Brazilian iron-ore producer Vale SA signs a long-term energy supply agreement with local wind

Brazilian iron-ore producer Vale SA signs a long-term energy supply agreement with local wind

developer Casa dos

Ventos that is tied to a 151.2-MW wind farm. The electricity will come

from the Folha Larga Sul wind farm, located

in Campo Formoso, Bahia state.

Mining is a power-hungry business. It

takes massive amounts of energy to excavate

and process ore into a marketable

mineral commodity. Although it’s hard to

compare operating costs between mines

located in different districts or regions,

it’s commonly estimated that a typical site

may incur energy costs that represent anywhere

from 10% to 30% of overall operating

costs. In some mineral-rich countries,

the mining industry is by far the largest

user of electrical power, accounting for

more than 20% of national consumption

in Chile and more than 50% in Zambia,

for example. Columbia University’s Center

on Sustainable Investment (CCSI)

predicts that with rising mineral demand

and falling ore grades, mining’s energy demand

will increase 36% by 2035.

The sheer amount of electricity required

for modern mining can be astonishing

when broken down into everyday examples.

For instance, 120-ton-payload electric rope

shovels can consume as much electricity in

one day as an average U.S. household uses

in a year. Power-infrastructure costs can be

equally daunting. First Quantum Minerals

reportedly spent approximately $230 million

to bring power from the Zambian national

grid to its $2.1 billion Sentinel mine

and the nearby town of Kalumbila.

Although access to energy is necessary

for almost any type of mining operation,

industry surveys indicate it hasn’t always

been at the top of the list of general industry

concerns. For example, in 2008 —

peak year of the mining supercycle — the

multinational professional services company

Ernst & Young (EY) ranked “access

to energy” as the ninth out of 10th top

business risks facing the mining industry,

and it stayed in ninth place until as recently

as the 2017-2018 report. In the

2019-2020 report, however, a new concern

titled “energy mix” appeared at sixth

in the list of risks.

What is energy mix, and why is it suddenly

more important than, say, workforce

concerns, technological disruption, industry

fraud, or perceived market threats

from New World commodities — all of

which trailed energy in assigned risk level?

Here’s why, according to EY:

“Energy costs already represent a

significant part of mine operating costs,

and as mines are beginning to extend to

depths beyond current norms, their energy

demand is growing even larger. To minimize

these risks, companies are opting

for a mix of energy sources — fossil fuels,

hydroelectricity and renewable energy.”

In their view, the “risk” elements are:

• Social and reputational implications of

choosing energy sources.

• Viability of energy sources, particularly

in remote locations.

• Management of the availability of energy

over the entire mine life and the counteracting

of fuel price volatility.

It fits a pattern. In the current business

environment, traditional methods

for accomplishing a number of critical

mining functions such as communications,

data collection and asset management

are increasingly regarded as

expensive, inefficient and outdated —

and conventional energy sourcing and

usage is ripe for inclusion in this category.

However, the mining industry seldom

benefits from one-size-fits-all solutions,

due to the differing characteristics and

needs of individual operations. Within

a single company, whether the label is

energy mix, energy efficiency or energy

optimization, it may be only one of

several issues competing for money and

management attention. But, at whatever

level energy efficiency ranks in an

organization’s hierarchy of operational

concerns, it can broken into two simpler

issues: how energy is sourced and how

it’s consumed. In this article, E&MJ provides

a quick scan of industry developments

that address both of these areas, highlighting new alliances, technologies

and equipment designed to solve some

energy-related challenges.

Picking Up Pace

Although recent developments indicate

the industry’s rate of acceptance and

implementation of energy-efficient strategies

seems to be quickening. According

to EY, it has struggled to overcome years

of inertia and delays caused by:

• Not utilizing third parties to develop, fund

and deliver RE assets.

• Renewables seen as “non-core,” with

significant internal resource/opportunity

cost.

• Limited over-arching divisional or regional

energy strategy.

• Lack of clear strategic view or response

to approaches by renewable energy

developers.

However, a press release distributed

recently by Voltalia, a French power

provider specializing in RE sources, and

THEnergy, a boutique consultancy focusing

on microgrids/mini-grids and offgrid

RE, points to positive changes and

expanded opportunities in the industry.

Specifically, this is in regards to energy

supply in remote regions or wherever

the power grid is incomplete, unreliable

or experiencing stress from growing demand,

such as Africa.

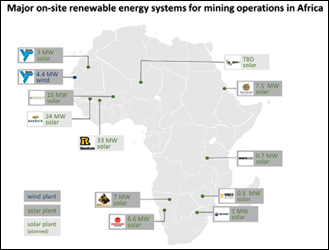

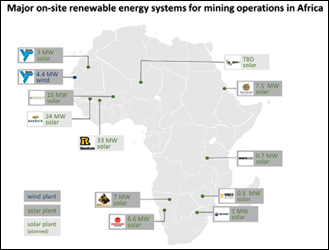

The release pointed out that mining

companies have increasingly adopted

wind and solar systems to reduce their

energy costs at remote off-grid mines.

The initial focus was on-site integration

capabilities, as miners were concerned

that adding intermittent renewables such

as solar and wind could affect the reliability

of power supply and even lead to

production losses. However, according

to the report, renewables combined with

diesel, HFO, or gas in various microgrid

applications have proven to be a source

of reliable power for remote mines, and

“…for almost all mines, the integration of

renewables will have a positive impact on

their energy cost position. Mining companies

do not have to invest their own money.

Independent power providers (IPPs)

invest in the renewable energy infrastructure

and sell electricity to mines through

power purchase agreements (PPAs).”

According to Thomas Hillig, managing

director of THEnergy, large IPPs take advantage

of economies of scale on components

for solar and wind power plants not

only for remote mining projects, but also

for much bigger grid-connected plants.

One of the most recent example of

mine operators turning to transactions

with independent power providers is Resolute

Mining’s signing of a joint development

agreement (JDA) with Ignite Energy

Projects Pty Ltd., a financier, developer

and operator of power projects in Africa,

for the development of a new 40-megawatt

(MW) independent solar hybrid power

plant at the company’s Syama gold

mine in Mali.

Source: Report, Renewables for mining in Africa enter the next stage–Focus

Source: Report, Renewables for mining in Africa enter the next stage–Focus

shifts to cost optimization,

THEnergy-Voltalia, February 2019.

The Syama solar hybrid power plant

will combine solar, battery and heavy fuel

oil (HFO) technologies. The innovative

project is expected to be the world’s largest

off-grid, fully integrated hybrid power

plant for a stand-alone mining operation.

The new power plant will replace the existing

historic 28-MW diesel-fired power

station at Syama and is expected to be

fully operational by the end of 2020.

The project will be funded and constructed

under an IPP model whereby

Ignite Energy, under the terms of an exclusive

power purchase agreement, will

be responsible for the design, construction,

ownership, funding, and operation

of the new power facility on an exclusive

basis and will supply power to Resolute

on a guaranteed basis subject to a maximum

tariff over a term of between 12

and 20 years.

Managing Director and CEO John Welborn

said the Syama solar hybrid power

plant will deliver long-term electricity cost

savings for the mine of up to 40% while

reducing carbon emissions and providing

tangible benefits to local Mali communities.

“The project is a key component of

delivering the expected sub-US$750 per

ounce all-in-sustaining-cost for the Syama

underground gold mine.”

The company said the plant will comprise

an advanced combination of modern

solar photovoltaic generation (Solar

PV), HFO-based generation, and a battery-

based energy management system.

HFO fuel costs are expected to be up to

50% lower than diesel, with larger modern

generating units substantially more

efficient than Resolute’s current engines,

which date back to when the Syama power

station was originally established by BHP

in the 1980s, featuring a fleet of diesel

generators, which have progressively expanded

to meet operational requirements.

The current cost to generate power at Syama

ranges from $0.20/kWh to $0.24/kWh

depending on prevailing diesel fuel prices.

PPA’s aren’t the only option for mining

companies looking for renewable or

greener power sourcing arrangements, according

to CCSI. Other avenues include:

• Energy Attribute Credits – The mining

company purchases credits produced

by RE power plants.

• Grid-connected sourcing green energy –

The mining company buys green premium

products or pays green tariffs to

a utility.

• Industrial Pooling – Several companies

commit to buying electricity from an IPP,

making a RE project viable.

• Self-generation – The RE power project

is built and owned by the mining

company.

For example, as part of a cost-reduction

program and drive to manage its

carbon footprint, Barrick Gold’s Loulo

operation in Mali plans to install a 24-

MW off-grid solar hybrid plant to support

its existing 63-MW thermal power

station. The company said the solar

plant has the potential of saving 10 million

liters of fuel a year while reducing

Loulo’s annual carbon emissions by

42,000 metric tons (mt).

Barrick said the RE project is part of

its strategy of moving away from thermal

power in Africa, where lack of infrastructure

means that many mines need to rely

on self-generated diesel energy, making

this their largest cost item.

According to a solar feasibility study,

the photovoltaic plant is expected to replace

50,000 MWh/y of thermal generation.

The introduction of the solar component

will cut the complex’s energy cost

by around 2 cents/kWh. Construction of

the project, which Barrick said meets

its investment criteria of 20% IRR, will

start later this year, and it is scheduled

for commissioning in late 2020. The

plant will use the latest weather prediction

models, which will enable the power

management system to switch between

thermal and solar without compromising

the microgrid.

Meanwhile, Gold Fields’ Granny Smith

gold mine is planning to install a microgrid

powered by more than 20,000 solar

panels and backed up by a 2-MW /1-MWh

battery system.

The mining company contracted mobile

and modular power company Aggreko

to design, build and operate the 8-MW

solar power generation and battery systems

at the mine, located east of Laverton

in Western Australia.

Gold Fields Executive Vice President

Australasia Stuart Mathews said, “We expect

the renewable power microgrid will

be up and running at Granny Smith by Q4

2019 and it will be a welcome addition

to our suite of on-site energy solutions

across other operations which will enable

us to reduce our carbon footprint.”

Construction of the renewable energy

system is to begin in May and, when completed,

will be one of the world’s largest

hybrid off-grid microgrids and integrated

with Aggreko’s existing 24.2-MW natural

gas generation.

Aggreko AusPac Managing Director

George Whyte said the solar, thermal and

battery storage assets will be integrated

and managed by Aggreko’s control software

platform. “The solar-plus-battery system is

projected to reduce fuel consumption by

10–13% and produce about 18 GWh of

clean energy per year,” Whyte said.

While the solar PV will reduce the

need to run thermal generators, the battery

plant will provide essential services

such as spinning reserve displacement,

PV ramp rate control and transient voltage/

frequency support.

Stable Sourcing

As RE technologies and systems proliferate,

power systems will need to adjust

accordingly to better accommodate inputs

from variable renewable energy (VRE)

sources like solar and wind plants by improving

system flexibility, according to a

report issued by REN21, a global RE policy

network. However, renewables technology

is evolving to improve ease of integration,

and state-of-the-art solar PV and

wind energy generators can provide a variety

of relevant system services to stabilize

the power grid, said the organization.

In countries that may have hundreds

of remote communities and a large number

of off-grid mining operations, the

intermittent nature and power fluctuations

of RE sources, combined with low

inertia of small isolated power systems,

give rise to power quality and stability

issues that require advanced dynamic

load-generation balance control. In addition,

with multiple generation assets on a

system, power dispatching becomes complicated.

As NRCan, Canada’s federal natural

resources agency pointed out, remote

and isolated microgrids require a resilient

real-time control system. Recognizing

the need, consulting engineering company

Hatch was awarded $2.22 million to

develop a commercially viable controller

that facilitates the integration of renewable

power and energy storage into remote

microgrids while maximizing performance

and maintaining system stability.

Hatch, employing research performed

at the University of Waterloo, designed

and developed the Hatch Microgrid

(HµGrid), described as a utility-grade

controller. HµGrid incorporates modules

for power system measurement, dynamic

power shaping, supervisory control, optimal

economic dispatch, as well as energy

storage, generator limit, smart load and

output management.

When fluctuations occur in a power

grid, the first few seconds determine

whether a blackout will occur. Last August,

Siemens introduced what it calls

“the missing link in the energy transition”

— its SVC Plus Frequency Stabilizer

(FS). Siemens claims to be the world’s

first supplier to combine reactive power

compensation capability with the use

of so-called supercapacitors. Supercapacitors’

charging mode is electrostatic,

which means that electrons are moved

instead of molecules. As a result, they are

charged and discharged much faster than

storage batteries.

According to the company, SVC Plus

FS can feed the reactive power needed for

stable grid operation in less than 50 milliseconds.

At the same time, up to 200

MW of electric power stored in the supercapacitors

can be transferred to the grid

at full load. As a result, the voltage and

frequency, and thus also the grid, remain

stable. This automatic procedure is triggered

whenever the voltage or frequency

exceeds or drops below certain limits.

This capability, said the company, is particularly

important in power grids that are

exposed to volatile infeeds. For example,

from increasingly more distributed and

RE sources.

Siemens buys the supercapacitors from

Maxwell Technologies, and is responsible

for managing the static var capacitors and

supercapacitors, connecting to the grid,

and integrating the system. It said SVC

Plus FS takes up approximately two-thirds

less space compared with a battery storage

solution at reference power of 50 MW.

And, while it’s unlikely that any manmade

mechanism will be capable of taming

the variability of wind and solar sources,

their predictability may be a different

matter, thanks to advances in Artificial Intelligence

(AI) technology. Deepmind, an

AI research company owned by Alphabet

Inc., parent company of Google, recently reported a successful effort to apply machine

learning to predict wind-farm power

output more than a day in advance.

Sims Witherspoon, a program manager

at Deepmind, and Will Fadrhonc,

Carbon Free Energy program lead at Google,

wrote in a February blog post that a

program that began last year has applied

machine learning algorithms to 700 MW

of wind power capacity in the central

United States. These wind farms — part

of Google’s global array of RE projects —

collectively generate as much electricity

as is needed by a medium-sized city.

“Using a neural network trained on

widely available weather forecasts and

historical turbine data, we configured

the DeepMind system to predict wind

power output 36 hours ahead of actual

generation,” they said. “Based on these

predictions, our model recommends how

to make optimal hourly delivery commitments

to the power grid a full day in advance.

This is important because energy

sources that can be scheduled (i.e., can

deliver a set amount at a set time) are

often more valuable to the grid.

“Although we continue to refine our

algorithm, our use of machine learning

across our wind farms has produced positive

results. To date, machine learning

has boosted the value of our wind energy

by roughly 20%, compared to the baseline

scenario of no time-based commitments

to the grid.”

The authors didn’t explain what the

“value” increase of the wind energy was

based upon, but it’s likely that a large

portion of this figure could be attributed

to operational cost savings.

Efficient Usage

Regardless of the source, how electricity

is used on-site is critical in achieving

improved energy efficiency. Comminution

consumes an estimated 50% or more of

electricity at most operations, with motors,

drives and pumps using the lion’s

share of that amount. For that reason, it

pays to work closely with motor and drive

equipment suppliers that can offer specific models, systems and advice to optimize

energy usage — particularly about

how new technology, combined with proper

component selection and attentive

maintenance, can make a difference energy-

wise. Here are two examples:

For customers seeking overall improvements

in plant performance, including energy

efficiency, ABB’s announcement of a

contract award from KAZ Minerals last year

provides a glimpse of available wide-scope,

integrated enhancements. ABB said it will

deliver a comprehensive process and power

solution that will double the capacity

of KAZ Minerals’ sulphide ore processing

plant in Aktogay, Kazakhstan. According to

ABB, this project is the third major order

from the customer and will reuse the engineering

and solution configuration from

the company’s two other production lines

in the area. KAZ Minerals is the largest

copper producer in Kazakhstan.

ABB will provide its ABB Ability MineOptimize

integrated process and power

control solution, which includes all process

control and electrification equipment and

infrastructure for the plant. ABB Ability MineOptimize

is a framework that encompasses

engineering, systems, applications and

services to help mining customers achieve the most efficient design, build and operation

of any open-pit, underground, mineral

processing or refining facility.

ABB’s scope of supply for this project

includes its ABB Ability System 800xA

digital automation system, as well as three

gearless mill drive systems, and a high-pressure

grinding roll to handle the increased

amount of ore that will be processed in this

expansion. The delivery also includes distribution

transformers and substations, motor

control centers, medium and low voltage

drives, mineral processing specific applications,

and other automation and electrical

equipment. Furthermore, ABB will provide

project engineering, installation and commissioning

services, and ongoing remote

monitoring and diagnostic services.

ABB said its delivery will provide numerous

operational and safety benefits for

this project. It will monitor, control and

manage all aspects of production, access

critical information from system devices

and provide detailed data analytics to

determine process efficiency and identify

opportunities for improvement. It will also

monitor and manage energy distribution

and consumption at this and other KAZ

Minerals sites.

Also available are power monitoring

software solutions focused on specific

equipment and systems. For example,

ABB’s Ability Smart Sensor package has

been integrated into a Swiss pump manufacturer’s

product line, allowing users

to monitor unit energy consumption and

apply predictive maintenance to avoid unscheduled

downtime.

In the conveyor market, Voith says its

BeltGenius ERIC allows mine operators

to see at a glance the efficiency of their

conveyor belt systems at any time. The

system continuously receives relevant

performance data from the conveyor belt

system, including belt speed, belt tension,

effective motor power for all drive motors,

and temperature. These parameters are

then transmitted to a server at Voith. The

server contains a digital twin of the system,

in which all relevant information about the

conveyor are stored, such as belt length,

belt width, the diameter of the carrying

rollers, drive pulleys, return pulleys, the

configuration of the transfer stations, the

topography, and the trough angles. Using

this information, ERIC determines a normalized

efficiency value referenced to the

energy consumption for horizontal material

transport, known as the Energy Performance

Indicator (EnPI). This indicator

allows the operator to quickly assess how

efficiently the particular belt conveyor is

currently operating. The data are visualized

on the client’s individualized user interface,

in the form of an online dashboard.

Voith says this normalization makes

it possible for mine operators to easily

compare all existing systems in terms of

their energy performance. The digital twin

compares the installed power to the energy

actually being used. This, according to

Voith, allows the operator to identify power

reserves and put existing belt conveyor

system capacity to optimum use without

jeopardizing the safety of the system.

Voith also offers the option of equipping

individual belt segments with RFID

chips. With this option, less-efficient belts

and system sections are easier to identify

through interaction between the digital twin

and the RFID, according to the company.

As featured in Womp 2019 Vol 03 - www.womp-int.com