Prospectors Are Feeling More Positive

The annual PDAC Convention attracts investors, analysts, mining executives, prospectors, geologists, Indigenous peoples, government officials, and students from roughly 125 countries. “This year’s convention was full of energy and excitement for the year ahead,” said PDAC President Glenn Mullan, referring to sold out exhibitor space, panel discussions, courses, workshops, and networking events. “After experiencing several years of economic challenges, today the mineral exploration and mining industry is experiencing a renaissance and renewed sense of confidence.”

PDAC, in partnership with the World Economic Forum, hosted the International Mines Ministers Summit (IMMS) for the third year, bringing together 26 ministers responsible for mining from around the world — the largest turnout to date. This year’s summit focused on the various ways in which trust can be fostered to enhance and expand the contributions that the mineral exploration and mining sector has on the prosperity and development of nations.

Toronto is the leading financial center for the mining sector. Mining and exploration companies hoping to attract investors display core samples, give presentations and mingle with mine financiers. Similarly, the engineering and drilling firms that support the exploration geologists and other professionals in this sector display their equipment and services.

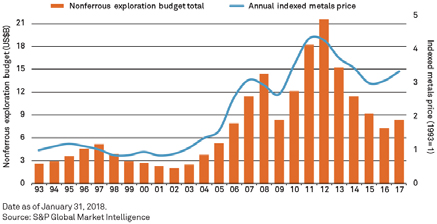

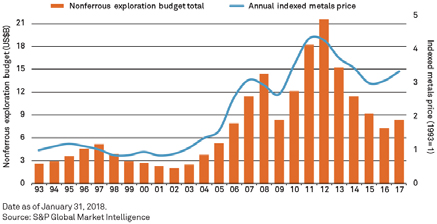

The mood throughout the convention was very upbeat and rightfully so. Global spending on the search for nonferrous metals rose to an estimated $8.4 billion in 2017, compared to $7.3 billion in 2016. This represented the first annual increase in exploration spending after four consecutive years of declining investment, according to S&P Global Market Intelligence. For 25 years, S&P has reached out to mining companies to conduct their World Exploration Trends survey, which reports exploration plans, and they are expecting an increase of 15% to 18% for 2018. For the full report visit https://spglobal.com/marketintelligence