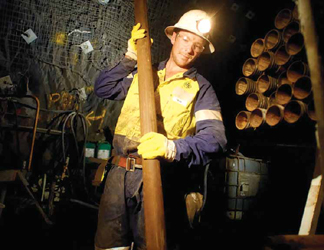

Rio Tinto’s Oyu Tolgoi copper mine was slated to deploy Cave Tracker after the system

was tested at two of the company’s other mines. Above, drilling before concreting at

Oyu Tolgoi. (Photo: Rio Tinto))

Block Cave Ops Benefit From

Real-time Data

Proven monitoring systems help underground miners envision the previously

unforeseeable, forge plans, streamline processes and cut costs

By Jesse Morton, Technical Writer

Tracking Cave Propagation

Developed by CRCMining, Elexon Mining

and Rio Tinto, Cave Tracker places rugged

magnetic beacons into holes drilled

into rock of strategic interest, usually

above the extraction level. The beacons

travel with the caved muck toward the extraction

level. That movement is tracked

with detectors located in and around the

mine. Thus, cave propagation can be captured

in real time, empowering miners

with critical data.

The proof of concept was conducted at Northparkes copper and gold mine, then owned by Rio Tinto. A prototype system was then trialed at Rio Tinto’s Argyle underground diamond mine in Australia in 2014. As of last year, it was slated for deployment to Rio’s Oyu Tolgoi copper mine in Mongolia. Also last year it nabbed Elexon a semifinalist slot in the Australian Technologies Competition. It is currently being deployed to Newcrest’s Cadia East gold mine in New South Wales. After three years of trials and tests, the system, which is intended to work in conjunction with other in-situ Elexon products, gives miners a glimpse of what was previously invisible: real-time ore flow, Simon Steffen, business manager, Elexon Mining, said. “The data captured so far has shown effects that were never actually ‘seen’ before,” he said. “For example, rat holing was clearly identifiable.”

Seeing into rock presents a formidable challenge as Wi-Fi and most radio waves will not penetrate through deep rock. Low frequency magnetic signals, however, will.

Cave Tracker’s beacons employ battery- powered spinning magnets that generate a magnetic field. The batteries have an up to 10-year operating life, depending on how often the magnet is spun. At Argyle, for example, the beacons are set to transmit every three days. “The background magnetic field of the Earth has no effect on the system’s operation,” Steffen said. “For calculating the Beacon’s distance, only magnetic signals very close to the beacon’s frequency will be considered. Other signals are ignored. Magnetic noise in the beacon’s frequency spectrum can affect the reading, but most of the noise is filtered out by algorithms.”

Larger beacons allow bigger magnets to be used, generating stronger signals. A 135-millimeter (mm)-diameter beacon has a proven transmission range of 200 meters (m). The 76-mm beacon can talk to a receiver 150 m away. “We are currently working on increasing the range by improving our signal processing algorithms,” Steffen said. “Testing thus far has yielded promising results.”

Placement of the beacons is determined by the type of flow effect that is desired to be monitored, as well as the access constraints. For example, beacons placed at the mine boundaries can reveal if the cave is propagating into undesired areas. Beacons placed around fault boundaries can detect if the cave has propagated through the fault, and that material is being drawn from the correct locations. “The goal is to get the best monitoring data possible,” Steffen said, “And ideally the beacon would be installed in a high density in the cave.”

The beacons are usually installed into drill holes. “To come up with a Beacon installation program, an iterative approach using the system’s analysis software is common.” This allows the installation to be optimized for performance and cost.

When envisioning an installation, the miner should first determine the primary areas of interest in the cave. “Geological domains and their rock mass properties determine cave-ability,” he said. “Expected fragmentation and cave propagation in conjunction with the mine plan will drive this point.”

Next, use of existing drill holes and the cost of additional drilling should be considered. “The availability of drilling locations will determine the lengths of the required holes and if it is technically viable to drill into the volumes of interest,” Steffen said. “The hole lengths will define the drilling costs.” Ultimately, costs can determine how many and where the beacons are located.

When a basic plan is hatched, Elexon calculates the predesign feasibility, Steffen said. “To assess installation design, we perform sensitivity simulations based on proposed installation designs,” he said. “If available, we include numerical modeling results provided by packages such as Itasca’s Rebop.”

To survive the trip, the beacons, which are comprised of batteries, electronics, magnet and motor assembly, are encased in a shell designed to withstand immense pressure. The shell can withstand forces such as localized pressure from “tons of rock leaning onto it, impact forces from dropping from the cave back through an airgap onto the muck pile and fluid pressure of a head pressure of more than 1,000 m encountered during grouting,” Steffen said. “The Beacon has internal features that protect batteries, electronics and spinning magnets from impacts.” The detectors also can withstand high fluid pressure, he said.

Beacons get extracted through the drawpoints by LHDs, Steffen said. “The LHD then dumps them with the ore.” Working in conjunction with Elexon’s Networked Smart Marker System, Cave Tracker can paint a picture of anomalies in muck that could pose safety threats, such as air gaps. The markers, which are like wireless TDRs, detect movement in the range of centimeters, whereas Cave Tracker detects it in the range of meters, Steffen said. An advantage of the Networked Smart Markers and the beacons is they require no cables that can be snapped by hole displacements. “Networked Smart Markers measure the propagation of the seismogenic zone and the cave back while Cave Tracker will detect mass movement,” he said. “Combining the data can be used to indicate the presence of an air gap.”

Knowing the location and size of an air gap empowers the miner to manage it. Meanwhile, real-time data on cave propagation will empower miners to plan with exactitude, improve process controls and thus reduce dilution, Steffen said. “Efficiency gains are to be expected through better control over cave growth, through delayed waste entries and improved ramping up of production,” he said. “For future caves, extraction, undercut layouts, and block heights can be optimized for better recovery and lower development cost.”

Exact planning, better processes, lower development costs and optimized ore recovery will significantly offset the drilling costs that accompany deploying the system, Steffen said. “The financial benefits through higher recovery, lower dilution and better predictability of mine performance would be in the hundreds of millions of dollars for a mid- to largescale project,” he said. “Compare that to an investment into drilling monitoring holes and installing Cave Tracker equipment, for which the costs would be lower than or around $10 million for a largescale installation.”

Inventory Tracking and Draw Cards

Last June, Glencore announced the deployment

of Modular’s DISPATCH Underground

2015 Fleet Management System

(FMS) to its George Fisher zinc mine in

North Queensland, Australia. There the

system is being rolled out to help manage a fleet of loaders (LHDs) and trucks.

At the time of the announcement, Chris

McCleave, general manager of the mine,

said, “With the implementation of (the)

system, we ultimately hope to improve

productivity through increased equipment

availability and improved utilization

of mobile assets, while also positively

impacting operator safety.”

Accomplishing that would align with the history of the technology, described as a fully integrated mine management system. To summarize it, previous writeups flashed adjectives like automated, scalable, full-featured, highly configurable, and end-to-end, descriptors increasingly common in press releases on modern open-pit mine management systems. In this case, however, they describe a system for underground operations.

The 2015 update, like its predecessor version, focuses on equipment surveillance in real time via a grid of RFID tags, readers and WiFi zones. When a loader, for example, is in a WiFi zone, the in-cab mobile computer talks to the DISPATCH FMS central server, sharing and receiving real-time data on planned and actual work. When out of range, the event data generated is saved to the computer. When back in range, the computer uploads the data to the server, which then automatically compensates for the lag. Logically, the FMS also advertises facilitated communication between management and operators.

Company literature on the system itemizes the upgrade’s new features, which target process optimization. They include advanced development and production process management, comprehensive active task management, expanded workflow automation and heightened data capture abilities. In short, the system was upgraded to more tightly monitor operators and equipment, nix some common user errors, and fully ensure materials go where they should when they should.

It does this by collecting more and better data, and by automating more tasks and workflows, Steven Peugh, global sales manager, Underground FMS, Modular Mining Systems, said. “The overall impression of the core fleet management functionality is that we are on the mark with the amount, types, and levels of data that the FMS collects and disseminates,” he said. “The production tracking, development workflow advancement, and equipment position tracking features greatly improve the mines’ operational visibility, enabling them to be more efficient and productive.”

Two of the system’s modules are designed specifically to help ensure muck, in this case, caved muck, is moved according to plan. Material Inventory module tracks quantities and qualities of materials and enables survey personnel to reconcile planned and actual values using data from manual surveys. And Draw Cards module, used exclusively in block caving environments, enables management of draw point extraction plans.

First, grade information, in the form of survey or assay data, is either imported or entered into the FMS from thirdparty mine-planning applications. Next, the RFID grid captures the exact movements of specific haulers, which reveals the exact movements of stock and waste. “The module uses LHD bucket or truck tray fill factor values to calculate by tonnage or volume the quantity of material moved among production locations,” Peugh said. “Accordingly, material quantities are incremented or decremented in the system.”

Hauler arrival and departure data are automatically captured, Peugh said. “This functionality minimizes the operator’s need for manual data capture by operators,” he said, “thus enabling the operator to remain focused on the tasks at hand.”

The primary deliverable of the module is real-time access to critical data, Peugh said. This empowers miners to follow material as it is moved, identify material re-handling, prevent the dumping of waste into ore stockpiles, reduce the frequency of manual surveys, and track dynamic material quantities and qualities of stockpiles and ore passes. “For block caving mines, the module facilitates tracking of tonnes moved at ore passes to prevent over- or under-extraction,” he said. “Mines also gain the ability to track additional material properties, including the presence of penalty minerals, to better assist the mineral processing team.”

So far, Peugh said, Modular has received positive feedback from an underground miner in Australia who used the module to manage ore pass inventory and to track volumes and grade parameters at intermediate muck piles.

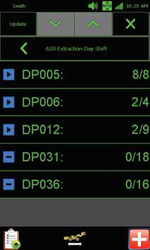

The Draw Cards module assists in block cave mining by automating some of the oversight tasks for LHDs. The module presents LHD operators with individual draw tasks corresponding to the draw point extraction plan for the current shift. The FMS imports .csv files from third-party mine-planning tools, and then automatically creates the draw cards. The cards include information on extraction location, number of draw points, planned start date, shift, assigned equipment, extraction status, and numbers of planned and completed draws.

Some of this information appears on the Mobile Application Draw Cards screen, which displays on the in-cab mobile field computer. “Draw Cards are transmitted to each assigned LHD via the mine’s communication network,” Peugh said. “The user interface presents only information that is pertinent to the task, enabling the operator to obtain instructions at a glance.”

That information includes the extraction location and the real-time extraction counts. Those counts are a deliverable of the Material Inventory module. That same data is accessible to the supervisor. “The Draw Cards perspective in the FMS’ Desktop Application utilizes color-coding and simple icons to communicate draw status,” Peugh said. “The supervisor can see actual-verses-planned deviations and variances.”

The operators can use the Mobile Application to communicate a change of plan. “That initiates a corresponding, corrective workflow to remedy the issue,” Peugh said. “The operator can also send a text message to the dispatcher or supervisor via the mobile field computer.”

The module enables a smooth transition between shifts, at least when it comes to transferring forward unfinished work. “When a Draw Card has unfinished work at the end of the shift, the FMS creates a new Draw Card for the following shift,” Peugh said. “The new Draw Card includes only the planned draws that the outgoing operator failed to complete.”