Advanced mapping techniques can help to reduce

dilution through optimizing stope performance.

(Photo: Emesent)

Narrow Vein Mining Fit for the Future

We investigate the mining techniques evolving to take advantage of new technologies.

By Carly Leonida, European Editor

The low waste, small footprint ethos of narrow vein mining aligns perfectly with the environmental, social and governance (ESG) conscious direction in which the mining sector is heading. And, as orebody knowledge and understanding has grown, along with digital modelling and mapping technologies, and fleets of nimble, compact equipment, new levels of efficiency are now within reach of these operations. The concept of mining narrow ore-bearing veins is nothing new. But what is new are the ways in which these methods are being adapted to broaden their application, and the way in which modern technologies are being harnessed to reduce dilution and improve recovery and safety. And there’s even a new mining method on the horizon…

Times They Are A-changin’

Paul Salmenmaki is a principal mining

engineer at AMC Consultants. He has

more than 20 years of experience in the

field of narrow vein mining and discussed

some of the trends he is seeing.

“I would say the biggest shift over the

past 20-30 years in narrow vein mining

has been the move toward mechanization,”

Salmenmaki said. “This has resulted

in higher levels of safety, increased

productivity and, because of the increased

productivity, typically there’s a reduction

in costs too. We’re also seeing more semiautomated

mining systems, particularly

on longitudinal stopes, where parts of the

mine are isolated and automated.”

There have also been significant improvements

in the application of ground

support, and not just for safety; Salmenmaki

said he’s even seen operations

pre-bolting hanging walls using cables to

help prevent overbreak.

On the technology side, seismic systems for monitoring the rock mass and predicting rock burst conditions are now widely used and much more affordable. “Another major change has been improvements in backfilling,” Salmenmaki said. “The biggest impact is the potential to increase recovery. Today, instead of having to leave behind pillars, you can mine right up against the backfill, which is of incredible quality if done correctly.”

Blasting technology too has improved a great deal with electronic detonators becoming standard underground. In certain situations, conventional caps are still used, but there are applications where electronic caps have enabled vast improvements in blast accuracy — to around 1,000th of a millisecond — which offers improved flexibility. “With electronic caps, you can perfectly time every single detonation,” Salmenmaki explained. “This can help with overbreak, improved fragmentation and reduce ground vibrations. Programmable blasting caps can even enable mines to take larger stopes; if you can open up a larger stope through blasting, that can help with increased productivity.”

Safety has been a primary driver in the adoption of mechanized mining. The use of handheld mining equipment like jacklegs are often associated with musculoskeletal diseases. While operating mechanized mining equipment can still be challenging for the human body, its usage eliminates many of the most pressing safety challenges. Placing miners in a ROPS/FOPS protected cabin or standing them at a distance from potential falls of ground are also a big safety advantage.

Although mechanized mining does reduce the selectivity slightly, it more than makes up for this through improvements in productivity and safety. “It used to be hard to find scoops that could fit into very small headings,” Salmenmaki said. “But many OEMs now offer smaller pieces of equipment specifically designed to fit into these headings. Jumbos and scoops have always been around, but now we’re starting to see compact bolters too. “Some mines still bolt with stoppers and jack plates, working off a small muck pile. But, if you can eliminate that for safety reasons, and use mechanized equipment for bolting then so much the better. And, of course, costs come down when you move material more efficiently.”

There has also been a quantum leap in mine design software in a relatively short space of time which, from the engineer’s perspective, has made designing narrow vein operations and orebody modelling infinitely easier and faster. “When I started out in the late 90s, everything was CAD-based,” Salmenmaki said. “Today, many packages have builtin programs for narrow-vein applications. For example, there are tools like Mineable Stope Optimizer (MSO) where you can create indicative stope shapes from a resource block model in a fraction of the time. Previously, engineers would have to examine block models visually and create the stope shapes for the entire life of the mine. That is incredibly challenging.

“There are also ring design software tools, like AEGIS from iRing, which designs blast ring layouts for longhole stoping. Compared to the old-school way where CAD software would be used to manually layout a ring… For that, you’d calculate your drill hole sizes, look at the volume to be excavated, the stope shape in tons to calculate your powder factors… It was a very complex process. “These new software packages can take survey wireframes and as-built models, calculate the powder factors and provide an indicative diameter for the drill holes. With those, you can create sections for each blast ring, plus the slot where you’re putting in raise holes. Some of these new tools can be challenging to learn but, in the end, they really do make life easier.”

Flexibility Creates Longevity

The primary reason methods like longhole

stoping and cut-and-fill have stood the

test of time is because they offer flexibility…

Flexibility in the types of equipment

used, in the sequencing (to a degree)

and, in the type of backfill used.

“Methods like cut-and-fill or longhole

stoping, they’re inherently smaller excavations

compared to more bulk mining

methods,” Salmenmaki explained. “In

highly seismic areas, this provides an advantage

in terms of ground control, and it

does provide the opportunity to deal with

more complex orebodies. Bulk methods

don’t lend themselves well to targeting

complex orebodies where you want to take

just the ore and leave the rest behind.”

Salmenmaki has seen multiple variations on cut-and-fill and longhole stoping techniques that provide tighter control of extractions. “For instance, if a mine is going to mine in a tighter area by longhole, because the orebody lends itself to that,” he explained. “Sometimes you get in and you’re having to wait for the horizon above to be established before you can start mining in earnest (long holing is typically a bottom-up mining method). “I’ve seen a lot of companies do a series of cut-and-fills so they can quickly ramp up production. That also provides time to establish horizons on the levels above or below.”

Sometimes different areas within an orebody lend themselves better to cutand- fill, some to long holing. So, applying combinations of the two methods can help improve the outcomes. Neither technique is new, but it’s about using the existing ones in a clever way. Resue mining is another variation on cut-and-fill that can help to reduce dilution through two passes of mining and release.

“One really common thing I’m seeing is the use of larger diameter raises, such as the V30,” Salmenmaki said. “Machines Roger here in Canada have a 30-in. (760 millimeter) diameter raisebore head that fits on to an ITH drill like Sandvik’s Orion. Mines would usually drill a series of conventional small diameter holes — and there’s nothing wrong with that — but, if you can use a large diameter bit to create a single hole, it makes the job much easier and faster. If you establish your slot right it makes mining the rest of the stope that much better.”

Trends in Fleet Selection

When it comes to fleet design and selection,

there are two big trends: automation

and battery electric. There are

many advantages to using battery-electric

vehicles including greater energy

efficiency and a lower environmental

impact than diesel equipment in some

cases. But, for narrow vein mines, the

biggest benefits are reductions in heat

and diesel emissions.

If battery-electric equipment is used, smaller ventilation pipes can be utilized, and the size of the drift reduced which cuts costs significantly. The amount of energy required for ventilation and refrigeration also drops. “Fleet selection, in particular the heavy working equipment, can make such a big difference,” Salmenmaki said. “For jumbos, a small diesel engine might be fine because most don’t move at lightning speed; they just sit and drill for most of the shift and then tram slowly to the next spot. But trucks, scoops and logistics vehicles are where we’re going to see big advantages with battery-electric technologies.”

By adding automation into the mix too, performance can be vastly improved. “I haven’t seen entire horizons set up for automation in narrow vein mines yet,” Salmenmaki said. “With semiautomation, you’re mining just the undercut of a long-hole stope. The operator trams the scoop into the stope while standing a safe distance away. “When the scoop gets to the muck pile, it would go back to a manual mucking mode. The bucket is filled, and the operator can then switch back to automated tram. Once the scoop reaches the operator, they would get back in a manually drive to the ore pass.”

This might sound overly complicated but, productivity for semiautomated equipment can be vastly improved compared to an operator running a scoop lineof- sight, mainly due to the tight working conditions. A semiautomated system uses proximity sensors which allow the machine to maneuver in the tightest of stopes. Thanks to this technology the scoop can head into the muck pile at higher speeds without fear of damaging the equipment and subsequent downtime. In time, automated drilling could also offer new possibilities…

“Automated longhole drilling is typically used in bulk stopes where you can drill multiple holes on a single drill set up,” Salmenmaki said. “If you can drill even 20 meters more during a shift, it makes the world of a difference on a week-toweek or month-to-month basis, or even over the life of a mine. And let’s not forget automated face drilling. I haven’t seen either of those used on narrow veins yet, but maybe with improvements in technologies we’ll eventually see them being used.” Salmenmaki concluded: “Narrow vein mining is always going to play a major role in the mining industry due to the nature of orebodies that are being discovered on a continual basis. I do think there needs to be a strong emphasis on understanding and utilizing all these new technologies that are coming through. It’s important to keep up with developments and look at how they can be modified and improved for different types of mining.

“For narrow vein mining, it really comes down to attention to detail. That’s what makes a successful narrow vein mine. Teams need to go down there on a regular basis, do monitoring and work together to constantly adapt to the changing environment.”

Eyes on the Ground

Dilution in narrow vein mining, whether

above or below ground, can make a significant and material impact on the profitability

of the operation.

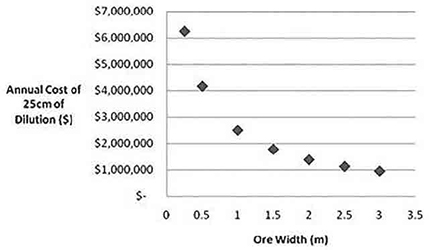

For example, based on the simplified economic model for an underground

stoping operation shown in Figure 1, a

narrow vein mine with a 3-meter average

vein width and 25 cm more dilution than

expected, would incur unforeseen operating

costs of up to $1 million per year.

Salmenmaki recently presented a webinar (the recording can be found on AMC Consultants’ website) explaining how careful mine design incorporating optimal drill and blast designs, varying development sizes and compact equipment can help to minimize dilution. However, advanced mapping techniques can also contribute to this through helping mines to better understand and optimize their stope performance. Jane Gray, mining research specialist, at drone autonomy, LiDAR mapping and data analytics specialist Emesent, spoke about the possibilities. “Most narrow-vein mining operations have distinct lithological changes between the country rock and the orebody rock types, and tight tolerances for waste versus ore,” she said. “Having accurate LiDAR surveys of stopes, with complete coverage (not just cavity monitoring), and regular data collection are invaluable for technical services to better understand stope conditions.”

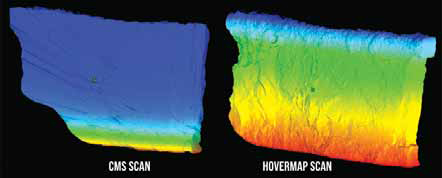

Gray explained: “For example, Emesent’s Hovermap system has autonomous flight capability that allows it to fly below the brow of the draw point or drive to capture high-resolution data of the entire stope. The LiDAR point cloud attributes, range, time and intensity, allow users to visualize the data to highlight the different rock types (such as quartz veins), large and small-scale structural changes (fractures, joints, breccia), and areas of overbreak (dilution) or underbreak (ore loss) that result from blast design or rock mass failure. This level of detail far exceeds what was possible with CMS systems.”

This essentially removes any ‘guesswork’ when dealing with stope issues. For example, geological structures, like fractures and faults that can impact stope performance, can be accurately mapped and added to the geotechnical model. The engineers can then develop data-based plans to deal with the issues, such as changing the blast design to reduce overbreak. Comparing the stope shape after a blast, to the stope design also helps to improve future blast designs. “Many mines scan a stope after each blast, so they have an ‘as-built’ model,” Gray explained. “Accurate, georeferenced data can be added to the mine model and help to highlight if a failing stope could risk adjoining stopes or access drives.

“This level of detail also enables surveyors to calculate accurate stope volumes for reconciliation. Many mines used to count truck loads to estimate the amount of material extracted from a stope. With CMS, they could not extract accurate volume data from the LiDAR point cloud, because the scans have highly variable point densities and many areas of shadow. Surveyors had to guess the dimensions to create a solid for volume calculation. “Today, accurate data on stope performance reduces the risk of stope loss due to unknown geotechnical conditions.”

SLAM-LiDAR vs. CMS

LiDAR is ideal for mapping narrow vein

operations because it generates high-resolution,

accurate 3D visualizations, and is

unaffected by light conditions, dust, depth

etc. Surface survey techniques, such as

photogrammetry, require GPS and ideal

light conditions which make them unsuitable

for underground applications.

As mentioned earlier, CMS LiDAR has traditionally been used for void surveys and assessing stope performance underground. However, CMS does not offer complete coverage and often has alignment issues where at longer distances the overall position can deviate with angular rotational error. SLAM-based LiDAR mapping systems combined with autonomous flight, allow better coverage, accuracy and uniform point density.

“Traditional LiDAR, as in CMSs, presents safety, data, and production delay risks,” Gray said. “A CMS survey generally uses a scanner fitted onto a 5-meter boom that is extended into the stope from a mid-or top-level drift. Surveyors are exposed to potential falling rocks and working close to an open stope. CMS data is collected from just one point within the stope. Areas of over or underbreak are often occluded, meaning that geotechnical and safety issues with the stope are not apparent (in shadow).

Ground control points (GCPs) must be part of every scan, so the data can be accurately georeferenced and localized within the mine model. With CMS, surveyors have to setup control and survey in the CMS scanner each scan. This means that additional people, time and equipment are required for a CMS scan, which are all exposed to an open stope. In contrast, with an autonomous SLAM-based LiDAR mapping system, control can be established and surveyed once, in the access drive. Hovermap captures the GCP as part of the scan, which is then automatically georeferenced. This is a significant time saving and safety improvement in the data capture workflow. “All stoping operations face these challenges, but they are more acute in narrow-vein operations because of the increased likelihood of over or underbreak occlusion, and the increased risk to mine profitability from unplanned dilution or ore loss,” Gray added.

As mines get deeper, seismicity can also increase. Distances in underground stopes tend to be less than 100 m, so a drone is a very effective platform to quickly capture accurate data while personnel remain outside of the exclusion zone. Most flights take less than five minutes. Boston Dynamics’ robot dog, Spot, is another platform used by stoping operations to enter restricted zones, such as a draw point, to survey an empty stope. Consultant, Jamie van Schoor, CEO of Dwyka Mining Services, joined the discussion. Dwyka Mining Services provides scanning technologies like Hovermap (and others) to mines across Africa, including many narrow vein operations.

“As we mine deeper to access increasingly valuable orebodies, geotechnical stresses and events such as falls-of-ground make accessing and inspecting mining areas more challenging,” van Schoor said. “Operating drones and other autonomous platforms beyond visual line of sight (BVLOS) to capture data from high-risk areas are a game-changer for safer data capture. New platforms like Boston Dynamic’s Spot quadruped robotic dog are also going to add increasing value where confined space limits flying drones as the preferred platform for ground-based robots.

“In South Africa, where narrow tabular reef and narrow vein ore-bodies represent the majority of the PGM and gold orebodies, we expect a significant adoption to the Spot platform and are excited to see ‘See Spot fetch!’ LiDAR data with Hovermap.”

Informed Decisions Better

Performance

With regular surveys providing more detailed

data that ever before, engineers are

now able to make operational decisions

faster, which allows correction or fine tuning

of both design and execution of mining

to reduce dilution and increase recovery.

Using a drone to capture LiDAR data,

with a scan only taking 5 mins (15 mins

in total with setup and pack down), reduces

production delays. Surveyors can

fly a mission from a mid-level or top cut

assess drive, significantly reducing the

impact on production when compared

with traditional CMS scanning.

Geotechnical engineers, mine planning engineers and drill and blast teams also get immediate feedback on the blast design and stope shape. “Many mines are scanning a stope five to six times while it’s in production, or at least after every blast,” Gray said. “This data informs the next blast design, and engineers are able to assess any geotechnical issues and develop a plan to redirect dilution to the waste pile rather than ROM. “Analysis of LiDAR data can identify oversize blocks, which may cause a hangup, or the effectiveness of the blast to achieve the optimal fragmentation. Systems like Hovermap can also be flown into a draw point to assess a hang-up, informing a data-based plan to clear it, reducing the risk of the loss of that draw point.”

“The ongoing challenge at every mine is how to consume and share the large amounts of data captured in every scan,” Gray added. “Integration with mine planning software, such as Datamine, Deswik and Maptek streamlines the data processing workflows, and enables sharing of data across disciplines. Most mines are still in the learning phase of optimizing data capture and processing techniques, but early results are promising to help improve in stope performance and low inspection costs across an operation.” van Schoor added: “We are seeing rapid adoption of drone technologies and a willingness to experiment with the data across multiple third-party platforms. Most excitingly, our clients are interrogating point cloud data and sharing knowledge across departments to make collective decisions, based on visuals and data of challenging stoping environments that these teams never had previously. By removing the guesswork, data-informed decision- making has already paid back the investment multiple times over.”

SMD: A Whole New Mining

Method

It’s clear that mining methods like longhole

stoping and cut-and-fill are not only still

fit for purpose, through new technologies

they will continue to be useful long into the

future. However, their application will remain

orebody dependent. Once veins reach

a certain width, bulk mining methods (of

which there are plenty) become more economic.

But what about at the lower end

of the scale? Some veins sets are simply too narrow or geotechnically complex to be

mined profitably using these methods.

Novamera Inc. may have found the answer. The startup, which is a spin off from Canadian gold producer, Anaconda Mining, has developed a technique called Sustainable Mining by Drilling (SMD). The system was originally conceived to exploit Anaconda’s Romeo and Juliet deposit in Newfoundland. This consists of a network of very narrow, steeply dipping veins which aren’t conducive to economic recovery through conventional selective mining methods. However, following its presentation at the Disrupt Mining event in 2019, the team realized that SMD could benefit many other operations too.

In the second pass, a large diameter drill follows the pilot hole to excavate the ore and the cuttings are brought to the surface using reverse circulation, airlift assist technology. Once at the surface the cuttings are fed to a solid-solution separation system for dewatering before being transported to a local mill for processing. This two-pass sequence continues down the strike length of the vein; a series of primary holes are drilled, and every other hole is backfilled with paste. About 50-60% of the material is returned to the ground and the holes become landform tailings storage. The secondary holes are then drilled and refilled, and the sequence continued until the entire orebody has been extracted.

Field Trial Progress

Novamera is initially targeting near-surface

ore deposits with SMD and, when

E&MJ spoke to the team in mid-July, they

were in the field conducting a full-scale

trial of the system at Romeo and Juliet.

However, both the SMD technique and

the NBIT tool (which can be commercialized

separately) hold potential for underground

applications too.

Novamera has tested various elements of the system previously, but this program is about putting the full sequence together and seeing how it works as a process. “We plan to drill to 300 m with the commercialized system, but we only need to go to 100 m for the proof of concept,” Angelo said. “We’re demonstrating the concept and that the entire system works, from a technological, operational and procedural standpoint.” Angelo said that, so far, everything’s going to plan. “We’ve done a couple of mini pilots, along the way,” he explained. “So, the functionality, the mechanics of it, are all in place. We’ve got a prototype rig that we’re using and, mechanically, things are working well.

“One of the key challenges that we have to overcome, is in the first 15 to 20 m, you don’t have the same type of static pressure as further down the hole in order to use reverse circulation airlift assist. So, we’ve developed a process called direct flush which uses water to bring the material to the surface. It’s often used in other industries, but it hasn’t been done in this application before. We’re really interested to see how that’s going to work, and if we can separate the material at a pace that can keep up with the direct flush. Again, it’s about testing the system. We’ve got a couple of backup plans if the primary method doesn’t work.”

Aside from testing the system, the data that the trial provides will be invaluable in helping the Novamera team to validate the economics and operating metrics of SMD and give potential customers better insight into what to expect. In February, Novamera announced that Hochschild Mining had joined its preferred partner program which entitles the company to certain privileges, monetary discounts and advance insight into the development of SMD technologies. Angelo said Novamera has recently finished a desktop study for the use of SMD on an orebody extension at Inmaculada mine in Peru.

“We’re now working on what we call an ‘after-action review’ with Hochschild and seeing if they would like to do further evaluation,” he explained. “One of the interesting things about these evaluations, is that often, they’re on vein systems and deposits that have been abandoned because conventional mining methods don’t work for them. There’s not usually much data available but, hopefully, if these companies see a positive result from our evaluation, it may give them the confidence to go back in and put together a geological model or gather more detail for us to use.

“Ultimately, we want to get to the point where we’re doing pilot trials in the field either with the NBIT or the full SMD system at other mining companies’ sites. I’m very encouraged by Hochschild and their engagement though, their desire to look at alternative technologies and to be more efficient and bring uneconomic deposits into production via innovative methods. This full field trial will be a huge milestone for us as a company as it will make SMD more tangible and hopefully give miners the confidence to begin looking at using our technology to improve their operations.”

Adapting SMD for

Underground

In time, Novamera does plan to adapt both

SMD and the NBIT for use underground. In

these cases, SMD would be complementary

to methods like cut-and-fill or longhole

stoping and could utilize existing infrastructure

to chase orebody extensions or

satellite deposits that are uneconomic to

recover with conventional mining methods.

Because there’s no blasting involved,

it’s a safer and more consistent mining

method (no exclusion time required) than

most others. It’s also selective so very little

waste is created and there’s virtually

no dilution.

Novamera has done preliminary work on greenhouse gas emissions and energy consumption, comparing SMD to the Costerfield mine in Australia which mines using cut-and-fill. In this case, SMD offered a 50% or more reduction in energy consumption, CO2, NOX and SOX emissions. There are operational savings too. Novamera’s modelling has shown SMD to cost around $100 per metric ton (mt), compared to approximately US$125-200/mt for conventional selective mining methods. “We know that existing underground mines around the world sometimes have to leave stopes and pillars behind and there can be depth limitations as well,” said Angelo. “SMD could be used to selectively mine out those areas where other methods can’t get to.

“We’ve always characterized SMD, not as a replacement, but a complement to other mining techniques. Once a mine’s in production with a certain method, it’s really hard to move away from that on a long-term basis. But we can help them get that incremental ore in a cost effective and sustainable manner. “Even the NBIT can be used to advance reconnaissance as you’re mining using your conventional method. There are lots of standalone applications for the NBIT, because once you can ‘see underground’ in high-resolution, that opens a whole new world of possibilities.”