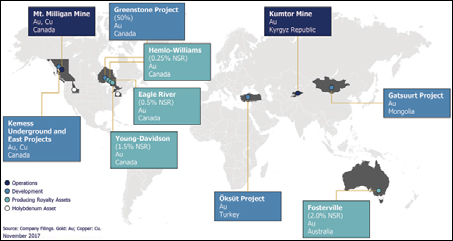

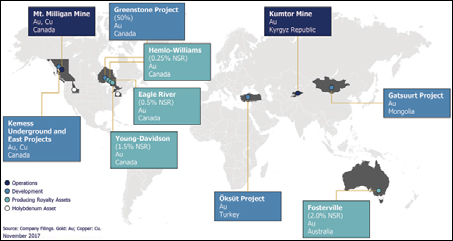

With the acquisition of AuRico, Centerra expands its global footprint.

Centerra Purchases AuRico Metals

AuRico Metals is developing the Kemess property in British Columbia, Canada, and also has a portfolio that includes a 1.5% net smelter return (NSR) royalty on the Young-Davidson gold mine in Ontario and a 2% NSR royalty on the Fosterville mine in Australia. Together with its Kumtor mine in the Kyrgyz Republic and the Mount Milligan mine in British Columbia, Canada, Centerra expects to establish itself as a low-cost gold producer with a geographically diversified footprint and peer-leading development pipeline.

“In the future, as the company delivers on building out this development pipeline, its production base will be sustained and continue to grow with sector-leading operating margins positioning the company to generate robust free cash flows for many years to come,” said Stephen A. Lang, chairman and director of Centerra.

The proposed acquisition is expected to be financed through a combination of a new $125 million acquisition facility and cash on hand at Centerra.