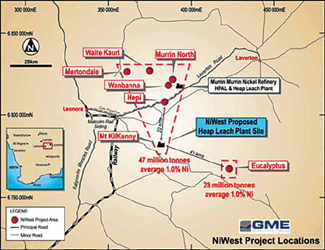

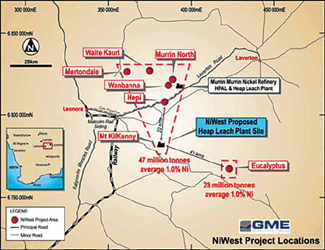

The NiWest project is located in south-central Western Australia that is

well-serviced by existing infrastructure

NiWest PFS Delivers Outstanding Results for GME

Initial mine life is forecast at 27 years at plant throughput capacity of 2.4 million mt per year (mt/y). The project construction period is estimated at 24 months from a final investment decision. Commissioning and plant ramp-up are estimated at approximately 20 months.

Pre-production capital expenditures to develop NiWest are estimated at A$996 million, representing a pre-production capital intensity of less than US$20/lb of average annual nickel production. Average life-of-mine cash unit operating costs, post royalties and cobalt credits, are estimated at US$3.24/lb of contained nickel. Operating costs during the first 15 years of operation are estimated at US$3.00/lb.

The initial ore reserve estimate for NiWest stands at 64.9 million mt grading 0.91% nickel and 0.06% cobalt, for 592,000 mt of contained nickel and 38,000 mt of contained cobalt. Opportunity exists to extend the high-grade profile through potential conversion of inferred resources and/or inclusion of other deposits.

Mining would be by conventional open-pit methods at a low projected strip ratio of 2.0:1. Ore would be processed by heap leaching followed by direct solvent extraction to produce low-cost nickel and cobalt sulphate products.

“GME will now utilize the PFS to undertake an intensive period of engagement with potential strategic partners and offtake parties for the NiWest project,” GME Managing Director Jamie Sullivan said.

The NiWest project is located in a semiarid region of south-central Western Australia that is well serviced by existing infrastructure, including rail, arterial bitumen roads, and nearby established mining towns.