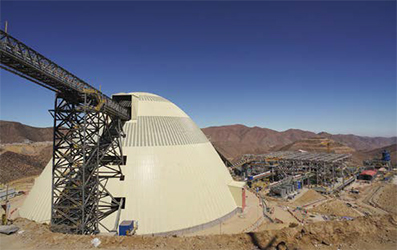

BHP has its eye on Anglo’s copper assets like the Quellaveco mine in Peru.

(Photo: Anglo American)

BHP Makes a Bid for Anglo

BHP offered 0.7097 of its shares for each Anglo share. One of the major conditions of the offer includes de-merging Anglo American Platinum and Kumba Iron Ore, which operates the Sishen mine in South Africa.

If the acquisition were to take place, it would propel BHP’s status as a leading miner and also as a leading copper producer with an estimated 10% of world output. With its acquisition of OZ Minerals in 2023, BHP moved ahead of Codelco as the world’s largest copper producer at 1.5 million metric tons per year (mt/y). Codelco, Chile’s national copper mining company, had held the No. 1 position for decades, probably since its inception. In 2023, Codelco produced 1.4 million mt of copper, followed by Freeport McMoRan (1.3 million mt). Anglo produced 571,000 mt of copper in 2023.

In addition to copper, platinum group metals, and iron ore, Anglo American is a multinational miner that also produces nickel, diamonds, manganese, metallurgical coal, and polyhalite.