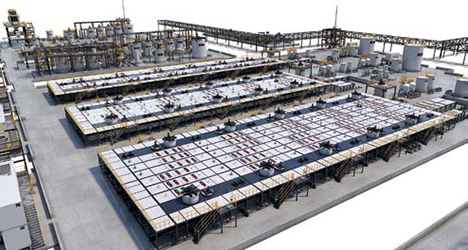

Copper leaching using Glencore Technology’s

Albion Process. (Photo: Glencore Technology)

A Hydrometallurgical Renaissance

Hydrometallurgical processes and technologies are undergoing an image makeover

as enablers of the energy transition.

By Carly Leonida, European Editor

“As the orebodies the industry’s extracting become more complex and, as we look to different raw materials, including tailings, and lower grade ores to recover different metals and minerals, this is placing increased pressure on traditional technologies and processes,” Don Simola, director, battery chemicals technologies, hydrometallurgy, at Metso told E&MJ. “The range of minerals that companies want to recover is also expanding. For example, 25 years ago when I started my career in hydrometallurgy, lithium, cobalt and rare earth elements (REEs) weren’t seen as important for certain applications as they are now. Today, there is a lot of work underway to optimize hydrometallurgical processes for the recovery of these metals, and more.”

Metso’s Planet Positive

Focus

Environmental standards and performance

expectations are also increasing,

and this is pushing mining equipment

and technology providers, like Metso, to

improve the efficiency of their technologies

when it comes to energy and water

usage. Today many of the company’s hydrometallurgical

equipment and processes

fall under its Planet Positive offering.

This aims to reduce customers footprint

on the environment while also providing

sustainable value.

“The mining industry is quite conservative when it comes to adopting new technologies,” Simola said. “So, what we’ve seen over the past 10-20 years are mainly incremental changes to technologies in areas, such as leaching and SX, rather than step change technologies.” One exception to this trend can be seen in lithium where new players are starting to challenge traditional thinking. Most commercial lithium extraction comes from brines through a process of evaporation and chemical recovery, with the balance coming from hardrock mining and the hydrometallurgical extraction of lithium from spodumene. While traditional hydrometallurgical processes are being tweaked to expand their application to other minerals such as pentlandite, there has also been a breakthrough in the form of direct lithium extraction (DLE).

DLE technologies, of which there are a range, allow the selective extraction of lithium compounds from brines, bypassing the evaporation stage used by most brine-pond projects. Goldman Sachs states that the application of DLE technologies has the potential to “significantly increase the supply of lithium from brine projects, nearly doubling lithium production on higher recoveries and improving project returns, though with the added bonus of offering sustainability benefits.”

The first public reference for this is Sibanye-Stillwater’s Keliber lithium project in Finland. The companies announced in 2022 that they would partner to install the technology at Keliber’s lithium hydroxide refinery in Kokkola. Metso also provides technology and equipment for entire nickel and cobalt production chains, from the mine to battery materials, with project scope ranging from equipment packages to turnkey plant delivery. Technologies include its well-known OKTOP reactors and pressure leaching autoclave, VSF X solvent extraction and Larox pressure filters, among others.

The company has seen increased interest in its digital services and optimization solutions in recent years to support hydrometallurgical installations as operators look to increase their plant efficiency and drive down operating costs. There has also been an increase in interest from companies looking to leverage hydrometallurgical processes in the secondary recovery of battery metals i.e., in the recycling of electric vehicle batteries.

“Hydrometallurgical processes lend themselves well to the recovery of metals from black mass,” Simola told E&MJ. “Interest is increasing, but the main focus is still on the primary recovery of these metals.”

Demand for Glencore

Technology’s Albion

Process Grows

It’s not just battery metals that are of

interest. Base metals like copper, nickel,

zinc and lead, which are also central

to the energy transition, make up the

lion’s share of hydrometallurgical deployments

globally.

Glencore Technology’s Albion Process combines ultrafine grinding and oxidative leaching at atmospheric pressure to liberate valuable metals. The first step involves mechanical liberation using an IsaMill to grind the feed particles to a very small particle size with a narrow size distribution. This prevents passivation of the mineral surfaces in the subsequent oxidative leaching step. The second step entails chemical liberation achieved by injecting oxygen at supersonic velocity into the base of a series of Albion Process Leach Reactors that are continuously fed with the ground concentrate.

The process offers lower capital costs than most pressure oxidation (POx) leaching plants and, because it operates at atmospheric pressure, it avoids many of the risks associated with traditional POx plants. Studies have shown that it can lower OPEX costs by one third. A key differentiator is the flexibility of the Albion Process, as it can tolerate variable feeds and lower grade ore grades than most others, delivering up to 97% recovery in refractory gold ores and over 99% recovery in chalcopyrite copper concentrates.

Laurie McDonnell, senior metallurgist at Glencore Technology, told E&MJ: “The primary cause of the increase in demand for the Albion Process has been a change in the market associated with the sale of concentrates to smelters. Producers want to maximize recovery and minimize waste while battling ever increasing complexity in the concentrates that are being produced. Consequently, they’re looking for alternate ways to treat this material.”

This has turned the collective focus to smaller extraction facilities located close to mines, allowing producers to process material without high freight charges. It also enables operators to get a premium for their products, such as those offered for cathode copper production. Along with these economic forces, there’s also a growing focus on stricter environmental limits globally. This has increased the number of mineral processing projects looking to produce high-grade concentrates as well as maximizing recovery through the treatment of intermediate/middlings streams (streams that are too complex or impurity-rich to otherwise allow for high final recovery).

“All these forces are converging to increase the need for a technique, like the Albion Process, that can successfully treat varying and difficult feeds for lower capital and operational costs and enable operations to increase their revenue,” said McDonnell. The Albion Process is fundamentally a sulphide oxidation technology, so it’s most suitable for treating sulphide- bearing minerals, like base metals, including nickel, cobalt and copper. But it’s also proven in precious metals locked within sulphide matrices – like refractory gold or silver.

“The advantage that the Albion Process has is the ability of its OxiLeach reactor to achieve the high oxygen mass transfer needed,” explained McDonnell. “It means the OxiLeach reactor can be applied in any application that needs gas, liquid or solid reactions taking place in aqueous phases. And yes, it’s been tested in the application of battery metal recycling and processing.

“We’ve also adapted the technology for the processing of ‘wastes’ from other base metals industries to be able to make high-grade products for reagent purposes. This has been applied internally within Glencore. We are continuously improving the technology application areas by testing in new fields and minerals.”

The most recent Albion Process installation was within the Glencore group last year, processing ‘waste’ from a Glencore facility to produce flotation reagents in a zinc plant. This installation returned the capital expenditure within the first six months of operation (which is almost unheard of in the industry). It also allowed the site to maintain production during a shortage of reagents from its normal suppliers, which was a big win for the operation.

“We’re currently working with a North American based copper producer coming into the feasibility stage of their study,” said McDonnell. “They’re looking to implement the Albion Process in a new copper sulphide leach project to increase production to 140,000 t/y of copper cathode once complete. “Going forward, we’re adapting our scalable OxiLeach reactor to industries requiring gas, liquid or solid reactions, from wastewater to the refining of metals and precipitates.”