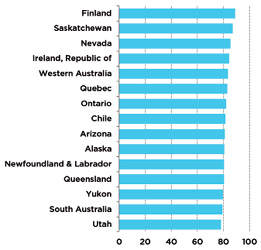

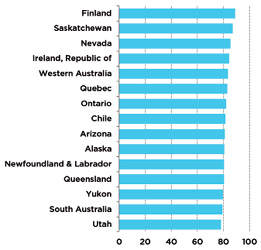

This list of top 15 places to conduct mining business was pulled

from a recently released report from the Fraser Institute.

Finland Tops Fraser’s 2017 Mining Survey

The survey assesses how mineral endowments and public policy factors such as taxation and regulatory uncertainty affect exploration and mining investment. The 2017 survey ranks 91 jurisdictions worldwide, including countries, states and provinces, on their attractiveness to investors based on responses from mining executives.

A total of 360 responses were received for the 2017 survey. The companies that participated reported exploration spending of $2.3 billion in 2017, up from $1.9 billion for the same companies in 2016.

The overall Investment Attractiveness Index is constructed by combining the survey’s Best Practices Mineral Potential Index, which rates regions based on their geologic attractiveness, and its Policy Perception Index, a composite index that measures the effects of government policy on attitudes toward exploration investment.

The report noted that analysis of regional trends continues to indicate a stark difference in investment attractiveness between Australia, Canada and the United States, and the rest of the world. Canada moved slightly ahead of Australia as the most attractive region in the world for investment in 2017, and the United States nearly tied with Australia. Six jurisdictions — Latin America and the Caribbean, Africa, Europe, the United States, Australia and Canada — all saw a decrease in their relative investment attractiveness during the year. Australia experienced a 9% decline in its regional median score from 2016, while Africa experienced an 11% decline.

“In general, investment attractiveness is declining in most of the world’s regions,” the report stated. This is in contrast to a year earlier, when the report said, “in general, the climate for investment appears to be slightly improving.” Policy factors examined by the survey included uncertainty concerning the administration of current regulations, environmental regulations, regulatory duplication, the legal system and taxation regime, uncertainty concerning protected areas and disputed land claims, infrastructure, socioeconomic and community development conditions, trade barriers, political stability, labor regulations, quality of the geological database, security, and labor and skills availability.

The Fraser Institute survey includes numerous quotes from company executives regarding experiences with regulatory issues in individual jurisdictions. Among these comments: “There is a lack of consistency in the application of regulations in British Columbia. Some regions have one set of expectations, particularly environmental, while others are very different. Every time the BC government tries to ‘simplify’ its application process, it actually becomes more complicated.” – A consulting company consultant.

“Saskatchewan has a great permitting process that meets time lines and provides certainty for investors. – An exploration company president. “In Chile, administration requirements have been streamlined for permitting processes, creating certainty for investors.” – A consulting company consultant. “In Brazil, the granting of exploration licenses has been suspended in most states. This drastic action is a major deterrent for investors.” – A consulting company manager.

Fraser Institute’s “Survey of Mining Companies 2017” is available as a free download at www.fraserinstitute.org.