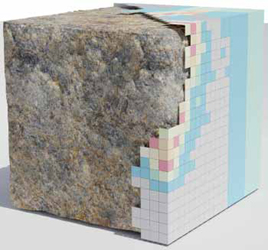

CRC ORE recently completes an assessment of bulk ore sorting opportunities for BHP’s Olympic Dam

copper operation in Australia. (Photo: BHP)

Copper Processing: The Quest for

Efficiency at Scale

Where do the greatest optimization opportunities lie? And what will future flowsheets

look like?

By Carly Leonida, European Editor

Copper processing operations are some of the most water and energy-intensive within the mining industry that, as a whole, is responsible for 11% of worldwide energy usage, according to the World Bank’s 2020 Minerals for Climate Action report. Today, the majority of copper is produced as a concentrate through conventional flotation, with a small portion produced as cathode through leaching followed by solvent extraction and electrowinning (SX-EW). Either way, a vast amount of energy is required to liberate metal from waste.

In its report, Zero Emission Copper Mine of the Future, The Warren Centre at the University of Sydney, stated that 87% of electrical energy consumption in Chilean copper mining during 2015 occurred in mill plant concentrators, leaching and SX/EW circuits. To put that into perspective, in 2019, 23.6 TWh of electricity was used in Chile for copper mining. The country accounts for 28% of global copper output. “The trend toward declining orebody grades and continued development of the pursuit of existing operations to exploit lower grade deposits is likely to continue, in the absence of high-grade project discovery,” the report stated in its outlook for copper production to 2050. “A decline in ore grade results in higher operating costs due primarily to the amount and depth of material required to be mined and processed to produce the same amount of copper product. It is no surprise that both GHG emission intensity and energy intensity increase as ore grade decreases. There is a point of inflection, where below an ore grade of around 0.5% copper, the intensity of both metrics rises sharply.”

Given that many mines are fast approaching, if not already tackling, similar grades, this is a pressing problem. In its fiscal year 2020 commodity outlook, BHP, the world’s third largest copper producer, estimated that grade decline could remove about 2 million metric tons per year (mt/y) of refined copper supply by 2030, with resource depletion potentially removing an additional 1.5 million to 2.25 million mt/y by this date. It’s clear that the headwinds copper producers face are significant, but so are the strides being made in more efficient and economic processing.

Growing Complexity

In copper, as with many other commodities,

as ore grades have fallen, orebodies

have become more complex, with higher

levels of impurities, some of which mines

are penalized for at the smelting stage if

left unchecked.

“Arsenic is an example of an impurity

that has increased in concentration.

It has increased processing costs, and

in some cases, made orebodies uneconomic,”

Mark Mulligan, global head of

process line management for mining at

FLSmidth, explained. “In other cases, the

orebodies are more polymetallic, also requiring

higher processing costs to extract

the copper.”

Orebody complexity can also pose

challenges in the early phases of a project

because, understandably, companies

want to know exactly what they’re dealing

with. Better knowledge of the orebody

reduces uncertainty, but more testing requires

more time and carries with it the

chance of cost blowouts.

“If you’re a banker, you would look

very closely at how well defined an orebody

is,” said Alan Boylston, vice president

for process engineering and comminution

at Metso Outotec. “Because you

want to minimize risk and make sure that

the plant you’re financing is going to be

able to produce metal.”

In terms of the design of the plant,

ore complexity also drives the approach

to both comminution at the front end and

separation at the back end.

“We’ve been looking at a copper plant

recently where there’s sulphide, oxide

and supergene mineralization zones in

the orebody,” Boylston said. “The comminution

characteristics are so vastly different

between those three zones, that a

traditional SAG ball mill circuit is likely

going to struggle.

“The way that a SAG mill is going to behave with those different ores is very different. So, that can drive the front end of the process. And then, obviously, whether you’re dealing with an oxide or a sulphide- based ore, that’s going to drive what’s happening in the back end of the process. “Complexity is a big issue these days. It’s one of the reasons that companies are trying to extend the life of their existing assets, because they’re often in a more stable part of the orebody. They know it much better and are prepared to deal with it.” Ore complexity also reinforces the need for digital technologies like advanced process control. Higher variation in the plant feed means that constant measuring is required and subsequent adjustment in the operating parameters of separation technologies to maintain metal production through swings in the volume and head grade; process control systems are critical in achieving this. Remote operation and support capabilities also allow mines to tap into domain expertise offered by their vendors, and machine learning and simulation open up new opportunities in performance optimization.

Opportunity to Innovate

The past 20-30 years have been characterized

by a gradual decline in the discovery

and extraction of copper oxide orebodies,

which can be treated through heap

leaching flowsheets, and a shift toward

sulphide ores, which are traditionally treated

through flotation. Hence the increase in

the number of concentrators built worldwide

and particularly in South America.

While there are some new copper projects

in the wings, most mining companies

are looking to expand or optimize their

existing operations rather than run the

gauntlet of permitting a new development.

Boylston’s colleague, Matt Gallimore,

senior manager for sustainability at Metso

Outotec, also joined the discussion. “It’s

getting really difficult to bring new operations

online, for a range of reasons,” he

explained. “Exploration costs are going

up, the timeline for getting permits and

designs finalized is much longer…

“But a lot of mining companies are

using that opportunity to think outside of

the box. They’re more open to trying new

things and that’s really encouraging.”

This can present a challenge for vendors, as many existing operations are stretched for space and capacity. Fortunately, there are some opportunities though around water reuse. “In the case of some tailings handling processes, it’s possible to put them into an existing operation,” Gallimore said. “But the challenge is that they might not fit with their tailings management system. It might require a really signficant investment of capital if, for example, the mine is used to pumping its tailings to one place. To move to filtering would require a completely different material handling system. “Having said that, you often have to do things at the brownfield level, because how in the world is a mining company going to take a bench-level or small pilot- level validated technology and build a whole new facility around it? It compounds the risk. By necessity, companies have to take the risk somewhere, and it’s more logical for them to take it at a brownfield facility. But, again, the cost can be quite significant.”

Historically, risk has always been discussed in terms of finance. However, social license to operate now exceeds that in some areas; EY has named it the no. 1 risk to mining companies for two years in a row, and water use is a crucial aspect of that. It’s important to find a balance between priorities. “Water usage can determine whether or not a mine can even run their plant,” Gallimore said. “We’ve seen mines that had to stop or reduce production because of a lack of water.”

First, the Front End

Some of the most visible advances in process

efficiency in recent years have been

at the front end of copper flowsheets in

comminution.

“There are two technologies that have

been really strong over the last 20- to

30-year timeframe,” explained Boylston.

“Firstly, stirred mills like the HIGMill, vertical

mills or stirred media detritors (SMDs).

“With stirred mills, the big drivers are

lower energy efficiency and media consumption.

Then, in the finer size ranges,

where something like a HIGmill or a SMD

are used, it’s all about energy efficiency. It’s

much more efficient to grind to very fine

or ultra-fine levels using these technologies

that have very small media than in a ball

mill where a lot of the energy is wasted in

lifting the media, as opposed to grinding.

“Second are HPGRs. These started out

in aggregate and soft-rock applications

and have moved into more hard-rock type

applications. HPGRs are typically about

30% more efficient as a primary grinding

device than a SAG mill would be.”

The case has been made on paper, but Boylston said it’s now a matter of gauging how eager mining companies are to see what could be achieved if they implemented a similar setup at their own operations. Because it’s hard to answer some of these questions at a pilot scale, let alone on a laboratory scale. His team has seen inquiries from mines referencing certain parts of the study, but interest in the more holistic view hasn’t come about quite yet. “I would say that forward-looking companies like Newmont and Freeport that are used to dealing with new technologies and have the people who understand the risks and rewards… I think they are coming down the path,” he said. “The next step is to develop some small-scale demonstration plants to look at the possibilities over a year’s worth of operation and to fine tune them before companies drop several billion dollars on a new 150,000-mt/d copper concentrator using the technology.”

Sensor-based Ore Sorting

One of the best ways to reduce energy

and water consumption in concentration

or improve leaching is to remove as much

gangue as possible as early as possible.

“I’m really optimistic on preconcentration

and ore sorting,” Boylston said. “The

technology has been used in many places,

but it’s not mainstream yet. I think the

biggest reasons for that are scaling and

energy usage.”

Ore sorting is essentially a form of preconcentration and, while it does require a certain amount of energy to separate the material using blasts of air, the savings downstream in terms of energy, water and reagent consumption can be significant, as can the energy avoided; the amount saved by having ore or gangue bypass the concentrator altogether. It also translates into fewer tailings and coarser tailings, which are easier to handle. There are two main types of sensor- based sorting: bulk ore sorting and particle sorting. Particle sorting systems detect individual particles and accept or reject them depending upon their mineralogical composition. These systems are very effective at pinpointing minerals. However, they do have limitations in terms of throughput. While higher throughputs can be achieved by using multiple units, the complexity, size and cost of the installation can prohibit their use in very high throughput operations.

Through bulk sorting, it is possible to achieve a net increase in metal production despite having losses in the sorting plant, because mining recovery is improved and that eliminates the misassignment of trucks. The net impact across the whole system is that more metal is produced for the same amount of effort. So, in the processing plant, if you have a higher head grade going in but the same tonnage, then effectively on a unit cost basis, or per-metal-ton, there will be a reduction in costs, and the same is refl ected in the mining operation due to increased recovery.

Prompt Gamma Neutron

Activation Analysis

PGNAA is one of the best known and

widely proven techniques for multi-elemental

measurement and sorting in bulk

material. The advantage of PGNAA is that

it measures through the full conveyed

cross section continuously and provides

representative element measurement

without the need to constantly sample

coarse conveyed flows.

“High specification PGNAA analyzers

enable accurate measurement over time

increments as short as thirty seconds,”

explained Henry Kurth, chief marketing

officer at Scantech International. “Elements

such as copper can be measured

to a precision of 0.02% copper over thirty

seconds which is sufficient for high confi-

dence in decisions for bulk flow diversion.

Increments of 8 tons (from a 1,000-tonper-

hour flow) are diverted through a bulk

ore sorting application to remove batches

of waste from mill feed as well as divert

material to different stockpiles based on

ore quality.”

Longer measurement increments of two to five minutes are suitable for blending control of ores to reduce feed quality variability and to control average ore quality within a target range. Feed blends can be adjusted as frequently as required but, typically, multiple measurement increments are composited to produce a rolling average ore quality. Feed forward control is a growing application as process operators can see when ore type changes and adjust the process parameters to cater for that. Measuring the primary crushed conveyed ore quality provides all these capabilities simultaneously. Scantech’s GEOSCAN analyzers have been successfully applied at numerous copper operations, including Chifeng Jilong Gold Mining Co.’s Sepon gold-copper mine in Laos, which uses the technology to manage feed variability and gangue acid consumption in its leaching circuit, New Gold’s New Afton copper-gold operation in British Columbia and Anglo American’s El Soldado copper operation in Chile, which use a GEOSCAN-M analyzer to upgrade mined and stockpiled ore prior to concentration.

Magnetic Resonance

MR is a penetrative sensing technology that, unlike PGNAA or XRF, only tunes into one specific mineral. Initially that seems like a disadvantage. However, the trade-off of reduced selectivity is faster sensing times. “Our best in-field measuring frequency is two seconds to get a measurement precision of ± 0.023% copper,” Beal said. “Also, we simply don’t have to recalibrate our equipment once it’s out in the field.” What happens if you have a polymetallic deposit or if there are changing ore types? “That’s the drawback,” Beal said honestly. “MR offers high accuracy and speed, but you have to make sure that the mineral you’re looking for is either the dominant economic mineral, or that it’s a proxy that indicates the absence of any economically viable material. Changing ore types can be managed with a well thought out sorting strategy, as demonstrated at Capstone Mining’s Cozamin mine in Mexico where MR bulk sorting was used specifically for the main copper dominant zone.”

The other option is to install two analyzers on the same conveyer belt and calibrate each to detect a different mineral or proxy, and the price point of the NextOre system is designed to allow that. “We’re seeing a lot of interest at the moment from miners with satellite orebodies and mines that are looking at stockpile reprocessing,” Beal said. “And also, from large, mature copper operations that have depleted the high-grade portion of their orebody but still have a significant amount of metal in the ground; if you can use the plant you’ve already got to increase metal recovery from the same number of tons, then that avoids having to go through environmental permitting for an expansion. Most of the really big mines in the world that are older than 10 years are having exactly the same problem.” At the AusIMM Preconcentration conference in November, Beal presented the Cozamin case study mentioned above. The underground, polymetallic mine opted for a 200-mt/h bulk sorter from NextOre to upgrade the copper domain within its orebody.

“During the trial, we demonstrated a 30% grade increase and a 32% reduction in volume reduction with an overall net copper recovery improvement of 6%-8% despite having some losses in the bulk ore sorting stage itself,” Beal said. “A lot of companies are looking to cut down on the capital cost of bulk sorting and we’ve gotten a lot of positive feedback on a new mobile solution which has a feed conveyer, analyzer and diverter gate all together in a mobile integrated system. All the mine has to do is deliver tons to the plant either, with a crusher in front of it or not. They could then collect the upgraded and rejected piles and pay for the system on a monthly basis. We’re actively working on the design and will be rolling the system out in the next six months. The first unit is destined for the Magnetite Mines project in South Australia.”

From Front to Back…

While much work is being done to create

efficiency in comminution, there’s

plenty of development in the back of

flowsheets, too.

Lower head grades and higher impurity

levels have, in some cases, led to a

requirement for regrinding in the flotation

circuits in order to achieve saleable

grades, which have pushed energy consumption

levels up.

“Previously the focus was always energy

efficiency at the front end because

it’s so energy intensive in size reduction,

but there’s also been a refocus on the effi

ciency for the backend of the plant as

well,” explained Gallimore.

“Alongside that, there’s more pump

thickening, high density thickening and

filtration for dewatering now than 30

years ago. You tend not to see as many

plants pumping their tailings directly out

to a tailings pond.

“Filtration’s a trend we’ll see more

of, because of the vast enhancement in

safety for tailings impoundments. The

permitting process should get easier too

because long-term risks are reduced, and

the ability to reuse water greatly increases

so, new water consumption goes down.

It’s a lot cheaper to filter and recover process

water than it is to desalinate and deliver

new water.”

Coarse flotation technologies hold

much promise in delivering higher recoveries,

and higher grind size requirements,

which will help to reduce both energy and

water consumption. Tailings with a lower

proportion of fine and ultra-fine materials

are also easier to handle and rehabilitate.

Heap and In-situ Leaching

Leaching bypasses the need for grinding

and flotation, allowing mines to skip

straight to the recovery of metal from a

pregnant leach solution through SX/EW.

Heap leaching and, in particular, in-situ

leaching of orebodies is energy efficient

and can be used to recover very low copper

grades. However, traditional lixiviants

like sulphuric acid aren’t effective on

sulphide-heavy ores… i.e., the majority

remaining worldwide.

U.K.-based startup, Argo Natural Resources,

thinks it may have found a (forgive

the pun) solution to this problem.

The company has developed a leaching

solution based on deep eutectic solvents

(DES); a special group of ionic solvents

that are liquid at low temperatures.

These consist of chemical components

that are widely available throughout the

world at low cost.

In combinations they form non-aqueous solutions that allow for the oxidative dissolution of metals as part of the leaching process. Conventional recovery techniques and technologies can then be used to recover metal from the loaded DES. The barren DES can then be reused, unlike solvents in acid leaching systems. Fred White, who handles business development at Argo, explained: “DES were discovered at the University of Leicester 20 years ago and a wide group of precious metals, base metals and rare earth elements have been proven amenable to DES. As the solvents are environmentally benign, biodegradable, recyclable and utilize an energy- and emission-light process, there is a major environmental advantage over conventional processing, which we believe has the potential for a sustainability revolution across multiple sectors. DES are also characterized by very high metal recoveries and fast leach kinetics, which also justify their advantage on a pure economic basis.”

There are two big opportunities for DES in copper processing: first, the processing of copper deposits in jurisdictions with water usage sensitives and, second, the processing via leaching of transition ores and copper sulphides. “As the DES process requires minimal water usage, we only use it as an option for washing,” White said. “The technology is well suited to replace the water-intensive leaching operations that are causing a huge strain on the license to operate for mining companies, especially for projects in South America. “There are a lot of large, low-grade copper oxide deposits moving into transition zone ores or sulphide ores. These are very difficult to process with the existing infrastructure built for copper oxide processing. The DES process can integrate into conventional processing operations and recovery from transition ores and oxides is something we are actively working on.”

Argo currently has testing contracts with a major mining company looking at several target metals and ores, along with contracts with a handful of juniors. “We are currently designing and optimizing flowsheets and hope to establish our first DES plant in 2023,” White said. “Argo operates under a licensing and royalty business model in the mining industry and will look to implement DES processing with mining partners.”

New Business Models

Argo is also looking to commercialize DES

in the recycling of e-waste; something

that is likely to become a part of more

mining companies’ business models in

the future — Boliden is a current example

— as ore grades fall and pressure grows

to close metal production loops.

“E-waste is the world’s fastest growing

waste stream generating $57 billion

of contained metal waste in 2019. The

future market potential is massive and a

few of the world’s top mining and metals

houses have already identified this trend,

along with the increasing social and regulatory

pressures to recycle more and create

a circular economy,” White said.

“The future of the metals market is

being driven by the electrification of the

economy, which will require an ever-increasing

metals consumption per capita.

The paradox is that it takes carbon-intensive

processes to recover metals for use in

low-carbon solutions. We believe that Argo’s

process will benefit from significant

environmental leverage.”

Bio-metallurgy

Advanced bioleaching is another area that

holds much promise. Marny Reakes, vice

president of mining BioTech at Cemvita

Factory, said her company has seen a rise

in interest recently from copper miners

looking to optimize mineral processing

and leaching circuits.

Even if sites don’t use bioleaching,

there will be microbes throughout their

processing circuits, and these may be

helping or hindering recovery and effi-

ciency. Synthetic biology and the latest

biotechnology tools have the potential to

allow us to better understand microbial

actions within mineral processing facilities

and harness greater control.

“One of the big problems at the moment is finding a large-scale commercial leaching method for the high recovery of chalcopyrite,” Reakes explained. “Chalcopyrite floats well but if ore grades drop then often it’s not economic to put it through a grinding and flotation route. It’s better to have coarser leaching instead.” Around 70% of the world’s copper is currently found in the form of low-grade chalcopyrite; a copper-iron sulphide mineral. So, this is a key area that Cemvita has been working on with its mining clients. “We’re looking at how to take the normal archaea and extremophiles that are used in bioleaching and modify them to speed up kinetics and increase the recovery of primary minerals like chalcopyrite that are usually recalcitrant in terms of their leaching ability,” Reakes said.

“What I’ve found when I talk to longterm miners about heap leaching, is that the culture that they use for bioleaching was probably borrowed from a neighbor 30-plus years ago. Each mining site or process will have a specific microbiome that is adapted to the local environmental conditions. For effective bioleaching, it’s critical to understand the genetic properties of the native microbiome. In turn, this provides key information to generate a bioleaching microbial consortium with high efficiency that is in balance with the native microbiome and is adaptable to the environment. “When I talk to universities, companies or metallurgical labs that do leaching test work, quite often, they won’t have performed comprehensive analyses (genomics, transcriptomics, metabolomics or proteomics) on the culture to understand how it functions and can be augmented. “Understanding and optimizing biometallurgical consortia using synthetic biology could allow for much higher recoveries and less waste. Synthetic biology can also be used to develop grinding aids or soften ore.”

Anglo Puts Technology Into Practice As in alternative comminution circuits, the real benefits will come when we start to piece together these new technologies and processes to create completely different flowsheets for copper extraction. That is when we will see step changes in energy efficiency and water savings. One mining company that is already headed down that path is Anglo American. “We believe that the copper flowsheets of the future will look completely different to those of 20 or 30 years ago,” a spokesperson said. “From preconcentration and waste rejection up front, to energy efficient comminution, alternative separation technologies, and coarse particle recovery, all the way through to how we dispose of our discards. “With the current digital transformation, plants will furthermore be extensively instrumented with real-time sensing of all aspects of an operation, leading to highly autonomous and virtualized operations.

“For us, some of the greatest opportunities going forward are the areas that our FutureSmart Mining program is focused on: energy efficient comminution, coarse particle recovery, sorting, dry processing, digital transformation and data analytics and a shift toward cathode production instead of the traditional concentrate to smelter route.” For Anglo American, bulk sorting is an important step towards dry separation. “It’s another of our step-change innovations and takes advantage of ore heterogeneity,” the spokesperson explained. “It’s cost effective in sorting material into low-value ore, which we reject, and high-value material, which we then send through the plant. This results in more mineral output.” Three demonstration plants have been successfully trialed in Brazil, Chile and South Africa. “We are seeing a more than 5% uplift in feed grade and a 10% reduction in energy and water intensity. As a result, full-scale units are under construction at our Mogalakwena and Los Bronces mines and are due to go live this year with a third planned for Barro Alto in the near future,” the spokesperson said.

Anglo American was one of the first miners to voice it’s ambition for waterless processing plants, and work continues on this through FutureSmart. “There are a number of steps to waterless processing,” explained the spokesperson. “First, a reduction in water intensity i.e., using less water per unit of ore processed. Second, closing the loop by recycling the water that we do need; coarse particle recovery and hydraulic dry stacking take us to an 85% recycle opportunity; and, third, dry processing.” “Dry comminution is the first step to eliminating mass use of water in mineral processing. Subsequent separation and upgrade steps will deliver dry concentrates, which will further allow for new methods of refining. Today, our focus is on water recovery at the backend of the process recovering 85% of the water using hydraulic dry stacking in combination with coarse particle recovery. In the future, it will be on the safe stacking of dry waste, preventing dust and acid mine drainage. “There are also many novel leach approaches being tested at the moment throughout the industry,” they hinted. “Herein lies the next wave of step change efficiencies over and above those provided by coarse particle recovery and bulk ore sorting.”