Global Mining Projects by Stage

Constraints Mount to Slow Mining

Project Growth in 2024

Even though capital spending growth will moderate this year, it should reach the

highest level in nearly 10 years

By Joe Govreau

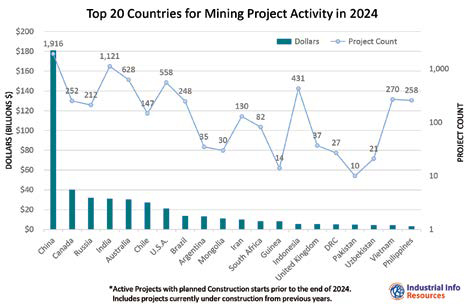

Mining project construction activity declined 2.2% over the past year, based on the value of projects, dropping from about $269 billion in 2022 to $263 billion worth of projects currently under construction. The level of activity is projected to be flat to moderately higher in 2024 when compared to 2023. For the most part, mining companies are moderating growth in capital expenditures in order to wait out erratic market drivers. However, eight of the largest global mining firms (Anglo American, Barrick, BHP, Freeport- McMoRan, Glencore, Newmont, Rio Tinto and Vale) are collectively planning to spend 8% more in 2024 than they did in 2023, with both BHP Group and Rio Tinto announcing plans to spend about $10 billion each. This follows a 6-year growth cycle, which has seen major mining firm project spending increase every year, since the bottom of the last cycle in 2017, except during the COVID-impacted 2020. Nevertheless, 2024 should see mining project spending reach the highest level since 2015.

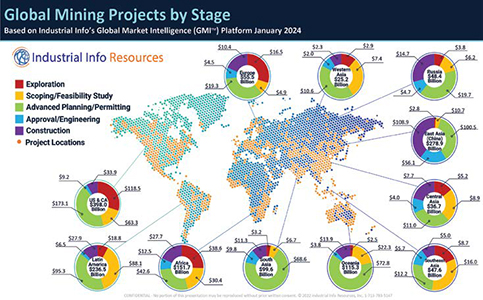

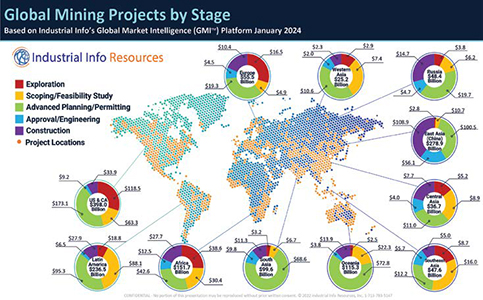

There is $1.2 trillion worth of mining project activity worldwide (see map), according to Industrial Info’s Global Market Intelligence (GMI). This includes capital and maintenance projects such as grassroot mines, expansions, modernizations, and other in-plant capital and maintenance spending. Projects range from the early exploration stage through to those under construction. As can be seen from the map, the majority of the activity (74%) falls in the pre-approval stage, meaning those projects have not received financing or permit approval. These include projects in the exploration, scoping, feasibility, advanced planning, and permitting stages. Projects that have reached approval or are involved with detailed engineering total $118.8 billion, and there is $263 billion worth of projects currently under construction.

Mining companies are preparing for the expected long-term demand increase for energy transition metals and minerals like copper, cobalt, graphite, rare earths, lithium, manganese and nickel. Geopolitical issues, including the continuing war in Ukraine and China’s dominance over critical mineral processing, are forcing governments to seek energy and resource security, which will be a major driver for reshoring, near-shoring and friend-shoring activity in 2024. Australia, Canada, Chile, Colombia, Mexico, Morocco, Panama, Peru, Singapore and South Korea are set to benefit from this trend.

Government stimulus to spur domestic production of critical and strategic metals and minerals is dominating mining company investment decisions. Governments are also seeking to increase the benefit of domestic natural resources, often through measures such as increased royalties and taxation, stricter regulations or even nationalization of industries. Resource nationalism is impacting project activity in many parts of the world, namely Chile, Indonesia, Mexico, Namibia, Peru, and Zimbabwe.

As a result of the long permitting process for new mines, there has been an increase in expansions and efficiency improvements at existing mines, which are easier to permit.

Environmental Social & Governance, or ESG, is becoming more prominent in corporate plans and is influencing financing and project activity in a big way. For mining, most companies are focusing on renewable energy projects, mainly solar or wind and sometimes combinations with battery storage to replace fossil fuel usage at mines. Industrial Info is tracking more than $18 billion worth of renewable energy projects globally at mining operations. For example, Anglo American plans to add 3 to 5 gigawatts (GW) of renewable energy projects at its operations. Greenhouse gas reduction makes up the majority of the remaining ESG-related projects, which include things like replacing diesel mining equipment with battery electric vehicles, hydrogen fuel cells, and other electrification projects like trolley assist projects for mine haul trucks.

U.S. & Canada

In the U.S., the Inflation Reduction

Act, Infrastructure Bill and Critical Minerals

Bill are driving project development

throughout the supply chain from

mining, processing to end-product

production. The U.S. Department of

Defense has funded more than $326.9

million to support projects, including:

lithium mining and chemical production,

graphite mining and processing,

battery recycling, cobalt mining and

processing, rare earth processing and

magnet production, antimony mining,

and nickel mining and processing.

Similar stimuli are happening all over

the world, including in Australia, Canada,

China, the EU, and Japan, all of

which have their own stimulus plans

for critical minerals development.

Both the U.S. and Canada are in the top 10 for mining project activity in 2024 (see table). In the U.S., Highland Copper’s Copperwood project is a fully permitted project (the environmental impact statement began in 2008) in Michigan’s upper peninsula. Approximately $30 million had been acquired for starting early site works last year and the company hopes to acquire full funding in early 2024 to begin construction next year. But like many projects in the U.S., funding has been difficult to come by, and extensive regulatory requirements keep delaying this project.

Latin America

Social unrest and resource nationalism

have been on the rise in Latin

America in recent years, and this has

had a significant impact on mining activity

in the region. In May 2023, Chile

approved a new mining royalty and

taxation plan, which increases mining

royalties from the current 5%-14% up

to 8%-26%, depending on the operation,

and adds a 1% ad valorem tax on

sales profit. The new royalty plan has

caused companies to reassess projects

such as Antofagasta’s $4.4 billion

Centinela mine expansion, which has

recently been approved. Freeport Mc-

MoRan has placed some projects on

hold as a result.

Like other parts of the world, project activity in the region is being driven by demand for metals necessary for the energy transition especially copper and lithium. There has been an increase in lithium investment projects in Argentina, Chile, and Bolivia, in addition to the discovery of new deposits in Peru, Brazil, and Mexico.

Europe

The ongoing war in Ukraine and energy

transition continue to be major drivers

for project activity in Europe. In the

EU, the Critical Raw Materials Act is

due to be enforced in early 2024. The

act states that the EU should mine

10%, recycle 25% and process 40%

of its annual needs of 17 strategic raw

materials by 2030. These include base

metals aluminum, copper and nickel,

along with key battery material lithium

and rare earth elements used in permanent

magnets for wind turbines or

in electric vehicles.

Russia is currently the third largest country in the world for mining project activity in 2024 after China and Canada. Construction is scheduled to begin in summer 2024 for the delayed $8 billion GDK Baimskaya copper-gold mine. And the United Kingdom has also risen up to the top 20 with projects like Anglo America’s Woodsmith polyhalite project under construction.

Africa

Africa’s mineral reserves are vast. According

to the UN, Africa is home to

30% of the world’s mineral reserves,

and it continues to receive resource

and infrastructure investment from

many countries interested in securing

critical mineral supply, including

Canada, China, Russia and U.S.,

not to mention many others. However,

many challenges are constraining

development, including regional geopolitical

instability, resource nationalism,

energy/infrastructure investment

and security/safety concerns. Mali,

Namibia, and Zimbabwe have all initiated

new taxation/royalty programs

or nationalized mining to some extent.

Namibia and Zimbabwe have both recently

banned lithium ore and other

critical mineral exports with the goal

of encouraging processing in-country.

Safety and security are main concerns

in many countries, especially those

involved in armed conflicts, including

Burkina Faso, Cameroon, Democratic

Republic of Congo (DRC), Ethiopia,

Mozambique, Niger, Nigeria, Mali, and

South Sudan. In the DRC, armed conflict

threatens more than 60% of the

world’s cobalt production, an important

energy transition metal for rechargeable

batteries. All of these issues work

to deter mining investment in these

countries. As a result, countries such

as Ghana, Morocco, Zambia, Ivory

Coast and Guinea are getting more

attention as comparatively friendly jurisdictions

to do business in. Guinea is

a rising producer of bauxite and the Simandou

iron ore project in the country

is moving through construction.

South Africa has the largest established mining industry and logistics infrastructure, with 324 major operational mines, and accounts for about 43% of all mines in Africa. South Africa is an important producer of platinum group metals (PGMs), including platinum, palladium, rhodium, etc., as well as gold, manganese, coal, zircon, vanadium and diamonds. However, South Africa’s electricity problems and common rolling blackouts are discouraging investments and causing existing operations to close. And other countries, such as Tanzania, Zimbabwe, Botswana, Namibia and Mozambique, have robust mining project activity.

Middle East

Many countries in the Middle East

have recognized the need to diversify

their economies away from a heavy

reliance on oil and gas exports along

with incorporating decarbonization initiatives

across industries. One avenue

they are exploring is the expansion of metals and mining industries, with

a focus on manufacturing and value-

added production. Iran dominates

mining activity in the Middle East and

is the only country from the region on

the global top 20 list. The National Iranian

Copper Industries Co. is planning

to start construction on a 320-megawatt

solar farm at the Sarcheshmeh

copper mine in 2024. In Saudi Arabia,

the Saudi Vision 2030 aims to reduce

the country’s dependency on oil by

expanding non-oil industries, including

mining and manufacturing. Oman

has been focusing on the development

of its mining sector with plans to process

and export metals like copper

and zinc.

South Asia

India has a growing mining industry

with coal and iron ore leading the way.

Coal accounts for 80% of power generation

capacity in India. Coal India is

on track to dispatch 1 billion metric tons

(mt) of coal this fiscal year, with annual

coal demand expected to remain in the

range of 1.2 billion mt through 2030.

As the second-largest steel producer

in the world, India has a large iron ore

demand. In 2023, iron ore production

was stable at around 250 million mt,

with a 6% increase in domestic steel

production. Indian iron ore production

is expected to increase to 260 million

mt by 2025. In 2024, steel demand in

India is expected to be robust. In Pakistan,

Saudi Arabia has shown interest

in investing in the world class Reko Diq

gold-copper project.

South East Asia

Indonesia, Vietnam and Philippines

are all on the global Top 20 list. Indonesia

has risen as a pivotal player in

the nickel domain, as the demand for

nickel, a crucial battery component for

electric vehicles (EVs) and renewable

energy storage systems like lithium-ion

batteries, continues to surge globally.

Indonesia’s prominence in the global

nickel industry is partly due to its ban

on nickel ore exports, which has stimulated

the growth of nickel mining, metal

smelting, and processing facilities

within the country. Indonesia is pushing

forward with multiple high-pressure

acid leaching (HPAL) projects and

plans to broaden its scope by encompassing

nickel sulfate, hydroxide,

cathode active materials (CAM), and

their precursors (pCam), processing

directly at the production sites. While

Indonesia’s role in the nickel industry

is substantial, it remains subject to

global market dynamics, with China

playing a significant role as the primary

source of foreign direct investment

for projects, and market fluctuations influenced

by EV demand and advancements

in battery technology.

Resource nationalism has impacted nickel direct shipping ore (DSO) operations, primarily in Indonesia, leading to a shortage of laterite and saprolite ores required for smelting and HPAL processing. Consequently, the Philippines has expedited several grassroot nickel DSO projects and is in the planning stages for constructing two additional HPAL facilities within the country, spearheaded by the mining company Nickel Asia Corp. This highlights the region’s response to the challenges posed by resource nationalism, demonstrating its determination to secure a stable supply of nickel to meet the growing demands of the clean energy and electric vehicle industries.

China

China’s economic recovery has been

slower than expected following the

pandemic lockdowns, and continued

friction with its main trading partner,

the U.S., will significantly impact China

in 2024. As a consumer of more

than half of the world’s resources,

any slowdown in the economy has a

significant impact on global mining

project activity. Still, China remains

the largest country for mining project

development, especially for coal, gold,

copper, and iron ore mining projects.

Lithium and potash project activity is

also very robust. China’s share of the

global market for lithium batteries has

reached more than 80%.

As a result of frequent accidents in the mining industry, the Chinese government will conduct strict safety inspections on the mining industry in 2024, closing small and medium-sized coal mines to reduce production overcapacity, increasing investment in non-ferrous metal mining, focusing on 5G+ intelligence, digitalization, and automation construction in mines.

Australia

Australia is well positioned to support

the energy transition as the world’s

largest miner of lithium, the third-largest

producer of cobalt and fourth-largest

producer of rare earths elements.

Not to mention a leading exporter of

iron ore and coal as well as other resources,

including nickel, manganese

ore, tungsten, and vanadium.

Globally, coal remains the number one commodity for mining project activity. Coal producers are facing growing constraints on the availability of finance because banks have increasingly sought to pivot away from coal in favor of renewables. Nevertheless, Australia is a major exporter of metallurgical and thermal coal to India, Japan, South Korea, China, and Taiwan, all of which are continuing to add coal-fired power plant capacity.

In Australia, the rapid growth of global battery demand will drive mining and downstream processing project activity for battery chemicals like lithium hydroxide, nickel sulphate, cobalt sulphate, high purity alumina, and vanadium pentoxide. The first lithium hydroxide refinery, owned by Tianqi Lithium Corp and IGO, is now undergoing major work to fix production bottlenecks. The second lithium hydroxide refinery, owned by Wesfarmers and SQM, is under construction, with first production expected in 2024. Pilbara Minerals and Calix are planning to construct a lithium phosphate refinery with a patented electric kiln technology that can reduce emission intensity and is powered by renewable energy.

In conclusion, with construction activity plateauing and major mining firm capital spending growth moderating, 2024 should see flat to modest growth in project activity in 2024. The energy transition, ESG goals and government stimuli to enhance domestic critical mineral development will be the main drivers of project activity in 2024.

Joe Govreau is Vice President Research – Metals & Minerals for Industrial Info Resources headquartered in Sugar Land, Texas, USA.