High-quality parts combined with good service and

reasonable pricing have seen many mines looking

beyond the traditional OEM offerings when it comes

to crusher maintenance in recent years.

(Photo: CMS Cepcor)

Keeping Critical Crushers Up and Running

As the global skills shortage hits home, mine operators are increasingly relying on

service providers and digital technologies to support crusher maintenance activities.

By Carly Leonida, European Editor

While the drivers for regular repairs, upgrades and optimization initiatives are clear, supply chain challenges, and also the availability of skilled and experienced engineers to mastermind and execute important shutdowns and maintenance tasks has put tremendous pressure on service providers and mines alike over the past 2-3 years. As such, many are now placing an enhanced focus on maintenance planning and are looking to digital insights and remote service provisions to help bridge the gap. In line with these trends, OEM, Weir Minerals, is seeing an industry-wide shift in the way that crushers and servicing are offered and sold to miners and aggregate producers. “Increasingly, when we sell a Trio crusher, we give the customer the option of adding service and spare parts packages whereby Weir Minerals will perform all the maintenance work and supply all the required parts,” said Sebastian Rakoczy, Weir Minerals, Global Product Manager for Crusher Products. “We then have an interest in maintaining the machine to the highest standards to avoid unnecessary costs, which ultimately benefits the customer because it prevents unplanned downtime.”

Trio crushers are built to last even in the toughest applications, so total cost of ownership (TCO) is a vital way of understanding and measuring their performance and value. The focus on TCO — as opposed to focusing solely on CAPEX — is predominantly down to miners and aggregate producers taking a more holistic, long-term view of their equipment. Rakoczy told E&MJ: “Today, operators typically have a much more detailed understanding of their operations than they did 10 or 20 years ago. They understand the wear life of their parts and they plan maintenance accordingly. As an OEM, it’s important that we work with them to ensure we have the required spares available on or close to site.”

There is also greater importance placed on maintenance strategy today, particularly when the life of mine (LOM) is relatively short. Rakoczy said that maintaining profitability is a more difficult task when the LOM is, say, 10 years rather than 150 years. “Knowing, for instance, how much energy a crusher consumes or how often bowl liners need to be replaced and how much it costs each time is consequential and, ultimately, determines whether the mine will remain economically feasible,” he explained. “One of the main factors that guides our maintenance strategies is reducing downtime, which requires careful planning and preparation. Prior to a shutdown, it’s important to understand exactly what maintenance needs to be performed to ensure the service team has all the parts, people and tools on hand. At the end of the day, downtime is lost production and we want to keep that to a minimum. Also, whatever maintenance needs to be performed must be carried out safely, and this must be factored in at every stage, from planning to execution.”

“Customers often come to Weir for a reason; they have a problem that they want us to help them solve. So, firstly, we want to understand the plant schematic, product flow and any issues or bottlenecks they might have because one crusher could impact downstream crushers. This approach is why the Trio and ESCO products work so well together.”

Overcoming Sustainability

and Supply Chain Issues

There is also a growing recognition that

implementing more sustainable processes

and practices in maintenance is of the

utmost importance, and there are several

things that Weir Minerals is doing to improve

the efficiency and carbon footprint of

its Trio crushers. For instance, the Gemex

belt tensioning system can now be integrated

with most Trio crushers. Typically,

operators must unbolt the motor and use

large wrenches to move the belt via jacking

bolts before re-tensioning the belt and realigning

the pulley. This is time consuming

when done with a high degree of precision.

Comparatively, once setup, the Gemex system allows the operator to adjust the belt tension quickly by reading the manometer of the hand pump and adjusting the pressure. Changing the belt tension also no longer affects the alignment of the pulleys. The belt transmission continues operating at the highest efficiency, which can reduce energy consumption by at least 7%. Additionally, ESCO wear liners allow miners to optimise crusher performance, which means they don’t need to be changed as frequently, resulting in less wastage.

Rakoczy added that digital technologies and insights are proving key to optimizing crusher maintenance programmes and shutdowns. The Trio cone crusher control system monitors wear via the closed side setting (CSS), and sensors detect increases in bushing or oil temperature and monitor vibrations of the crusher, among other things. The system then provides warnings and notifies the operator when certain maintenance needs to be carried out.

Weir Minerals’ Synertrex digital ecosystem is the next step. The Industrial Internet of Things (IIoT) allows operators to monitor and visualize the individual sensor data of each machine within a broader, more holistic context. This shift is driving the trend towards more proactive maintenance, planning and execution, resulting in unequalled plant optimization possibilities. “Sensors are brilliant at collecting data which can be used to set maintenance schedules and deliver warnings when the equipment isn’t performing optimally,” Rakoczy said. “Across the industry, there’s a shortage of qualified service teams, so digital technologies have a role to play in ensuring that those teams are deployed when and where they’re needed most. However, they are not a replacement for qualified technicians.

“COVID-related disruptions also forced us to innovate and harness digital technologies in new ways. Weir Minerals had some new Trio TP260 cone crushers go into operation in Morocco and the commissioning specialists — who were based in Poland and unable to travel — were able to remotely monitor the machine’s performance and provide support to the local service team. The customer was satisfied because they received two new, operational Trio TP260 cone crushers and, from our perspective, we’ve got a local team that’s gained a huge amount of knowledge and experience.”

The mining industry currently faces a myriad of supply chain challenges which OEMs, like Weir Minerals, are working to resolve. Rakoczy said that the next 5-10 years will continue to be about getting parts and spares to customers on time. Again, digital technologies can help in streamlining this process — data on wear life and wear characteristics will help eliminate unknowns and unplanned maintenance. But, just as importantly, it’s vital that equipment suppliers are close to their customers — both in terms of proximity, as well as in understanding their operations inside-out.

“This is why Weir Minerals’ global network of 150 service and support centres is central to our commitment to our customers,” he said. “We see our customers as partners, and we provide solutions based on their specific challenges.”

Data Enables Continuous

Improvements

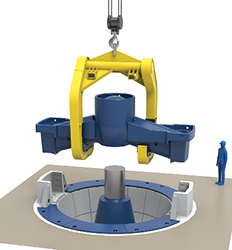

Nowhere is the skills shortage in crushing

being felt harder than in the maintenance

of primary gyratories. As the first

step in any comminution circuit, the colossal

size and relatively low number of

these units on any site (low redundancy)

makes their role and availability more important

than most others.

Nicholas Vanderlinde, Sales and Product Offering Specialist for Crushing Products at Metso, said that the company’s customers are struggling to find qualified and experienced technicians to maintain their crushers, which means an emphasis has been put on simplifying maintenance and increasing safety when it comes to gyratory crusher repair and upkeep.

“We have been pushed to create new longer lasting wear components and upgrade packages that accommodate increases in safety for maintenance crews onsite,” he told E&MJ. “In addition, we’re seeing customers constantly looking to increase their tonnage rates as orebodies change throughout the LOM. With lower percentage ores becoming the norm, demands on uptime and throughput are ever increasing on customer sites. This just means more demand on primary crushers, so any improvements that can be made at that stage of the process are paramount to customer profitability and success.”

These days, there’s a huge demand for TCO and aftermarket services. Vanderlinde said that, with operations having more data available each year, performance analyses are giving operators the insights they need to better understand their operational expenditures. “This has given our customers the ability to understand where their biggest maintenance hangups and costs are, and act to solve them,” he said. “It’s why we have moved to working closer with our customers to better understand their needs and provide solutions designed to solve those exact issues. Targeted upgrades and support for our customers means they are spending their money where it will have the largest impact on their profitability.

Despite growing demands on production, mine maintenance budgets are rarely increased, so whatever can be done to make dollars go further is a plus at any site. Vanderlinde said that additional monitoring solutions allow better planning of downtime and repairs, as well as tracking of parts onsite which, again, can help to reduce inventories. “Additional data allows mines to have the right parts onsite at the right time for their needs, helping to maximize the resources they already have,” he said. “Increased data at the crusher also allows teams to respond better to changes in feed or ore, helping to increase downstream process efficiencies at the plant too.”

Of course, the shrinking base of expertise on crusher maintenance has not only impacted mine operators but also OEMs and service providers. “The skills needed are becoming less common, so there is a premium placed on solutions that can fill that gap,” Vanderlinde explained. “This means new innovations in crusher monitoring and data gathering are going to become essential to making sure crushers perform at their maximum potential. By adding in remote technologies in operation of the machine and additional monitoring, we can help eliminate potential issues down the line and give mine sites even more information to streamline their processes.”

Mikko Koivunen, Director for Process Optimization and Remote Services Sales Support at Metso, added: “Greater availability of data online also enables Metso’s Performance Centres to react faster to arising issues and offer proactive support through data analysis.” Vanderlinde said that, as the skills shortage is unlikely to end anytime soon, going forward, there will be a huge push to simplify crusher components and maintenance practices. “As more knowledge is lost through retirement, there are fewer people stepping up to take the place of those who are leaving the industry,” he said. “This means that more of the demand for repair and replacement is going to come into the world of services and support. New training technologies and repair strategies are going to be paramount to keeping crushers running as well as additional manufacturer support for customers. Using monitoring technologies to help fill that gap is going to be an important step for the mining industry.”

Koivunen added: “This is where data- driven, digitally enabled field service experts with access to real time data and the support of Metso Performance Centres can really excel, helping customers to focus in on the right issues at the right time.”

Planning and Reliability Centered

Maintenance

Today, nearly all mines have their own sustainability

programs and commitments,

and OEMs are no different. Through FLSmidth’s

MissionZero strategy, the company

helps customers to identify crusher upgrades

that increase efficiencies on site.

“We are also shifting and expanding our

operating space, to help in the areas where

we once would have taken on a smaller

scope, like requests for component repairs

and incorporating recycling of used components

to reduce environmental impact,”

Trevor Kupstas, Global Product Manager

– Crusher Liners at FLSmidth, told E&MJ.

“We see our customers working to improve

their operational run time, so they

are focusing their maintenance strategies

on areas that provide these returns, like

reliability of equipment and the maintenance

of key parts,” he added. “Most large

sites have already shifted to preventative

maintenance, rather than reactive because

the benefits far outweigh potential costs.

Therefore, things that we did earlier, like

designing wear parts for specific shutdown

schedules, are moving even further.”

Like his peers, Kupstas has noticed a greater focus on reliability-centred maintenance and TCO programs over the past decade. The initial capital investment of the equipment is only a small portion of the overall costs, so it makes sense that the aftermarket expenditures are getting more attention. “I think that our customers are doing this because they are more and more impacted by pressure from pricing and finding skilled workers and need a solution,” he explained. “In the past, maintenance revolved around repairs and not as much planning. That was not necessarily because of want, but because of lack of information (data) to make more informed decisions. Today, we use data and technology that is available on our equipment to plan and schedule maintenance a lot better and earlier than before. Without data the results that we are getting with our TCO and Optimization Programs would be a lot less impactful.”

Reliability-centered maintenance plans are a good example of where digital technologies can be harnessed for maximum impact in crusher maintenance. For example, 3D scanning technology is commonly used in crusher liner assessments, and the results can be used to better plan maintenance activities, even months in advance.

“It helps us to spot changes in wear patterns that can negatively affect the operation of crushers and allows us to make adjustments before unplanned downtime occurs,” explained Kupstas. “Digital solutions, like condition monitoring, can have a big effect on proactive maintenance. One example of this is a condition monitoring service that we have with one of our mining customers. Through this program we were able to find a small oil leak in the hydraulic cylinder seal of a crusher and detect operational problems with the countershaft bearings. The site was then able to plan the maintenance changeout on the next schedule instead of it becoming an emergency situation.

“We saved this customer 10 hours of unplanned downtime and also saved other components from failure, since the bearings did not catastrophically fail, which would have sent hardened rollers throughout the machine.” Kupstas added that when performing maintenance or troubleshooting, a site can’t just deploy a new technician and expect them to deliver the same results as an experienced person, or even with the same speed. “We’re having the same trouble as our customers when it comes to finding skilled and experienced engineers, so we’re always looking at ways to become more efficient,” he told E&MJ. “For the moment it’s difficult to replace experienced personnel with digital technologies and it’s not possible to do all jobs in a digital way, but technologies are getting better.

“One example of these technologies successfully helping is the communication capabilities that we have today: virtual meetings, video calls, or our augmented field engineer tools. These capabilities, complemented by data-driven information, support us in fast and effi- cient decision making (in several places at the same time), and can also help to compensate for the shortage of skilled workers in a short time.”

With the acquisition of thyssenkrupp Mining Technologies last year, FLSmidth has bundled the companies’ combined knowledge to offer a stronger position in the market. This includes an active R&D pipeline to develop new products and upgrades to improve crusher operations. An example is the new Metal Matrix Composite (MMC) concaves for gyratory crushers which were developed and introduced in 2021. These have shown improved wear behavior compared to standard wear parts, even under the toughest conditions. The MMC technology is based on the combination of hard particles in a softer casted base material (e.g., carbides embedded in steel alloys) and offers the advantage of extreme wear and impact resistance at the same time.

“I’m very excited about some of the offerings that are actively being field tested and that are scheduled for launch later this year,” said Kupstas. “I think in the future, we will continue to see the trends of improving efficiencies and needing to do more with less, meaning we will continue to create digital offerings that are more automated, predictive, and safer to use because of continued shortage of qualified personnel. We’ll also see a bigger shift to more sustainable maintenance, including expanded refurbishment programs and reduction of waste during maintenance.”

The Growing Role of Thirdparty

Service Providers

In the past, aftermarket services for

crushers, particularly gyratories, have

largely been the domain of OEMs. However,

established non-OEM suppliers are

gaining traction where skills shortages or

capacity limitations are forcing operators

to look elsewhere.

“Once the opportunity to prove the

combination of high-quality parts, good

service and lower pricing is a real option

we are seen as a genuine alternative,”

said James Shelley, Group Sales Director

at CMS Cepcor.

CMS Cepcor has been carrying out service visits, repair work and wear liner changes on primary crushers for many years. This has centred around the use of aftermarket parts that are interchangeable with OEM parts. Through its recent acquisition of the Columbia Steel crushing business, CMS has expanded this to offer far greater possibilities in terms of optimization of primary gyratory crushing chambers with the aim of exceeding the standard performance benchmarks set by OEMs.

“Columbia Steel was far more developed in its engineering of wear profiles than CMS Cepcor and much of this experience was directed to primary crushers,” said Shelley. “The combination of both companies’ offerings is of signifi- cant benefit to the client, and we’re now able to take whichever route (standard or bespoke) the client wants or needs. Considering the vast experience of the personnel that have joined us from Columbia I think it would be difficult to find a better partner for wear liners.”

The skills shortage has seen many mines turn to third-party service providers in a bid to keep their crushers up and running. Shelley told E&MJ that mines are increasingly relying on service providers whose teams often possess greater skills and experience than their own.

“An example would be the annual service contracts that CMS offers,” he explained. “Together with the operator, our sales and service team will develop a maintenance plan for the year encompassing all the likely parts and service requirements. We then assemble a quote around that and a financial solution to make their budgeting and maintenance spending more predictable and easier to manage. This approach combines the strengths of both parties, where the operator has experience of running the plant and we have the experience of maintaining all types of crushers around the world; it’s a great combination.

“For the longer term we are offering students from local colleges the opportunity to come and start their career as apprentices. We hope this gives them the opportunity to acquire the skills and experience needed to plug the skills gap in the years to come.” Because the repercussions of unplanned downtime can be very expensive in mining, it’s becoming ever more impractical to rely on last minute planning or reactive maintenance approaches. Shelley said that, as such, operations are increasingly pursuing proactive planning and preventative maintenance strategies. “As the demand for crucial components like new main shafts or shells continues to rise, the lead times for these items are also getting longer as the number of qualified suppliers is remaining relatively constant,” he added.

Although TCO is an issue with primary gyratory crushers, relative to other major equipment types on site, these units are not major consumers of wear parts and spares. “It may well be a serious consideration when evaluating the initial selection of capital equipment between suppliers, but once installed we often find production factors outweigh long-term spend,” Shelley told E&MJ.

“Where we see a real challenge to this is where there’s the need to push throughput as far as possible. This means the machines can be operating at or above their advised limits, increasing the risk of major breakdowns. This challenge becomes more pronounced when considering the presence of older machines still in operation, surpassing their intended design life of 25 years. With the combination of an aging machine and pushing equipment to its limits then breakdowns are inevitable.”

As operators continue to push the envelope in production and rely increasingly on third parties to help them with plant maintenance and supply chain management, it’s likely that the role companies like CMS Cepcor plays will continue to grow in importance.

“It’s our opinion that aftermarket offerings of the OEMs are fundamentally compromised because their business models are not fully dependent on being truly competitive in that sector,” Shelley said. “All of the OEMS have a broad portfolio of processing equipment of which crushing is only a minority part. Even within the sector, the attraction of the large capital orders they can achieve means their aftermarket business is always fighting for attention internally because the values are so much smaller. CMS Cepcor is focused solely on crushing; it’s what our whole business is geared towards and it’s why we commit such a large proportion of our resources to stock and availability.”