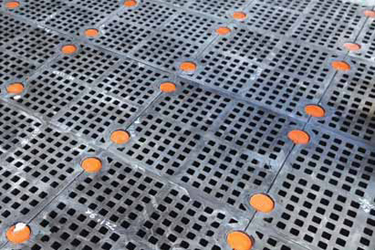

Above, three dual-motor Linear Motion screening machines process 4,000 gallons per minute at an

Alaskan gold mine. (Photo: Derrick)

Designed to Stay Off Your Mind

The latest in screening solution offerings are promoted as producing results

while reducing labor costs

By Jesse Morton, Technical Writer

More Gs in Less Space

Derrick Corp. announced a major gold

miner recently adopted its Linear Motion

screening machines for an open-pit heapleach

mine in southern Nevada.

The purchase is the latest in a series

by the miner and is in response to more

than a decade of the same machines

meeting and surpassing expectations at

its other operations, said David Perkins,

metallurgical engineer and general manager,

Latin America, Derrick Corp.

“They have rewarded us,” Perkins

said. The miner previously “made this a

standard across all of their other mines,”

he said. “Obviously, they felt very strongly

about the Derrick design.”

The miner first tapped Derrick “in the early 2000s” and trialed a carbon column train with three 4-ft-by-10-ft dual motor Linear Motion screening machines at a similar but larger mine in central Alaska, Perkins said.

There, the ADR (adsorption, desorption, recovery) plant mandated a system effective at capturing almost the entirety of the impregnated carbon. “If they are not captured before they leave the ADR plant, this solution that contains the fines is recirculated back out to the heap leach, where it is distributed by a series of pipes and smaller pipes and emitters,” Perkins said. “And what happens is that fine carbon will be redeposited on the heap leach where it will sit there and adsorb gold until the point where it can no longer adsorb.”

Additionally, the particles could “cause a blockage at the emitter that would prevent the solution from getting to a particular part of the heap leach,” Perkins said. Leach lines were buried to prevent freezing. It was critical that less than a trace amount of fines recirculated back to the emitters, Perkins said. “The minute they got plugged, they would never find it,” he said. “They’d never know because they are buried under the ore, so it was super-critical the job that these machines played in their success at that mine.”

The carbon particles ranged in size from 50 microns up to a millimeter and were suspended in a cyanide-leach solution at a concentration of 350 to 400 parts per million and flowing at up to 4,000 gallons per minute. “There is almost zero undersize particles,” Perkins said. “The slurry is just about 100% minus 150 microns, whereas the carbon particles themselves for the most part are about 0.8 to 1 mm in diameter.” The system mandated “a machine capable of handling very high volumetric flows and making a good separation and also has the ability to not be a maintenance nightmare to the customer,” he said.

Each machine was equipped with Derrick’s non-blinding 200 mesh Polyweb urethane screen panels. Each featured a “very high open area, the highest of anyone in the world that makes urethane panels,” Perkins said. “That coupled with the high G-forces at a very high frequency gives the Derrick machine the ability to process a very high volumetric flow on a very small footprint.”

Eight Gs at a frequency of 1,800 rotations per minute means “we’re shaking this machine really hard and really fast, and the machine has to be robust enough to handle that,” Perkins said. “That takes some pretty high-tech manufacturing to do that.” Derrick, he said, cuts “all of our steel with lasers, and we use robots to do the welding.” The machines are coated “in a solid spray-on urethane instead of just a paint, so we essentially have a machine that is going to not only be able to do this, but is going to last a very long time doing it.”

In 2013, a second ADR plant was built, with a line of three Linear Motion machine specified in the blueprints. “They essentially had two ADR plants at this mine, each of them operating in parallel,” Perkins said. “There is a train of carbon columns in each plant and each plant also has three of the Derrick screens in it.” After that, the miner adopted the machines for their gold mines in Chile and Brazil. “They are basically seeing Derrick as a provider of a solution to some difficult applications.”

Derrick Linear Motion machines are available in sizes ranging from 3-ft-by-8- ft to 5-by-14. Feed box options are available for “all flow conditions,” the company reported. “Abrasion-resistant urethane coatings and sealed-for-life Derrick vibratory motors assure long-life, low-maintenance operation,” the company reported. “The machines’ versatile design allows for the use of both traditional wire and Derrick anti-blinding, high open-area Polyweb urethane screen panels.”

Perkins describes the machine as the “workhorse for a lot of our gold applications,” which also include carbon-in-pulp or carbon-in-leach (CIP/CIL) plants. “So, at the typical CIP/CIL plant, most of these safety screens are screening at 600 microns on average,” he said. “Derrick is able to offer to our customers to screen at 300, 350 microns.”

The machines, he said, pay for themselves in two or three months. “What they are able to do is recover more gold than they were with other technologies,” he said. “And it is because these machines are more effective at screening out these carbon particles, whether it is ultra-fine at 75 microns at an ADR plant or it is 300 microns at a CIP plant.”

Derrick installed one of its Hyperpool Linear Motion machines equipped with patented screens and panel technology. “We replaced that 10-by-20 with essentially a machine that has a footprint of 4-by-8,” Perkins said. A Derrick machine outperforming a competitor machine more than double its size is not unexpected, he said. “We are able to do some very interesting things for a lot of our clients because we are thinking about how we can do things smarter instead of just throwing brute force at challenges.”

Rubber Gains Ground

Rubber is in, and Metso’s 1-ft-by-1-ft

Trellex 305PS proves it, according to

Claes Larsson, director, screening media,

consumables, Metso Mining. The line of

screening media, released in 2016, beats

the competition in wear-resistance, and

has, in turn, seen an uptick in demand.

“We have gained traction due to increased

wear-life,” Larsson said. “The trend in my

opinion in the mining industry, not only in

the U.S., is rubber gains ground over urethane

from a performance perspective.”

Company literature labels the rubber compounds available for the 305PS as “unique” and “the result of decades of dedicated research” that led to the development of “highly flexible materials that are unbeatable in fighting blinding and pegging.”

Larsson said that translates to increased availability and uptime. “We have actually done our homework,” he said. “We have come up with solutions to differentiate ourselves and we have done some good trials, some good installations where we feel our product is performing better than what we are replacing and that has led to a growing confidence.”

The trials consisted of replacing “polyurethane decks with rubber decks that we have developed in the same format,” Larsson said. “We have proven that we can reach the cycle time or the goal the customer has for how long they can operate the equipment before the need to take it out for maintenance.” The rubber compounds are the deliverables from internal research and development spanning more than “40 or 50 years in the mining consumables industry,” Larsson said. “We have a range of different rubber compounds to meet different applications.”

The range includes compounds for coarser duties, compounds that withstand high pressure, and softer compounds for applications otherwise prone to blinding and paving, he said. “We specify our own recipe,” Larsson said. “While most others buy from rubber batchers in certain compounds, we have developed our own unique recipe.”

Beyond the rubber compounding, the series features a “hammerless design” and injection molding, the company reported. “The unique item about this system is the hammerless design in which you screw the holding device with the holding wrench to hold the panel down, which means you don’t have to use a hammer,” Tom Dougherty, mining sales, Minnesota, North and South Dakota, Metso, said. “There are no pry bars to pry it out or hammers to pound it in.”

Company literature reports the system is centered on “specially developed pins” that “can be screwed into place as well as removed using an impact driver.” The system saves time normally spent on removing traditional pins and sleeves, Larsson said.

“Basically, you have a polyurethane pin with a thread and can knock it in, and then you can screw it out with a normal impact torque wrench with a specially developed socket that we have,” he said. “You can also screw it in and screw it out.”

With the 305PS “you don’t really need any sledgehammer at all and you can work in quite confined spaces,” Larsson said. And “there is no added labor that increases risk when you take it out.” Metso offers a monitoring service “where Metso will monitor the wear and give recommendations,” Dougherty said. “That entails going out to the site and taking readings on panel thickness, from the feeding end of the screening unit down to the discharge end of the unit, laying it out on a graph, adding time and or tons, whatever the customer wants, and giving it to them back in the form of a wear monitor — how long did it last over what time at what throughput.”

All this combines to make the 305PS an “easy proposal” for a customer to accept, Larsson said. “It is a low-threshold entry product in that sense,” he said. “It is easy to replace, easy to put on trial, and you don’t have to discuss making modifications to support frames or rails.”

A Departure From Old Concepts

McLanahan Corp. reported that with

positive field results received on a MAX

Vibrating Screen prototype from an openpit

nickel miner in Sudbury, the company

could expand the line by offering the

design in more sizes. “Our MAX Inclined

Screen has been (there) for an entire

season and it continues to meet every

expectation,” Gerry Mangrich, global production

manager, crushing and screening,

McLanahan, said. “With sufficient

field-proven experience, we are confident

in the design and our ability to broaden

the scope over numerous model sizes.”

The line was announced in late 2016 and was pitched as capable of separating coarse feed materials from finer material. Market research and the deep experience of company engineers provided the original seed idea for the solution, Mangrich said. “As a major manufacturer of processing equipment over a broad spectrum of industries, we find a common need, a common link, critical to each industrial market,” he said. “That common link is an expanding line of inclined and horizontal screens.”

The goal was to “introduce a new family of both inclined and horizontal screens,” Mangrich said. “The MAX screens represent a departure from old concepts, and introduce new features and designs based on the latest technologies.”

While the screens are now offered in sizes and configurations ranging from 5-by-16 ft to 8-by-24 ft in triple, double- and single- deck models, the prototype was an 8-by- 20-ft triple deck with a dual mechanism, Mangrich said. It is field proven, opening the door to further development of the solution. “The MAX line of screens has proven to meet expectations, but is still in its early stages,” he said. “The encouraging feedback is what drives us to achieve new goals.”

Screen design is intended to improve user safety and facilitate maintenance, the company reported. The line provides maximum headroom between decks to speed and simplify media changeouts, McLanahan reported.

The shaft integrates bronze sleeves at both ends for protection when the outer race of the bearing could potentially turn on the shaft, the company reported. “This reduces unnecessary downtime and only requires the sleeve to be replaced,” Mc- Lanahan reported. “All components slide onto the shaft, allowing for easy removal and installation.”

The straight shaft features jacking bolts in the mechanism tube that supports the shaft during changeouts, eliminating the need for a crane “and thus improving safety while minimizing downtime,” the company reported. “The screens are also equipped with a quick-change spring kit that allows for the removal of the spring pack with only minimal vertical clearance and no need for an overhead crane.”

The line provides operators looking to upgrade their screening operations with a solution that fits directly into their system with no rework to existing structures, the company reported. “MAX Series Vibrating Screens make it easy to get more from your screen without needing to change your entire operation,” McLanahan reported. “Customers can be sure they are getting a solution that will give them more uptime, easier maintenance and a safer working environment.”

The line is also well-suited for a miner designing a new plant, Mangrich said. “What customers often desire is the ability to package the screen with a crusher,” he said. “We now have the ability to provide single-source responsibility when making major modifications to a system or opening up a new greenfield location.”

And this is where the market research paid off, with a solution that compliments other offerings, Mangrich said. “As a family- owned company, McLanahan is small enough to be dynamic in its management, and large enough to offer complex equipment systems,” he said. “McLanahan can now truly offer a complete system from the face to the filter press, and include the key component, the McLanahan MAX Screen.”

One-stop Plant Shopping

Sandvik launched three plant acquisition

solutions in June. Two enable customers

to speedily order entire plants from a

menu. The third aims to produce a contract

and a relationship that meets the

exact needs of the customer.

FastPlant offers more than a dozen predefined plants, each of which can be “quoted and ordered in just one meeting” and will be shipped out within 12 weeks, Sandvik reported. The SmartPlant offering is similar but empowers the customer to “select the SmartStations that meet their crushing and screening needs and place them together to create their plant.” And CustomPlant initiates the customer into a “long-term plant partnership that delivers a new level of integration between the customer and Sandvik,” the company reported.

The launch formalizes offerings largely previously offered by the company, said Pär Stigmer, director, plant solutions, crushing and screening, Sandvik Mining and Rock Technology. FastPlant offers 13 designs and is geared toward quarries, Stigmer said. The solution is ideal for “a small-style-type of industrial process, with maybe one shift a day, five shifts per week,” he said.

The FastPlant offerings “cater” to operations mining “less-abrasive” material, Stigmer said. And how Sandvik operates, he said, will buffer the risks inherent in selling to potential wildcat startups. “For me it is not a transactional deal or business we’re in,” he said. “Even though we talk about partnerships, especifically for the CustomPlant segment, you could say that we are in a service partnership and a supplier partnership regardless of the offering that we carry.”

The selection process is designed to be completed in a single meeting that begins with an information exchange. “We try to find out what the customer needs, what are they trying to produce and why are they trying to produce this, and how can we optimize our proposal for the solution based on their needs,” Stigmer said. Sandvik gathers the desired plant capacity, the mined material characteristics, the end-product specs, and then suggests some logical process flow options. The discussion moves to Sandvik’s recommendations for proper machine use and how that fits into the design.

Next comes pricing and the quote. And the first shipment leaves the port within three months, Stigmer said. “Fast- Plant is about time to market.” SmartPlant customers could range in size from large quarries to small mines, Stigmer said. “That spans most of our customer base.” The goal, he said, “is to enable our customers to use different the different modularized smart stations.” The resulting plants are “automation ready and can be upgraded to accommodate the customer’s evolving requirements,” Sandvik reported.

The idea is to ensure the plant “will be future-proofed by the configuration itself,” Stigmer said. “These are not just mechanical modules; they are also electrical and automation modules,” he said. “What we try to do is we try to bring out smart modules that are preconfigured for a plant.” Those modules are interchangeable, allowing the miner to upgrade when needed, Stigmer said.

The selection process for a SmartPlant is similar in many ways to that of a Fast- Plant. For the former, Sandvik expects the customer to already have a predefined design. “They have full freedom of designing any type of flow sheet they want,” Stigmer said. “We’re saying we have the modules, the smart stations, let’s configure them to your needs,” he said. “What we try to enable is the fastest time to market by being preemptive of the modularity.”

CustomPlant is for the junior miner open to an Early Contractor Involvement agreement. The solution has Sandvik managing “product risks” and leveraging “skills not only from Sandvik but from customers,” Stigmer said. The solution arose from the basic need of the contractor to establish a robust relationship early enough with the miner to prevent critical misunderstandings. “If you send us specifications, it will be very difficult for you to blindly pencil down everything that one needs to know for us to take that and basically as a black box deliver something back to you that 100% meets those needs,” Stigmer said. “It is very hard to detail out very complicated models.” And the bigger the contract, the greater the risk of misinterpretation of its details by either party. “Either the customer carries the risk, or we carry the risk, and in both cases, nobody really wanted the risk,” Stigmer said.

With CustomPlant, Sandvik is looped in on the basic engineering and design of the plant. To facilitate the dialogue, the company developed a system that generates a 3D conceptual model to illustrate design specifications and details.

The effect, among other things, is to draw out a clearer picture of the customer’s expectations and the ways they can be met. That, Stigmer said, is good for the relationship, and can help it be an enduring one. “The reason why they can be sure is that we want to be part of the operations — if it is one year or 20 years, we will be there to back them up.”