Innovative partnerships for automation solutions underground will ultimately lead to the creation of

new markets, according to Vladimir Sysoev, product manager, automation, Epiroc.

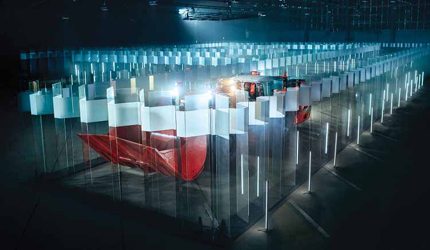

Above, an Epiroc control tower. (Photo: Epiroc)

New Age Partners Dig Open

Relationships

The framework of many corporate partnerships hatched today smash boundaries of

traditional roles in the race to automate underground mining

By Jesse Morton, Technical Writer

If recent developments in underground haulage automation are any indication, those partnerships will be innovative in what each party brings to the table. One example would be an underground gold mine in Mali that is partnering for what is described as full automation. “Our story is a historical turning point,” mining automation expert Riku Pull, Sandvik, said. In the partnership, the miner taps the equipment supplier not just for automated machines, some supporting systems and data management, but for mine design work. “We have combined teams from Finland and Australia in various workshops throughout the mine development phases to ensure good brainstorming and a cohesive partnership for this futuristic mine.”

Future partnerships targeting automation solutions will also require the parties to be more transparent, receptive and flexible. “It is impossible to create a standard automation product that will fit each and every mine,” mining automation expert Vladimir Sysoev, Epiroc, said. “We need to look at the particular site and conditions on the site and then collaborate on decisions on which way to adopt machines, platforms or technologies.” Thus, partners collaborating on automation solutions must “be very honest with each other to understand where inefficiencies lie on both sides,” underground hard rock mining business expert Clint Byington, Epiroc, said. “It must truly be a partnership in order for the technology and the automation to be adopted and deployed efficiently.”

In a way, Jacques’s statements were a shot across the bow of an industry long reputed to be conservative. That industry, however, is witnessing the rapid proliferation of automation solutions that reportedly offer mind-boggling increases in productivity, efficiency, safety and cost-savings. And as Boomer miners retire, those taking their place are decidedly friendlier to automation. One effect has been a recent uptick in demand. “A few years back, no one was even talking about automation,” Sysoev said. “Something has changed.” Before that, we were pushing the technology from our company, while today, the customers are pulling it from us.”

Demand hasn’t been uniform, as barriers remain. Implementation is typically incremental, requiring process change management to handle more than simply the technical aspects of adopting, deploying and managing machines. “There has to be a culture shift,” Byington said. “Mine management has to embrace and also push down toward the operators that this is the direction that they are moving, which is sometimes tough for some operators to embrace.”

As the numbers come in, the competitive advantage realized by those companies able to make the shift will become palpable. According to Jacques, that will prompt next-generation partnerships and solutions. “That means that soon we will have another industry,” Sysoev said. “New areas will be opened, new businesses, whatever they might be. It is quite an exciting time that we are living through.” Indeed, recent headlines on some of the latest partnerships, projects and innovations indicate that, industry-wide, the culture is shifting.

Partnering to Map Unified Route

“Imagine a mine where a few surface operators

can control a fleet of machines,

mobilizing ore from underground directly

to surface with the world’s-first fully autonomous

truck fleet. The fleet travels autonomously

from underground directly to the crusher on the surface from many mine

levels. We expand this adaptation of manual

tasks to automated tasks for many machines,

such as drills, rock breakers, plate

feeders, trucks, and loaders, resulting in

cost saving and less time loss throughout

the operation cycle of the mine.”

Riku Pulli, vice president, automation, Sandvik Mining and Rock Technology, isn’t reading an unpublished Isaac Asimov novel from the mid-20th century. Instead, the description encapsulates a system currently being commissioned in an underground mine in Mali, West Africa. Sandvik will “fully automate” Resolute’s large-scale Syama mine according to a partnership framework agreement announced by the supplier in June 2018. Per the agreement, Sandvik “will develop” the “underground gold mining operation” around “a fully automated Sandvik production system.”

Tapping those capabilities and others will ensure Syama’s system is “the most advanced autonomous system that has ever been developed and deployed for underground mining,” Pulli said. “This system will allow Resolute to assign direct operative missions to machines from the surface without any human intervention for the driving of vehicles. One operator can control and assign missions for multiple machines in full autonomous mode, with newly improved Mission Control systems, reducing an immense amount of OPEX throughout the value chain of the operation.” Additionally, “we will be controlling all the mine operations including day-to-day tasks via our OptiMine task and mission plan management modules,” Pulli said. “This will include machine- and data- monitoring, operation SMART scheduling, spares and maintenance activity optimization and more.”

OptiMine is the supplier’s gateway Industry 4.0 solution. Beyond the aforementioned features, it offers mine scanning and visualization, equipment location tracking, scheduling, and task and case management. “The solution provides transparency of underground operations and enables joint development of mining process efficiency supported by our experts,” the company reported. The agreement is the latest between Resolute and Sandvik for mine design work at Syama with the goal of full automation. Company reports state the partners collaborated early on on equipment selection and the design of the underground infrastructure.

The mine was first commissioned in 2009. Since then, “we used the latest simulation and design packages to simulate the entire production operation with various mine models,” Pulli said. “To keep it as close as possible to reality, we used actual machine data with many other parameters such as road conditions, haulage dimensions, machine passing bays for optimal traffic management and more. By using this anonymized, real-time data that we gather throughout our journey in optimizing mines around the world, Sandvik, in collaboration with Resolute, created the most optimized mine development and design concept that will easily digest the automation implementation.” Syama, with 7.5 million ounces (oz) in resources, 2.9 million oz of reserves, and a 12-year mine life, is the “mine of the future,” Pulli said. “This is a story of two pioneering companies following a unified route toward more intelligent mining.”

It is also a story with a prequel and a likely sequel. In December 2018, Hecla Mining Co.’s Casa Berardi mine in Quebec adopted a second automated Sandvik TH540, which will leverage the underground mine’s AutoMine Truck-based haulage system. The truck is marketed as a high-performance, 40-mt dumper for use in 5-m x 5-m drifts. When announced in 2012, it was pitched as offering “a higher payload ratio, cleaner air, and enhanced productivity.”

Casa Berardi “will benefit from the industry- leading traffic management capabilities of the AutoMine system, allowing them to run two TH540 trucks in a single heading transfer level in a productive and safe way,” Pulli said. “In the future, the truck haulage level can be easily be expanded as required to connect new production areas to the hauling level.”

The numbers reveal the impetus for the purchase. The miner reported running a single automated TH540 improved availability by 30%, reduced the cost of maintenance by 30%, and upped productivity in terms of hours by as much as 40%. “The improved availability for the TH540 truck comes from automation and means more hours available for operation during shift changes, blast clearance times and other breaks,” Pulli said. “Because of the high-precision of the InfraFREE navigation system, there is less damage; and optimized control of the truck results in less wear and tear, lowering the maintenance cost,” he said. “The higher productivity is due to more hours available, but also fast cycle times due to the InfraFREE navigation system allowing TH540 trucks to be operated at optimum speeds.”

Prior to that deal, in November 2018, Hindustan Zinc tapped Sandvik to implement “a major digital transformation” at the Sindesar Khurd (SK) mine. Sandvik will deploy OptiMine, “which will deliver personnel tracking with cap lamps, tracking and telemetry data for the entire mobile underground fleet, including non-Sandvik equipment, numbering more than 150 drills, loaders, trucks and other equipment.”

The miner deploys AutoMine at other sites, “allowing them to run underground loaders autonomously and unmanned,” Pulli said. By adopting OptiMine at SK, the miner is positioned for “fast deployment of autonomous Sandvik trucks” when needed. The platform will “make the mine one of the most advanced in the world,” Pulli said. “The technology will make the mining process fully transparent across the mining value chain, including people, Sandvik equipment, non-Sandvik equipment and associated processes,” he said. “Everything can be seen and controlled in real time, and the advanced data analytics algorithms will process all the generated data and convert it into a simple and user-friendly form that allows the mine to identify bottlenecks and various process optimization opportunities easily.”

At SK, OptiMine will replace the historically voluminous paper reports with real-time dashboards tracking key performance indicators, facilitating process optimization projects, Pulli said. “The next natural step in the mining optimization journey is to allow the full fleet of equipment run autonomously based on Auto- Mine,” he said, “and the Hindustan Zinc SK-mine will be exceptionally well-positioned for this after this project.”

With the evolution of AutoMine propelling it “to the forefront of mining automation,” any downsides to the technology, such as some of the dystopian scenarios envisioned by Asimov when he penned his rules for robots in 1942, have not presented, according to Pulli. “Nowadays there are AutoMine systems successfully operating on six continents,” he said. “More than 400 AutoMine loaders and trucks have accumulated more than 2 million hours of operation with zero lost-time injuries in actual mine production use.”

Stats like that reveal the demand driving the development of the technology. Consequently, improved workplace safety is one of AutoMine’s primary deliverables, Pulli said. “AutoMine takes people out of hazardous environments and straining repetitive tasks and makes them higher-level decision makers in the mining process,” he said. “In many mine sites, the significantly increased productivity and profitability with use of the system has actually already led to increases in the number of people employed as the cost of human labor becomes more marginal in relation to the overall productivity gains enabled by automation.”

Pulli said what emerges as one result of the new age partnerships described by Jacques is “a shift in some of the traditional job profiles, for example, from equipment operators to system supervisors.” Emergent automation-centered “technologies may actually provide more job opportunities for people in safer, more comfortable and more creative roles.” The vision of man using machine for a net improvement of his lot has been the bread and butter of futurists, and the bane of Luddites, for decades. It is a vision shared by others in the sector.

Partnerships to Set New Standards

“Our goal is autonomous production with

the highest conceivable level of safety

where people and machines work side

by side.”

Ten years ago, this statement could have

been attributed to a star-eyed futurist, aging

in boardroom meetings when not on speaking

tours. Today, it is how Vladimir Sysoev,

product manager, automation, Epiroc, describes

the mission of the company’s new

Sustainable Underground Mining (SUM)

testbed in Norrbotten, Sweden. “We have

ambitions to set new standards for sustainable

mining at great depths, which means

carbon dioxide-free mining, digitalized, with

high utilization of autonomous machines.”

The testbed is tasked with ensuring “the Swedish mining industry remains competitive,” with creating jobs and growth, and with cranking out products for the global market, specifically equipment that will enable LKAB “to mine at greater depth,” Epiroc reported. Sysoev said “right now we are in the first phase” of launching the testbed. “We are mapping out prerequisites, allocating the resources and deciding on the future setup of the application,” he said. “It will be followed by the construction of the test mine in 2019.” The testbed “reflects the need of keeping pace with technology development,” Sysoev said. “It will shorten the cycle of bringing new technology to the market as every partner is responsible for their dedicated area of the project, which means different tasks can be addressed simultaneously.”

An example of the type of technology to be developed and perfected includes an underground truck automation system, successor technology to that which can now be leveraged by Epiroc’s MT42 mine truck. The first generation of the truck hit the market in 2011 after two years of trials in Canada and Sweden. It comes with the company’s Rig Control System (RCS), allowing for varying degrees of automation.

The high-capacity truck is described by Epiroc as “powerful,” with a “low profile” and a “compact footprint,” and capable of “high speed on the ramp.” RCS “enables mining equipment to assist the operator and the functions to become semi- or fully automated,” Sysoev said. “It simplifies the operation and achieves more productive results.”

The truck enables a miner to wade into automation at their own pace and as circumstances allow, Sysoev said. RCS facilitates data capture and monitoring, and remote control. “The truck is adopted to be an integral part of the mine’s information management system,” he said. “All the vitals, including the utilization calendar or production data and alarms can be sent in real time wirelessly.” Comprehensive digitalization, as enabled by RCS, is a crucial phase in a “journey to be taken in a step-by-step manner,” Sysoev said. “You start with monitoring and analyzing the fleet performances, defining where the bottlenecks and the main process constraints are.”

The automation solutions considered would then “address the challenges of a particular site,” he said. Epiroc can “customize the automation solutions based on the mine’s and the customer’s needs,” Clint Byington, business line manager, underground rock excavation, United States, Epiroc, said. “It is not an all-or-nothing choice,” he said. “There are several different options or steps in between, from fully automated to more of an operator-assist.” The MT42, via RCS, offers a range of automation capabilities, “without any substantial changes in the design,” Sysoev said. “It can be automated by installing the retrofit automation kit in the field when the time comes.”

Another example of the type of technology that will likely be developed, perfected and trialed at SUM is an underground loader automation system. Predecessor solutions would include the Scooptram Automation Regular package, released by Epiroc in June 2018. The package allows for remote control that can “quickly and easily transition from manual to automatic mode,” the company reported.

The package includes cameras, sensors and safety modules that are mounted onto the Scooptram as well as a safety system that can be easily installed in the mine, Epiroc reported. “If a person or another machine should enter the Scooptram’s work vicinity while the safety system is enabled, the Scooptram will automatically shut down to avoid causing potential harm.”

Leveraging a mine’s Wi-Fi, the package will enable “loaders to be operated remotely all the way from the stope to the ore pass,” Sysoev said. “And according to our records, up to 80% more cycles can be done if the mine eliminates the need of line-of-sight remote control. And, also, by having the operator station on the surface, the mine can continue the mucking operations throughout the shift changes when no one is allowed to be in the mine, and by doing that increasing the loader’s utilization rate.”

As with the MT42, with the Scooptram, the automation experience should be seen as a journey, not a destination, Sysoev said. “We can run the trials first and try to identify the constraints and limitations to be sure that the mine will benefit from usage of this technology,” he said. “We would never recommend running the loaders in fully automated mode from day one.”

In those statements is a warning. Adopting automation solutions strictly out of a zeal for high technology is a mistake, according Hans Schill, application center manager, United States, Epiroc. “I think it is important, before you start to implement the technology, to figure out what the main goal with the technology is. What is it that we want to achieve? Is it more efficient production, is it safety, is it a better environment, or something else?” he said. “When you have decided on that, then you can start talking about the different technology solutions and how to implement them.”

Schill is in the process of establishing an application center in the U.S. to provide automation and digitalization solutions support and resources. The goal is to plot “partnerships that we can build” and to service existing partnerships.

Among other things, the team will qualify, prepare and guide customers on adoption and deployment. “The first level is to use the data that we have today, and perhaps to do some dashboards, helping the customer to realize what their operation looks like,” Schill said. The next level is optimization projects, “where we, together with the customer and the data, make a bigger analysis of how we can improve efficiency,” he said.

The third level would be partnering on adoption and system integration. “A lot of customers already have systems in place from other suppliers they want to be integrated with our system, whether our control system or telematic solutions,” Schill said. “We would have the resources to be able to help out with that, and tailor-make our solution to fit the customers.” The barriers to adopting automation solutions are twofold. First the infrastructure must be in place. Next, the culture at the mine must accommodate the change, according to Byington. “One of the barriers is getting the operators to actually use the technology and to embrace it,” he said.

When reduced to its core, a primary mission of the SUM testbed and partnership, and the technologies it will produce, is to improve the work environment of miners, Sysoev said. “That is the main thing we are trying to achieve with all of our solutions,” he said. “Repetitive, hard jobs that are done in the underground department are usually not good for people,” Sysoev said. By deploying automation solutions, “we actually remove the people from those roles and create new roles in analysis and decision making, where the humans can’t be replaced now.”

Some of those new roles will require skills previously found in other fields, Byington said. “There are more people that are being hired to support the technological or IT functions behind the technology.” And many existing jobs and roles, he said, will shift. The role of the boardroom futurist, however, likely won’t change much. “We are living in very exciting times,” Byington said. “There are a lot of changes happening in the mining industry,” he said. “At Epiroc, we are excited and dedicated to helping our mining customers be more efficient, to operate safer, and to really get more productivity out of their investments.”

Fully Automated Sublevel Caving Goes Live in Mali

By Gavin du Venage, South Africa Editor

CAPE TOWN, South Africa—In a world first, Perth-based Resolute

Mining has gone live with its fully automated sublevel operation

on its Syama gold project in Mali, West Africa. “Syama

will be the world’s first, purpose built, fully automated sublevel

cave gold mine,” said Resolute Managing Director and CEO

John Welborn. “It is a world-class, long-life, low-cost asset that

will deliver long-term benefits to our shareholders, stakeholders

and local Mali communities for years to come.”

Automation has long been a goal for the industry, with Australian majors such as Rio Tinto pioneering the way using remote- controlled haulage trucks to shift iron ore in western Australia. Syama gold mine, 300 km south of the capital Bamako, however, takes automation to another level entirely. Syama’s entire fleet of vehicles will be operated from the surface, which makes it the only operation in the world to hand over blasting, rubble clearance and ore removal — the entire extraction cycle — to autonomous machines.

Syama was originally developed by BHP as an open-cast gold mine in the 1980s, but Resolute acquired it in 2015 and began looking for ways to blow new life into the aging asset. A positive definitive feasibility study completed in 2016 showed the geology was suited to a long life, low cost underground mine. Syama now has a life of mine of 14 years, with an underground ore reserve of 3.5 million ounces (oz). All-in sustaining costs are US$746/oz. This is a decrease from earlier projections of $881/oz. With sublevel caving, blast holes are drilled up from below into the ore body. The ore body is collapsed down into a draw point, where the ore is collected and extracted.

As technology evolves, savings are expected to improve over time. Syama is now heading toward 200,000 oz/y of gold production, but intends to reach 300,000 oz/y, Beilby said. Full production will be reached in June 2019. The trucks, robotic loaders and drills are supplied by Swedish mining engineering specialist Sandvik. Resolute opted for Sandvik as its equipment was “mine ready” using its AutoMine and OptiMine systems, said Beilby.

Automation is not the only innovation Sandvik is deploying at Syama. The 422iE jumbos that will carry out the drilling are also fully electric, saving on the need to run diesel pipelines underground for refueling. Charging is done off existing infrastructure. Multiple trucks can operate on the same incline, and a dedicated traffic management system keeps them out of each other’s way. Trucks are fully capable of navigating themselves both underground and on the surface. Altogether, Resolute expects to save around 15% in operating costs. Some of the cost benefit is in reduced downtime, with no handovers at the end of a shift, said Neil McCoy, key account manager in Sandvik’s Johannesburg office. Nor do operators have to travel underground to get to their machines. This keeps the equipment running at up to 22 hours a day, rather than the 15 or 16 hours they worked before.

Automation also means fewer operators, whose skills command a premium. “The big issue we’re looking at is the lack of critical skills,” said McCoy “Automation is the tool to bridge the skills gap.” Countries such as Mali face another impediment to attracting skilled technicians and operators; ongoing conflict and extremist activity. The UN regards its Mali peacekeeping mission, installed after a failed coup six years ago, as its most dangerous. In October 2018, two peacekeepers based in Ber, close to Timbuktu, were killed when the blue helmets repelled a motorized attack.

Autonomous machines mean that companies can reduce their staff demands in troubled countries. Along with reducing the number exposed to the inherent dangers of mining, which is a win for all. Still, a touchy issue surrounding automation is the potential threat to jobs, and the fear that men will be replaced by machines. Mali ranks 175th out of 188 countries on the UN Human Development Index for 2016, and the average wage is US$1.25 per day. Resolute may save having to fly in expert technicians, but it could deprive Malians of desperately needed jobs.

However, Beilby said the issue has been talked out with the government, and Resolute has undertaken to ensure locals are trained in those skills needed on the ground, such as maintenance and servicing equipment. Ultimately, he noted the automation route is not really about lowering the headcount but increasing productivity. And, reducing the number of men underground, an environment that presents a lot of hazards. “The government has been quite supportive of us,” Beilby said. “We’ve undertaken to providing quality jobs and skills. We’ve made it clear that expatriates who are sent over will be there to train Malians, not just to work.”

Sandvik’s McCoy added that even automated machines still need mechanics, electricians and other specialists to keep them functioning. The Sandvik fleet will for the most part self-diagnose problems, letting the operator know its status. This will then result in a technician either being dispatched or the vehicle being called to the surface.

“At the end of the day you still need a pair of hands to repair and maintain equipment,” McCoy noted. “Remote control helps the operator, but the artisan still has to get out there and be on the ground when needed.”