Zijin Chairman Chen Jinghe delivers a presentation on the history and future development of the Chinese mining industry during the

keynote session.

China’s Miners Promote New Era

of Openness and Cooperation

Major reforms within the mining sector and the government will foster green mines

at home and greater investment abroad

By Steve Fiscor, Editor

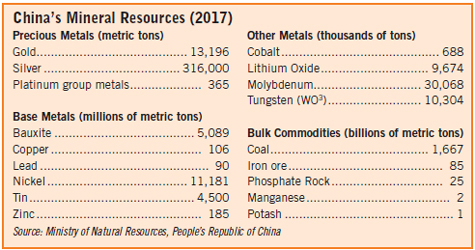

China is well aware of its status as the largest consumer and, in some cases, the largest producer of raw materials. It leads the world in gold production. The country consumes most of the nonferrous base metals and iron ore. It mines and burns three or four times as much coal as the No. 2 consumer. China’s influence on rare earth metals is well-documented.

Chinese President Xi Ping has redirected diplomatic strategy toward international cooperation with the Belt and Road Initiative (B&RI). An action plan to promote B&RI has been developed that promotes an opening up and cooperation for the resources sector, strengthening policy and information sharing. Rule changes related to foreign investment have removed entry restrictions. Basically, through the B&RI, China is open for business, and it and its neighbors will benefit from the policy.

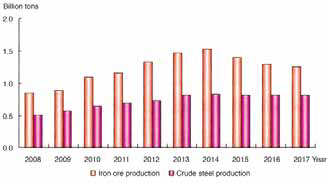

China initiated serious reforms related to mineral resources in 2017. It canceled lots of administrative approval items, revised the regulations for geological data, and abolished regulations related to the qualifications for mineral exploration. As far as resource management, the Ministry of Natural Resources was established in March 2018, further streamlining regulations by combining several agencies. The new ministry now manages state-owned natural resource assets, monitors ecosystems and improves environmental management. In April 2018, the government began adjusting the supply and demand with a notice related to coal and steel. Large productive operations were encouraged to continue, while inefficient capacity was idled. This move pushed seaborne coal prices higher and it had a moderating effect on iron ore prices.

At the same time, under the direction of Mr. Xi, China has embarked on a path to restore and rehabilitate mines at home and develop new green mines. The green development idea begins with using advanced technology for exploration. Industry standards have been established for the construction of green mines that cover six areas: environment, resource development methods, comprehensive utilization, energy and emission reductions, technological innovation, and enterprise management. The plan is to improve the mining industry’s image and secure the economic benefits associated with these operations.

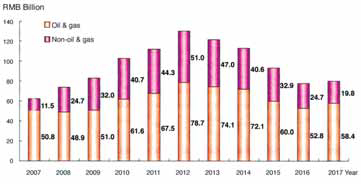

A host of mining executives and government administrators gave presentations and what follows is a summary. The Chinese include oil and gas along with mining when they address mineral resources. Also, the term ecological is used frequently where most developers in the West simply say environmental. Most of the program was delivered in Chinese and E&MJ should be forgiven for what may have been lost in translation.

Ministerial Changes

Mr. Xi promised a “beautiful China” with

clean air and blue skies during the 19th

Party Congress last year and protecting the

A rising political star, Lu Hao, was appointed to run the new Ministry of Natural Resources and he kicked off the China Mining 2018 conference. “For this conference, we take up the theme of ‘Opening New Model for Cooperation,’” Hao said. “We will further open the mining sector to establish the new pattern of mining cooperation. This year marks the 40th anniversary of China’s reform and opening up, and it’s the 40th anniversary of China’s mining industry’s ever-expanding foreign exchange and development. Back in the 1980s … international cooperation of exploration and development began with offshore oil and it was carried out by introducing foreign capital and actively exploiting mineral resources. Today, we not only meet the demands for rapid domestic industrialization, but export mineral products to earn foreign exchange, laying the foundation for industrial modernization.”

The development of China is intertwined and integrated with world development, Hao explained. He believes the world economy is at the forefront of a recovery. “For the first time, more developing countries are faced with resource development growth,” Hao said. China has also been developing very fast. In 2017, the investment in exploration in new resources was 78.2 billion RMB ($11.3 billion). “In the future, the door of China’s reforms will only open wider and wider,” Hao said. “We will continue to promote investment, modernization and trade liberalization in the mining sector, and promote a new pattern of mining development. At the same time, we will implement the reform measures related to the environment and resource optimization.”

At the time, he said, China by November 1 would reduce or eliminate tariffs on 1,585 items, covering a wide range of nonmetallic rare earth and other minerals. “In addition to reducing tariff barriers, we will also have a higher level of openness to trade and services related to mining,” Hao said. These statements were made six weeks prior to the arrest of Huawei’s CFO in Vancouver.

“We should improve communications, share our experiences, and provide a better environmental policy toward mining,” Hao said. “We should support a modern trade system to maintain market stability and reduce risks for both sides. We call on other governments and the mining industry to focus on fairness so that others can benefit from sustainability and green development. We have a bright future and the Ministry of Natural Resources will work with the mining industry to build a shared community for mankind.”

International Cooperation

Zijin Mining Group is a leading Chinese

mining company, especially when it comes

to partnering with mining projects around

the world. The company is mainly engaged

in the exploration and mining of gold, copper,

zinc and other metals. In 2017, it was

ranked third among the world’s publicly

held gold miners. Listed in Hong Kong and

Shanghai, Zijin has developed an extensive

portfolio of mines and smelters in 24

provinces across China and in nine foreign

countries. The company also holds extensive

reserves and it has been among the

most profitable in the industry for years.

He explained that many small- and medium- sized mines have been shut down in the last two years because of the previously mentioned supply-side reforms and environmental protection issues, resulting in a supply shortage and soaring marketing prices for some products, but it also gave mining companies a chance to catch their breath. “For now, as the pace of growth for the world economy slows and the economic restructuring process accelerates, the level of resilience, sustainability and the relatively high growth speed of the Chinese economy is still foreseeable,” Jinghe said.

The revival of the U.S. and other developed economies, and the rise of emerging economies including India are propelling the global market, Jinghe explained. Meanwhile, the average grade for global mines continues to decrease as capital expenses and unit metal costs climb, while the metal prices drift lower. “The trend of economic globalization is irreversible,” Jinghe said. “As China is further reforming and opening up, more transnational enterprises with global competitiveness will emerge at this crucial point. Those ambitious Chinese companies should take opportunities to make this happen.”

He said his confidence was based on

three areas:

• China has unsustainable needs and it

will incent the development of the global

mining industry;

• More than 20 countries have industrialization

rates that are too low. As people

seek a better life, the demand for

metals will only increase; and

• Similar to China, other countries, possibly

India or Brazil, will emerge with similar

demands for natural resources.

“The B&RI has now become a reality bringing economic development to China and neighboring countries,” Jian said. “It will improve the demand for minerals resources for infrastructure, ports, transportation, energy transmission, etc. Neighboring B&RI countries have great potential for mineral exploration and mining development.” He specifically noted uranium, iron ore, as well as rare earth minerals.

“Globally, the opportunity for mining exploration and major discoveries are shrinking. In fact, some countries have already given up, but the B&RI countries boast a large potential,” Jian said. “The investment in the mining sector will create more job opportunities for local communities. The B&RI will become an important historical opportunity for metal mining development.” “China Minmetals has been working with B&RI countries and it also has great experience with international cooperation,” Jian said. “We will continue to work together with colleagues to continuously grow with B&RI.”

China Minmetals possesses a unique, competitive edge. It was the first multinational metal miner to establish a presence in the full industrial chain from resource acquisition, investigation, design, construction, operation to logistics, and mineral processing.

With a rich reserve of metal mineral resources, it owns high-quality mines at home and in Australia, South America, Africa and other parts of Asia. It has one of the world’s biggest reserves of copper, zinc and nickel, and the world’s largest reserves of tungsten, antimony and bismuth.

The discussion on New Pattern of Opening, New Model for Cooperation concluded with a presentation from Li Chaochun, chairman, China Molybdenum Co. (CMOC). “CMOC is more than just molybdenum,” Chaochun said. “We also have uranium and were the leading producer of tungsten.” The company also owns the Northparkes cooper and gold mine in Australia and a large stake in the Tenke Fugurume copper mine in the DRC (Democratic Republic of the Congo), making it a rising star in the copper world. CMOC also bought Anglo American’s niobium and phosphate business in Brazil, making it the largest phosphate producer in a country with a lot of agriculture.

“In the future, we are confident that the cooperation between China and international community and the integration of East and West will become a major theme for the mining sector,” Chaochun said. “We love and work in this sector and we are absolutely confident in future prospects for the industry.” “The Northparkes operation in Australia is one of the most sophisticated underground copper and gold mines,” Chaochun said. “It was the first block cave in Australia and it uses high technology to remotely mine with eight pieces of equipment.”

The Leading Gold Producer

Shandong Gold Group (SD-Gold) is the No.

1 gold producer in China and the theme of

Chairman Chen Yumin’s presentation was

Shandong Gold, Ecological Mining. He focused

on the strategic layout of SD-Gold

during the 13th Five-Year Plan and the

effects of internationalization and ecological

mining construction, and affirmed the

group’s business performance and development

trends in recent years.

SD-Gold was established in 1996 and in 2015 converted into a state-owned capital investment company under the Shandong Provincial Government. As such, it takes the lead in China’s gold industry in terms of gold output, resource reserve, economic benefits, scientific and technological level, and talent advantage. At present, SD-Gold has four mines ranked among the top 10 gold mines in China and “Shandong Gold, Ecological Mining” is the company’s mantra and slogan.

“Global mining has entered the era of green development,” Yumin said. “We must adhere to ecological mining practices and the harmonious coexistence of human and nature. Not only can mining enterprises create great wealth and boost employment, but they can also turn the vision of ‘lucid waters and lush mountains as invaluable assets’ into reality, to win the wide understanding and recognition of the public while realizing the substantial increase of economic benefits.”

Yumin stressed that, as global mining enters the digital age, it is necessary to speed up the transformation of old and new growth drivers of traditional mining, carry out extensive research, and embrace intelligent mining technology. “As the global mining enters this era of win-win cooperation, it is imperative to be open, inclusive and sharing, jointly promote the sustained prosperity and development of the global mining, comprehensively deepen international cooperation in the field of mining industry, strengthen exchanges and communication in various aspects such as scientific and technological innovation and management experience, so as to promote steady and sustainable development of the global mining,” Yumin said.

The Shandong Zhaojin Mining Group is an emerging Chinese gold producer. Liu Yongsheng, general manager, Zhaojin Mining, opened his presentation with a discussion of the fluctuating gold prices. “We have put policies in place for reform,” Yongsheng said. “We are looking at new technologies for gold exploration and mining, and we are focusing on green mines. It makes sense as we have long history working in green mountains near clean water.” With mine construction projects, Yongsheng said he looks for high-quality contractors that share the same green development vision.

Zhaojin Mining is ranked fourth among China’s leading gold producers and its one of China’s largest gold smelting companies. It is a comprehensive large-scale enterprise, which integrates exploration, mining, mineral processing and smelting. Located in Zhaoyuan City, Shandong Province, Zhaojin Mining works in a region that has abundant resources and a unique geological location. The area has a long history of gold exploration and production. According to the stats provided by the China Gold Association, Zhaoyuan has a large gold production base and some of the greatest gold reserves in the PRC.

In recent years, Zhaojin Mining has focused on gold mining, adhered to technology leadership and management innovation, and kept strengthening the company’s technological and cost advantages in the gold production field. As a result, it has increased its gold reserves, gold production and corporate efficiency year after year. Yongsheng said the company is considering a non-polluting smelting process. “We want to improve production efficiency and at the same time improve recycling rates,” he said. In the past, he explained, they were mostly concerned with production efficiencies. “In the future, we would like to use technology to develop and remediate mines,” Yongsheng said.

He briefly discussed partnering and globalization, noting that mining companies in the western world have a superior understanding of markets. “The other panelists gave us some good examples on partnering with which we could learn,” Yongsheng said. Yongsheng made it clear that Zhaojin Mining was seeking a joint development effort, which caught the attention of the final speaker, Woo Chan Lee, president, Barrick Gold China.

The merger, which was announced in September, will create a gold company that produces 6.5 million oz/y or more than 200 mt/y with a market capitalization when it was announced of more than $18 billion. “The merged company will have the world’s best gold assets, which includes five of the world’s top 10 Tier 1 assets and two more potential Tier 1 assets under development,” Lee said. “No other company in the world has more than one Tier 1 asset.” Lee explained that Barrick’s partnership culture extends outwardly and internally, which means partnerships in local communities and other companies, such as Zijin and Shandong Gold in China. “Internally, everyone within the company owns stock and top executives cannot liquidate their shares until they retire,” Lee said. “We really own the company and we are building a leading gold company for the 21st century.”

The new Barrick will have even more opportunities to partner with China and China’s leading companies, Lee explained. Barrick is alone among major western gold companies that have made China one of the pillars in its future strategies. “Why?” Lee asked. “We believe fundamentally that no company in any industry in the 21st century can be a leading enterprise without a close relationship of trust with China; China is not only the leading gold producer, but the largest gold consumer. Chinese companies have global ambitions and are demonstrating an increasing ability to operate successfully abroad. Our experience has shown Chinese partners share a long-term business orientation. Chinese partners give us the best insight to the best and most-competitive Chinese suppliers and sources of capital that do not exist elsewhere. Partnering with China can help reduce risk in other parts of the world where we operate.

In 2015, Barrick partnered with Zijin at the Porgera gold mine in PNG. Last year the company developed a 50:50 partnership with SD-Gold at the Veladero gold mine in Chile. “On the day the Randgold merger was announced, both companies, Barrick and SD-Gold said they would buy $300 million in shares of each other’s companies,” Lee said. We also have a very close relationship with China National Gold.” Looking toward the future, Lee said he wants to get to know Zhaojin Mining, China’s fourth largest gold producer.