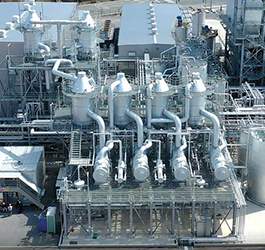

IBAT’s modular direct lithium extraction plant at a fabrication facility in Lake Charles, La. (Photo: IBAT)

New Lithium Operations Use Top Tech

Advanced technologies and systems help reduce risk, increase options,

and improve sustainability

By Jesse Morton, Technical Writer

Modular Direct Lithium

Extraction

International Battery Metals (IBAT) installed

a modular direct lithium extraction (DLE)

plant at US Magnesium’s operations near

Salt Lake City, Utah. The modular DLE

plant is processing brine from waste-magnesium

salts to produce lithium chloride for

conversion into lithium carbonate.

The plant was fabricated in Lake

Charles, Louisiana (U.S.), and transported

to Utah, IBAT told E&MJ in May. “We

loaded it up on trucks and transported it

halfway across the United States in four

weeks,” said CTO John Burba. “We put

it in place and did the basic piping in

about three weeks,” he said. “We are in

the process now of running test loops.”

The plant could enter production as this

article goes to press.

The speed of deployment is indicative of the efficiency of its design. “Our process itself is greatly simplified because of the absorbent system we use,” Burba said. “The simplicity of the operation allows for us to put together a process that does not have to be very large.” At the front end of the process are extraction columns that are “quite small, particularly if you compare them to competitor extraction columns,” he said. “The mechanism of absorption for this material is driven by salinity.” High salinity brines limit the range of motion of lithium ions. “Because of that, lithium enters into sites within this crystalline matrix,” Burba said. “The reason we don’t get sulfate or borate is this system has a size-limiting component, and only lithium will fit,” he said. “This material, it is a granular material, it is packed into an extraction column and then once we have pushed the brine through we follow that with a solution to extract the lithium chloride.” The lithium chloride is flushed from the columns. The rinse water then moves through an advanced reverse osmosis (RO) system.

With that system, “we can go from about 1% lithium chloride solution to approximately 12.5% to 13% lithium chloride in one step,” he said. “And in doing that, we recover 94% of the process water.” Evaporation enables further concentration. “For shipping, you typically want to see lithium chloride around approximately a 35% solution,” Burba said. “So we would take that 12.5% solution, take it through an evaporator, and take it to 35%,” he said. “The amount of evaporation that we do is actually very small.” The steam is condensed to “recover another 4% to 4.5% of the process water,” he said. The final lithium chloride solution, at 35%, “would go into tanks and then be ready for shipment to a carbonate plant,” Burba said. “We are recycling 98.5% of our process water,” he said. “The water that we recover is pristine. You can drink it. This is a big boon to us.” The list of benefits offered is topped by modularity, which means the plant can be easily scaled up.

The modules fit on skids that can be loaded on trains and trucks. “Some loads have to be permitted because of weight,” Burba said. “We tried to keep the sizes low enough that we have adequate paths for shipment.” Preexisting infrastructure requirements are minimal. “All we need for the equipment is a stabilized pad,” he said. “It does not have to be concrete; no rebar.” The modules fit together like Legos, Burba said. “We set everything down. We level it up. We have a long pipe rack, which runs the length of the plant and then everything just feeds into that pipe rack.” The modular DLE plant has comparatively low operating expenses. It uses minimal electricity.

“The only energy we need, because of kinetics, we like for the brine to be warm,” Burba said. “We have a huge amount of thermal heat recovery,” he said. “The other piece to it is we use energy on the evaporator when we are recovering water.” The plant can be configured to use multiple sources of energy. “We have the capability, and we have patents filed to use other forms of heat, renewable energy, solar, whatever is available,” he said. “In some places, we can use geothermal energy.”

Labor costs are relatively low. “The system is very highly computerized,” Burba said. “Therefore, we have only a minimal number of operators on site in any shift, and those guys are really people that know how to fix stuff,” he said. “They are mechanics and pipe-fitters.” The modular DLE plant also offers capex that is “much, much lower than a conventional plant. I mean by a lot,” Burba said. “We are substantially lower cost due to the modularity.”

Modules can be built in fabrication shops. “The construction time is very short because you’ve got parallel construction on these things,” he said. “And so they pop out really, really fast.” Once engineering and the procurement cycle is complete, “the construction time for one of these plants is about eight to 10 months,” Burba said. “The company we are working with has multiple fabrication shops,” he said. “Even if they didn’t have the capacity we would still take it over to other fab companies and do exactly the same thing.” Procurement is “the long pole in the tent,” Burba said. “By doing a good job on the procurement management, we can shorten that,” he said. “All-in, we are talking at most two years.”

The DLE plant will be “the first one in North America,” he said. “We feel like we are going to be leading the industry along into something that is going to be much more efficient, much less water intensive, and just a whole lot better environmentally and economically.”

Integrated Li2CO3-to-LHM

Plant

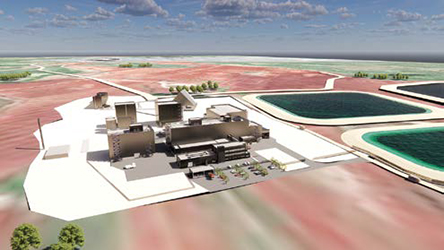

In H1-2024, Veolia Water Technologies

told E&MJ a Li2CO3-to-LHM conversion

plant supplied to a customer in Japan

ramped up from the start of production

to roughly 80% capacity, producing consistent

battery-grade quality, in approximately

3 months.

The engineering, procurement, and

construction contract for the Naraha plant

was announced in September, 2020.

Toyota Tsusho Corp., Orocobre Ltd., and

their joint venture, Toyotsu Lithium Corp.,

selected a Veolia HPD evaporation and

crystallization system after it proved capable

of reducing technical risks and increasing

project viability during trials at

the Phillip J. Stewart Technology Center

in Plainfield, Illinois, U.S., according to a

2019 announcement.

Veolia said the rapid deployment and successful ramp-up at Naraha demonstrated the capabilities of the HPD system and technologies and the company to meet and beat expectations. “This is a great illustration of what is possible with early collaboration with Veolia and the subsequent supply of an integrated Veolia plant,” said Jim Rieke, vice president of process engineering. “Veolia has a tremendous amount of institutional knowledge, laboratory capabilities, and proprietary equipment features that we have developed through our history of supplying integrated high-purity chemical production systems that we are now bringing to bear in support of the battery materials industry.”

Veolia provides “customized and optimized” solutions to recover lithium from rock, clay, and brines, Rieke said. Standard processes “generally include an HPD crystallization step for final purification and production of a crystalline material,” he said. “But Veolia also provides upstream unit operations for purification and concentration such that we can offer an integrated solution with a single umbrella process guarantee.”

Veolia’s lithium brine solutions “have special features and design details that allow us to efficiently segregate and remove various impurities based on each specific impurity’s characteristics,” Rieke said. “This knowledge is not limited to evaporation and crystallization equipment, but to the other essential unit operations that generally are used in the supply of these integrated systems.”

Best results are achieved after early collaboration with Veolia, which “allows us to fully understand the project drivers and develop a customized and optimized integrated solution,” Rieke said. “This leads directly to an optimal capex/opex and a derisked technical solution with an efficient project delivery timeline and quick rampup to production with limited surprises.” The lithium mining and refining process may give the opportunity to recover other materials, such as potassium and boric acid, he said. “However, maybe even more prevalent are the byproducts that result from the refining and purification process, such as sodium sulfate.”

Engineering solutions to challenges and opportunities presented by byproducts from the crystallization process are “our specialty,” he said. “Indeed, potassium sulfate, boric acid, and sodium sulfate are chemicals that Veolia has processed in other industries for many years, so this fits naturally into our offering.” For example, sodium sulfate can be reused. “Many of the processes in the battery material supply chain use sulfuric acid and caustic reagents, resulting in a sodium sulfate byproduct,” Rieke said. “A spodumene-to-lithium hydroxide refinery, for example, produces more than twice as much sodium sulfate and lithium hydroxide on a tonnage basis.”

The market for sodium sulfate, however, often is saturated. “Veolia has developed a bolt-on process for the conversion of sodium sulfate to potassium sulfate, an environmentally friendly high-value fertilizer with an increasing market demand,” he said. “This process has already been demonstrated commercially and its application provides a quick payback on the incremental capital.”

A bi-polar electrodialysis solution by Veolia “can convert the sodium sulfate back into sulfuric acid in caustic form to be recycled and reused within the lithium refinery, both offsetting the chemical inputs to the facility and the byproduct output,” Rieke said. “Conserving resources through recycling and reuse is at the core of Veolia’s value proposition.”

Adoption of Veolia offerings can be seen by investors as helping an operation to reduce technical risk. It also signals social responsibility. “We apply our strong safety, QA, and compliance protocols to comply with and supplement the client’s needs, wherever in the world the project is located,” he said.

The company has been developing processing solutions for eight decades. “Veolia is a large international company with a strong reputation for the successful delivery of projects with a high level of complexity and size in the mining industry, with many references with the largest mining companies and EPC engineering firms,” Rieke said. “As the global champion of ecological transformation, we are more than ever capable of providing solutions to meet the environmental challenges around the world,” he said. “And now with the launch of Veolia’s new strategic program, GreenUp, we are further committed to accelerating the deployment of affordable, replicable solutions that depollute, decarbonize and regenerate our resources.”

Automated Lithium

Hydroxide Plants

Valmet announced it will deliver and implement

a Valmet DNA automation system

to the concentrator of Sibanye-Stillwater’s

Keliber lithium project in

Kaustinen, Finland. The same system

was deployed to the Keliber lithium refinery

in Kokkola Industrial Park.

The system, customized to the specifications of the project, will manage total process control for the concentrator. Parts of the system include a condition-monitoring solution, the DNA Field Device Manager, the DNA Historian, and a training and simulation solution. Valmet DNA DCS will be used to manage cybersecurity. Valmet DNA Condition Monitoring offers vibration analysis and services. It provides automated anomaly detection, the supplier said. The solution supports audits, planning, analysis, and “diagnosis with expert specialist support,” Valmet said.

The DNA Field Device Manager is used to configure and manage maintenance for intelligent field equipment. It helps “users find the right solutions rapidly,” Valmet said. “As such, it supports proactive field asset management and enables effective planning of future maintenance work.” Valmet DNA DCS (distributed control system) is used for, among other things, “process controls, machine controls, drive controls, quality controls, and condition monitoring,” Valmet said.

A manager with Valmet told E&MJ Valmet DNA will be the main automation system of the chemical plant in Kokkola and the concentrator in Kaustinen. “There is 66 km distance between plants,” and Valmet DNA will help to optimize and synch the operations at both, Anna Sydänmaa, business manager, process industry, said. In addition to the automation solutions, “Valmet’s flow control business delivers mission-critical valves to Sibanye-Stillwater chemical and concentrator plants.”

Separately, Metso said its sustainable alkaline leach process technology for spodumene at the lithium hydroxide refinery in Kokkola is currently being built. “Keliber is the original project the process was developed for,” said Marika Tiihonen, technology manager, lithium hydrometallurgy. “The project is now in construction phase and will be commissioned during 2025.”

The sustainable alkaline leach process requires “natural a-spodumene- mineral-containing-concentrate be converted to ß-spodumene in a kiln process,” Tiihonen said. “The alkaline pressure leaching process uses soda ash to extract the lithium from ß-spodumene,” she said. “Further downstream, hydrated lime is fed to convert extracted lithium, as carbonate, to soluble lithium hydroxide.” Filtration separates residue from the lithium hydroxide.

“The alkaline process has certain benefits such as selectivity for lithium dissolving only limited amounts of impurities due to mild conditions,” Tiihonen said. “And, consequently, less downstream purification stages are required prior to lithium hydroxide monohydrate producing crystallization.” That means the process can help a miner attain sustainability goals because it uses minimal leaching chemicals, she said. “The process is very selective for lithium.” Other benefits stem from it being a “simple process resulting in a compact footprint,” she said.

The sustainable alkaline leach process grew out of “a Canadian invention,” Tiihonen said. “We tested and developed it further.” At first, it was a lithium carbonate process. “We converted it to a process to produce battery-grade lithium hydroxide by applying the necessary purification and polishing steps,” she said. “The hydrometallurgical lithium process has been demonstrated in pilot scale and first reference plants are in implementation phase.” The process offers the “capability of producing lithium carbonate with even a more simple flowsheet and lower costs,” she said. “Only soda ash is needed to extract and convert from spodumene to lithium carbonate.”

Sibanye-Stillwater adopted the sustainable alkaline leach process because it was part of a bigger value chain concept offered by Metso. Accordingly, in Q4 2023, Metso reported Sibanye-Stillwater ordered an effluent treatment plant for the Kokkola refinery, which is expected to eventually produce 15,000 mt/y of lithium hydroxide monohydrate. “Metso’s scope of delivery for the effluent treatment plant includes the engineering, procurement and supply of the equipment for the full process, as well as advisory services.”

The order speaks to the fact that the “main process steps can be handled with our own technologies and solutions,” Tiihonen said. “We have expertise on the upstream spodumene beneficiation and calcination processes in house, so that adds understanding of the whole value chain,” she said. “That means we can equip the flowsheet with our own Metso equipment and our expert teams can be involved to optimize the design from early testing phase to engineering phase and all the way until the final project execution.” For example, the miner tapped Metso Outotec for “key processes for Keliber’s concentrator plant,” Sibanye-Stillwater reported in 2022. For the plant, Metso Outotec was contracted for “engineering and supply of all the main equipment.”

In the Q4 2023 press release, Metso said that equipment “consists of OKTOP Atmospheric Reactors enabling the precipitation of impurities and the recovery of lithium, an electrochemical water treatment unit for arsenic removal, as well as an inclined plate settler and Metso’s Planet Positive Larox PF filters and FP pressure filters for efficient dewatering,” the supplier said. “For the concentrator plant, Metso will supply all key process equipment from crushing to dewatering.”

The Keliper project is expected to produce “battery-grade lithium hydroxide from its mined ore reserves, and to supply the region’s battery industry with a critical raw material that is necessary to produce electric vehicles,” Valmet said. The project is predominately owned by Sibanye-Stillwater. A minor stake in the project is owned by Finnish Minerals Group, a state-owned company.

Salton Sea Brine Project

Falcon Ridge Lithium contracted Zelandez

to conduct prefeasibility studies, to

further define the lithium resource, and

to design production flow sheets. Falcon

Ridge Lithium said the development will

accelerate the project down the path to

commercial operation.

“Zelandez’s comprehensive technical

services and proven track record were

instrumental in our selection process,”

said CEO Shawn Helda. “We are confident

that this partnership will ensure the

efficient and rapid development of the

Falcon Ridge Lithium project.”

Located in the Lithium Valley district in Imperial Valley, California, the project could reportedly produce over 9,000 mt/y of lithium carbonate and lithium hydroxide. Zelandez offers a suite of exploration and extraction tools. It also offers integrated services that use those tools and other technologies.

Recently, Zelandez released the Borehole Formation Tester (BFT), which, the company said, will deliver actionable lithium- aquifer data that can be used to reduce the cost of exploration and to produce more lithium. “The slimmest pump-through formation tester ever made has been delivered to the lithium sector,” the company said. The BFT measures aquifer pressure, analyzes fluids downhole in real time, and obtains representative brine samples. Matt Adams, director of sales at Zelandez said the BFT “is now available to lithium developers globally, as well as anyone needing to understand aquifer pressure and characterization of their exploration and development wells or take representative fluid samples directly from a formation.”

A miniaturized version of traditional oiland gas-formation testing technology, the BFT “enables miners to conduct rigless pressure and permeability testing in addition to fluid sampling in low permeability, laminated, fractured, unconsolidated and heterogeneous formations,” he said. With a truck and winch, the unit is lowered down a borehole as small as 122 mm on a wireline cable. “Using an internal Gamma Ray log to establish location, once the BFT has reached the required measuring point, a probe is extended radially away from the tool until it makes contact with the wellbore,” Adams said. “At this point an internal pump within the tool is activated to displace fluid from the formation, through the sensor array and into the wellbore,” he said. “Once the sensor array has identified representative fluid samples, the flow of fluids is diverted into a sample chamber.”

The BFT analyzes the fluids and sends the data to the surface. It can “capture multiple clean lithium brine samples from a well, for further testing,” the company said. “When testing is complete, the probe is retracted, and the sample chambers can be emptied and replaced, and the tool can move to its next testing location,” Zelandez said.

The unit “enhances a miner’s ability to make critical decisions about the productivity of the aquifer they are working with,” Adams said. “It enhances lithium miners’ decision-making by delivering real-time access to actionable aquifer data,” he said. “Through enhanced definition of the complex sub-surfaces, poor well deliverability is mitigated.” The data also helps “miners to better understand their reinjection requirements,” Adams said.

Compared to competitor solutions, the BFT offers significant cost savings. “Lithium developers will no longer depend on large expensive rig-deployed sampling, which has high supply costs, to retrieve brine samples from below ground,” the company said. “It significantly reduces the costs of lithium brine development when compared to the less-accurate incumbent ‘packer-testing method.’”

That method “is limited to sampling to a depth of 400 m, which prevents proper resource definition beyond this point,” Adams said. “With its current specifications, the BFT can easily take samples to a depth of 2,000 m, providing miners with multiple, high-quality, uncontaminated representative fluid samples.” The packer-testing method is also time consuming and cumbersome, said Zelandez CEO Gene Morgan. “It makes it hard to find new lithium brine resources and to bring more lithium to market.”

The BFT “changes the game for lithium developers,” Morgan said. “It was built to address the specific challenges of aquifer testing and fluid sampling in lithium brine exploration and production,” he said. “Instead of it taking weeks, it delivers results within hours or days.” The unit can also help a miner increase lithium production, the company said.

“Companies need access to high-quality, actionable data in real time to better define resource origins and concentrations and understand the productive intervals in their boreholes for optimum resource recovery,” Adams said. “The BFT delivers on the those needs for miners and importantly does it much quicker than the incumbent packer-testing method,” he said. “More importantly, if a miner can understand their most productive aquifers in a period of hours or days, as opposed to weeks, then the yield and productivity of the operation is significantly improved, saving costs and generating more revenue in the process.”

The unit can also offer safety gains and can help a miner comply with regulations. “As a lightweight and rigless formation tester, in comparison, the BFT can reduce the inherent risk associated with heavy tools that require a rig and many staff to operate,” Adams said. “From a regulatory perspective, a miner’s ability to reinject fluid into an aquifer is paramount when complying with environmental rules and regulations,” he said. “As the pump in the BFT can be put into reverse, it can reinject fluid back into the formation.”

Development of the BFT was driven by customer feedback. “In 2022, our customers came to us seeking a better method for quickly and safely extracting clean lithium brine samples from below ground without damaging their wells,” Adams said. “They were dissatisfied with the existing packer-testing approach,” he said. “The BFT was born as a result of conversations between our team and our customers.”

Zelandez CTO Stuart Weston, “who has over 25 years of experience developing technology in the oil and gas industry, came up with the idea and design,” Adams said. “Our engineering team worked tirelessly to make it a reality, crafting a solution that not only solved our clients’ problems but also reduced costs,” he said. “We’re thrilled to add the BFT to our suite of technologies and services that are designed to speed up the supply of lithium.”