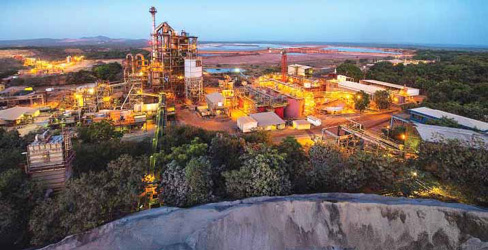

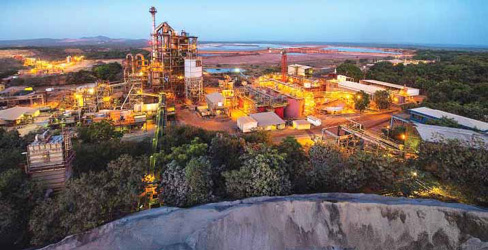

Resolute’s Syama mine (above) in Mali is expected to produce 155,000 to 170,000 oz of gold from sulphide ore.

Resolute Reaffirms Guidance

Based on total 2021 gold production from Resolute’s Syama gold mine in Mali and Mako gold mine in Senegal, together with operating cost and capital expenditure guidance, Resolute expects to generate sufficient operating cash flows to support debt repayments of $50 million in 2021. This includes the early repayment of $25 million over and above the minimum debt repayment obligations of $25 million, which are due in September 2021.

Proceeds from completion of the sale of Bibiani to Chifeng Jilong Gold Mining Co. Ltd. for $105 million in cash were to be taken as an opportunity to rapidly accelerate Resolute’s debt repayments. However, these proceeds are not required to meet Resolute’s minimum debt repayment obligations which can be satisfied through operating cashflow generation from Syama and Mako. Resolute continues to work through all options in relation to resolving its position with the Ghanaian Government regarding the termination of the Bibiani Mining Lease with the objective of reaching an amicable solution to restore the Mining Lease and enable the sale process with Chifeng to continue.

Resolute is forecasting total gold production for 2021 of 350,000 ounces (oz) to 375,000 oz at an all-In sustaining cost (AISC) of $1,200/oz to $1,275/oz. Syama sulphide production is forecast to increase by more than 25% to between 155,000 oz and 170,000 oz with a resulting decrease in AISC to between $1,200/oz and $1,275/oz. A planned 36- day shutdown of the sulphide processing circuit has been scheduled during September and October 2021. Syama oxide production of 80,000 oz to 85,000 oz is forecast at an AISC between $1,050/oz and $1,090/oz from the Cashew and Tabakoroni satellite operations. The Mako mine is expected to produce 115,000 oz to 120,000 oz at an AISC between $1,175/oz and $1,225/oz.

In addition to cash and bullion balances of $106 million at the end of 2020, operating cash flows in 2021 are expected to be sufficient to support the repayment of $50 million in debt during 2021. This is not contingent on completion of the sale of Bibiani. Resolute established a new low-cost senior debt facility in March 2020 comprising a three-year $150 million Revolving Credit Facility (RCF) and a four-year $150 million Syndicated Loan Facility (SLF). The company’s SLF begins to amortize in September 2021 with repayments due under this facility of $25 million every six months.