Barrick Signs Nevada JV With Newmont

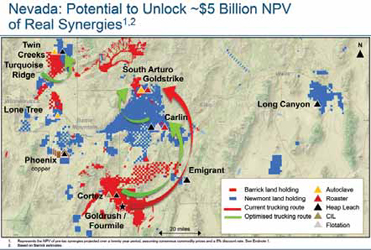

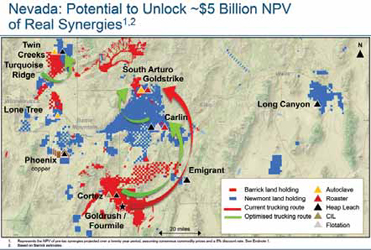

Newmont’s assets in Nevada include Carlin, Phoenix, Twin Creeks, and Long Canyon and Lone Tree properties while Barrick’s Nevada assets include Cortez, Goldstrike, Turquoise Ridge, Goldrush and South Arturo. Development assets include Fourmile, Mike and Fiberline.

In the proposed joint venture, Barrick will hold an economic interest equal to 61.5% and Newmont Goldcorp will hold 38.5%. Barrick will be the operator. The board of directors will include three Barrick seats and Newmont will control two seats. On the technical, finance and exploration advisory committees, there will be an equal representation by both companies. CEO of Newmont Gary Goldberg said the logic of combining the two companies’ operations was compelling. “This agreement represents an innovative and effective way to generate longterm value from our joint assets in Nevada, and represents an important step forward in expanding value creation for our shareholders,” Goldberg said. “Through the joint venture, we will also continue to pursue the highest standards in safety, along with responsible and meaningful engagement with our employees, communities, and other stakeholders.”

According to Barrick, the joint venture will allow them to capture an estimated $500 million in average annual pre-tax synergies in the first five full years of the combination, which is projected to total $5 billion pre-tax net present value over a 20-year period. Barrick President and Chief Executive Officer Mark Bristow said the deal has been 20 years in the making. “We listened to our shareholders and agreed with them that this was the best way to realize the enormous potential of the Nevada goldfields’ unequalled mineral endowment, and to maximize the returns from our operations there,” Bristow said. “We are finally taking down the fences to operate Nevada as a single entity in order to deliver full value to both sets of shareholders, as well as to all our stakeholders in the state, by securing the long-term future of gold mining in Nevada.”

Following the completion of the joint venture, the Nevada complex will be the world’s single-largest gold producer, with a pro forma output of more than 4 million ounces (oz) in 2018, three tier one assets, potentially another one in the making, and 48 million oz of reserves, the companies said. The agreement is expected to be completed in the next few months. The joint venture will exclude Barrick’s Fourmile project and Newmont’s Fiberline and Mike deposits, pending the determination of their commercial feasibility. As a result of this agreement, Barrick has withdrawn its Newmont acquisition proposal announced on February 25.

Barrick Gold Corp. said its proposal to merge with Newmont would form a gold company with unprecedented potential for value creation. Barrick President and CEO Mark Bristow said the proposed merger would unlock more than $7 billion net present value of real synergies, a major portion of which is generated by combining the two companies’ assets in Nevada, including Barrick’s mineral endowments and Newmont’s processing plants and infrastructure. Barrick also recently merged with gold miner Randgold Resources and Newmont has entered into an agreement to purchase Goldcorp Inc. That transaction is moving forward as Goldcorp recently obtained an interim order from the Ontario Superior Court of Justice to hold its shareholder meeting in April.

In the proposal, each Newmont shareholder would have received 2.5694 Barrick shares per Newmont share. Barrick shareholders would have owned approximately 55.9% of the merged company and Newmont shareholders would own approximately 44.1%. On March 4, the Newmont board unanimously determined Barrick’s proposal wasn’t in the best interest of Newmont’s shareholders.

Newmont CEO Gary Goldberg said, “The combination with Goldcorp is significantly more accretive to Newmont’s shareholders on all relevant metrics compared to Barrick’s proposal, even when factoring in Barrick’s own synergy estimates. Realizing value through Barrick’s proposal for Newmont’s shareholders hinges entirely on a new management team that lacks global operating experience and is only two months into its own transformational integration.”