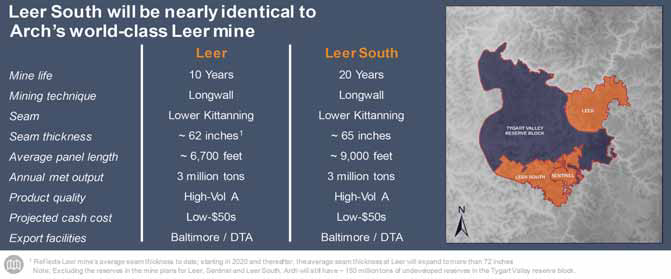

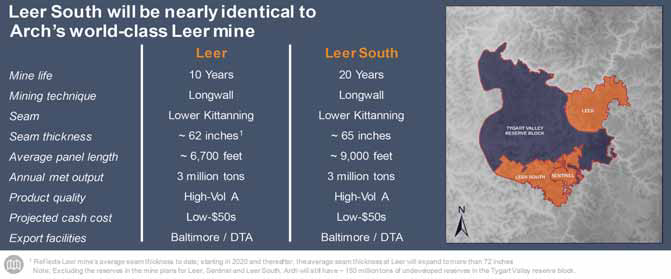

Arch Coal’s newest longwall mine will operate in the same reserve base as the Leer mine. (Photo: Arch Coal)

Arch Coal Starts Development of New Coking Coal Mine in West Virginia

“We are excited about this new project, which we view as transformational for Arch Coal and its shareholders,” said CEO John W. Eaves. “With the addition of Leer South, Arch will greatly enhance its portfolio of world-class coking-coal assets, and cement our position as the premier global producer of High-Vol A coking coal. “We believe there is significant, unfulfilled global demand for High-Vol A coking coal generally, and our Leer brand specifically, and are already engaged in discussions with leading steel producers around the world that are eager to secure additional volumes of our Leer-brand products.”

The company plans to sell the output from the Leer South complex principally into the seaborne coking-coal market. Arch Coal believes global coking-coal markets remain under-supplied following years of under-investment, with few largescale projects — particularly in high-quality coking coal reserves — contemplated in coming years. Premium High-Vol A coals, such as those produced at the Leer complex, face a particularly tight supply outlook. With average seaborne coking coal demand growth projected at 1.5% per year, and assuming a modest annual depletion rate of 2% at existing mines, seaborne coking coal markets will require the installation of 10 million tons of new mine capacity annually, or a total of more than 75 million tons between now and 2025.

“We believe that Leer South’s projected position in the first quartile of the U.S. coking coal cost curve — coupled with its extremely high-product quality — will enable us to achieve highly attractive margins, an excellent return on investment, and a rapid payback across a range of potential market environments,” Eaves said. Leer-brand coking coal has the significant, added advantage of high coke strength after reaction, or CSR, which results in an even stronger finished coke product. Arch estimates that the global supply of High-Vol A or equivalent coals totals less than 25 million tons per year.

Arch expects to invest approximately $360 million to $390 million over the next three years to develop the mine, with the longwall scheduled to start up in late 2021. Arch also announced it would be transitioning its Mountain Laurel operation from longwall to room-and-pillar mining at the beginning of 2020, and moving the Mountain Laurel longwall equipment to Leer South at that time. “We view this transition as beneficial in multiple ways,” said Paul A. Lang, president and COO. “First, Mountain Laurel’s still-extensive reserve base is increasingly well-suited to room-and-pillar mining, which is expected to deliver greater operational flexibility, higher product quality and a modestly lower cost structure.

“Second, the redeployment of the longwall equipment to Leer South will lower the capital requirements for the new project by around $35 million and further enhance our expected return on investment. Third, we see great value in expanding further our high-margin High-Vol A production while maintaining a value-creating position in High-Vol B markets via a reconfigured Mountain Laurel operation.” Following the transition to room-andpillar mining, Mountain Laurel expects to produce approximately 1.3 million tons of High-Vol B coking coal annually. The transition will not result in the layoff of any of Mountain Laurel’s outstanding workforce, as they will be repositioned in the new room-and-pillar mine plan. When fully operational, Leer South will employ nearly 600 employees.