According to the International Council on Mining & Metals, large mining mobile

According to the International Council on Mining & Metals, large mining mobile

equipment currently produces

roughly 30-50% and in some cases, up to 80% of

Scope 1 emissions at a mine. (Scope 1 emissions are direct

emissions from sources

owned or operated by a company or organization.) ICMM’s Innovation for Cleaner,

Safer

Vehicles (ICSV) initiative has brought together 27 of the industry’s leading

mineral producers and 19 major OEMs

with the goal of introducing greenhouse

gas emission-free surface mining vehicles by 2040.

For the better part of a century, diesel

power has rumbled along a wide, uncrowded

path to dominance in surface

haulage of mined materials. In the underground

world, the path hasn’t been

quite as smooth — at coal operations

in certain countries, for example, where

only approved diesel engines are permitted

in mines — but even so, diesels have

consistently prevailed over electric-drive

equipment in underground metal mining.

However, the route ahead for both

surface and underground diesel deployment

is going to get tougher as competing

technologies and evolving customer

demands congest the traffic flow.

Nobody is predicting that diesel will

lose its prime position anytime soon,

but high-horsepower engine builders

and OEM earthmover equipment suppliers

can be excused for having a lot

on their minds as they piece together a

product-line development strategy capable

of solving issues ranging from basic

power train configurations — diesel, hybrid

or fuel cell, for example — to industry

trends that will dictate how and to

what extent diesel-powered haulage can

be economically used, or eliminated.

For example, as mentioned in our

September issue (see Futuristic Decisions

Threaten Status Quo, pp. 60-69)

Anglo American plc is moving ahead

on a program that, if successful, could

ultimately lead to conversion of more

than 400 of its diesel-powered haulage

trucks to use hydrogen fuel.

A pilot project starting next year at

Anglo American Platinum Ltd.’s Mogalakwena

operation in South Africa will

use a 3.5-megawatt electrolyzer to produce

hydrogen on site. The company will

convert a Komatsu 930E truck to run on

a hydrogen fuel cell module paired with a

scalable modular lithium-ion battery system

from Williams Advanced Engineering.

This arrangement, which replaces

the existing vehicle’s diesel engine and

fuel tank, is controlled by a high-voltage

power distribution unit delivering more

than 1,000 kWh of energy storage.

Meanwhile, Nouveau Monde Graphite

is publicizing plans to develop the

first all-electric open-pit operation at

its Matawinie project in the Canadian

province of Quebec. The company

said the mine will have an all-electric,

zero-emission mine fleet comprising

electric battery-driven 36-ton mining

trucks, battery-driven front-end loaders,

cable reel excavators and bulldozers,

and battery-driven service vehicles. It

also will have an electric in-pit mobile

crusher and overland conveyor system

to feed crushed material to the plant.

In the underground sector, activity

and interest in battery-powered equipment

is on the rise: Late last year, Epiroc

announced that Agnico Eagle Mines

had just ordered a Boltec E Battery rig

for the Kittilä gold mine in Finland, and

orders from several other companies

had been booked in previous quarters

for battery electric versions of the Boltec

rig, Boomer face drilling rig, Scooptram

loader and Minetruck hauler.

Agnico Eagle had previously been

testing several Epiroc battery-powered

machines at Kittilä as part of the Sustainable

Intelligent Mining Systems

(SIMS) project. SIMS, in which Epiroc

serves as coordinator, is part of Horizon

2020, a large European Union research

and innovation program. A Boomer E2

Battery had been operating for some

months at Kittilä, and in midyear, a

Minetruck MT42 Battery and a Scooptram

ST14 Battery also arrived at the

mine as part of the SIMS project.

In the U.S., Sandvik and Barrick

signed a partnership agreement for trialing

battery electric vehicles (BEVs) at

the Turquoise Ridge gold mine, part of

the Nevada Gold Mines joint venture (JV)

in which Barrick serves as mine operator.

During a three-year production trial,

Sandvik will deploy four Artisan Z50 BEV

trucks at the mine — the single-largest

gold-producing complex in the world.

The 50-t-payload Z50 BEV haul

trucks are equipped with AutoSwap, a

self-swapping system for the Artisan

battery pack that is claimed to only take

about six minutes per swap and that can

be accomplished in a passing bay or old

re-muck bay without need of overhead

cranes or external infrastructure, according

to Sandvik.

Diesel-powered loading and haulage

fleets aren’t the only area of focus of

electrification: Iron ore producer Fortescue

Metals announced a A$32 million

renewable hydrogen mobility project

that will deploy 10 hydrogen-powered

buses to replace an existing fleet of diesel

buses at its Christmas Creek mine in

Western Australia starting in mid–2021.

It will be supported by installation of a

refueling station, which will harness renewable

electricity from the Chichester

solar gas hybrid project to generate renewable

hydrogen onsite.

And in some cases, the stimulus for

electrification comes from unexpected

or nontraditional sources: In the U.S.

in the state of Minnesota, for example,

electric utility company Minnesota Power

has asked state regulators to consider

a pilot project involving site-specific

analysis, replacement or retrofitting of

a portion of existing diesel-electric haul

truck fleets to trolley-assisted operation

at its Iron Range mining customers’

mine sites. The utility said mines in

the region, along with paper mills, currently

use about two-thirds of its power

production. It plans to file a formal plan

with state regulators next year that may

include financial support for retrofitting

an existing haul truck fleet and installing

trolley-assist infrastructure at a mine.

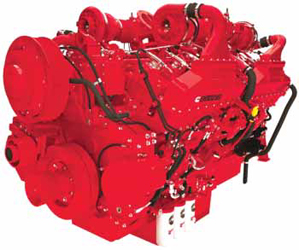

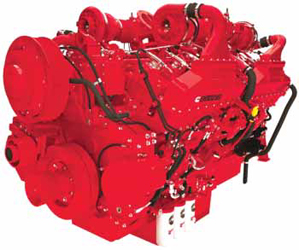

MTU says Series 4000 diesels are its most successful

product range, with more

MTU says Series 4000 diesels are its most successful

product range, with more

than 37,000 versions of the

engine placed in service since its introduction.

Balancing the Benefits

There is no current effort under way to

tighten emissions regulations applicable

to high-horsepower off-highways diesels

in North America, but the European

Union’s Stage V standards loom just over

the horizon, now scheduled to take full

effect in 2021 after a pandemic-related

extension granted by the European Parliament.

Logically, because the EPA and

EU emissions-control standards in the

regulatory tiers and stages have largely

mirrored each other, there is an expectation

that North American standards may

be adjusted to reflect the more stringent

standards of EU Stage V at some point

in the future. However, most diesel engine

suppliers would argue that due to

the substantial reduction in emissions

attained by recent engine-control strategies

as well as improvements in fuel

usage and power density, there’s actually

more benefit to be gained by taking earlier-

tier or non-tier engines out of service

and replacing them with Tier 4 models

than there would be in achieving only incremental

gains in emission control by

imposing Stage V standards.

Recent reports indicate mining customers

are indeed taking advantage of

an opportunity to improve performance

without investing in completely new

equipment fleets. Rolls-Royce Power

Systems, for example, said it will deliver

30 Series 4000 MTU engines this year

to a large contract mining company in

Brazil for a truck-repower program. The

engines are going to U&M Mineração e

Construção S/A, which will install the

MTU 12V 4000 engines in its existing

fleet of mining trucks and excavators.

The engines to be delivered this year

follow upon an earlier order by U&M for

20 of the same engines in 2019.

“We prefer to have the same engine

powering both our load and haul machines,”

Mauricio Casara, U&M’s commercial

director, explained. “We tested

the MTU 12V 4000 at a mine where we

had Komatsu 930s equipped with 16V

engines so we could compare. We found

that the cycle times for the 16V and the

12V were virtually the same.”

U&M also has installed MTU 12V

4000 engines to repower its fleet of Hitachi

EX5500-6 mining shovels. After

working with an MTU support team to

make necessary power calibrations, the

company said shovel performance now

exceeds previous levels obtained with

the replaced engines.

Mindful of the industry’s enthusiastic

interest in autonomous operations, Rolls-

Royce also noted it had joined with Autonomous

Solutions Inc. (ASI Mining) to

ensure compatibility of MTU diesel engines

with ASI’s Mobius command and

control software for autonomous vehicles.

The two companies signed a memorandum

of understanding enabling Rolls-

Royce to offer autonomous-compatible,

Mobius-ready MTU engine solutions for

equipment in a wide range of mining applications.

The companies said they plan

to apply their expertise to offer customers

engine solutions that are compatible

with ASI’s vehicle automation software to

help optimize vehicle power performance

and efficiency.

A potential benefit to MTU and ASI

Mining customers is the ability to retrofi

t power systems on existing haul trucks

to convert them to autonomous operation.

The companies said they are interested

in exploring the value customers

would receive by repowering trucks with

higher-efficiency engines along with implementation

of ASI’s autonomous mining

solutions.

Cummins reported last year that it

had helped an Arizona mine obtain better

performance from its fleet of seven

Komatsu 930E-1 haulers by repowering

them with Tier 2 QSK60 engines. After

a trial engine changeover involving two

of the trucks, the mine achieved signifi-

cantly improved operating performance

from them, including MTTF improvement

of 43%, an availability increase

of 3%-4%, and a 1-2 gal/h reduction

in fuel burn, impressing mine management

enough to proceed with repowering

the rest of its Komatsu fleet.

Looking at Options

Demand for conventional diesel engines

remains healthy, but engine suppliers

are hedging their bets, moving ahead with engine design and performance

tweaks as well as expanded emission-

reduction options to meet the demands

of regional regulations — while

concurrently securing, through investments

and partnerships, new expertise

and market presence in emerging

non-traditional power technologies such

as batteries and battery management

systems, hybrid systems, fuel cells and

hydrogen production technologies.

Prospective diesel engine buyers now

have access to a range of dual-certification

(Tier 4F/Stage IV or V) options from

most major suppliers that allow them to

comply with differing regional emissions

regulations as well as configurations for

low- or non-regulated locales. These options

cover the entire spectrum of engine

ratings, from high to low. Caterpillar, for

example, offers Tier 4 Final versions

— standard (1,450) and high (1,600)

horsepower — of the 3512E engine in

the company’s new Next Generation 785

mine truck, along with another version

for sales in less-regulated markets. At

the lower end of the size spectrum, Cat’s

new C3.6 in-line four-cylinder industrial

diesel is offered in ratings up to 134

bhp at 2,200 rpm and provides a 5%

increase in power density and a 12%

increase in torque compared to earlier

versions. It is dual-certified Tier 4 Final/

Stage V with no changes to the engine or

aftertreatment systems.

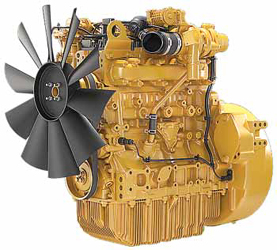

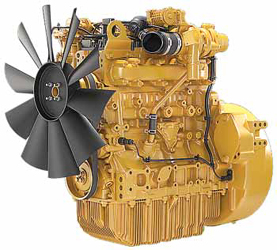

Introduced at the 2019 bauma trade show, Cummins’

Tier 4 Final/Stage V

Introduced at the 2019 bauma trade show, Cummins’

Tier 4 Final/Stage V

QSK60 engine offers up to 2,850

hp (2,125 kW) in mining applications,

with simplified

air handling, reduced complexity and improved serviceability,

according to the company.

Balancing the Benefits

Cat’s largest dual-certified diesel is the

78-liter V16 Cat 3516E industrial model

introduced in late 2019, which uses dual

SCR-only aftertreatment to meet EU Stage

V and EPA Tier 4F standards. The 2,100-

hp engine’s aftertreatment system uses

a diesel oxidation catalyst (DOC), diesel

particulate filter and high-efficiency selective

catalytic reduction (SCR) to eliminate

the need for EGR. Fuel consumption,

according to the company, is reduced up

to 6% and the system is 63% lighter and

65% smaller than its current equivalent.

It does require DEF, according to the company,

but engine technology advances

provide a lower rate of fluid consumption.

Diesel OEMs know that engine effi-

ciency improvements can attract new

customers, and some notable technological

advances have come from diesel

suppliers that aren’t top-of-mind in

brand recognition, but nevertheless are

major players — China’s Weichai Group,

for example, which sold a million engines

last year.

In September, Weichai officially

launched what it claims to be the world’s

first commercially available diesel engine

with a brake thermal efficiency

(BTE) over 50%. Brake thermal efficiency

is a measure of the fuel efficiency of

internal combustion engines. The higher

the BTE, the lower fuel consumption

will be, along with reduced emissions.

Weichai’s high-BTE six-cylinder engine

has 13-L displacement, is rated

at 560 hp at 1,900 rpm and features

a Bosch 2,500-bar common rail fuel

injection system. Increasing BTE from

46% to 50.26% reduces both fuel consumption

and CO2 emissions by 8%, according

to the company.

Weichai said it has been involved in

studying and designing internal combustion

engines for more than 70 years

and has invested 30 billion yuan ($4.6

billion) in related R&D over the past 10

years. Its investigations into BTE improvement

got a boost in 2015 when it

assigned a special technical research

team to conduct large-scale simulations

and bench tests that produced a steady

stream of incremental (0.1%) BTE improvements

and finally led to its recent

breakthrough. Weichai said it had developed

several proprietary technologies

that contribute to the improvement,

including advanced fields synergy combustion

technology, exhaust energy distribution

technology, subzone lubrication

technology and WISE ECU technology.

Belarussian truck builder BelAZ now

offers Weichai diesels in its 90-ton 7558

series, as well as other options that include

a gas-turbine engine using CNG

fuel and another that uses a valve-inductor

electric drive configuration. The truck

maker said it plans to offer Weichai diesel

options in future models of its 45-, 136-

and 220-ton-payload haul trucks as well.

Elsewhere, underground mining and

tunneling equipment supplier Normet

is now installing Volvo Penta’s Stage V

solution in its new L-Series platform, encompassing

12 different products that

include transmixers, agitators, fuel, water,

multipurpose and material carriers, a

sprayer, dumper and charging unit. This is

the first time the company has used Volvo

Penta engines and Normet reportedly is

already planning to roll the engines out

in other products, such as Stage IIIA versions

of the L-Series machines.

“We started looking at updating the

L-Series platform in 2018, when the

Stage V emission regulations were on the

horizon,” explained Jarmo Husso, director,

platform and module development,

at Normet. “We decided to completely

redesign and update the product platform

with a new structure and features, as well

as streamline our engine offer. Although

we hadn’t used Volvo Penta engines before,

we’d heard good things about the

company. Over the last couple of years,

our two companies have been working together

as one team on this project.”

Volvo Penta’s Stage V off-road lineup

includes five engine models — D5,

D8, D11, D13 and D16 — providing a

power range from 105 to 585 kW (143–

796 hp). A particular focus has been on

maximizing equipment uptime by reducing

active regeneration requirements.

Andreas Viktorsson, the company’s chief

project manager for Stage V, recently explained

how it managed to achieve its

goal in the latest D series engines.

“The Stage V emissions legislation

requires engines to have a diesel particulate

filter (DPF), which captures

and stores soot. This soot needs to be

burned off periodically to regenerate the

DPF and typically this is done while the

machine is at a standstill — active regeneration.

But who wants to keep having

to put their machine aside for this

process, where it is not working and

earning?” Viktorsson commented.

“From a strict technical point of view

there will always be a need for at least

some active regeneration if the engine

is not loaded. However, we challenge ourselves to examine this and reduce it

to an absolute minimum.

L-Series underground equipment from Normet will be available with Volvo Penta Stage V engines starting in 2021.

L-Series underground equipment from Normet will be available with Volvo Penta Stage V engines starting in 2021.

Normet says it also plans to offer Stage IIIA versions of Volve Penta diesels in future L-Series machines.

“For our Stage V off-road platform,

we have developed the engine and aftertreatment

system hand in hand, and it

has been an ongoing optimization project

for all engines in the range, which share

a common architecture. For example, we

have implemented new water pumps,

new oil coolers, new piston rings and new

thermostats — relatively minor changes

all over the engine but combined they

have made significant improvements.

Connected to this design philosophy, we

have also achieved impressive fuel effi-

ciency figures, helping customers to save

costs and the environment.”

Cleaner Combustion

Ongoing research into utilization of alternative

fuels for off-highway diesels

has provided fleet operators with potential

options for cutting hydrocarbon-fuel

emissions while keeping diesel engine

infrastructure largely intact. For example,

ClearFlame Engine Technologies, a

U.S.-based startup specializing in development

of clean engine technology

for the off-highway and industrial markets,

announced in mid-October it had

successfully matched the torque and

power of a commercial diesel engine

using ethanol in place of diesel fuel,

delivering more than 500 hp and over

1,850 ft-lb of torque while eliminating

the need for additional aftertreatment

such as selective catalytic reduction or

diesel particulate filter systems.

ClearFlame said it achieved the results

on a Cummins X15, a 500-hp,

15-liter-displacement engine by using

a high-temperature stochiometric combustion

process, which employs higher

temperatures to achieve diesel-style

combustion of decarbonized fuel. Temperatures

are achieved by optimizing

existing engine thermodynamics and

adding insulation on key engine components.

The fuel injection system is also

engineered to accommodate decarbonized

fuels like ethanol.

ClearFlame claimed its engine technology

enables low-carbon and carbon-

negative fuels to be easily integrated

into existing diesel engine platforms,

while providing equal performance

to that associated with diesel

engines and eliminating the need for

aftertreatment solutions.

dynaCERT, a Canadian company,

reported in October 2019 that its HydraGEN

technology had been approved

for underground mining applications in

Canada pursuant to a formal risk assessment

commissioned by dynaCERT’s

dealer, Total Equipment Services, and

one of TES’s major underground mining

customers in Northern Ontario.

The Workplace Risk Assessment

and Control (WRAC) was undertaken to

develop a better understanding of any

occupational health and safety hazards

that could arise from the use of a HydraGEN

unit, in this case installed on a

boom truck currently being used by the

mine in underground applications. Risk

assessment involves the assigning of a

level of risk to each known health and

safety hazard, followed by the ranking

of those hazards. The next step, according

to the company, is a user case study

currently under way to analyze effectiveness

of the HydraGEN technology

underground by measuring changes in

emissions and fuel economy.

dynaCERT said its patented technology

uses distilled water to extract hydrogen

and oxygen on demand through

a unique electrolysis system and supply

both through the engine air intake to enhance

combustion, resulting in lower carbon

emissions and greater fuel efficiency.

In October 2020, the company announced

that Japanese conglomerate

Marubeni Corp. had signed a distribution

agreement with H2 Tek, a

dynaCERT distributor, to market the

HydraGEN system. Marubeni will sell

HydraGEN primarily to mining equipment

owners in Chile, Peru, Colombia,

Mexico, Australia, Mongolia and Japan.

Plotting a Path to

Electrification

All available indicators point to a gradually

declining role for diesel-powered

equipment in underground mining, with

BEVs increasingly taking larger bites

of responsibility for production duties

rather than being limited to utility and

light-duty tasks. However, unless a

mine is specifically designed from the

outset to operate a fleet of battery-electric

vehicles, the changeover from diesel

to electric power can be a lengthy

and costly process, particularly if the

anticipated benefits don’t accrue in a

reasonable time frame.

Cat’s new 3.6L industrial diesel was designed to be physically

smaller,

Cat’s new 3.6L industrial diesel was designed to be physically

smaller,

with flexible aftertreatment mounting options and a

simplified

installation process, to provide equipment OEMs

with more design

and serviceability options.

In order to plot an effective course,

mine operators can get help from initiatives

such as the International Council on

Mining & Metals’ Innovation for Cleaner

Safer Vehicles Program, an initiative

launched in October 2018 designed to

connect ICMM members with equipment

OEMs and suppliers and accelerate innovative

development of a new generation

of cleaner mining vehicles. ICMM

said its producer members represent

approximately 30% of the global metals

market with more than 650 assets.

The stated goals of the ICSV initiative

are to introduce greenhouse gas

emission-free surface mining vehicles

by 2040, minimize the operational

impact of diesel exhaust by 2025 and

make vehicle collision avoidance technology

available to mining companies

by 2025. ICMM recently announced

that eight new OEMs joined the initiative,

raising the number of participating

OEMs to 19. Diesel suppliers include

Caterpillar, Cummins, Komatsu, Liebherr

and MTU.

In what seems to be a common first

step in the process of reducing DPM exposure,

hardrock mines often fit their

largest items of mobile production equipment

— trucks and scoops — with diesel

particulate filters (DPFs). As a 2019

report* from NIOSH indicated, operators

primarily retrofit haulage trucks and

LHD vehicles with DPF systems because

they’re perceived as the major contributors

to exposure of workers to diesel

aerosols and gases, and they operate

over duty cycles that are characterized

by higher DPM emissions and that favor

passive regeneration of DPF systems.

These modifications generally produce

favorable results. One instance

provided by ICSV showed that Barrick,

for example, has been able to signifi-

cantly reduce harmful emissions from

a fleet of Cat R1700G LHDs and AD30

underground trucks at its Hemlo mine in

Canada by switching to biodiesel and installing

DPFs on all units. The objective

was to minimize the frequency of occurrences

when measured DPM exceeded a

company-mandated OEL of 0.16 mg/m3

— significantly lower than the government

standard OEL of 0.4 mg/m3.

Hannah Demers, an industrial hygienist

at Barrick, reported at the Mine

Diesel Emissions Council (MDEC) conference

held in Toronto last year that

timely inspection and replacement of the

filters has helped the mine reduce the

number of excessive DPM occurrences in

underground work areas, and it is moving

forward with other supportive measures

such as making continual ventilation upgrades

— doubling flows in the lowest

and busiest mining areas — and purchase

of BEVs and cleaner diesel-powered

equipment, including BEV jumbos

and bolters as well as scoops and trucks

fitted with Tier 4F-compliant engines.

In another example, workers at

BHP’s Broadmeadow underground metallurgical

coal mine in Queensland benefi

tted from a company-wide emissions

monitoring program. It promotes the

use of real-time monitoring technology

to assess worker exposure to DPM and

coal dust.

According to BHP, the mine approached

the goal of reducing worker

exposure in four stages. The effort began

by implementing a DPM awareness

campaign among mine workers to help

identify improvements and increase the

general discussion on how we can eliminate

the risk of exposure to DPM.

With the workforce engaged, the

mine introduced an emissions-based

maintenance project for the underground

vehicle fleet. Maintenance activities

relevant to DPM emissions were reviewed

and exhaust DPM limits set that

vehicles had to pass to be put back into

service; failure to meet these limits triggered

further maintenance. This led to a

40% reduction in DPM emissions from

machinery used in the underground environment.

Other options considered at

this stage included the investigation of

alternative fuels, a DPM health check

and exhaust filtration.

After successfully reducing emissions

through revised maintenance practices,

the mine worked with a local company

to develop a low-emissions engine for

underground equipment. A new engine,

from Japanese diesel builder Hino, was

installed across the fleet and yielded a

further 70% reduction in DPM emissions

from each underground vehicle.

While the first and second stages of

the program led to a significant reduction

in DPM emissions, the team determined

the only way to eliminate DPM emissions

entirely was to move away from

diesel power for underground vehicles.

The team was unable to identify a lithium-

ion powered (LIP) electric mining

vehicle supplier in Australia but found

a manufacturer in Canada and worked

with them to develop a tailored underground-

approved electric vehicle for coal

mining. The Broadmeadow team worked

to enable the vehicle to be certified for

use in most underground sections of the

mine. Trials of the LIP electric vehicle in

the underground environment were successful

and Broadmeadow has acquired

three more electric vehicles.

BHP said Broadmeadow was also

one of the first BHP mines to pilot a

new real-time mine emissions monitoring

system. This technology has now

been introduced at its Escondida operations

in Chile and Whaleback iron-ore

mine in Western Australia. It enables

emissions such as DPM to be tracked in

real time and allows additional controls

to be implemented, where appropriate,

to support those already in place for

managing the risk of worker exposure

to these emissions. The real-time data

can be analyzed and accessed across

a range of mobile devices and has the

capability to issue automatic alerts and

alarms to further protect workers.

BHP said it was in the process of

extending this capability to another 11

mines.

And finally, the NIOSH report mentioned

earlier called attention to the

role that medium- and light-duty underground

diesel equipment — shotcrete

trucks, explosives carriers, graders,

personnel carriers, side-by sides and

pickup trucks — play in contributing

to DPM exposure. In the U.S., for example,

they’re commonly perceived by

mine operators as less-than-significant

contributors to worker exposure to diesel

emissions because they generally

work in duty cycles that generate less

DPM and are less favorable for passive

regeneration of DPF systems. However,

perceptions can be flawed: medium

and light-duty vehicles also constitute

an estimated 60% of the total number

of units in underground fleets surveyed

by NIOSH, and due to their numbers,

generally higher attrition rate and diffi

culty in retrofitting with DPF systems,

represent a prime target for replacement

by battery-powered vehicles, or

repowering with cleaner, contemporary

engines instead of like-for-like original

equipment, according to the report.

As featured in Womp 2020 Vol 12 - www.womp-int.com