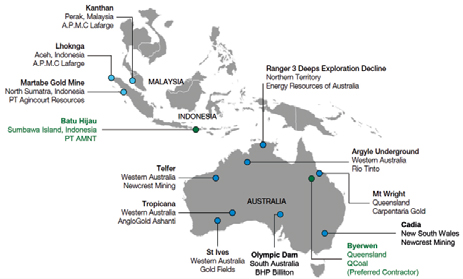

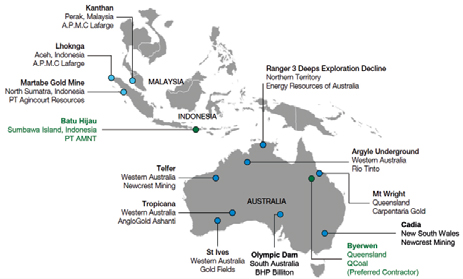

Macmahon’s existing operations are spread across multiple projects in Australia and Southeast Asia, with the

proposed Batu Hijau project to build on existing experience and presence in Indonesia.

Macmahon Advances Service Agreement for Batu Hijau

“We are thrilled at the prospect of working with PT AMNT at Batu Hijau,” said Michael Finnegan, CEO, Macmahon. “If completed, this transaction will see Macmahon’s scale significantly increase and that brings with it a number of benefits, which will assist us in the execution of new and existing projects. It will make us a stronger and more robust business, and will provide us with a supportive and strategically aligned major shareholder which should help us to grow even further.

“We have been working hard on this transaction for some time now, and are looking forward to achieving completion so that we can start operations at Batu Hijau and deliver the benefits of that to all of our shareholders,” he said. AMNT acquired an 82.2% interest in Batu Hijau in late 2016 from Newmont and Sumitomo. The mine is a large, openpit, porphyry deposit located on Sumbawa Island, Indonesia. It’s the second largest copper-gold mine in Indonesia behind Grasberg. There is potential to extend the scope of work to include the undeveloped Elang and Nangka deposits in the future.

“This transaction is important in allowing PT AMNT to achieve important operational restructuring goals, which will allow us to more efficiently extract the resources from the Batu Hijau deposit, while simultaneously allowing us to explore and develop other opportunities in the region,” said Alexander Ramlie, director, AMNT. “Macmahon has a strong team in place, which we highly respect, and, which, we believe, will be invaluable to PT AMNT as we execute our longer-term business goals. We look forward to working with Macmahon at Batu Hijau and to assisting Macmahon in growing its business regionally and in Indonesia.”

Production at Batu Hijau commenced in 2000 with remaining life-of-mine production of approximately 1.5 million metric tons (mt) of copper and 3.5 million oz of gold anticipated over 14 years (excluding the other potential development opportunities). AMNT’s mine plan includes removal of waste to access the next stage of ore reserves, with processing of stockpiles thereafter.

The life-of-mine mining services contract is expected to generate $2.9 billion in revenue over the 14 years. A total of $1.8 billion in revenue is expected over the first five years, once full operations commence. Macmahon described the agreement as an “alliance-style” contract designed to align interests. It includes cost-plus payments. It allows up to 12 months for the ramp up period (Phase 1) in which the performance targets will be agreed. Macmahon will then commence the full scope of mining services. The margin during full operations is based on higher rates of preagreed return on capital or margin on costs. During full operations, potential exists for upside and downside sharing based on performance against targets (but with a floor on downside at nil contract margin). The performance targets can be reset annually.

Macmahon will acquire mobile equipment valued at $145.6 million from AMNT, which includes 111 haul trucks, seven rope shovels, three hydraulic excavators, four wheel loaders, seven blasthole drills and 61 dozers. The majority of equipment has been maintained by Trakindo (a local Cat dealer) and subject to close inspection by Macmahon. The contract’s pricing mechanism allows for the equipment value to be recouped via monthly depreciation charges over five years. AMNT has agreed to fund any significant additional equipment required in the future and provide the use of this equipment to Macmahon free of charge. If the Mining Services Contract is terminated, AMNT is required to repurchase the equipment at a pre-agreed value, which decreases to zero over five years.

AMC Singapore, a subsidiary of AMNT, will be issued a 44.3% shareholding in Macmahon as consideration for the mobile equipment. The transaction needs support from Macmahon shareholders and AMNT’s lenders. Macmahon’s directors fully support the transaction.