The Sandvik DU412i ITH longhole drill can, without modifications, be

used in both production drilling and slot development. Leadership at

the company calls it the most versatile rig of its kind on the market.

(Photo: Sandvik

Data-driven Drilling Diminishes

Deviation

New solutions offer intelligent controls, automation, near real-time measurements,

and optimally planned holes for the new age of precision mining

By Jesse Morton, Technical Writer

Several new solutions hit the market recently, or will soon hit the market, that offer, among other things, holes that are almost laser straight, clean, or true to plan, or are optimally planned, or that can be quickly compared to plan to help with snap decisions. Each shows just how diffi- cult it can be to truly know the geology and in turn to answer it. Each also likely speaks to a dawning future of precision mining, where plans and decisions are data driven, and where wasted time and energy are, increasingly, things of the past.

Intelligent ITH Longhole Drill

Sandvik reported its DU412i ITH longhole

drill can drill holes that deviate less

than 2% regardless of hole length.

Maximum accuracy “ensures that

the holes are drilled as planned,” Jukka

Naapuri, product manager, underground

long hole drills, said. “The result is minimized

dilution, minimized ore loss, and

good fragmentation as correct burdens

and spacings at the bottom of the holes

allow explosives to cut and break the

rock as planned.”

The unit can drill 115- to 165-mm-wide holes accurately up to 60 m in production drilling. It can drill single-service support longholes up to 203 mm and up to 150 m in length. The unit can also be configured to ream 762-mm primary slot raises up to 35 m accurately, Sandvik reported. Naapuri said the unit is the most versatile fully automated and teleremote- operated ITH longhole rig in the market. “Without modifications it can be used in both production drilling and slot development, offering great versatility to mining operators utilizing ITH drilling,” Naapuri said.

The unit is capable of V-30 reaming at a quicker rate than other methods of slot development. It all but guarantees “that the slot will be successful,” Naapuri said, especially in comparison to methods such as drilling and blasting. “It gives the capacity to develop blind slots without the requirement for an upper level,” Naapuri said.” For slot-raising, it comes standard with “blind bore feed and split centralizer, a spaced-out RH6250 rotation head and a PC225 carousel,” Sandvik reported.

Pipe handling during reaming is mechanized. The unit comes with the new iSOLO drilling control system, supported by the Sandvik Intelligent Control Architecture platform. “iSOLO supports drill plan transfer for onscreen drill plan management and OptiMine remote monitoring,” Naapuri said. “It has readiness for AutoMine fleet and information management.” AutoMine packages enable it to repeat drilling cycles, operate unmanned through breaks and shift changes, and be operated remotely, Sandvik reported. “The standard Silver drilling package features single-hole automation, including uncoupling of pipes, while the optional Platinum delivers fan automation, drill plan management and as-drilled data download."

The DU412i was successfully trialed at production drilling in a gold mine in Ontario. It was trialed at slot development at Sandvik’s test mine in Tampere, Finland. “There 762-mm primary slot raises up to 20 m have been reamed successfully,” Naapuri said. “Four units have been sold in Canada and we have started ramping up our production in the Tampere plant.” Deployment requires a supply network for 7 bar (100 psi) compressed air. “An alternative to this are Sandvik KA-series portable atmospheric compressors, which deliver the same at much less investment,” Naapuri said. The 7 bar compressed air “will be boosted on board the DU412i up to 28 bar (400 psi) for the ITH hammer.”

When using 6-ft drill pipes, the drifts have to be a minimum of 4 by 4 m. Cross sections have to be a minimum of 4.5 by 4.5 m. “If pipe length is 5 ft, then the unit can be used in production drifts that are roughly 3.7 by 3.7 m,” Naapuri said. The rig also needs a WLAN/LAN network for transferring the drill plan to and from the office, for equipment health monitoring, and for teleremote drilling operation. “Teleremote drilling will soon be expanded to include fan-to-fan tramming.” Sandvik has been in the underground top hammer longhole production drill space since the 1970s. “Top hammer longhole drilling, in terms of units delivered, represents about 80% of the deliveries globally,” Naapuri said.

The company started developing i-class drills in 2012, at roughly the time it acquired Cubex, maker of ITH longhole drills. In 2015, the company moved to offer the i-class platform on ITH units. Naapuri said the new unit ends the debate of whether compressed-air-drilling technology can hack it underground. “Increased productivity and product safety requirements apply to ITH longhole drilling, and the DU412i is the first fully automated and teleremote-operated product to meet the requirements of the industry across the application,” Naapuri said. High on that list of requirements is tight accuracy. “Hole accuracy is paramount in production drilling and service support,” he said. “ITH drilling ensures Sandvik can meet even the strictest requirements in this area.”

Controls Auto-adapt Energy Komatsu reported the Montabert Intelsense drilling control system, typically deployed to Joy face-drilling jumbos and other drifters, helps ensure straight, clean holes while optimizing the life span of drilling consumables. “Intelsense optimizes the performance and reliability of the drifters with the objective of achieving a low maintenance cost,” said Hugues Neyrand, drilling business line manager, Montabert. The control system is designed to optimize drilling performance by auto-adapting the energy generated into the drifter. “The danger is to have uncontrolled energy that is not transmitted to the rock but dissipated into the drilling tools or inside the drifter, which can cause damage,” Neyrand said.

Depending on the geology, the system adjusts striking pressure, which is directly connected to the feed force. “Each rock condition needs its proper setup to optimize performance,” Neyrand said. “The Intelsense system self-adjusts and controls the hydraulic parameters supplied to the drifter in order to perform at its best with the highest penetration rate.” In soft rock conditions, the system will increase feed speed and lower striking pressure. In hard rock conditions, it will increase feed force and striking pressure. By optimizing feed pressure, deviation is prevented and the result is straighter, cleaner holes for blasting, Komatsu reported.

Intelsense also includes an anti-jamming system to control the torque at the bit. That reduces the risk of getting the drill bit stuck in the face. “The system offers huge benefits to improve the longevity of drilling consumables,” Neyrand said. “The drifter is working optimally, so the maintenance interval is significantly extended,” he said. “Such will provide important cost reductions for the mine and will increase the equipment’s reliability.” For example, the system can help extend shank life substantially. “The full energy of the drifter is used for the rock penetration, thus reducing the loss of energy into the tooling or inside the drifter,” Neyrand said.

OEMs have historically used the system to improve the competitiveness of their rigs, Komatsu reported. Robodrill, for example, has used it for 20 years to offer a very aggressive price per drilling meter. “China’s Kaishan understands the benefits on controlling the energy,” Neyrand said. “They are referenced as a premium manufacturer in China, and are now competing abroad in the Russian and Kazakh mining market.” While others have tried to replicate Intelsense, Neyrand explained that Montabert stays one step ahead through continuous improvements to its control and drifter development.

Controls Offer Precision,

Digitalization

Epiroc reported its long-proven Rig Control

System (RCS) helps drill rigs navigate and

drill in an optimized manner, adapt to different

rock conditions, and execute multiple

straight holes with superior precision.

“Safety, productivity, higher utilization

and consistency are also important values

to be achieved,” said Guillherme Paiva,

global automation lead, underground

drilling, Epiroc.

The system can be complemented

by other Epiroc control and automation

solutions, such as the telematics system

Certiq, Rig Remote Access, Underground

Manager, and ABC Total, for digitalization

of drilling and beyond.

A control and automation package first released more than two decades ago, RCS offers benefits in drill performance, in maintenance, and in planning. The system provides electronic navigation, and eliminates the need for manual face marking, which minimizes exposure to risks, Paiva said. The precision drilling results in straighter, as-planned holes, which brings savings in explosives and gives homogenous fragmentation. Better blasting can mean numerous downstream benefits, from reduced need for rock reinforcement and scaling to better dilution control, which helps the mill.

Company literature described Certiq as a telematics solution that gathers, compares and communicates vital equipment information. It offers detailed knowledge and summaries of entire fleets. Deliverables include “production data, alarms, warnings, reporting capabilities and operational data,” Paiva said, “on a Web interface with standard dashboards.”

Underground Manager is software for planning, administrating and evaluating a drilling operation, Epiroc reported. Paiva said the solution offers “drill plan design and evaluation tools, and measurement while drilling (MWD) analysis.” Data from RCS can also be leveraged by Epiroc’s ABC (Advanced Boom Control) Total, an onboard automation package. The solution offers advanced capabilities in the area of drill plan handling, MWD, breakthrough stopping, multi-hole drilling and more. Paiva said the above solutions can be adopted incrementally as part of Epiroc’s comprehensive underground operations value chain optimization and digitalization solution, 6th Sense. “6th Sense is not just another system,” he said. “It is all about a long-term work to create a platform of automation and digitalization in support of the actual operations.”

Digitalization is bigger than the sum of its parts, Paiva said. “Drill rigs configuration, software options, system settings, drill string components, maintenance service and monitoring results with a continuous improvement approach are all elements that must be balanced in order to achieve sustainable results.” Incremental digitalization is disruptive and must be carefully managed, he said. “It calls for a new way of working,” Paiva said. “Our customers need people, processes and technology to synchronize. 6th Sense is the Epiroc way to optimize our customers’ value chain through automation, system integration and information management, for a smart, safe, seamless operation.”

RCS encapsulates the company’s mission by being a solution in itself while integrating into increasingly more comprehensive systems and solutions, Paiva explained.

NSR: Production Optimiser

Ups Accuracy, Production

Minnovare published a white paper that

showed how the Production Optimiser

dramatically improved drill results at

Northern Star Resources (NSR) mines.

According to the paper, the gold miner

implemented the plug-and-play solution

across its Kalgoolie operations in mid-

2018. NSR reported the Production Optimiser

provided a significant improvement

in drilling accuracy and consistency.

“It helped us reduce our bridge-tostope

tons ratio by more than 50%,” Jeff

Brown, principal, innovation and technology,

NSR, said. “That reduction resulted

in less rework and delays, and ultimately

an improvement to both the reliability

and productivity of the mines.”

Other listed realized benefits included increased productivity and reduced fixed costs. According to Minnovare, total output was increased by 33% and valued at roughly $12 million. Brown said the solution helps ensure operators give their best effort. “Aside from improved accuracy, the digitization of what was traditionally a paper-based process delivers an efficiency gain that boosts people’s productivity through greater accountability and visibility,” Brown said. “It has brought a level of data integrity and quality control to our drill and blast operations that simply wasn’t there previously.”

The solution can be used on any production rig make and model and in either narrow vein or large stope mines. It operates independently of current set up systems and processes. That means it offers reduced reliance on survey mark up, and no laser alignment, rig leveling, or onboard inclinometers are required. Minnovare said that conventional set up processes rely on multiple variables and are often prone to error. “Therefore accuracy is often unreliable,” Mick Beilby, cofounder and commercial director, Minnovare, said. “The Production Optimiser reduces the number of variables in the process, resulting in a simplified, more consistent and more accurate set-up process.”

The biggest gains offered result from how the solution aids in the setting up and aligning of the rig. Improper setup and alignment accounts for 70% of all blasthole deviation, Beilby said. “If you aren’t ending up in the right place, you can expect poor blasting outcomes.” Accordingly, one of the capabilities offered is Smart Collar, which automatically recalculates holes with obstructed collars.

By giving increased speed and accuracy, the solution reduces stope turnover time and makes possible ambitious drilling patterns. The result is optimum blasts that lead to reduced dilution and increased recovery, Beilby said. “It’s a tight-focused area that can have extremely wide-ranging impacts on the overall performance of the mine.” Production Optimiser launched in 2018 and was quickly adopted by mines in Australia, Africa and the U.S. “It was adopted by more than 35 mines in just two years,” Beilby said.

Speedy Surveying System

Audits Holes

Carlson reported plans to release a new

version of its proven borehole surveying

and deviation measurement system, Boretrak,

in late Q2 2020. The new system

is designed with improvements over Carlson’s

previous models, the Cabled Boretrak

and the Rodded Boretrak.

The improvements help speed up the

workflow, improve the usability of the system, and extend the angular range of deployments.

Boretrak2 produces more accurate results, which are vital when used to optimize safety-critical blasting operations, said James Husack, support and special projects engineer, Carlson Software. Boretrak2 uses an inertial measurement unit (IMU) that incorporates a three-axis gyro, accelerometer and magnetometer, to measure boreholes as small as 2 in. in diameter in any direction or inclination. The system provides “an as-built survey of how a borehole was actually drilled compared to the design parameters,” Husack said. “It offers quick, easy-to-use, reliable and repeatable borehole mapping in a variety of environments and situations,” he said. “It has been built from more than 30 years of product and field experience.” The hardware consists of a compact, lightweight and rugged Boretrak probe and a deployment system, Carlson reported. A variety of deployment systems can be used, depending on the operation. Usually, a simple metal cable is suitable for downhole deployments, while push rods or standard Boretrak rods can be employed for horizontal or uphole operations. The system also comes with a PDA or tablet PC to run field software.

The PDA or tablet runs software “that allows operators to visualize the results in the field alongside data from Carlson’s underground scanners, the C-ALS and VS+,” Husack said. “Results can be passed to Carlson Blast Ops software for additional blast design analysis.” The company can also supply other software packages for more advanced processing and 3D scanners to pick up complementary data that can be georeferenced and analyzed alongside the borehole survey, he said. “Minimal training is required for the customer to get up and running.”

Boretrak2 improves upon Carlson’s old Cabled Boretrak model as it does not rely on a magnetic compass to orient the system, the company reported. “Boretrak2 can be used in environments that contain ferrous materials and near things that could cause magnetic fields that would otherwise compromise a compass-based system,” Husack said. Boretrak2 also improves upon Carlson’s old Rodded Boretrak: “Users of the traditional Rodded Boretrak Systems were forced to use rods to fix the orientation of the probe.” Husack said. “But with Boretrak2, the need for this has been eliminated, and the rods will only be used to move the probe horizontally or uphole,” he said. “The rods are no longer required to orient the system, a fact which means the deployment operation is much simpler and less prone to error.”

The software supplied with Boretrak2 is faster, more versatile and more intuitive than the software previously supplied with older Boretrak models. “New users of the Boretrak2 should easily adapt to the established workflows taught during training with minimal impact on their existing operations,” Husack said. The fact that the Boretrak2 can be deployed at any angle, uphole or downhole, means that it is an essential tool to help audit and manage underground drilling, Carlson reported. Analyzing the Boretrak2 data alongside scans of stopes and voids collected by Carlson’s C-ALS and VS+ scanners provides a unique and comprehensive solution for underground data capture, Husack said.

MWD for Optimal Plans,

Snap Decisions

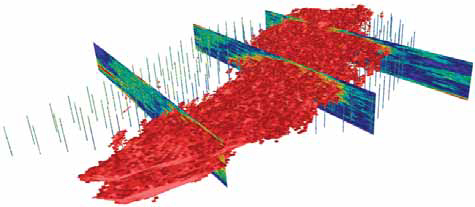

DataCloud reported RHINO, in combination

with MinePortal, can provide near

real-time geology data for process optimization

across an operation, from drill

plans to the mill.

Installed on a drill steel, RHINO,

an Industrial Internet of Things (IIoT)

sensor system, captures acoustic impedance.

The data from RHINO is assimilated

in the DataCloud’s digital mine

platform, MinePortal, which provides

incremental measurements on orebody

hardness through a process called Seismic

While Drilling (SWD). MinePortal allows

the user to turn SWD measurements

into graphs and 3D models.

DataCloud said those measurements and models can be used to develop optimal drill plans. “You can better plan spacing if you know more about your orebody,” Thor Kallestad, CEO, DataCloud, said. It can also be used to ensure exactitude while drilling, Steven Putt, director, mining software, DataCloud, said. “In cases where the ore and waste have a contrast in hardness, blasthole drilling data can be analyzed to detect when drilling has crossed an ore-waste boundary,” he said. “Knowing quickly and exactly where the boundary is can help blast crews backfill holes in order to prevent dilution.”

For orebodies where grade has a relationship to hardness, SWD can be used to help detect higher grade ore. “If you are drilling through a harder, or softer spot, and that means that there is more money in the ground, then you want to know about it,” Putt said. SWD, accurate down to a fraction of a meter, tells you almost instantly, he said. SWD was proven in the oil and gas drilling space, Lindsey Miller, director, marketing, DataCloud, said. “It is a super- popular technique.”

If any of the sensors are not calibrated properly, the resulting measurements and calculations will be off, Putt said. “Even if they are working OK, you’ll see that one drill might have just a little bit of a different number to another drill,” he said. “And there might be one drill where it is completely different.” Which is what happens when technology is used for an application different from that for which it was designed, Putt said. “It is just because those sensors weren’t really made to do this,” he said. “They are just sensors that came with the drill.”

Oftentimes, the data coming off those sensors have to be piped into Excel, creating sprawling, unwieldy spreadsheets, he said. “Even if the existing sensors on the drill were good enough to get viable information from the rock, the problem with the existing systems is all you get is a database full of numbers,” Putt said. “We’re talking a data point for every fraction of a foot or fraction of a meter,” he said. “They typically don’t give you any tools to review the data other than Excel. And the data piles up quickly to the point where you can’t actually look at it in Excel anymore.”

Drill hole chip samples often have to be sent off to a lab, processed, and then sent back, a significant investment in time. When they come back, they often can provide only an average for an entire hole. “You have a 50-ft-deep hole and you are saying it is throughout only one value of gold. The case might be that there is a narrow vein running right through the middle of it,” Putt said. “If the results say that entire hole needs to be sent to the mill for processing, every piece of rock that you send to the mill that has no gold in it is basically wasting money. You’ve taken rock with no value, large chunks of rock, and you’ve ground it down to powder just to throw it away.”

Conversely, RHINO provides near-realtime data. And it does it with technology engineered specifically for the task. RHINO is “purpose built to detect what the drill is drilling through with a kind of complete independence of the type of drill,” Putt said. “It is a tool that we built for a specific purpose, verses these other ways of retrofitting.” The graphs and models in MinePortal are easier to use and understand than the spreadsheets and databases created by typical MWD solutions. “We don’t just say here is some data, good luck,” Putt said. “We actually do integrate it completely into a 3D modelling package that we can color by hardness or any other property that we pick up.”

The solution can be used to optimize more than drill plans and processes. Accurate rock hardness data is crucial to calculations used in and mixing and timing explosives. “There are a few decisions that you can change to help optimize your blasting,” Putt said. It can be used to optimize the mill. “If, from SWD, you have a high-resolution good idea of what the input rock is going to be, then, with MinePortal, you can track that rock all the way to the mill, using the truck and the loader and the data coming off of them,” Putt said. “Once that material gets to the mill you can track how efficient the mill was at crushing it and what your recoveries were. And then you can create this feedback loop that says, given this type of rock, and these measurements from the drills, you treat it this way with blasting, and you blend it this way, and you are going to get this result in the mill, and you can start to tweak the levers to make sure you are doing the best job possible.”

MWD, Modelling Solutions

Streamline Ops

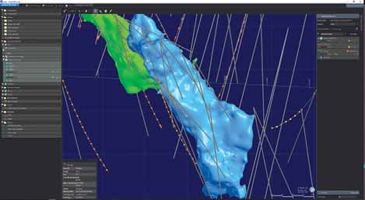

Sun Metals said it used Seequent’s Leapfrog

Geo to arrive at an efficient exploration drilling plan for Stardust mine that

revealed a new high-grade zone. “It was

a tremendous validation of the scientific

use of data using modern technology to

do targeting,” Steve Robertson, CEO, Sun

Metals, said.

And it was the reward for several

months of mundane data entry work.

When Sun Metals, backed by principals

of Oxygen Capital Corp., acquired

the undeveloped property in northcentral

British Columbia, the existing exploration

drilling data was all in hard copy form, on

stacks of paper.

Buying properties for which there is a lot of data that is not optimally organized, and then reorganizing that data, is part of Sun Metal’s strategy. “We take a better look at the data, make better use of it, and build value more efficiently by using the data previously generated by others,” Robertson said. With Stardust, “we went into an environment where there had been 100,000 m of drilling on the project before us, but none of it was put into a computerized database,” he said. The miner spent several months transforming data in Leapfrog Geo, Seequent’s geological analytics and modelling program.

“We came up with an obvious high-priority target out of that analysis that directly resulted in the discovery of a new zone, and that discovery hole was 100 m of 5% copper equivalent,” Robertson said. “It was a tremendous success,” he said. “We went out last season and continued to drill out that zone and we’ve now extended it to a 375-m plunge length on this new high-grade zone that we discovered using this technique, and so it has been a pretty good success for us.” The company selected Leapfrog Geo due to its ease of use. “You don’t have to be a dedicated expert that spends their entire life in front of the computer to be able to be pretty proficient at the use of it,” Robertson said.

“It is very visually impactful,” he said. That ability to crank out convincing, accurate models distinguishes the product, Robertson said. “That is the beauty of the package,” he said. “That is what makes it so successful at my mine.” Leadership at Seequent told E&MJ the big advantage conferred by use of Leapfrog Geo is the resulting downstream optimal use of funds. “It allows people to make decisions in the shortest period of time that will enable them to use money in the most efficient and most effective manner,” said Rob Ferguson, segment director, exploration and resource management, Seequent. “You may be spending more money because you find the deposit is bigger so you have to drill more. So it is not about saving money but about making real-time decisions that improve your exploration program.”

Leapfrog Geo assimilates data from a multitude of sources that can be in an array of formats. “It allows users to work with all their data, and add additional data at any stage,” Ferguson said, “which flows downstream, to build the most accurate picture of the geology.” That picture allows users to process data; visualize data in 3D; import, correct and analyze different data types, including drilling and structural data, and filter them to see where information is coming from; and gain rapid insights using the geostatistical evaluation and exploratory data analysis.

“It allows geologists to build up virtual models, called digital twins, of what that deposit looks like,” Ferguson said. “Once those geologists build up that model, they pass that to the mine engineer that will produce mine plans, optimizations, and the sequence of mining down through the value chain.” For near real-time data on drilling accuracy, measure-while-drilling solution IMDEXHUB-IQ can be leveraged by Seequent’s Central for a single unified source of active drilling information. “Exploration geologists and managers can visualize and analyze drill hole data alongside 3D models in real time,” Ferguson said. “Teams can visualize in real-time the accuracy of the drilling to the model, saving time and money with the next drill holes.” Both IMDEXHUB-Q and Central are cloud based. The former leverages downhole sensors that determine hole location based on dip and azimuth.

“That information is transmitted to IMDEXHUB- IQ, which is technology for storing data,” Ferguson said. “Once that data is up in that environment, users of Central can directly connect to that database and pull the information directly into Central, which has tools for visualizing the location of the drill hole in 3D space and relative to 3D models that have been created for the drill plan. You can compare those actual locations of the drill hole with the planned location of the drill hole.”

The Central is an interactive 3D application used for data review and collaboration. “All the existing information, which could be from planned drill holes, existing drill holes, geological models, topographies, and any other information that is relevant, can be displayed in this 3D window,” Ferguson said. The integration partnership that allows Central users to import IMDEXHUB-IQ information will likely be replicated with other providers going forward. “IMDEX was the first. It has been in place for 18 months. It has been well adopted,” Ferguson said. “Our goal is to have as many integrations as possible with providers over time.”