Top Miners: As Prices Rose in 2017, Production Fell but Beat Guidance

Last year, rising prices enabled the world’s top gold producers to increase revenues or

cash flow as total gold output dipped again

By Jesse Morton, Technical Writer

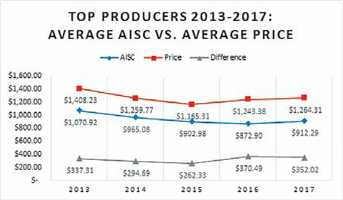

Most of the miners reported raising either revenues, cash flow or profits and a couple reported all three. The reason, most reported, was the two-year rally in gold prices. Barrick reported that the increase in prices came despite central bank action. “During the 12-month period to December 2017, the U.S. Federal Reserve raised its benchmark interest rate a total of four times,” it reported, “but despite periods of weakness heading into each of these hikes, 2017 proved to be a positive year for the gold price, which recorded an overall gain of 13.2%.” That overall gain did not translate into substantially higher received prices for some companies. Of the 13 companies researched for this article, nine reported a 1% increase in average gold price received yoy. When adjusted for inflation, the price represented a sideways movement. Sibanye-Stillwater reported, “The year under review was a period in which the gold price essentially remained in a phase of consolidation, after a steep decline from Brexit related peaks in mid-2016.”

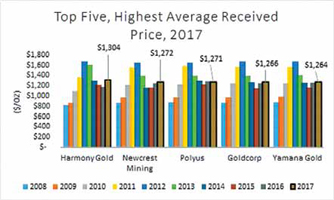

The average price received was $1,264.31/oz, up roughly 2% yoy and 8% since 2015; and down almost 24% from the 2012 high of $1,661/oz. Harmony gold reported the highest average price received, at $1,304/oz. Sibanye reported the lowest, at $1,254/oz. Polyus reported that its average received price fell roughly 1% to $1,271/oz.

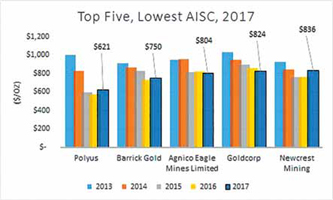

Costs, on average rose. The average AISC for the group was 912.29/oz, up 5% yoy, but down 14% from the five-year high of $1,010.92/oz in 2013. Of the group, Polyus reported the lowest AISC for the fourth year in a row, at $572/oz. Harmony Gold reported the highest AISC, at $1,182/ oz, which represented an increase of 18% yoy. That increase was due in part to increased labor costs resulting from an enterprise- wide employee bonus, an uptick in expenditures on consumables, some of which went to maintenance work, and an acquisition of a partner’s interest in a mine. Sibanye-Stillwater also reported a yoy AISC increase of 18%, which it attributed in part to “unsustainably high costs associated” with a mine it effectively closed in Q4; and Newcrest reported a 10% increase.

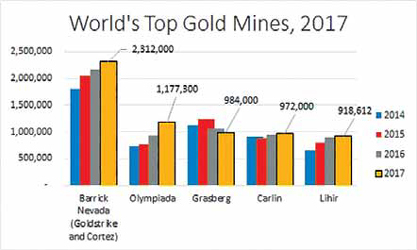

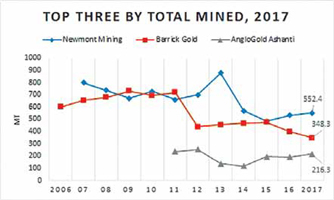

The group combined to produce 31.72 million oz. That number is down less than 1% yoy, and down 3% from the five-year high of 32.79 million oz in 2014. Total gold output for the group has fallen two years in a row. That came as no surprise to the miners, who reported it was all in line with the guidance they released to investors. Ranking them based on total gold output provides an incomplete picture because only a couple of the top five in output were ranked in the top five for highest price received and the top five for lowest AISC. Instead what it reveals is who was most successful of making the most of the potentially waning days of a negative-interest- rate environment.

No. 1 Barrick (5.32M Oz)

Barrick reported net earnings of $1.4

billion in 2017, up from $655 million

in 2016. (The company reported a $2.8

billion loss in 2015.) The company’s revenues

approached $8.4 billion in 2017,

down 2% yoy and down 7% since 2015.

It nixed roughly $1.5 billion in debt. AISC

rose 3% yoy in 2017 to $750/oz.

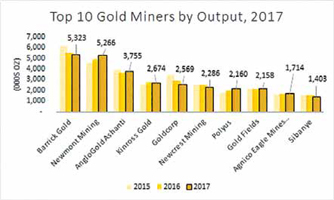

Total ore mined and total ore processed fell 13% and 25% yoy, respectively. And total gold production fell for the seventh straight year. It was down 4% yoy and is down 38% from the 8.64 million oz produced in 2006. Last year’s decline was attributed to the impact of the company’s divestment of its 50% interest in Veladero, effective June 30, 2017. That aside, “gold production decreased by 1% or 48,000 oz due to lower grade and recovery at Turquoise Ridge, lower grade at Pueblo Viejo and Hemlo, lower recovery at Lagunas Norte and lower throughput at Acacia as a result of reduced operations at Bulyanhulu,” Barrick reported. These decreases were partially offset by higher production at the company’s, and the world’s, biggest mine.

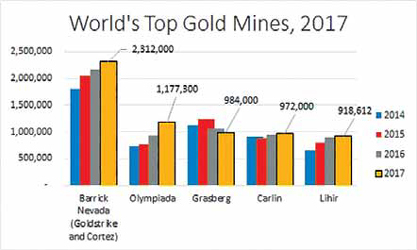

In its 2017 annual report, Barrick combines the numbers from Goldstrike and Cortez under the title of Barrick Nevada, which now amounts to the biggest pureplay gold mine in the world. Production there increased 7% yoy to 2.3 million oz. For reserves, Barrick reports it has 64.4 Million oz in 1.29 billion metric tons (mt) of ore grading at 1.55 grams per mt (g/mt). “That compares to 86 million and 1.33 g/mt at the end of 2016,” Barrick reported. “The decline in oz primarily reflects the reclassification of Pascua-Lama reserves to resources.” Exploration drilling added 7.9 million oz in 2017, “more than replacing the 6.2 million oz depleted through production,” the company reported. Reserves for Barrick Nevada reached 20.4 million oz by December 31, 2017, an 11% increase yoy.

No. 2 Newmont (5.27M Oz)

Newmont posted an adjusted net income

of $780 million, up 26% yoy. It also reported

an 87% increase yoy in what it

calls free cash flow. The increases were

“primarily due to higher gold production

and higher average realized gold prices,”

the company reported. AISC was up 1%

yoy to $924/oz, but down more than 22%

from the 2012 high of $1,192/oz.

Total ore mined and processed increased 4% and 8% yoy, respectively. The company mined 552.4 mt, roughly 59% more than Barrick. Thus, it “increased gold production 8% from the prior year due to “a full year’s production from Merian and Long Canyon, partially offset by lower grades at Twin Creeks, Yanacocha and Tanami, further impacted by adverse weather conditions at Yanacocha and Tanami,” Newmont reported.” Production increased 7% yoy at Carlin to 972,000 oz. It fell 18% yoy at Yanacocha to 535,000 oz. It fell 2% at Boddington to 787,000 oz.

Newmont’s reserves were reported to be 73.7 million oz as of December 31, 2016; and 81.6 million oz as of December 31, 2015. The company expects to produce between 4.9 and 5.4 million oz in 2018. Commercial production is calendared for the second half of 2018 at both Subika Underground and Twin Creeks Underground.

No. 3 AngloGold Ashanti (3.8M Oz)

In 2017, AngloGold Ashanti raised gold

income by more than $270 million to

almost $4.4 billion. Adjusted headline

earnings fell from $143 million to $9

million. And debt rose by almost $100

million to $2 billion. AISC rose 7% yoy to $1,054/oz, but was down roughly 18%

from the 2012 high of $1,285/oz.

Total ore mined increased 13% yoy to 216.3 mt, and total ore processed fell 3% to 81.35 mt. The company produced 3% more gold yoy, breaking from a trend in declining output dating back to 2013. The company reported production from Siguiri and Geita, in Continental Africa, and Sunrise Dam and Tropicana, in Australia, “offset a lower output from South Africa, where an agreement was reached to sell the Moab Khotsong and Kopanang mines, and where TauTona is undergoing an orderly closure process.” The Australian mines benefitted from optimization initiatives and the Continental Africa operations mined higher grades, enabling total gold output there to increase 10% yoy. “The strong performance across the portfolio, particularly in the fourth quarter, demonstrated continued cost and operating discipline and improvements through internallyfunded, low-capital, high-return brownfields investments,” AngloGold Ashanti reported.

The company listed 49.5 million oz in reserves as of the end of 2017. (It reported 50.1 million oz as of the end of 2016.) This year, AngloGold Ashanti expects to produce between 3.325 million oz and 3.45 million oz. Completion and commissioning of the Mponeng Phase 1 (life extension) project is slated for mid-2018.

Total ore mined and total ore processed fell 14% and 13% yoy, respectively. The company processed 124.8 mt last year, second only to Newmont. The result was a 4% yoy drop in total gold output, which has hovered in the 2.6 to 2.7 million oz range for six of the last seven years. Last year’s decline in total gold output was “due to a decrease in production at Kupol due to lower grades, at Paracatu due to a temporary curtailment as a result of lower than average rainfall in the area, and at Maricunga due to the suspension of mining and crushing activities in 2016,” Kinross reported. “These decreases were offset by higher production at Bald Mountain as a result of more oz recovered from the leach pads and higher grades, as well as at Round Mountain and Tasiast due to higher grades.”

As of year-end 2017, Kinross reported reserves of 25.9 million oz. “The decrease of 5.1 million oz in estimated gold reserves compared to year-end 2016 was mainly a result of the sale of Cerro Casale, which accounted for 5.8 million oz in estimated mineral reserves,” the company reported.

Kinross predicts 2018 total gold output to hit 2.5 million oz., “which is in line with our average production over the last several years.” The Phase One project at Tasiast is set to reach commercial production by July. “Phase One is expected to almost double Tasiast’s production to approximately 400,000 Au eq. oz, and significantly reduce AISC,” Kinross reported. “Mining of high-grade ore at Moroshka is expected to commence in the second half of 2018 for processing in the Kupol mill.” A new heap-leach pad is scheduled for completion in mid-2018 at Fort Knox Gilmore.

Last year, the company bought: Kinross’ 25% interest in Cerro Casale and a 100% interest in the Quebrada Seca exploration project; an additional 25% interest in Cerro Casale from Barrick; Exeter and its 100% owned Caspiche Project. Also last year, it formed a 50/50 joint operation with Barrick on Norte Abierto.

The company reported it sold: Los Filos to Leagold Mining Corp.; its 100% interest in the Cerro Blanco project to Bluestone Resources; its 21% interest in the San Nicolas copper-zinc project; and its 100% interest in the Camino Rojo project, “part of the Peñasquito segment,” to Orla Mining Ltd.

AISC fell 4% yoy to $824/oz, down 20% from the 2013 high of $1,031/oz. It saw its average received price increase 2% yoy and ranked fourth out of the group for the metric. Total ore processed fell 36% yoy to 48.3 mt, and total gold output fell 11%, the steepest decline for the group. This happened according to plan. “Gold production in 2017 exceeded the midpoint of the company’s gold production guidance of 2.5 million oz,” Goldcorp reported. Lower production and gold sales were thus attributed to lower grades, “an increase in operating costs, and the impact of the receipt in 2016 of insurance proceeds relating to oxygen plant failures in 2015.” Total gold output at Pueblo Viejo fell 7% yoy to 650,000 oz after rising 22% yoy in 2016. It rose 2% at Penasquito, to 476,000 oz after declining a whopping 46% yoy in 2016.

The company is targeting reserves of 60 million oz by 2021. Last year, “its proven and probable gold mineral reserves increased to 53.5 million oz at June 30, 2017, from 42.3 million oz of gold mineral reserves at June 30, 2016, a 26% increase,” Goldcorp reported. Reserves at Pueblo Viejo fell 10% yoy to 7.2 million oz as of December 31, 2017.

Goldcorp forecasts producing roughly 2.5 million oz in 2018. Median guidance for Pueblo Viejo is 600,000 oz, which would represent an 8% decline yoy. Nonetheless, “the company expects gold production to increase to approximately 3 million oz by 2021,” Goldcorp reported. “This is a result of the ramp-up to nameplate capacity at Cerro Negro and Éléonore, increased grades at Peñasquito following an intensive stripping campaign, the execution of the Pyrite Leach project at Peñasquito and the materials handling project at Musselwhite, and initial production from the Borden and Coffee projects.”

Total ore mined and total ore processed fell 2% and 5% yoy, respectively. Total gold output at Lihir increased 2% yoy to 918,612 oz after increasing 23% yoy in 2016. Company-wide, however, total gold output fell 8% yoy. That decline came despite an uptick in production to close the calendar year. “Gold production in the December 2017 quarter was higher than the prior quarter, driven by increased production at Cadia, Lihir, Bonikro and Telfer, partially offset by a decrease in production at Gosowong,” Newcrest reported. Quarterly production numbers at Lihir were detrimentally impacted by a motor failure in a SAG mill. For Q4, production at Cadia from the two Panel Cave projects increased, with recoveries improving to 81%, the company reported. In December, the company sold its Bonikro gold mine in Côte d’Ivoire to a consortium consisting of F&M Gold Resources and Africa Finance Corp.

In a presentation including results on the half-year ending at December 31, 2017, Newcrest reported its reserve life for Cadia was at more than 45 years, and Lihir was at more than 25 years. It put its reserve base at Lihir and Cadia at roughly 25 million oz each. The company will wrap up feasibility studies at Golpu and Cadia in 2018. Cadia is set to hit a 30 mt per year (mt/y) of ore production rate by end June 2018. Lihir’s mill throughput rate will reportedly hit 15 mt/y by the end of June 2019. Official guidance for the year ending June 30, 2018 is between 2.4 and 2.7 million oz.

No. 7 Polyus (2.16M Oz)

Polyus reported its revenue for 2017 increased

roughly 11% yoy to $2.7 billion,

“driven by increased sales volumes.” Raw

earnings rose 11% yoy to $1.7 billion.

“Adjusted net profit for 2017 amounted

to $1 billion, a 7% increase from the prior

year,” Polyus reported. Debt fell yoy to

$3 billion, down roughly $170 million.

Polyus reported the lowest AISC of the

group for the fourth straight year, despite

it rising 9% yoy to $621/oz. It also reported

the third highest average received

price, at $1,271/oz, a decline of 1% yoy.

The company reported its reserves rank it second in the world. It reported 68 million oz, as of December 31, 2017, “down from 71 million oz as of December 31, 2016, which reflects mining depletion during 2017.” More than 95% of the company’s reserves are located within the operating assets. The Krasnoyarsk Business Unit has 28 million oz at Olympiada and 9.6 million oz at Blagodatnoye. “Ore reserves at Verninskoye and Kuranakh were recorded at 5.1 million oz and 4.4 million oz, respectively,” Polyus reported. “Natalka has estimated ore reserves of 16 million oz.” The average grade is reportedly 1.8 g/mt, “inclusive of alluvial operations and lower grade ore for heap leaching operations,” the company reported. “The gold grade of ore to be processed in plants stands at 2 g/mt.”

The company expects to produce between 2.38 million oz and 2.43 million oz in 2018. “In the second half of the year, we anticipate Natalka to be fully ramped up,” the company reported. “We will also continue with debottlenecking initiatives at our existing operations that have already strongly contributed to our operational results during the last several years.”

No. 8 Gold Fields (2.158M Oz)

Gold Fields reported its revenue for 2017

rose by 3% yoy to $2.76 billion. Profits before

taxes fell 57% yoy to $152.4 million.

After taxes, the company posted a $20.8

million loss. Debt rose $137 million, or

11% yoy. Capital expenditures hit $840

million. Net cash flow fell by almost $300

million. Company-wide total gold output

rose 1% yoy. The company reported it met

its goals. “Despite operating in a difficult

economic environment — the gold price

has fallen by almost 20% over the fiveyear

period — Gold Fields has continuously

met its production and cost targets and

generated $419 million in net cash-inflow

over that period,” the company reported.

“Attributable production for the year was

above our guided 2.1 million oz to 2.15

million oz and 2016 production.”

The company increased gold reserves by 890,000 oz to 49.01 million oz as of the end of 2017. Guidance for 2018 is for between 2.08 Million oz and 2.10 million oz. The year is anticipated to bring gradual improvement in production at South Deep, with a projected output of 321,000 oz; a rise in Damang’s production to 160,000 oz from 144,000 oz, but lower output from Tarkwa; and a “decline in gold-equivalent production at Cerro Corona from 307,000 oz in 2017 to 280,000 oz in 2018, due to expectations of a lower copper price.” The company is reportedly set to spend $341 million at Damang “over a number of years to extend the mine’s life to 2025, and in Australia we have partnered with Gold Road to develop the Gruyere project in the highly prospective Yamarna district in Western Australia.”

No. 9 Agnico Eagle (1.7M Oz)

Agnico Eagle Mines Ltd. reported its

2017 net income rose 54% yoy to $243

million. Revenues from gold increased

$91 million yoy to $2.1 billion. Total

liabilities increased roughly 12% yoy to

$2.9 billion, “primarily due to a $169.2

million net increase in long-term debt and

a $80.8 million increase in reclamation

provisions.” Of the group, Agnico Eagle

had the third lowest AISC, at $804/oz,

which was down 2% yoy and down 16%

from the 2014 high of $954/oz.

Total ore mined rose 1% to 31 mt, the most for the miner in at least the last half decade. The result was “record production during the year of 1.71 million oz with lower total cash costs, exceeding our production forecast and beating our cost guidance for the sixth consecutive year,” the company reported. The company reported the fewest number of lost time accidents in its history, and, separately, increased its dividend by 10% in Q4.

The company plans to produce 1.53 million oz in 2018. This year it will finalize development of Meliadine and Amaruq, after which “capex will drop significantly in 2019, as benefits begin to flow from the substantial investments we have made in Nunavut,” Agnico Eagle reported. Mining at Lapa, an underground mine in the Abitibi region (Quebec, Canada), “is expected to end in the first quarter of 2018, with ore being stockpiled for processing,” the company reported. “Milling operations are planned to resume in March 2018.” Underground mining at LaRonde’s Zone 5 will reach commercial production in Q3 2018, “while evaluation is underway on a phased approach to LaRonde 3, a project that would develop deeper levels for mining beyond 2022.” Production is calendared to begin at the Pinos Altos Sinter Deposit operation in Late 2018.

No. 10 Sibanye-Stillwater (1.4M Oz)

Sibanye-Stillwater reported its 2017 revenue

hit $3.8 billion, up 47% yoy. Net

debt hit $1.9 billion, up from $525 million last year. The company posted a loss

for the year of $370 million, after posting

a profit of $254 million for 2016. AISC

rose 18% yoy to $1,128/oz, the highest

since 2013. Total ore processed fell 16%

yoy to 19 mt, and total gold output fell

7%, to its lowest level since 2012.

The cessation of underground operations at Cooke contributed to the decline in company-wide production numbers. “Underground production from the Cooke operations decreased by 52%,” Sibanye-Stillwater reported. “At Beatrix, underground gold production decreased by 8%.”

Underground production declined 21% yoy at Driefontein due to lower grades. Total gold output at Kloof underground production increased 8% yoy, with mill throughput reaching 2.2 mt, the company reported. “Surface throughput increased by 34% to 3.6 mt, owing to the greater volumes of Venterspost surface material treated at the Ezulwini plant.” As of December 31, 2017, the company reported reserves of 25.7 million oz. “This represents a reduction of 3 million oz (10%), which, after accounting for depletion of 1.5 million oz due to mining activities in 2017, equates to a 6% decrease yoy.”

The company predicts 2018 gold production of between 1.24 million oz and 1.29 million oz. In March, the company will transfer assets from its West Rand operation to DRDGOLD in exchange “for a 38% stake in that company with an option to acquire a majority stake,” Sibanye-Stillwater reported. That will “enable us to realize immediate value from the West Rand tailings retreatment project while providing future optionality without the need to incur significant capital investment.”

The second is central bank activity and the expectation of it. So much so is this a commonly understood reality in the sector that when, in its annual report, Newmont lists the 13 factors that it has identified as influencing price, five of them pertain to central bank activities: gold purchases or leases by central banks, the relative strength of the dollar, expectations of inflation, interest rates, and central bank fiscal policies.

The value of the dollar on the market, which is decided in part by the Federal Reserve’s key rates, impacted gold prices throughout 2017, Barrick reported. “Over the year, the gold price was positively influenced by a weakening of the tradeweighted dollar to lows not seen since early 2015,” it reported. Throughout the year, the key rates at the Fed, the Bank of England, the Bank of Japan and the European Central Bank, in real terms, were all negative, meaning the interest rate was lower than the inflation rate. This lifted gold prices somewhat in 2017, and the anticipation of higher interest rates has since then had the opposite effect.

Going forward, however, central bank key rate hikes could either suppress gold prices or introduce price volatility, Goldcorp reported. “2018 marks a change in leadership at the Federal Reserve Bank, with market expectations for a continuation of their recent balance sheet normalization process and an additional three or four rate hikes in 2018,” the company reported. “In addition to any impact from interest rate policy, the dollar index is trading close to three-year lows, and uncertainty surrounding the US dollar’s direction during 2018 is likely to be reflected in future gold price volatility.” Indeed, the likelihood of Fed action quashing the gold price rally to backstop the dollar is high enough to bear mentioning in Barrick’s annual report. “The outlook for gold remains relatively muted, with expectations of the U.S. Federal Reserve raising rates in the U.S., capping upside in 2018,” the world’s foremost gold producer reported. “Gold demand remains relatively firm, however, and the specter of rising global inflation is likely to provide ongoing support below $1,300/oz in our view.”

Thus, according to the miners, it is likely central bank activity — whether it is the key rate hikes planned by the Federal Reserve or gold purchasing by the Chinese central bank to bolster the fledgling so-called petro-yuan3 — will be the foremost factor affecting gold prices and, in turn, production in 2018.