Glencore’s metallurgical coal production is expected to rise by 67% from 2017 to 2019 to 15 million mt with

Glencore’s metallurgical coal production is expected to rise by 67% from 2017 to 2019 to 15 million mt with

Hail Creek added to its portfolio. Last year, Glencore produced more than 87 million mt of coal from 17 mines

in

Queensland and New South Wales.

Last month, Rio Tinto announced three

separate deals that totaled $4.15 billion,

which will complete its exit from

coal. This includes $1.7 billion sale of

its interest in Hail Creek and Valeria to

Glencore, the $2.25 billion deal to sell

Kestrel to Adaro Energy and EMR Capital

and the $200 million transaction to sell

Winchester South to Whitehaven Coal.

The Kestrel longwall mine, located in

the Bowen Basin, 40 kilometers northeast

of Emerald in central Queensland, Australia,

produces high-quality coking and

thermal coal products for export markets.

In 2017, it produced 5.1 million metric

tons (mt) of coal, comprising 4.25 million

mt of hard coking coal and 840,000 mt

of thermal coal. Rio Tinto reported marketable

reserves for Kestrel of 146 million mt

and mineral resources of 241 million mt.

Glencore is purchasing Rio Tinto’s 82%

interest in Hail Creek and adjacent coal

resources, as well as its 71.2% interest

in the Valeria coal resource. The remaining

18% of Hail Creek is currently owned

by Nippon Steel Australia Pty Ltd (8%),

Marubeni Coal Pty Ltd (6.67%) and Sumisho

Coal Development Pty Ltd (3.33%).

Hail Creek is a large-scale, long-life

and low-cost mine producing two-thirds

premium quality hard coking coal and

one-third thermal coal for export. Located

120 km southwest of Mackay, Hail Creek

produced about 9.4 million mt of coal,

which was exported through the Dalrymple

Bay Coal Terminal. Hail Creek has resource

of 794 million mt with proven and

probable reserves of 142 million mt.

The Valeria thermal coal deposit is

located 265 km west of Rockhampton

and 67 km southeast of Glencore’s Clermont

managed coal operation. It has

resources of 762 million mt. The acquisition

is subject to regulatory approvals

and is expected to be completed in the

second half of 2018.

“This represents a 41% premium to our

valuation for Hail Creek, assuming a zero

valuation for the Valeria project,” said Viktor

Tanevski, senior research analyst, Wood

Mackenzie (WoodMac). “We estimate the

deal was struck at an implied long-term

benchmark hard coking coal price of $146/

mt and a benchmark thermal coal price of

$83/mt, which signals greater confidence

in higher longer-term prices.

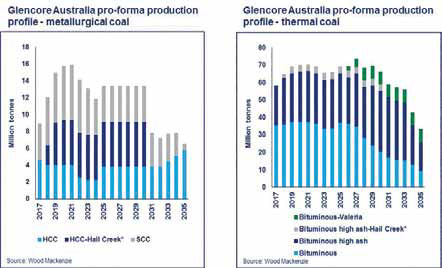

Glencore’s metallurgical coal production

is expected to rise by 67% from 2017

to 2019 to 15 million mt with Hail Creek

added to its portfolio (excluding the impact

of yet to be finalized transactions relating

to Hunter Valley Operations and Tahmoor).

The deal will revitalize Glencore’s hard

coking coal production profile which has

declined with the closure of its Oaky No. 1

mine in 2017, the winding down of coking

coal production from its NCA assets and

the conclusion of the sale of Tahmoor to

SIMEC. Last year, Glencore produced more

than 87 million mt of coal from 17 mines

in Queensland and New South Wales.

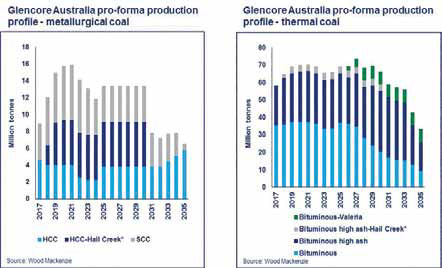

As part of the deal, Glencore will also

marginally add to its Australian thermal

coal supply with Hail Creek’s high-ash

thermal coal product, Tanevski explained.

It also offers a longer-term opportunity to

develop Valeria as a replacement for its

Clermont thermal coal mine which is estimated

to close in 2026.

The deal will increase Glencore’s margins.

“We estimate a total average margin

of $64/mt for its metallurgical coal post

deal in 2018, and a thermal margin at

$37/mt,” said Tanevski. “Even though

we estimate Hail Creek to lie within the

fourth quartile of the seaborne metallurgical

coal cost curve, it attracts a very good

return due to its high quality.”

Hail Creek’s high (25%) ash thermal

coal attracts a healthy margin because it

only incurs processing and re-handling

costs. There are no mining costs associated

with the thermal coal product, which

is derived from coarse plant rejects. The

value of the assets is highly sensitive to

price and this represents both the main

upside and downside risk for Glencore.

“While the total consideration is at a

premium to our valuation, the break-even

price is only marginally higher than our

long-term valuation price assumption,”

Tanevski said. “An increase of only 12%

is required to bridge the consideration -

valuation gap.”

The sale of Winchester South could

also unlock potential coal output that

would have likely been delayed under Rio

Tinto’s ownership given competing portfolio

interests, Tanevski explained.

As featured in Womp 2018 Vol 04 - www.womp-int.com