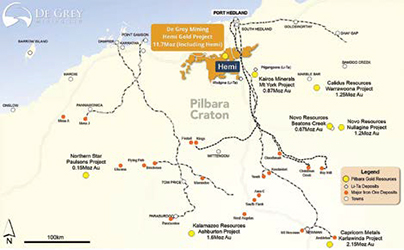

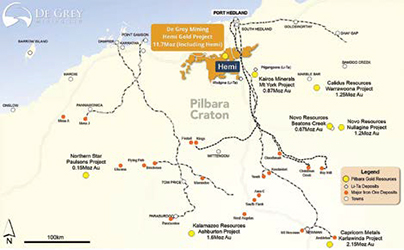

The Hemi project is a large undeveloped gold project located in Western Australia.

(Map: Northern Star)

Northern Star to Acquire De Grey and the Hemi Project

Under the terms of the transaction, De Grey shareholders would be entitled to receive 0.119 new Northern Star shares for each De Grey share held, representing an implied offer price of A$2.08 ($1.35) per De Grey share, which implies an equity value of approximately A$5 billion ($3.2 billion).

A September 2023 definitive feasibility study (DFS) forecasts Hemi’s annual gold production to be 530,000 oz/year (oz/y) over its first 10 years. Northern Star said it plans to use its exploration, mine development and operating expertise to unlock the long-term value potential of the Hemi Project.

“The acquisition of De Grey is strongly aligned with Northern Star’s strategy and contributes to our purpose of generating superior returns for shareholders,” Northern Star Managing Director and CEO, Stuart Tonkin, said. “We remain committed to our profitable growth plan to 2 million oz/y by FY26, with the KCGM Mill Expansion and addition of Hemi propelling a significant further increase in Northern Star’s production to ~2.5 million oz/y by FY29.”

The combined Northern Star Group will operate across two Tier-1 jurisdictions (Western Australia and Alaska) and four production centers, with proforma mineral resources of 74.9 million oz and ore reserves of 26.9 million oz.

The Hemi DFS originally predicted construction by mid-2024 and first gold production in mid-2026 with a final investment decision (FID) subject to project approvals and debt financing. While significant progress has been made, De Grey is awaiting State and Federal environmental approvals before progressing to the FID.

In parallel with finalizing approvals, Northern Star intends to continue to optimize the Hemi project development and mine plan under its ownership, applying experience from the KCGM expansion project and the company said it will update the Hemi project metrics ahead of the FID.