The mtu Series 4000 and 2000 diesel engines celebrated 25 years in 2023. (Photo: Rolls-Royce)

Advancements With Off-highway

Diesel Engines

Fuel efficiency presents the best opportunity to tackle emissions and operating costs

By Steve Fiscor, Editor-in-Chief

Over the course of a large diesel engine’s life, fuel consumption amounts to most (80%) of the machine’s operating costs. Mining companies understand firsthand how high diesel prices impact the bottom line. So, fuel efficiency should be top of mind during the purchasing process and maintaining that efficiency throughout the engine’s life is vital to its operational success.

Diesel engines also are a large, primary source of emissions for open-pit mines, and they have been targeted for replacement by the green energy transition. For the near term, fuel efficiency is probably the miner’s best tool to show improvement in emissions from diesel- powered engines. Renewable fuels, like hydrotreated vegetable oil (HVO), are another tool miners can use to lower emissions from combustion engines.

“Miners want engines that operate well. Downtime has to be held to an absolute minimum and they want the lowest possible TCO,” said Cobus van Schalkwyk, head of global mining for Rolls-Royce’s Power Systems division and managing director, Rolls-Royce Solutions Africa. Coming from an engineering background and working with mines for more than 20 years, he is familiar with both underground and open-pit operations and he gets it.

Last year, Rolls-Royce celebrated 25 years of excellence with its mtu Series 4000 and 2000 engines. The company said that the mtu Series 2000 is the most popular with more than 65,000 sold to date. The company said they have sold more than 52,000 mtu Series 4000 engines. For mining applications, the mtu Series 4000 is used for haul trucks, hydraulic excavators and wheel loaders while the mtu Series 2000 is used primarily for haul trucks and support equipment. All-in, the company estimates it has more than 320 million operation hours of experience with these engines.

E&MJ readers might recall the announcement last year that Rio Tinto had switched its entire fleet at the Boron mine in California to HVO fuel. Rolls-Royce assisted with that conversion along with the fuel provider. “We focus on what our customers want, and we try to help them accomplish their goals,” van Schalkwyk said. “With mine operators, the transition to greener technologies dominated the conversation two years ago. Today, the discussions are more about optimization for the short-term with a longer-term view toward that transition for most mining companies.”

Designing Engines That

Support a Lower TCO

The goal for Rolls-Royce is to design and

produce the most fuel-efficient engines.

“Customers tend to focus on the initial

capital expense and ways to extend the

time between overhauls, but it’s more important

to keep the engines running as

efficiently as possible,” van Schalkwyk

said. “More efficient engines emit less,

and we couple that with improved reliability

to deliver an engine with the lowest

TCO in the mining business.

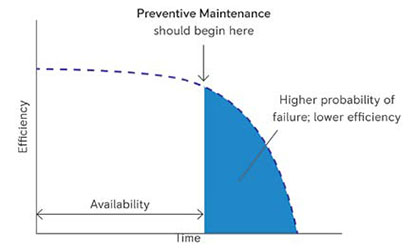

Extending the time between overhauls (TBO) is a key factor in reducing the TCO. However, mines should not run the risk of damaging components or causing a total loss by extending the TBO. Because then the engine would no longer be repairable, let alone overhaulable.

Thanks to improved analysis options and significantly better data on the condition of the engines than before, combined with its years of experience, Rolls- Royce has succeeded in finding the fine line between time between overhauls and realizing unwanted downtime. The effect: an extended TBO, improved TCO and minimized risk.

Understanding engine life has led Rolls-Royce to establish a very lucrative repower solution for the mines. “For us, repower solutions is a big driving force,” van Schalkwyk said. “A haul truck has a design life of 20 years, and on average engines need to be overhauled every five years of operation. The mtu Series 4000 engines are not an option for some truck brands. Our repower strategy is to displace competitor engines at the first overhaul cycle on these trucks.”

Rolls-Royce has modeled the TCO for an mtu Series 4000 engine installed in a new haul truck after five years and it shares the information with mine operators. “We take the required modification of the truck, the maintenance of the engine and fuel consumption benefit into consideration,” van Schalkwyk said. “We deliver a business case to the mine operator and, in the majority of cases, the TCO is lower than the original engine installed on that truck. The model works and we’ve been incredibly successful with repowers, mostly on first engine life, but we can do it on second and third as well.”

Remanufactured units are also an option and mine operators should also consider purchasing rebuilt engines. “We offer the same overhaul life between a rebuilt engine, a reman and a new engine,” van Schalkwyk said. “It really depends on what the customer wants. Some mines prefer to buy new engines. We can also offer them overhauling services through a local distributor, who would provide rebuilt engines using the cores from the mines.”

During the past few years, Rolls-Royce has made a significant investment in its factory in Friedrichshafen, Germany, and its facility in Aiken, South Carolina, USA, to reduce lead times for mining class engines. “We saw a large post-COVID increase in the demand for engines and we have successfully ramped up production volumes to meet that demand,” van Schalkwyk said. “To shorten lead times, we have improved the efficiency and the quality of the work on the factory floor. We believe in the future of combustion engines, and it just makes a great deal of sense to invest in our facilities at this stage as well.”

Combustion engines can burn fuels other than diesel. Rolls-Royce has been working with mining companies to develop drop-in HVO systems. Rio Tinto pioneered that process, which demonstrated that HVO-powered engines perform as well as diesel engines. The trials addressed many misconceptions related to HVOs related to engine performance.

“We believe in alternative fuels as the transition technology and most of our mining engines are released to run on HVO,” van Schalkwyk said. “That’s why we have invested our efforts into testing engines with alternative fuels. They will operate just like diesel with the same maintenance costs and times between overhauls. There is no downside really to running our engines on HVO, except the availability of HVO.”

Mines require huge volumes of fuel and the availability of HVO is a problem for some mines, van Schalkwyk explained. “When supplies are tight, pricing can be quite high,” he said. “From our perspective, the technology is readily available, and mines can transition if they want, but costs could be a concern.”

Looking toward the future, van Schalkwyk said the Rolls-Royce R&D department is looking at several initiatives, including possibly getting more power from a smaller footprint. “It’s a general trend in our industry and we are looking at ways to improve the engine’s power density,” he said. “We expect to make further announcements in this area in the years to come.”

With its mtu series 4000 and 2000 product lines, Rolls-Royce has a really good range of combustion engines, van Schalkwyk explained. “They perform really well, and they are highly fuel efficient,” he said. “We have invested a lot of work to make sure that they deliver what mining operations require. We are working on a couple of new developments, but we’re not quite ready to announce them yet. The most important topic for us at this stage is providing engines that are fit for purpose, giving mine operators the best availability, high fuel efficiency, and low TCO.”

Cummins Commissions

Diesel Hybrid in China

Cummins Inc. recently commissioned a

diesel hybrid solution in partnership with

North Hauler Joint Stock Co., Ltd. (NHL), a

Chinese haul truck manufacturer. The hybrid

NHL NTH260, a 220-metric-ton (mt)

payload mining truck, rolled off the production

line in January and was shipped to

Baogang Group’s Baiyun iron ore mine in

China to begin field testing in March. Cummins

said the optimized hybrid system will

allow the truck’s engine to be downsized

from the previous 2,500-hp QSK60 to the

current 2,000-hp two-stage QSK50.

Cummins said the truck is expected to provide a low TCO based on initial cost advantages, fuel efficiency and extended service life of the engine. Improved fuel efficiency directly correlates to emissions and greenhouse gas reduction. The company said it believes its advanced hybrids have the potential to improve fuel efficiency up to 30%, depending on the mine’s profile and advanced battery technology and controls integration.

“We are intent on enabling multiple pathways to carbon neutrality for industrial markets, including both first-fit and retrofit solutions,” said Molly Puga, executive director of strategy, digital and product planning for Cummins Power Systems. “It’s partnerships with our customers like NHL and the Baiyun iron ore mine that will accelerate product availability in the market and make both near- and long-term carbon reduction goals attainable.”

Last year, Cummins announced approval of unblended paraffinic fuels (EN15940), often referred to as renewable diesel, including HVO. The use of HVOs, according to Cummins, could reduce net GHG emissions by up to 90% compared to conventional diesel, dependent on the exact feedstock and fuel pathway. This approval applies to all high-horsepower (19L-95L, V903, ACE) engines for all applications in use across a variety of industries, including mining. All industrial engines currently in the field can be fueled with 100% renewable diesel, or any blend of renewable and traditional diesel, with no engine modifications required. Any renewable diesel used must meet the EN15940 standard, as defined by the European Committee for Standardization (CEN).

Volvo Penta Reduces Fuel Consumption

The combustion technology in Volvo

Penta’s most powerful diesel engine, the

D17, reduces fuel consumption by 5%

per kWh compared to the D16. It’s compact

and low-weight design is well-balanced,

providing smooth operation with

low noise and vibration and an overall

easy installation, service and transport.

The 17-liter, 705-kW (945 hp) diesel engine

uses dual-stage turbochargers and

heavy-duty steel pistons, making it optimally

designed to power a wide range of

stand-by (up to 881 kVA) and prime power

generator sets (up to 758 kVA). As far

as TCO, The D17’s extended service and

oil change interval of 1,000 hours, low

heat rejection, serviceability, and spare

part commonality, can all contribute to

keeping expenses down.