Not all types of mine equipment are created equal: some are more important to production than others,

Not all types of mine equipment are created equal: some are more important to production than others,

and not all

require the same level or kind of maintenance. A mine-wide equipment strategy is needed to

ensure that each item

gets the maintenance attention it warrants. (Photo: Liebherr).

Maintenance is a key element in achieving

operational goals for almost every segment

of mining activity. At the most fundamental

stage of mine or plant operations, equipment

performance and health have a direct

role in assuring worker safety and productivity.

And, at the highest echelons of mine

management, maintenance planning demands

a level of attention commensurate

for an activity that accounts, on average,

for about thirty cents or more of every operating-

cost dollar. Too much or not enough

“wrench time” — in other words, over- or

under-maintenance — can sink carefully

crafted production plans and punch holes

in otherwise-solid operating budgets.

It’s also the mine function with the

widest selection of tools and options for

getting the job done and measuring the

effectiveness of planning, scheduling, task

performance and outcome. In the software

and systems area, these can range from

simple work-order generation and tracking

apps all the way up to enterprise asset

management platforms that encompass everything

from maintenance-related human

resource allocation to spare-parts inventory

control. Here’s a quick look at a selection of

new-generation solutions designed to make

maintenance more cost-effective and effi-

cient, along with advice from maintenance

experts on structuring critical maintenance

processes and policies.

What’s Out There

There are literally dozens of maintenance

software products available from a variety

of sources, including major fleet-management

solution providers such as Modular

Mining, Hexagon, and Wenco, which

offer maintenance programs as standalone

applications or as modules in their

comprehensive FMS suites. Others are

geared more toward fixed-asset condition

monitoring, such as ABB’s Ability Asset

Vista. The latest generation of maintenance

programs take advantage of the

data granularity, management capabilities

and flexibility provided by the Internet

of Things (IoT), cloud computing,

mobile devices and artificial intelligence

(AI), and in many cases are designed to fit

comfortably within larger enterprise asset

management platforms.

Modular, for example, has offered its

MineCare maintenance product since 2003.

It is now in its third iteration, as MineCare

3 — a cloud-based, Software as a Service

(SaaS) program that functions as a separate

application or as a module within Modular’s

Dispatch fleet management system. According

to the company, the program’s SaaS

subscription structure eliminates expensive

IT infrastructure investments, improves

data storage efficiency, and simplifies installation,

upgrades, and management.

SaaS, said Modular, doesn’t require capex

investment and has modest network communication

requirements. Its capability to

scale according to user needs allows mines

to monitor and manage a single machine, or

thousands of units across an entire enterprise,

from one centralized location.

Earlier this year, Hexagon’s Mining division

released HxGN MineOperate Asset

Health, described as “a platform of servers

and data-loggers that will extend the life of

mining equipment. Asset Health will help

maintenance and operations staff to identify

machine health trends in real-time,

empowering them to improve efficiencies

and minimize equipment downtime.”

The company said integrating Asset

Health with its fleet management system

(FMS) on a common hardware platform

that efficiently uses networking and server

resources simplifies installation for existing

FMS customers. Asset Health can be

used to connect OEM-agnostic platforms

for onboard data logging, telemetry and

messaging. Onboard alerts can be synchronized

with the office, dispatch, reliability

engineering and maintenance centers.

According to Hexagon, future development

will offer Asset Health maintenance

analytics with machine learning models

to improve predictive maintenance capabilities,

enabling maintenance departments to plan for and prevent downtime

and lost revenue.

Prior to the official launch of Asset

Health, Hexagon Product Manager and Innovation

Lead Carl Brackpool offered interesting

insight into the development team’s

design approach during an interview on the

company’s Spotlight podcast series.

Brackpool said: “If you think about all

the sensors on board a large piece of machinery.

Let’s take a haul truck, that’s the

most common piece of machinery that’s

constantly working and it’s traversing the

greatest distance in an open-pit mine, from

the bottom of the mine over maybe even an

hour to get all the way out to a dump, or a

stockpile, or a processing plant. There are

as many as 6,000 sensors or data points

on board, and the normal ones you look at

are tire pressure, brakes, hydraulic pressures

and electrical systems.

“But there are so much more data

coming off these machines: exhaust gas

temperature, turbos, as well as all the environmental

data, things that are offboard

that machine. You know, what time of day

is it? What’s the barometric pressure? Is

it raining? We look at the CRM data and

the human resources data. Is the operator

brand new, just out of training? Did

that machine just come out of the maintenance

bay? If you start stacking all that

data together, you’re going to increase the

amount of noise, but our data scientists

are writing amazing algorithms that scrub

away all that noise, and they get it back

down to a very pure data set, and they

start looking for anomalies, things that

don’t belong in there.

“And if you look at that pattern over a

period of time, that [truck], through machine

learning, is going to say, ‘I’m about

to fail. But it’s an opportune time because

I just happen to be between shifts,’

or, ‘I’m going to go to the main yard.’ So

anyway, in short, that’s really what we’re

doing here with the data collection in real

time and processing of that data.”

Wenco, a subsidiary of Hitachi Construction

Machinery, offers a threepronged

service-and-software approach as

part of its ReadyLine maintenance package.

Through its ProActive maintenance

service, it can provide consulting experts

to assist in analysis of equipment data,

maintenance records, and other details

to optimize maintenance processes and

practices before implementation of the

ReadyLine program. These services range

from planning optimization, lean maintenance,

workflow and alarms processes to

ISO 55000 readiness and more, according

to the company. By using a combination

of ReadyLine OEM sensor-monitoring

software, business intelligence tools, and

third-party systems, the company said its

experts can create predictive maintenance

capabilities that lead to better maintenance

planning. Areas of focus include

asset health condition monitoring, safety

conditions monitoring, and failure mode

and effects analysis (FMEA). Finally, the

ability to connect with Hitachi’s Lumada

or other enterprise-wide machine learning

and AI platforms allows ReadyLine to apply

data cleansing to create valuable context

required to use mine data effectively.

E&MJ reported last year on how ABB’s

Asset Vista is helping Vale manage the

maintenance of stackers and the conveyor

system at its S11D iron ore project in

northern Brazil. According to the company,

Asset Vista allows the mine to monitor the

functioning of 6,000 critical assets on the

site, including hundreds of transformers

and large motors, more than 1,500 switchgears

and almost 400 drives, and hundreds

of process controllers and servers.

Asset Vista is a fundamental part of

ABB’s Ability Predictive Maintenance

service. It pulls together previously disparate

condition data from various assets to

collectively analyze and compare all data,

enabling ABB to provide forewarning of a

potential fault with a proposed solution,

in time to address it before production is

affected. Critical analysis of the assets

takes into account failure modes, available

control system data, as well as information

from pre-installed expert condition

monitoring systems and datasheets.

Technology advances are opening

the door to market entry for new maintenance-

related concepts, multiplying the

options available to fleet and plant operators

for monitoring equipment status and

usage to make better-informed maintenance

plans. As an example, MachineMax,

an off-road fleet management solutions

provider that is majority-owned by Shell,

recently announced it has integrated semiconductor

technology specialist Semtech’s

LoRa devices and wireless radio frequency

technology into a new, smart off-road machine

usage-tracking solution.

MachineMax said its devices can be deployed

on to fleet machines in under a minute.

They attach magnetically and don’t require

an external power source or additional

infrastructure to begin gathering real-time

data on machine usage status. “With Semtech’s

LoRa Technology, we were able to

create simple, easy-to-deploy solutions,

which effectively monitor machine status

from anywhere on a mining site,” said Amit

Rai, CEO at MachineMax. “Real-time data

from the sensors is presented to site managers,

offering tangible insight into their

fleet’s efficiency. Managers can use this

data to identify problem areas at their site,

and work to reduce machine idling, reducing

fuel waste and maintenance costs.”

Semtech claims its LoRa technology

solves many of the traditional radio-frequency

design compromises involving

range, interference immunity and energy

consumption, and offers a low-cost solution

to connecting battery-operated devices

to the network infrastructure.

From Preventive to Predictive

As machine-health data collection and

analysis technologies steadily improve, an

increasing number of fleet and plant operators

are transitioning, either in full or in

part, from preventive maintenance strategies

in which planned upkeep is scheduled

according to usage or time-based

triggers, to predictive maintenance that

compares measured physical parameters

with known operating limits. This allows

equipment problems to be detected and

corrected before a major failure occurs.

The benefits to be derived from the

improved data integration capabilities required

by predictive maintenance can, in

some cases, be a tough sell to corporate,

however. According to a report just released

by Rockwell Automation on the progress to

date of mining’s move toward digital transformation,

financial departments may have

difficulty recognizing digital value that is

not readily apparent on a balance sheet. For

example, predictive maintenance that helps

avoid a repair cost can be difficult to quantify.

In one interview conducted during the

report’s information-gathering phase, a mining

executive explained why. “It’s a dynamic

non-event...if the event had happened, it

would have cost this much,” they said. “Accountants

have a hard time, because there’s

nothing that happens in the balance sheet.”

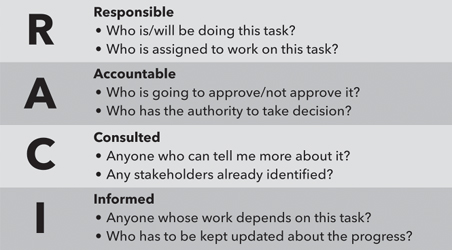

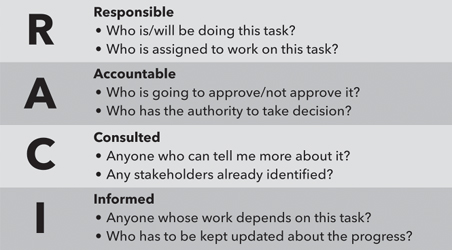

RACI, explained.

RACI, explained.

To make predictive maintenance truly

effective, most maintenance experts say

it’s crucial to have an equipment strategy

in place to prioritize objectives, ensuring

focus is put on the highest-impact items first. Partners in Progress (PiP), a global

management consulting firm, pointed out

that because many large companies have

too many pieces of equipment to be able

to address them all in the same way, a

defined strategy creates stability and momentum

among staff as they are able to

focus on a manageable number of objectives

rather than a seemingly infinite number

for all equipment. Once equipment

has been prioritized, it becomes easier

to systematically maintain critical items.

This approach prevents management from

trying to do everything at once and incurring

the risk of doing it poorly. Organizations

without equipment strategies run the

risk of having to manage both breakdown

costs and rising over-maintenance costs.

Bluefield AMS, another maintenance

consultancy, listed in a recent blog the primary

reasons for having structured asset

management. According to the company,

a well-constructed asset management plan

actually extends beyond maintenance, and

should not be a “set and forget” document

that sits on the shelf in a maintenance manager’s

office: It is the core document that

enables cross-functional alignment and

agreement on how a machine or area of the

plant will be maintained and how it will be

shut down in a scheduled manner. It should

contain several key elements, including:

• Asset productive life – It is important

from the outset to lay out the targeted

productive life and the drivers that contribute

to it. This should have input

from mine planning, production and

maintenance as the anticipated life can

influence the maintenance strategy

to ensure the machines meet the needs

without over or under cutting maintenance.

It is essential that this aspect is

reviewed as part of the life of asset and

five-year planning process.

• Operational context and operational

limits – It is essential to understand

these aspects in order to build an appropriate

asset plan. Additionally, operational

limits of the machine should be

documented here to allow the condition

monitoring strategy to monitor any adverse

operating conditions and report

to operations in a manner that enables

them to take concrete action.

• Scheduled downtime strategy – Details

the times the machine will be stopped

for scheduled maintenance. It should also

include opportune maintenance such as

operator pre-starts. A scheduled downtime

availability can then be calculated

to show the potential of the machine.

• Condition monitoring strategy – It is important

to clearly articulate all the condition

monitoring tasks that are expected

to be completed on the machine and

at what frequency. It is important document

what is achievable and practical

for the application.

• Component change-out strategy – This

should document every component to

be changed on a scheduled or expected

frequency. Consider this list as a

major source of items to be loaded into

the maintenance planning system.

• Life cycle cost model – A zero-base cost

model should be built containing all the

items covered in the strategy, with allowances

for general and unscheduled repair.

• Stakeholder signoff – This is the most

important part of the document because

it is considered a working agreement

signed off by all parties involved. These

should include the mine planning manager,

production manager, maintenance

manager, and ideally, the OEM representative.

The signoff should signify an agreement

on how the machine will be operated

and maintained throughout its life.

According to Bluefield, the asset management

plan should be a live document

that is reviewed at least annually and

should align with budget generation. This

will ensure any changes in strategy from

operations to maintenance can be captured

and reflected in site operation.

PiP said another critical step in the

path toward predictive maintenance success

is to specify well-communicated,

simple roles and responsibilities for predictive

maintenance personnel and others

in the organization that will be involved in

the process. For example, a simple RACI

chart can be used for communicating the

process and clarifying specific roles for

all functions associated with the process.

RACI is a synonym for who is “Responsible,

Accountable, needs to be Consulted,

needs to be Informed.” This ensures that

all actions are implemented — a prerequisite

for effective predictive maintenance.

And yet another important step is to set

regular and formal reviews of performance

using Results-Action-Reviews (RAR) at all

levels of the maintenance department. A

RAR consists of the following steps:

• Review results – Did it work? How are the

KPIs tracking?

• Review actions – Did we do what we said

we’d do?

• Agree on future results and actions.

• Prioritize future actions.

• Assign resources to advance highest

priorities.

• Communicate key information.

RAR implementation creates a closed

loop to review performance by tracking actual

KPI results against targets, using pareto

charts to highlight problems and take

appropriate actions. This is then followed

with supervisors doing effective short interval

control to ensure, for example, that

those actions are performed on schedule.

Martin Provencher, industry principal

for mining, metals and materials at OSIsoft,

noted in a recent white paper that the ultimate

level of predictive maintenance is

now “PdM 4.0,” a stage that moves from

dependence on planned events to being

able to take real-time action from actual

events. According to Provencher, this represents “prescriptive maintenance” that can cut the time required for planning by

20% to 50%, increase equipment uptime

by 10% to 20%, and reduce overall maintenance

costs by 5% to 10%.

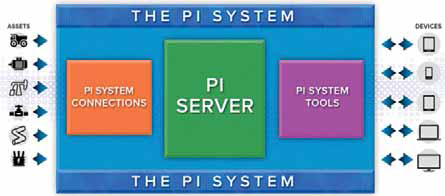

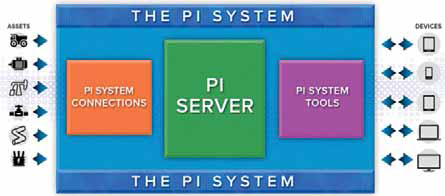

Main elements of OSIsoft’s PI System, an open-enterprise data-collection platform.

Main elements of OSIsoft’s PI System, an open-enterprise data-collection platform.

Implementing it usually requires a

multi-step process that begins with establishing

an operational data infrastructure

— such as OSIsoft’s flagship openenterprise

data collection platform, called

PI System — to capture data, followed by

enhancing and conceptualizing the data.

In other words, giving it meaningful context.

The third step, implementing condition-

based monitoring, serves to identify

the conditions that lead to an eventual

failure of components on an important asset,

and prepares an organization for full

PdM 4.0 — the ability to apply analytics

and pattern recognition tools to provide

real-time, actionable intelligence to automatically

determine patterns that lead to

an eventual machine failure.

PI System has been used by several producers,

including Syncrude, a major player

in the Alberta oil sands industry. In an example

provided by OSIsoft, Syncrude wanted

to apply event synthesis on their mining

equipment fleet for early intervention of

maintenance problems and to reduce costs.

The fleet also includes a large number haul

trucks as well as other production and support

equipment such as shovels, graders

and dozers. Manual analysis of truck sensor

data sets proved too cumbersome for timely

analysis and intervention.

By using OSIsoft’s PI System to create

a solution for reporting mechanical events

occurring on the equipment, they were

able to optimize and streamline calculations

and integrate these with notification

systems as well as validate and tune performance.

This involved collecting data

from 6,600 data points on 131 heavy-duty

trucks and five shovels. The results,

according to OSIsoft, were impressive.

Syncrude calculated that fleet operating

expense savings came to $16.75/hour

per unit, which equates to a $20 million

annual operating cost avoidance, not including

probable lost production hours.

AI Gains Ground

Over the past year or so, mention of AI

has crept into almost every crevice of the

mining technology landscape, and maintenance

is no exception. Producers are

turning to AI for deeper insight into big

data in order to recognize trends and determine

decision points.

In January, Vale SA inaugurated an Artificial Intelligence Center at Tubarão in

Vitória, Brazil, that will serve all of Vale’s

operations around the world. The company

said teams connected to the AI Center

were working on 13 projects jointly with

the company’s ferrous, base metals and

coal business areas. The primary focus

was on optimizing maintenance of assets

such as its haulage trucks and railroad

facilities, along with improving management

of ore processing and pelletizing

plant processes, improving environmental

controls, health and safety prevention

and corporate integrity enhancements.

Teck Resources has used sensors and

data to monitor the health of haul trucks

and manage repairs and preventive maintenance

since 2011. It’s now using machine

learning — a branch of AI — to take another

step forward, through a partnership with

Google Cloud and Pythian, an IT products

and services company. Teck said it is “…

unlocking new insights from the millions of

data points generated by our mobile fleets.

Issues that were previously unpredictable,

such as potential electric failures, are now

being identified before they happen by machine

learning algorithms. We are also modelling

and predicting remaining life span

of our trucks, determining wear and wear,

identifying abnormal failures and enhancing

alarm and notification systems.”

Meanwhile, AI technology specialist

Uptake and Chilean copper producer

Codelco are working together to support

Codelco’s digital transformation. Uptake

said Codelco will deploy AI to monitor the

health of mining equipment to anticipate

maintenance needs.

The current agreement involves mining

and processing equipment at Codelco’s

Division Ministro Hales (DMH) mine

in Calama, Chile, including haul trucks,

grinding mills, roasters, crushers, pumps,

among other equipment with a view to

creating an enterprise-wide Asset Performance

Management solution across all

Codelco operating mines.

Uptake, which a few years ago helped

Caterpillar develop a digital analytics

platform, said its APM software solution

improves operational efficiency by leveraging

AI to create value from operational

data. Its flagship product, Uptake APM,

builds on what was formerly known as Asset

Perform, a product used widely across

major industrial sectors.

The company said Uptake APM integrates

key features of what was formerly

Asset Performance Technologies’ Preventance

maintenance solution, including

the Asset Strategy Library (ASL) — touted

as the world’s most comprehensive

database of industrial content including

equipment types, failure mechanisms

and maintenance tasks. Uptake acquired

the ASL through its 2018 acquisition of

Asset Performance Technologies.

What’s Ahead?

It’s clear that emerging technologies and

strategies such as those listed above as well

as Augmented and Virtual Reality, 3D printing

of components, and vendor-managed

parts inventory, to name just a few of many

promising concepts waiting in the wings,

offer enormous potential to boost maintenance

productivity in the coming years.

Most of those benefits will ride on the back

of increased digitization initiatives that, in

turn, require reliance on sophisticated sensors,

faster data communications and higher

computing power. The question is, will

the ultimate outcome validate the oft-repeated

promise of high-tech evolution: to

uncomplicate workers’ jobs in an increasingly

complex industrial environment?

As featured in Womp 2019 Vol 05 - www.womp-int.com