Inventory Management Study Shows How

Mining Stacks Up Against Other Sectors

New cross-industry survey illuminates the landscape and challenges of inventory

management and optimization

The study asserted that historically, asset-intensive companies such as mining have a somewhat sub-optimal record when it comes to managing inventory, specifically excess, obsolete, incorrect material, and/or wrong quantities in stock. That said, there is no doubt that when a piece of equipment goes down in one of these industries, everyone mobilizes to “get the oxcart out of the ditch” and ensure the asset is back online as quickly as possible, according to study by contributing author Andy Flores, a partner at ScottMadden.

However, the systemic issues related to not having the right mix of inventory on hand can often go unaddressed as the pressures on asset management personnel compel them to have material on hand “just in case.” The real challenge then is determining what the right amount of inventory is for infrequently used items in an asset-intensive environment where downtime subtracts from net income.

The survey was designed to address

three elements:

• Provide up-to-date information about

the application of inventory optimization

practices across asset-intensive

industries;

• Compare practices across several industries

that maintain MRO inventory environments;

and

• Review metrics for inventory and asset

reliability to understand the relationship

between a selection of inventory management

practices and performance.

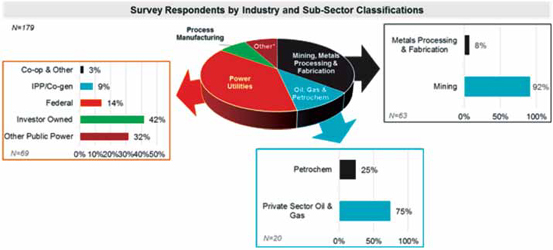

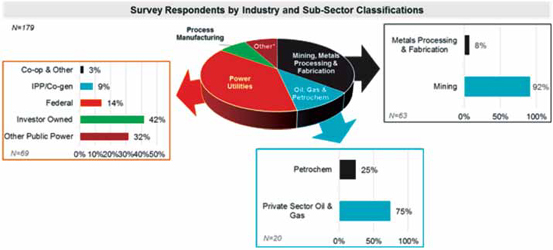

The survey questionnaire consisted of 11 questions focused on inventory optimization practices and three questions related to inventory and asset performance. It involved more than 170 respondents in mining, power utilities, metals, processing and fabrication, oil, gas, and petrochemicals, and other industries.

Inventory optimization, according to

the author, is a cross-functional exercise

that requires the right practices

(process, technology, etc.) to execute

effectively and deliver high-performance

results. Key takeaways from the study

results involve:

Accountability for inventory optimization

– The survey results indicate that companies,

regardless of industry, assign

responsibility for inventory optimization

to individuals or groups within separate

business units, though a growing percentage

of respondents (30%) assign responsibility

to a dedicated individual or group

at the corporate or business unit level.

Assignment of stocking level criteria – Approximately

50% of survey respondents

across industries indicated some kind of

system-generated or automated calculation

to assign inventory stocking level

criteria, while 24% of all participants still

use manual calculations.

Reassessment of stocking level criteria

– Frequency of inventory stocking level

reassessment ranged widely from “every

time a purchase is made” (21%) to

“only when a stock out occurs” (5%),

but the largest response category was

“other” (31%) in which participants

suggested that the reassessment frequency

is driven by numerous factors

that may vary depending on the type

of inventory.

Degree of integration across materials

management and other systems – The

largest number of respondents indicated

that the degree of integration between

the materials management system and

work order/asset management systems

is “somewhat integrated” (44%). This

indicates that challenges and barriers

to “fully integrated” (the integration level

reported by 36% of respondents) are

common.

Key performance metrics reported in

the survey include:

Inventory performance metrics – More

than half (53%) of all respondents across

all industry groups use Inventory Turns

Ratio, and less than a third use Line Fill

Rate (32%).

Asset performance metrics – Use of asset

performance metrics varied by industry,

with the most common metrics being:

– Mining, Metals Processing & Fabrication

– Equivalent Availability Factor

(33% adoption)

– Oil, Gas and Petrochemicals – % Production

Lost Due to Unplanned Maintenance

(50%)

– Power Utilities – Equivalent Availability

Factor (16%)

Performance metric results were as

follows:

Inventory Turns – Only 9% of respondents

across all industries reported “three or

more,” and 40% of respondents in oil,

gas and petrochemicals and power utilities

reported “less than 1.”

Line Fill Rate – 45% of respondents

across all industries reported “95% or

more,” driven by approximately 70% of

power utilities respondents, but the remaining

responses were evenly distributed

across all other ranges from 80% to

94.99%.

Line Fill Rate for Critical Spares – 53% of

all respondents reported “98% or more,”

led by approximately 60% of mining,

metals processing & fabrication respondents

and approximately 50% of power

utilities respondents.

Complete results from the survey are available for purchase at www.scottmadden. com.