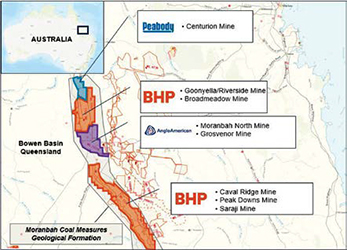

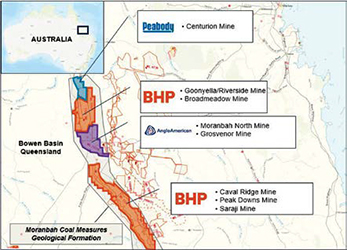

With the acquisition, Peabody’s footprint in Australia’s Bowen Basin grows.

(Image: Anglo American)

Peabody to Acquire Anglo’s Met Assets

In total, Anglo will receive $2.78 billion for its remaining Australian coal assets, a portion of which would include $455 million from the sale of the Dawson mine to BUMA International, a subsidiary of Indonesia’s Delta Dunia Group, in a back-toback transaction. “This transformative transaction presents a rare opportunity for Peabody to acquire premier steelmaking coal assets at a compelling valuation as we reweight our portfolio toward seaborne metallurgical coal,” Peabody President and CEO Jim Grech said.

The acquisition includes four metallurgical coal mines — Moranbah North, Grosvenor, Aquila, and Capcoal — located in Australia’s Bowen Basin, which is widely recognized for its high-quality metallurgical coal. Approximately 80% of the production from these mines is hard coking coal. The mines are complementary to Peabody’s existing Australian platform, including the Centurion mine, and are expected to produce approximately 11.3 million tons of primarily hard coking coal in 2026. The acquired mines have an average mine life greater than 20 years with 306 million tons of marketable reserves and an additional 1.7 billion tons of coal resources.

The acquisition is expected to transform Peabody’s metallurgical coal segment, increasing metallurgical coal production from an estimated 7.4 million tons in 2024 to an expected 21 to 22 million tons in 2026.