In 2018, these operations produced a total of 4.1 million oz of gold, approximately double that of the

industry’s next largest gold mine.

Barrick Gold, Newmont GoldCorp Finalize Nevada Gold Mines JV

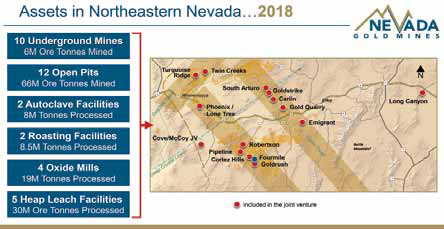

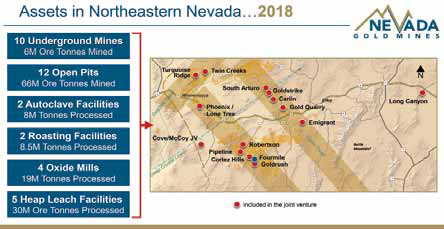

Its assets in northeastern Nevada comprise 10 underground and 12 open-pit mines, two autoclave facilities, two roasting facilities, four oxide mills, a flotation plant and five heap-leach facilities. In 2018, these operations produced a total of 4.1 million ounces (oz) of gold, approximately double that of the industry’s next largest gold mine (Muruntau in Uzbekistan). The company has proven and probable reserves of 48.3 million ounces; measured and indicated resources of 27.4 million ounces; and a further 7.5 million ounces of inferred resources with still more potential.

Nevada Gold Mines is targeting production of between 1.8 million oz and 1.9 million oz at a preliminary estimated cost of sales of $940 to $970 per oz and AISC of $920 to $950 per oz for the second half of 2019. “Its creation was driven by a compelling logic, which had long been evident to all but had been elusive for two decades until we finally achieved a breakthrough this year,” Barrick President and CEO Mark Bristow, who is chairman of the new company, said. “Over the past months, we have selected and set Nevada Gold Mines’ leadership in place.

“The company now has one team that shares one vision, and who are more than ready to race out of the starting blocks. We have also identified the very signifi- cant synergy opportunities, which are immediately available and those which have been targeted for the future.” Identified synergies are expected to deliver up to $500 million per year over the first five years from 2020, stepping down over time after that. These will come mainly from integrated mine planning, optimized mining and processing, cost reductions, and the combination of the adjacent Turquoise Ridge and Twin Creeks, which will be operated as a single mine. Second half guidance builds in those synergies that the company believes it should be able to realize within the next six months, representing approximately half of the targeted annual cash flow improvements.

Bristow noted that the Nevada Gold Mines management team included executives from both joint venture partners. The executive managing director is Greg Walker, formerly head of operations and technical excellence for Barrick’s North American region. Barrick has three board seats and Newmont Goldcorp has two, with the board supported by technical, finance and exploration advisory committees on which both companies have equal representation.