Some American miners working on the Carlin Trend

are installing the Nevada Bolt, slang for Jennmar’s

MPA and J-LOK P resin pumping system.

New Tools for Back Support

As more mines gravitate toward mechanized systems, operations consider roof

support alternatives to improve safety and cycle times on lateral development

By Steve Fiscor, Editor-in-Chief

One of the bright spots for underground mining in the U.S. are the gold mining operations in the Carlin Trend. There has been considerable recent consolidation among the mines in this region with Barrick Gold and Newmont forming Nevada Gold Mines. Today, Elko has the highest concentration of underground miners in the U.S. It also has some of the worst ground conditions. Imagine for a moment the frustration of trying to stab a resin cartridge in a hole with a cable bolt before it collapses in squeezing ground.

Most mines use some combination of rock bolts, chain mesh and shotcrete to support the heading. The popularity of rock bolts varies by region with some mines favoring resin bolts, while others prefer friction stabilizers or inflatable bolts. They have mixed feelings about shotcrete. Some see the advantages, especially with macro-synthetic reinforced fiber, while others see it as complicated. The ground conditions at mines are site specific. Some of the older, deeper miners in Ontario, Canada, for example, are testing the limits of these new tools, while their younger counterparts in Australia are going a different direction with great success. All of them are looking at alternatives to turn around the cycle times associated with ground control.

Mechanized Bolting Trends

During his presentation, Experience and

Future of Mechanized Rock Bolting, at

the annual conference for the Society for

Mining, Metallurgy and Exploration, Ryan

Lyle, senior geotechnical engineer for Cementation

Canada, offered data confirming

what many had already suspected.

The evolution and adoption of mechanized

bolting has improved safety.

Cementation Americas is one of the largest North American underground mining contractors. Lyle and the Cementation team, which included Alex MacInnes, mining estimator, and Eric Smith, executive vice president, health and safety, compiled and analyzed data on bolting activities in lateral development from multiple projects carried out by the company.

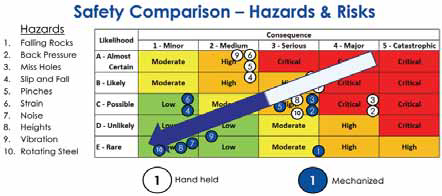

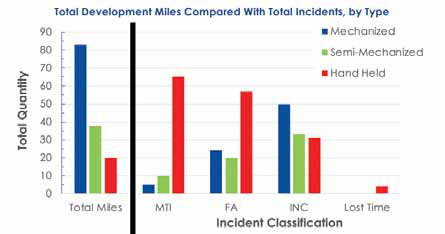

Comparing the bolting hazards and risks with handheld and mechanized bolting, they identified a clear trend with mechanized bolting. “We wanted to see where the different methods fit in the risk matrix,” Lyle said. “Mechanized bolting eliminates a lot of hazards. But, is it actually better?” During the last 10 years, at more than 50 mine sites in North America, Cementation has completed 134 km of lateral development with mechanized bolters, 60.5 km with semi-mechanized bolters and 32.5 km with handhelds.

Making a safety comparison between the three methods, medically treated injuries and incidents that required first aid were much lower for mechanized bolting. “This confirms what we suspected, that mechanized bolting is safer,” Lyle said. If mechanized bolting is the safest method, then why aren’t more mines using it, Lyle asked rhetorically. Mechanized bolting has many strengths and challenges, Lyle explained. Cementation worked with the first fully mechanized cable bolter at a metal mine in Michigan. Fully mechanized bolters improve safety by separating the operator from the hazards. One machine scales and installs ground support. They install inflatable and friction bolts efficiently and they can be operated remotely.

On the other hand, standard mechanized bolters are large machines that have height requirements. The machines can encounter productivity issues if the operators and mechanics are not trained properly. With a price tag of $1 million-$2 million, they are an expensive capital item. Lyle said they also have high “perceived” operating costs. “Some miners believe these machines are just too expensive to operate,” Lyle said. “They have a lot of sophisticated systems. If something breaks, it’s expensive to fix and the machine is down until it’s repaired. Even when there is no serious injury, shutting down development for an incident can cost hundreds of thousands of dollars. You can buy a lot of spare parts with that much money.”

“There are some who see these machines as so expensive that they might as well send the miners out with jacklegs, which cost $5,000 each,” Lyle said. “Cementation sees this internally,” Lyle said. “If we have two miners on a scissor deck running stopers and putting bolts in the back, in certain conditions they might be more productive than a mechanized drill, but two miners and two drills are also in a potentially more compromising position.” Mechanized bolters struggle with resin bolts and resin bolts are the bolts of choice at most mines in the Canadian Shield, Lyle explained. “The mines may be able to overcome this issue in the future with hollow bolts and pumpable resin systems. Miners in the Sudbury Basin and elsewhere in Canada are currently testing such systems. We are hearing a lot of good things about the ‘Nevada Bolt,’ hollow bolts with self-drilling anchors and sacrificial bit. These hollow bolts may be connected together to do away with cable bolting. Recognizing the advantages, mining companies looking more closely at mechanized bolting and Lyle believes Canadian miners are on the cusp of making it work.

The Nevada Bolt

When it comes to ground support products

in the U.S., business has been brisk with

gold miners, explained Todd Young, western

hardrock manager for Jennmar. “The

ground conditions encountered in northern

Nevada, and the Carlin Trend in particular,

are notoriously poor,” Young said.

“Sometimes it appears to be as loose as

gravel. The drill holes collapse before the

miners can install ground support.”

That is why Jennmar introduced its multipoint anchor (MPA) technology for the region three years ago. The MPA is a hollow core self-drilling bolt. The system pumps resin through the bolt, encapsulating the bolt and filling the hole. The miners do not need to remove the bolt to install a resin cartridge, which would ordinarily allow the hole to collapse. Previously, many of the mines in Nevada were using rolled-form, inflatable bolts, Young explained. Using a special head on the bolter, they would inject high-pressure water and hydraulically inflate the bolts to 310 bar, creating a friction- type stabilizer.

“They use the MPA’s with chain mesh and shotcrete and the J-LOK P is the biggest improvement they have experienced lately,” Young said. “They can couple these bolts and use 16- and 20-ft lengths.” “Three years ago, Jennmar began a partnership with customers to develop the MPA system. With assistance and input from those customers, we were able to develop technology that addresses their ground support needs, and it has really taken off,” Yound said. Mines operating in the Carlin trend are currently using six machines and they are considering a couple more. As they go deeper, they believe ground conditions will continue to deteriorate.

The J-LOK P pumpable resin system can be mounted on any bolter and Jennmar has developed attachments that allow miners to quickly convert bolting rigs.

Shotcreting Solutions

Shotcrete has several advantages, according

to Sika, speed, ease of application,

and how it performs over time compared

to other existing systems under load. Sika

is one of the world’s largest suppliers of

shotcrete consumables.

“With today’s shotcrete mix, you can

get very nice early strength development

and significantly decrease the cycle times,”

said Fabian Erismann, market field manager,

mining, Sika. “Some mining companies

still shy away from it, thinking it’s too

complicated or they need advanced education

on concrete technology. Some wrongly

believe that it’s difficult to maintain consistent

quality of large volumes of batched

concrete at the mines. It’s true. It’s not easy

to maintain quality from both a production

and application perspective, but once they

get into a working routine, they see that its

extremely versatile, flexible and fast. Shotcrete

has a proven to be the go-to technology

for underground construction globally.”

When it comes to lateral development rates, Erismann believes that Australian mines are more efficient than North American mines and he partially attributes that success to the use of shotcrete. “Many large North American mines install bolts and screen mesh only, while their peers in Australia, operating in similar geology at a similar depth, are using 100% shotcrete,” Erismann said. “The Australian mines are used to yielding shotcrete. They put it up fast and efficiently. This reduces cycle times, increases development rates and lowers overall costs.”

There are many other differences between Australian and Canadian mines that contribute to these differences in efficiencies, such as ramp vs. shaft access and the use of fully mechanized machines. Last year, Sika acquired King Shotcrete Solutions, the leading shotcrete supplier for Canadian mines. “Canadian mines usually apply shotcrete for specific applications, such as ore passes, paste barricades or rehabilitation purposes, but rarely is it used in the mining cycle on a day-to-day basis, but it’s coming,” Erismann said. “Several large modern mining operations are considering full-scale wet and dry applications or have already implemented it, even for challenging projects in the Canadian Arctic.”

“Today, we can provide the same energy absorption per square meter of support with way less fibers per kilogram than we used 10 years ago,” Erismann said. “Less kilos in the concrete mix is less money. The shift from steel fibers to synthetic fi- bers also avoids the corrosion risks in an acidic mine environment.” Under dynamic loading, when we talk about seismic shock or destressing events, you need a support system that can handle ultra-rapid rock mass movements,” Erismann said. “These synthetic fibers have proven they can handle these rapid movements much better than traditional shotcrete systems. With the use of these synthetic fibers, we no longer see the spalling of shotcrete that has been sprayed over mesh. In many mines, we have a much more homogeneous buildup of the support system because we no longer have the mesh-concrete interferences.”

Underground Construction

Expertise

When it comes to poor ground conditions,

there are several solutions that

range from anchoring resins for rock bolts

to ground-consolidating chemicals — a

rock glue that fills the cracks when rock

bolts can’t get the job done, according to

MAPEI. “MAPEI is the largest privately

held chemicals and powders company in

the world,” said Jim Pinkley, UTT country

manager for MAPEI. “We also offer

shotcrete accelerators and other shotcrete

materials. MAPEI has 27 plants in

North America and all of them have been

deemed essential. Because of that, we

have product readily available and we have

recently picked up additional business.”

MAPEI has a large presence in the tunneling sector. Pinkley and his team are looking to share MAPEI’s heavy underground construction experience with the hardrock mining sector in North America. Bill Cheatham, business development leader for MAPEI covering the western U.S., is very familiar with the region, especially the poor rock conditions in the Carlin Trend. “The rock mass rating in this region can drop to as low as 10 and it averages about 40,” Cheatham said. “They have a lot of faults, clays and silts.”

In addition to the ground-consolidating chemicals, Cheatham explained, MAPEI also markets void-filling foams, which expand four to 10 times their volume. “These products are really useful for mines that encounter large vugs,” Cheatham explained. “They have a surprisingly high compressive strength. They make bad, loose ground solid again.” MAPEI produces its own powders and chemicals and it does not have a contracting arm. “We supply mining contractors; we do not compete with them,” Cheatham said. “We’re engaging them to bring us to the table when they have encountered extraordinary conditions and we evaluate these situations as individual engineering projects.”

Sharing his experience in Canada, Brent Zemoroz, MAPEI’s business development leader for that region, explained that ground conditions often change over the life of a mine. “Miners are always looking to gain an edge to improve cycle times without compromising on safety,” Zemoroz said. “Most mines use some combination of bolting, mesh and shotcrete and, as much as they would like to eliminate one of the processes, they usually can’t. More recently, the engineers at the mines have been looking at new ground control strategies such as macro- synthetic, fiber-reinforced shotcrete and better blasting techniques.”

Zemoroz sees room for improvement with the use of macro-synthetic fibers. Synthetic fibers retain structural integrity under load, while exposed steel fibers have issues associated with oxidation. Steel fi- bers are heavy and sink in water. Synthetic fibers are lighter, cheaper and easier to handle. “But, because they float in water, they are getting into the ditch lines, then the sump and plugging the dewatering pumps,” Zemoroz said. “Someone needs to develop a synthetic fiber that sinks.” One of the best ways to improve ground control in the headings starts with blast design. “We’re seeing better blasting techniques that provide more rounded backs on stopes,” Zemoroz said. “The blasters today are more knowledgeable and some of the stopes we are seeing in Canada look like they may have been cut with a tunnel boring machine.”

The Case for Friction

Stabilizers

In the Australian Pacific region, the mines

tend to use jumbo development rigs for

both development and rock bolting applications

and friction stabilizers are the

more commonly used bolt for ground control

in underground hardrock mines.

In the last two or three years, there

has been a shift toward mechanically anchored

friction stabilizers, such as DSI

Underground’s Kinloc rock bolt. In addition

to standard frictional force, the Kinloc

bolt also provides a tensionable point

anchor by way of an internal solid bolt.

Soon DSI will offer the next generation

Kinloc and the Kinloc Indie, which has

an independent connection that loads dynamically

more effectively.

“These new products lend themselves to being more dynamically capable so they can handle more load,” said Derek Hird, APAC CEO for DSI. “They offer improved safety along with better productivity and performance. The speed of installation is much quicker than a resin bolt. They bang the Kinloc in and they have a high-capacity support. It’s a friction stabilizer so it has a higher loading capacity.” DSI Australia has also established inhouse testing facilities to validate products before they approach traditional third-party testing facilities.

Unlike the U.S. and Canada, the adoption rate for pumpable resin systems in Australia is low. “We are currently working with a mine in Western Australia and an OEM to install a pumping system on a rig and trial the hardware,” Hird said. “When it comes to fully mechanized systems, however, there are still a lot of questions that need to be answered.” It can get warm in Western Australia and most mine sites have refrigerated containers for storing resin as ambient temperatures in the region can reach 40°C. “We have researched various ways to prolong the shelf life of resins and we have a fairly good understanding of the affect high temperatures have on resin,” Hird added.

DSI also has a few small product initiatives. One clever, cost-effective device is a resin mixer that attaches to the end of the bolt. In bad ground, the miners can use the device to improve resin mining in the hole. The Posimix resin bolt, which forces resin to the back of the hole as the bolt spins, now has a version that has no tail, meaning no bolt protruding from the bearing plate. “It has a coupling arrangement that screws in on itself,” Hird said. “It’s a bit like a forged-head bolt, but it can be tensioned.”

For the digital space, DSI is developing an app. In addition to product catalogs, it has a Knowledge Center where users can download conference papers, and view market-related news and events. They can also view pricing and request a quote. “We see this evolving into a customer engagement tool,” Hird said. A consignment feature assists customers with common stock. Using digital tools to manage stock in real time, the system re-orders product when it moves from the warehouse underground.

DSI is also looking at the use of digital twins to demo the life cycle of the product from the factory to the mine and then the point of installation. Someday, geo-referencing tools may be able to show the position of all the bolts in a heading.