Reflecting the industry’s growing interest in maximizing data analysis and usage for making better operational

Reflecting the industry’s growing interest in maximizing data analysis and usage for making better operational

decisions,

iron ore producer Fortescue Metals recently opens the Hive, a purpose-built facility that brings together

teams from the

company’s planning, operations and mine control organizations along with port, rail, shipping and

marketing groups.

Miners are trained to be familiar with

tools. For anything from a jackleg drill to

a production spreadsheet app, the principles

are similar: Set and control the tool

to do what you want it to do. When the job

is done, put the tool aside and move on.

But suppose a tool requires a relationship

— a constant back and forth dialogue

about how best to approach a job and

measure the value of the results? And suppose,

in the end, that tool turns out to be

smarter than the user? When it comes to

Artificial Intelligence (AI), a tool that’s increasingly

important for business success,

these aren’t just remote possibilities.

They’re almost a given, if you take into

account the rate of increase in industry interest

and implementation of AI and the

speed and scope of AI development. Mining

is adopting AI technologies at an unprecedented

rate, its suppliers are expanding

or realigning their product and services

portfolios to support that trend, and various

social and technological trends are funneling

the industry’s future format toward a

mostly automated, robot-assisted scenario

in which AI’s predictive algorithms control

where to drill for, how to process and where

to ship mineral products.

For the foreseeable future, however,

AI won’t be a set-and-forget tool. Cliff

Justice, U.S. leader for enterprise innovation

at KPMG, offered this prediction on

a recent episode of the MIT Technology

Review Business Lab podcast: “The ecosystem

that got you to a level in more of

an analog-centric world is going to be very

different in a more AI-centric world.

“That AI-centric world is going to accelerate

everything digital has to offer.

What I mean by digital are the new ways

of working — the digital business models,

the new ways of developing and evolving

commerce, the ways we interact and exchange

ideas with customers and with

colleagues and coworkers. All of these

are becoming much more digital-centric,

and then artificial intelligence becomes

one of the mechanisms that evolves and

progresses the way we work and the way

we interact. And it becomes a little more

like a relationship with technology, as opposed

to a tool that we program because

AI is something that evolves and learns

and develops the more it gets exposed to

humans,” he explained.

Most social scientists will say that an

important key to improving relationships

is good communication between two

parties. However, there are signs that future

human relationships with AI may be

skewed towardstechnology having the upper

hand: Neural networks, for instance,

are data-hungry, powerful AI tools that

can be applied to problems that would

simply take too long and require too much

effort for humans to efficiently solve. But,

as a recent article on the Scientific American*

website pointed out, neural networks

aren’t always forthcoming about how they

produce results. Like a stubborn child,

they might present a perfectly good answer

to a problem but won’t tell you how

they reached that solution.

According to author Robin Blades,

“In the past 10 years, machine learning

has become an extremely popular tool for

classifying big data and making predictions.

Explaining the logical basis for its

decisions can be very difficult, however.

Neural networks are built from interconnected

nodes, modeled after the neurons

of the brain, with a structure that changes

as information flows through it. While this

adaptive model is able to solve complex

problems, it is also often impossible for

humans to decode the logic involved.

“This lack of transparency has been

nicknamed ‘the black box problem’ because

no one can see inside the network

to explain its ‘thought’ process. Not only does this opacity undermine trust in the

results — it also limits how much neural

networks can contribute to humans’ scientific understanding of the world.”

AI also poses the possibility of disrupting

the traditional pattern of workforce

roles. David Degerfeldt, program

manager-artificial intelligence in mining

at Boliden, touched upon this during a

webinar held earlier this year titled AI: A

Necessary Enabler for Sustainable Mining

Production, sponsored by Swedish Mining

Innovation, a joint partnership among

Swedish government innovation agency

Vinnova; Formas, a research council; and

the Swedish Energy Agency.

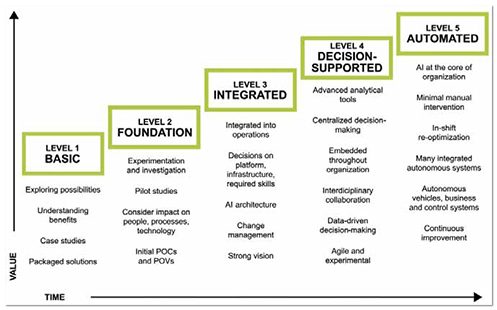

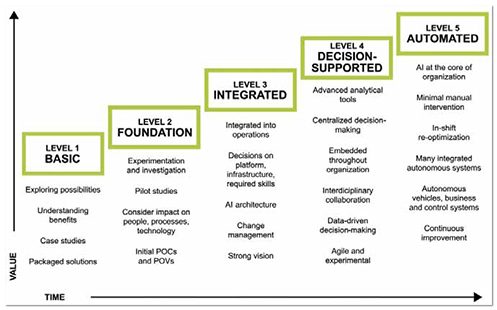

Degerfelt outlined Boliden’s recent

progress in AI initiatives in terms of an

AI Maturity Timeline chart developed

by the Global Mining Guidance Group

(GMG) for its 2020 report Foundations

of AI – A Framework for Ai in Mining. He

estimated that his company is currently

at Level 2, with a goal of eventually

reaching Level 6, which is beyond the

scope of the GMG chart and represents a

fully autonomous operation.

He wondered, at that point, who the

“heroes” of mining would be. “We would

have a fully automated mine, with very

few people on site. There would be no

shifts. Machines controlled by AI don’t

require breaks, they work 24/7.

“Of course, the heroes in today’s mine

are the operators,” he noted. “They do

all the heavy work and without them we

couldn’t do anything. But in an automated

mine, who would be the heroes?

Consider the IT group, for example. It’s

usually regarded as a support organization

and not involved in production. In an

automated mine, however, they might be

considered the heroes that keep the operation

running, while the operators would

just step in when things go wrong on the

ground. Would operators then be considered

a support function?”

Unrealistic expectations could also

cause investment in AI to waver. As Javier

Pigazo Merino, FLSmidth’s technical

product line manager, group digital,

warned in a recent online post, prospective

AI customers need to be aware of the

“Hype Cycle.”

“Especially with emerging technologies

and trends in the industrial

landscape, we hear bold promises from

marketing materials or sales presentations

— sometimes inherited from other

sectors where maturity levels and/or

conditions are far from similar,” Merino

said. “This can make it very difficult

for a non-technical audience to discern

hype from what is technically viable and

commercially profitable for their specific

business needs.

“This overinflation of expectations,

combined with low resistance to failure,

leads to huge doses of frustration and

early dropping of the investment, even

before the learnings are incorporated into

a new iteration or before a good productivity

level is reached,” he explained.

Looking Downstream

The industry’s implementation of AI and

other new, disruptive technologies may

also have unanticipated downstream impact

on ESG strategies and supply chain

arrangements, according to a 2021 report

from the International Institute for Sustainable

Development, an independent

think tank. The study, titled New Tech,

New Deal: Mining Policy Options in the

Face of New Technology, is the result of

a project conducted as a partnership of

the IISD, the Intergovernmental Forum on Mining, Minerals, Metals and Sustainable

Development (IGF), the Columbia Center

on Sustainable Investment (CCSI), and

Mining Shared Value/ Engineers Without

Borders Canada.

The authors pointed out that the advent

of new technologies could pose significant

implications for mining supply chains and

is likely to transform the procurement

function at the site and corporate levels.

Three aspects of procurement will particularly

be affected. In their words:

An AI maturity model for the mining industry (Global Mining Guidance Group, 2020).

An AI maturity model for the mining industry (Global Mining Guidance Group, 2020).

“Strategic sourcing — i.e., what mining

companies buy, from where, and through

the most effective market analysis — is

becoming more predictive. This means

mining companies are able to better plan

and manage their procurement needs, select

their suppliers, and secure the most

competitive prices. Centralized decisions

are expected to increasingly be made at

corporate level, to then be redirected at

the country or site level. Unless mandatory

local procurement policies require them to

do otherwise, this may reduce local sourcing,

as local suppliers may not be able to

compete with new global suppliers identified by AI and thus far unknown. Smaller

suppliers may not have sophisticated

enough structures to participate in digital

platforms to serve mining operations.

“Second, with digitized sourcing platforms

and payment systems, transactional

procurement is being automated,

allowing companies to centralize, analyze

and structure their procurement orders

more efficiently. Integration of different

systems helps reduce risks and costs.

Local suppliers may not have the same

level of digitization and secured payment

systems, which disadvantages them.

“Third, leaner systems are redefining

mining companies’ relationships with

their suppliers. Collaborative platforms

and suppliers that are able to provide tailor-

made solutions or proactive innovative

technologies will benefit more from digitized

procurement functions than traditional

and small local suppliers.”

Those changes, the report’s authors

contend, will have profound implications

for local procurement strategies, from

both mining companies (as buyers) and

local suppliers, who will have to adjust

their business models accordingly.

Sorting Out Strategies

Despite the potential for encountering

these speed bumps, various surveys point

to a high rate of AI interest and adoption

throughout the mining industry — which is

somewhat surprising given the industry’s

reputation for technological risk aversion.

For instance, earlier this year, Aspen Tech

commissioned an independent survey of

200 North American and European IT and

Operations decision-makers from across

the industrial sector, including companies

in construction and engineering, chemicals,

energy, oil and gas, metals and

mining and others. The results showed

that nearly all respondents recognized the

importance of Industrial AI to their organizations

— 99% could name at least one

business driver for adopting an Industrial

AI strategy — but few actually had one.

Overall, the survey indicated that:

• 79% said they either have an Industrial

AI project live right now or are piloting

one. Only 1% of respondents said they

have either no initiatives for Industrial

AI in place, or no plans to develop one.

• Although Industrial AI depends on ingesting

quality data, much data is often

left undiscovered due to a number

of structural challenges. Nearly all

(98%) of the IT and Operations decision

makers polled said their organization was

experiencing at least one of these industrial

data challenges, inhibiting their

data quality and management practices.

• In the same vein, on average, the survey

respondents estimated that they only had

visibility over about 66% of their organization’s

industrial data. That means industrial

organizations, on average, have

little to no visibility over one-third of the

industrial data they’ve collected.

• More than eight in 10 said Industrial AI has

played a significant or major role in their

organization’s broader digital transformation

strategy in the last three years.

According to FLSmidth’s Javier Merino,

the benefits of AI are clear — particularly

in processing applications — once

certain misconceptions are overcome.

For example, he pointed out that “APC

[Advanced Process Control] systems are

very often seen as one of the main drivers

needed to reach the dream of autonomous

operations. In this context, it’s

commonly heard in the media that AI is

replacing APC systems. But this wrongly

assumes that AI is already a synonym for

fully-autonomous operations. This kind

of misrepresentation does not help, as

such fully autonomous continuous-process

plants are still not that close to reality.

“However, there are many examples

where new technologies and workflows

can heavily enhance the level of information

that is gathered and analyzed, transforming

it into much better actionable insights,

to take decisions faster than ever,”

he said. “This is what we call ‘intelligence

augmentation’ and can clearly assist and

elevate the performance of either existing

APC systems or human-based control.”

There are three main areas where

APC can and will benefit from AI, according

to Merino:

Cognitive augmentation – The ability to

gather, analyze and combine various data

streams in real time can bring relatively

quick benefits from operational and safety

perspectives. One example would be

building new virtual sensors to replace

unreliable or unavailable signals, particularly

when the instrumentation is placed

in risky areas or is often out of service.

Smart controllers – In certain contexts,

controllers, such as linear and non-linear

MPCs, can be enhanced and complemented

by virtual models of machinery or

processes, known as digital twins. If the

digital twins are done well, they can be

used to find the controller’s optimum parameters,

which leads to more stable processes,

achieves higher production and

quality levels, or decreases the amount of

energy or water used.

Dynamic adaptiveness – Many industrial

processes are by nature nonlinear and

time-varying. This means that actions

that were optimal to achieve specific

goals yesterday (or even an hour ago)

may be suboptimal or even inefficient

now. The ability of AI technologies to

continuously adapt to changing conditions

to find the optimal operating parameters

and targets is one of the key

areas in which AI can improve the ability

of APC systems to optimize cement and

mining processes.

Scoping Industry Interest

Although mine operators may be technologically

conservative by nature,

cost-cutting and profitability are powerful

magnets for attracting operational investment.

Potential benefits lie in the areas

of exploration, mobile and fixed asset optimization,

worker safety and environmental

compliance, among others. Now that

we’ve seen some of the pros and cons of

AI and sampled its rate of uptake, it’s fair

to ask “where is the mining industry now in terms of AI integration?” A fair answer

would be “all over the place.”

That’s not a flippant observation; it

just reflects the widening scope of AI

application capabilities and possibilities

open to the industry. To provide a glimpse

of how wide-ranging the industry’s interest

in AI applications has become, here’s

a quick rundown on just a few of the latest

developments.

Minerva Intelligence, a knowledge

engineering firm based in Vancouver,

British Columbia, recently released the

results of an evaluation of Freeport Resources’s

Star Mountains property in

Papua New Guinea. Minerva used DRIVER,

its Al software, to perform an evaluation

of multi-element drilling data. In

addition, Minerva reinterpreted existing

geophysical information on the project

and completed traditional K-Means Cluster

analysis on the multi-element data.

Gord Friesen, CEO of Freeport Resources,

a Canadian junior company,

said his company found Minerva’s analysis

and the DRIVER system to be “very

useful” for understanding the project.

“DRIVER validated our geologists’ interpretation

of the deposit zonation and

gave indication of mineral potential beyond

known resources on our properties

and confirmed it in a fraction of the time.

The synthesis of independent methodologies

was a valuable contribution to the

project and gave us confidence about the

results.”

In September, the Silicon Valley investor-

backed AI startup Kobold Metals

announced it would work with BHP to

discover battery minerals such as copper

and nickel in various districts around the

globe. Kobold said its data platform, TerraShed,

aggregates and structures vast

collections of scientific data and makes

it rapidly available for analysis. Then Machine

Prospector, a suite of algorithms,

interrogates that data with a range of

techniques — from ensemble machine

learning, to full-physics joint inversions,

to computer vision — to predict the composition

of the subsurface in a statistically

valid manner.

Kobold’s principal investors include

Breakthrough Energy Ventures, a climate

technology fund backed by Bill Gates and

Jeff Bezos, among others; along with Andreessen

Horowitz, a major Silicon Valley

venture capital fund; and Equinor, the

Norwegian state oil company.

Earlier this year, KoBold announced a

partnership with iCRAG (Irish Research

Center for Applied Geoscience) researchers

to explore for critical minerals. iCRAG

researchers will use the microscopy, geochemistry

and spectrometry facilities in

the iCRAG Labs at Trinity College Dublin

to investigate minerals containing cobalt,

as well as other elements often found

proximity to cobalt, such as nickel and

copper. In particular, the research project

will focus on examining mineral samples

from the Kisanfu cobalt-copper deposit

in the Democratic Republic of Congo to

better understand how cobalt deposits

form. The analysis will form the basis of

machine learning techniques developed

by KoBold to gain insight into the exploration

of critical raw materials in similar

deposits around the globe.

Australian drill-tech company IMDEX

recently paid about $20 million to acquire

MinePortal software from California-based

Data Cloud International. IMDEX describes

MinePortal as a new-generation

native cloud application that enables geological

data modelling and real-time 3D

visualization. Among its features are:

• Capacity to process high volumes of

data in a cloud environment, while applying

geostatistical and machine learning

algorithms to identify orebody trends.

• Integration with IMDEXHUB-IQ to deliver

a connected real-time orebody

knowledge ecosystem.

• Ability to process IMDEX BLASTDOG

data and other data sets, including

MWD data and other IMDEX sensor data.

IMDEX said BLASTDOG is a semiautonomously

deployed system for logging

material properties and blast hole characteristics

at high spatial density across the

bench and mine and is commodity agnostic.

It has been developed in collaboration

with Universal Field Robots and tested at

mines in Queensland, Western Australia,

Chile and Nevada. At an industry event

held in November, IMDEX said BLASTDOG

will advance from engineering development

to commercial prototype by the

end of the year. Long-term, the company

expects its acquisition of MinePortal

to enhance the value of BLASTDOG for

clients by translating sensor data into 3D

visualization models.

Managing Mobile Assets

Last year, Caterpillar introduced MineStar

Edge to augment its MineStar Solutions

suite of technologies and to align with

the way many mining operations manage

their businesses. Edge, according to Cat,

creates an operational ecosystem for mining

companies. Rather than having data

in individual silos, Edge brings visibility

to the entire mining operation and enables

managers to see how activities early

in the process impact those further down

the value chain. Edge enables supervisors

to access real-time information from a

computer or tablet from any place with an

internet connection.

MineStar Edge also leverages cloud

computing and AI so it can grow as it

collects data, identifies patterns and

learns to make decisions. These capabilities,

said Cat, enable mine managers

to focus on improving operations rather

than collecting and interpreting data.

Edge also automates data collection,

which ensures accuracy, unburdens personnel

and enables managers to trust

the information they receive.

Cat claims that because Edge is delivered

as a cloud-based, subscription

managed application, it reduces costs of

deployment, service and training. Caterpillar

handles all office-based deployment,

support, updates and upgrades.

Customers select an offering by role,

function or task — paying only for those

functionalities they need.

Cognecto, a Bangalore, India-based

company that has developed an AI-based

platform that provides real-time analytics

solutions and managed services related

to heavy equipment, announced the

launch of Machine Link, which it said is

custom-built for the demanding environments

of mining, material handling, construction,

and logistics. According to the

company, Machine Link will enable fleet

owners to retrofit new and aged equipment

with relevant sensors. It comes

with the inbuilt capabilities of an advanced

IoT device and easy to integrate

tire pressure sensors, fuel sensors, load

sensors, RFID sensors, and open channels

to tap into the various electrical and

mechanical sensors.

Cognecto said the modular design of

the edge device helps customize the sensor

inputs as per customer requirements

and delivers ROI within few months.

The base model enables connecting all

the assets at the site to ensure visibility

to complete material/process flow. It is

pre-configured to connect with the Fleet Management Platform and is intended to

help Cognecto remotely manage and upgrade

the installed device without complex

local support.

In June, Rio Tinto’s Iron Ore Auto-

Haul Rail announced a feasibility study

of AI vision systems for hazard detection

in its Pilbara, Western Australia,

heavy haul railway network. AI Systems

Ltd. is participating in the trial, now

under way.

The feasibility study involves the trial

of AI Systems’ AI solution installed on

a locomotive to validate its capability to

detect and classify objects in the rail corridor

ahead of the train.

Train control specialist company 4Tel

Ltd. formed AI Systems as a special purpose

company based in Newcastle, New

South Wales, aimed at commercialization,

management and further development

of AI intelligence vision systems

and intellectual property previously developed

by 4Tel.

AI Systems’ technology is focused on

object detection software, using a patented

sensor array. The detection system can

be fitted to both moving vehicles and to

stationary locations such as level-crossings,

stations and large intersections.

From Pit to Process Plant

The Weir Group is acquiring Motion Metrics,

a Canadian developer of innovative AI

and 3D technology used in mines worldwide.

As part of the agreement, Motion

Metrics’ Vancouver headquarters will become

Weir’s global center for excellence in

AI and machine vision technology.

Motion Metrics produces smart, rugged

cameras that monitor and provide

current data on equipment performance,

faults, payloads and rock fragmentation.

This data is then analyzed using embedded

and cloud-based machine learning to

provide real-time feedback to the mining

operation. This enables immediate identification of potential issues that could

impact safety and cause expensive unplanned

downtime. This includes boulder

and foreign body detection to dislodged

ground-engaging tools that can critically

damage crushing equipment if undetected.

According to the company, it also

provides information that can be used to

optimize asset efficiency, supporting better

decision making as miners seek to increase

productivity while reducing energy

consumption, particularly in areas such

as comminution.

These technologies were initially developed

for GET applications but have recently

been extended into a suite of products

and solutions that can be applied

from drill and blast to primary processing.

Motion Metrics technology is currently

used on more than 80 mine sites.

Weir said Motion Metrics will join its

ESCO division, reflecting the early adoption

of its technology in ground engaging

tools. Motion Metrics’ AI and machine

vision capabilities are expected to be

leveraged across the whole mining value

chain served by the Weir Group.

Moving forward, Weir said ESCO’s

focus is on accelerating growth through

geographic expansion and the continued extension of its front-of-shovel offering.

The Motion Metrics acquisition, according

to Weir, is fully aligned to this strategy,

including the early realization of

the digitally instrumented smart bucket

concept, which provides information on

bucket and GET health alongside payload

and ore fragmentation analysis.

Global chemical company BASF and

IntelliSense.io, an industrial AI company,

announced a partnership called the

“BASF Intelligent Mine Powered by IntelliSense.

io” that delivers AI solutions embedded

with BASF’s mineral processing

and chemical knowledge.

The partners said BASF Intelligent

Mine Powered by IntelliSense.io is an

open, real-time, decision-making platform

that can be configured for individual

sites, typically within three months. Each

plant process, such as grinding, thickening,

flotation and pumping, is supported

by an Optimization as a Service (OaaS)

application, which predicts and simulates

future performance, generating

process-specific recommendations for insights

and optimization. As multiple OaaS

applications link together, customers can

generate efficiency gains throughout the

entire mine-to-market value chain.

Remote operations access allows for

24/7 visibility of mine operational and fi-

nancial performance, with BASF process

experts available to provide real-time

support. Additionally, the in-built simulation

tool can be used to test alternative

operating conditions, train staff and run

non-intrusive “what-if” scenarios.

The AI solutions are based on a hybrid

cloud architecture, enabling both on-site

and cloud deployments.

Meanwhile, in response to studies

that suggest industrial companies typically

are able to use only about 20%

of the data they generate, ABB has developed

a solution called Ability Genix

Industrial Analytics and AI Suite — a

scalable advanced analytics platform

offering pre-built applications and services.

According to ABB, it collects,

contextualizes and converts operational,

engineering and information technology

data into actionable insights, and the

use of AI produces meaningful insights

for prediction and optimization that can

help improve business performance.

Customers can subscribe to a variety of

analytics on demand, as business needs

dictate, speeding up the traditional process

of requesting and scheduling support

from suppliers. Genix supports a

variety of deployments including cloud,

hybrid and on-premise.

ABB additionally bolstered its digital

offerings with the recent launch of the

Ability Genix Asset Performance Management

(APM) Suite for condition monitoring,

predictive maintenance and comprehensive

asset performance insights for

the process industries and others. Genix

APM is built on the Genix Industrial Analytics

and AI Suite.

“The ABB Ability Genix Suite brings

unique value by unlocking the combined

power of diverse data, domain knowledge,

technology and AI,” said Rajesh Ramachandran,

chief digital officer for ABB Industrial Automation. “We have designed

this modular and flexible suite so that

customers at different stages in their digitalization

journey can adopt ABB Ability

Genix to accelerate business outcomes

while protecting existing investments.”

A key component of Genix is the Ability

Edgenius Operations Data Manager

that connects, collects and analyzes operational

technology data at the point of

production. Edgenius uses data generated

by operational technology such as DCS

and devices to produce analytics that

improve production processes and asset

utilization. It can be deployed on its own,

or integrated with Genix.

Planning a Strategy

Big-data information science companies

are buying startups or competing tech developers

on an almost weekly basis. One of

the larger AI-related M&A transactions of

interest to the mining industry is AVEVA’s

recent $5 billion acquisition of OSIsoft,

finalized earlier this year. OSIsoft, a California-

based company founded in the early

1980s by Dr. Patrick Kennedy, developed

the PI System, a widely used data

management platform for industrial operations.

AVEVA, based in the U.K. with a

majority shareholder and strategic partner

in Schneider Electric, specializes in engineering,

design and operations software

for heavy industries and has nine of the

top 10 mining companies in the world as

customers. The acquisition allowed AVEVA

to add OSIsoft’s PI System platform

to its existing software product lineup,

which includes AVEVA System Platform,

AVEVA Production Management, AVEVA

APC, AVEVA Predictive Analytics, AVEVA

Unified Engineering and others.

E&MJ recently had an opportunity to

speak with Martin Provencher, AVEVA’s

global head of mining, about some of the

general challenges and choices mining

companies may encounter when considering

an AI strategy.

E&MJ: The use of AI technologies is

quickly gaining momentum in the mining

industry. For companies that are just

formulating an AI strategy, or may have

already tried AI but failed to achieve

expected results, what are some recommended

steps to help achieve success?

Provencher: There are a lot of challenges

that need to be considered, but they

mainly fall into three areas. First, a company

needs to identify its goals for using

AI — is it interested in cutting downtime

and increasing reliability of its

equipment, for example, or mitigating

operational risk, or in achieving autonomous

operations?

Then, it should determine what level

of analytics it needs to achieve its goals.

Are predictive analytics required, and

if so, how powerful do they need to be?

Does a company’s AI strategy require

the use of perceptive analytics, which

enables users to analyze audio or visual

data in addition to standard digital input?

For example, AVEVA can provide a library

of solutions that utilize both preset conditions

and variable machine learning to

trigger action for possible issues related

to asset operations.

And finally, a company needs to take

a hard look at what type of organizational

structure will be needed to achieve its

goals with AI. Is it prepared to assemble

a system in house, or go with an existing

system that can be tailored to its needs? Does it have the resources to train its staff

to maintain an in-house system? I work

exclusively with our mining customers

and although they all have roughly similar

long-term concerns — production effi-

ciency, environmental compliance, things

like that — I help them identify their

principal objectives and then recommend

the type and level of information technology

required to reach them.

E&MJ: AI depends heavily on access to

large volumes of data, some of which may

need to be shared. Mining companies

have traditionally been reluctant to share

data with anyone. Do you see any signs

that this hesitancy is diminishing?

Provencher: I do see it starting to

change. We’re not completely there

yet. Many companies have an operational

data platform in place, and OEM

vendors are trying to obtain access to

that data. But it can still be a bit of a

struggle as data continues to be siloed

among various organizations, and OEMs

increasingly are turning to connected

machines to directly acquire the information

they need. So, mining customers

who buy that equipment are already

aware that data will be going directly to

the vendor. I have had many discussions

with users of our PI System on how to

make that arrangement work most effectively

for them. It’s always best to

have only one version of the truth, and

part of that truth may be through access

to external data that enables a customer

to improve equipment efficiency. I

think the industry will eventually reach

a “sharing” perspective.

E&MJ: Is a corporate culture change often

necessary for success in AI?

Provencher: Success in this area usually

only comes with strong support from top

management. It’s a transformative process

based on a firm business decision, but I’ve

seen many companies that assume once

they’ve bought into an AI platform, everything

will just naturally fall into place and

their staff will know what to do with the

data and produce the kind of information

needed. But, companies first need to empower

their people to not only understand

and work with the AI platform, but to be

able to add insights — based on their expertise

— to the process. They need to become,

in effect, digital engineers.

E&MJ: What IT infrastructure or other

supporting technology usually needs to

be in place to carry out an AI strategy?

Provencher: That brings us back to the one

version of the truth principle that I mentioned

earlier. Right now, mining customers

have the challenge of handling data from

many different sources — control systems,

PLCs, etc. — and these may have trouble

speaking to each other. At that point,

a company faces the choice of buying or

building an AI platform. I see companies

that reach this decision point but may not

have the expertise to choose the right path.

If they choose incorrectly, the data they

need may not be usable or even available.

Establishing a consolidated data structure

is very important, and that’s what PI

System is very good at doing. Many companies

already have an ERP platform, an operational

data platform, along with a planning

and scheduiling platform. Once the data

structure to accommodate all of these is in

place, it becomes much easier to leverage

technology to achieve the desired results.

As featured in Womp 2021 Vol 12 - www.womp-int.com