “With that comes either an evolution from regular steel over to tungsten carbide or from tungsten carbide over to polycrystalline diamond,” he said. “We already see improvements with the changeover from steel to carbide of around eight times the life.”

In mining applications, switching from tungsten carbide to PCD offers up to 10 times the life, Trott said. “With more than 70 years of sustained investment and expertise, E6 was one of the first companies to commercialize PCD industrial materials,” he said. “And, today, we continue to leverage these capabilities to deliver unique solutions.”