Introduced at last year’s MINExpo, Atlas Copco’s Diamec Smart 8 is now the largest

model in the Diamec range, and is capable of coring to depths of up to 2,000 m

(6,500 ft), the company states.

Budgets Trimmed, with Closer Focus

Has exploration spending bottomed out? Which companies are most optimistic?

Will grassroots project spending pick up? E&MJ looks for answers.

By Simon Walker, European Editor

This is, of course, nothing new to anyone who has been involved in mining and exploration though a number of economic cycles. It is a sad but true fact that mining still seems to be locked into a self-perpetuating boom-and-bust mentality, spending like there is no tomorrow when commodity prices are high, and then suffering the consequences in each succeeding downturn. The current cycle is, unfortunately, no exception.

In a presentation to the PDAC in March, Richard Schodde, managing director of the Australian firm, MinEx Consulting, put the situation into some perspective. “Global exploration expenditure (for bulks and non-ferrous) reached an all-time high of $33 billion in 2012,” he explained. “In the four years since then, it has dropped by 69% to $10.2 billion.”

His paper Recent Trends and Outlook for Global Exploration was, Schodde pointed out, effectively an update on a previous PDAC presentation that looked at global discovery trends since 1950, focusing on the period since 2007. In terms of commodities, his data show that: “gold continues to be the main target (accounting for 39% of expenditure),” he said, “followed by base metals (29%) and bulk minerals (14%). The country spending most on exploration is China (26%) followed by Canada (11%) and Australia (10%).”

Schodde went on to describe how exploration success has also slipped in recent years. “Historically, some 70 to 80 moderate-sized (or larger) deposits were found each year in the world. This peaked at 149 discoveries in 2007 and has fallen dramatically since then,” he noted, while acknowledging that “we need to remember that it does take time for discoveries to be reported and fully-drilled out.

“Most of the discoveries were of small size and low value. Tier-1 (world-class) deposits are rare … and typically only 20-30 are found each decade,” he went on. “Over the last decade, only 12 were found, four of which were in Canada.

Over the last decade, due to a massive increase in spending and only a modest increase in the number of deposits found, the exploration industry’s performance declined, Schodde stated, with the average cost per discovery having risen threefold from $86 million to $238 million in constant 2016 dollars. What is more concerning, he pointed out, is the fact that the industry has switched from wealth creation to wealth destruction because of the lack of Tier 1 discoveries.

Putting this into figures, Schodde believes that the value/cost (V/C) ratio worldwide has declined to 0.47, although this average marks some significant regional differences. Thus while exploration expenditure in China has increased substantially, albeit with little to show for it, its V/C ratio is 0.33, similar to that of Latin America. By contrast, Australia remained on the positive side of the balance at 0.54, while Canada did even better, with a V/C ratio of 0.62.

“There are many factors associated

with the recent decline in discovery performance,”

Schodde said. “Some are

structural and others are cyclical. These

include:

• Increased emphasis on brownfield exploration

and feasibility studies at the

expense of greenfield exploration;

• The reduction in drilling activity; and

• The higher input costs for drilling and

geologists during in the boom years.”

Who Spent What...?

A glance at the most recent crop of annual

reports is revealing in terms of what some

of the world’s mining companies spent

last year, where and for what. As an example,

Anglo American reported that its

exploration expenditure during 2016 was

$107 million, down from $152 million in

2015. The commodity-wide decrease was

mainly attributable to an overall reduction

in drilling activities, the company said.

Copper was also BHP Billiton’s principal target during 2016, with the company spending $161 million during the calendar year on minerals exploration. Its greenfield work is predominantly focused on advancing copper targets within Chile, Peru, Canada, South Australia and the southwest United States, the company said.

Rio Tinto led the big spenders with its $497 million exploration and evaluation budget last year, down from $576 million in 2015 and $747 million in 2014. “As the next generation of deposits becomes more difficult to find and develop, we continue our focus on exploration,” the company wrote in its annual report. “Rio Tinto has one of the largest exploration programs in the industry, and in 2016 we were active in 14 countries across a range of commodities.

“In total,” the company said, “2016 exploration and evaluation activity covered eight commodities across a range of greenfield and brownfield environments. In recent years, Rio Tinto has shifted the emphasis of exploration expenditure to projects in the OECD and Peru in line with the increasing focus on copper exploration.”

Specific projects identified in Rio Tinto’s annual report included Roughrider (uranium) in Saskatchewan, Sanxai (bauxite) in Laos, La Granja (copper) in Peru, and Tamarack (nickel) in the USA. Brownfield projects included work on iron ore in Western Australia and bauxite in the Weipa region of northern Queensland, while the company remained in discussion with North Atlantic Potash over their exploration joint venture in Saskatchewan.

However, Rio Tinto noted that its five year exploration partnership with Chinalco in China has now ended, and it is retaining a presence in the country to monitor exploration opportunities and options for future partnerships.

Among the big copper producers, Antofagasta undertakes early-stage exploration with its core operations in Chile, but in response to the depressed copper market it cut its exploration and evaluation spending from $102 million in 2015 to $44 million in 2016. Internationally, the company reported working on projects in Argentina, Australia, Mexico and Zambia, with exploration in Canada and Australia generating new projects that will be evaluated during 2017.

Meanwhile, Freeport-McMoRan continued with its own budget-cutting, spending just $44 million on exploration last year compared with $96 million in 2015 and $109 million the previous year. Its indicated expenditure for 2017 is around $47 million, with its stated focus being on extensions to its existing mines.

...on What, and Where?

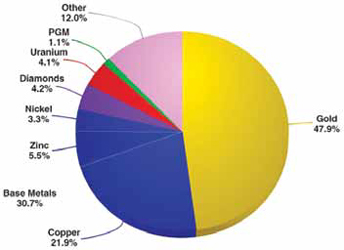

According to S&P Global Market Intelligence

in its PDAC-linked report Worldwide

Mining Exploration Trends, gold

remained the top-explored commodity in

2016, accounting for 48% of the global

exploration budget (See Figure 1).

However, in dollar terms gold exploration

declined to its lowest level since 2006,

dropping 16.3% to $3.30 billion. The

company bases its information on data

from 1,580 companies, which spent a

combined $6.89 billion on exploration

last year.

Within this umbrella figure, nickel was the metal least in favor as an exploration target, where-as companies were less likely to shelve work on lead and zinc projects.

S&P reported that Latin America remained the top regional destination for gold exploration, with 26% of the total gold budget. Within the region, Mexico attracted the largest gold allocation, followed by Chile, Peru and Colombia. However, on an individual basis, Australia overtook Canada as the top gold exploration destination for the first time since 2003, as shown in Figure 2. Over half of the total spent there on gold exploration was targeted at and near existing mines, although Australia was again the top destination for grassroots gold exploration.

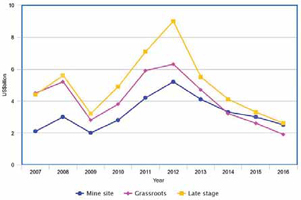

Writing in S&P’s Corporate Exploration Strategies report, the company’s Sean DeCoff noted that the spend on grassroots exploration fell to a new low of 28% of the total exploration budget last year, while minesite exploration reached a record high of 35%.

“Since grassroots spending is associated most strongly with new discoveries, the erosion of grassroots’ share of the worldwide total could potentially put pressure on future production due to a lack of new discoveries,” DeCoff added, pointing out that 2016 marked the third consecutive year in which companies allocated more to minesite work than to grassroots. This is illustrated in Figure 3, which shows the ten-year trends for spending on grassroots, mine site and late-stage exploration.

“The decline in grassroots’ share of overall budgets since the 1990s corresponds with the upward trend in the shares allocated to late-stage and mine site budgets,” DeCoff went on. “Companies have spent proportionally more on late-stage projects to move them towards production or to make them attractive for acquisition, while minesite work has been perceived as a less expensive and less risky means of replacing and adding reserves.”

Gold Companies on the Up

Sounding an optimistic note, Barrick

Gold pointed out that around 80% of its

total 2017 exploration budget of $185-

$225 million is being allocated to the

Americas. “After several years of exploration

focused primarily on existing core

districts and projects, we are increasing

our budget and broadening our focus to

include new greenfield opportunities,”

the company said.

With Barrick having actually spent $132 million on exploration and evaluation in 2016, well within its $115-145 million guidance range, the potential increase in spending this year is particularly welcome. Significant greenfield targets for the year within the company’s exploration portfolio include the Fourmile target, adjacent to Goldrush in Nevada, and the Frontera district on the border between Argentina and Chile.

Newmont has also indicated that it will be spending more on exploration this year. The company has said that it expects to boost its exploration and advanced projects expenditure by 22% from the $148 million spent in 2016, with about two-thirds of the budget going to fund more brownfield and greenfield exploration. For comparison, Newmont spent $156 million on exploration in 2015, and $163 million in 2014, so its year-on-year reductions have been notably less severe than those imposed by some other companies.

Goldcorp is another company that appears to be betting on a recovery. While it spent $34 million on exploration and evaluation in 2016, compared to $51 million in 2015, its exploration budget for 2017 is currently $100 million, with its efforts being targeted at precious metal properties in Canada, the United States, Mexico, and Central and South America. Goldcorp’s stated primary focus is on brownfield exploration, its approach to greenfield exploration being to make toehold investments in junior mining companies which operate in geological prospective terranes.

And echoing the positive trend for gold, Australia’s Newcrest Mining has an exploration budget of $60-80 million for the year to end-June, having spent $44 million in 2015-2016. The $23 million it spent in the first half-year, to the end of December, was 15% up on the comparable period in 2015-16, reflecting what the company referred to as its “growing portfolio of strategic partnerships, farm-in arrangements and investments across Asia-Pacific, West Africa and the Americas.”

Tools for the Job

Developed as a proprietary technology by

Ivanhoe Mines’ associate company, GoviEx

Gold, the Zeus induced polarization (IP)

system was instrumental in the discovery

of additional resources in the Oyu Tolgoi

district of Mongolia. In 2009 GoviEx used

the system on an expanded IP survey to

test the full extent, on strike and at depth,

of the 12 km-long chain of copper-gold

porphyry deposits that Ivanhoe had discovered

at Oyu Tolgoi since 2001.

GoviEx president and CEO, Govind Friedland, said at the time: “Zeus has the potential to revolutionize mineral exploration. It has enabled our field teams to accurately map important geophysical anomalies that likely would not be detectable with other existing and competing IP systems.”

According to GoviEx, while traditional IP surveys have typically been used on a mine scale, the Zeus system could be deployed regionally, increasing the efficiency and effectiveness of large-scale exploration programmes. The company’s chief geophysicist, Grant Hendrickson, explained that by using copper cables up to 20 km long, Zeus could transmit, receive and analyze the electrical signals that dissipate from well-mineralized bodies and their weakly-mineralized host rocks due to the strong induced polarization that was applied.

And now, eight years on, Zeus has been replaced by a new system, Typhoon, owned and operated by High Power Exploration (HPX), another private company within the Friedland group. HPX claims that “the Typhoon data acquisition system is the most accurate and powerful IP and EM geophysical survey technology available to base metal explorers today.”

Introduced in 2012, the first Typhoon unit is housed in a customized 20-ft container, together with a 230 kVA diesel generator. It has since undertaken surveys in Namibia, Chile and Australia and is designed for projects in open, flat terrain, HPX says. Since then, a further two units have been commissioned, in 2013 and 2014 respectively.

The second, a split system with the generator and Typhoon transmitter transported separately on flatbed trucks, was designed for work in remote and challenging terrain, while the third unit, which HPX used on the Conico copper prospect in Chile in 2015, has a modular design for the transmitter. Each of the two transmitter modules is heli-portable, which means that the system can be airlifted into areas that are completely inaccessible by surface transport. All three variants use the same high-power technology while being customized for use in different terrain, with the ancillary equipment required to perform either regional or focused IP and EM surveys including 25 km of high-voltage IP cable and five km of high-current EM cable.

HPX states that Typhoon has an order of magnitude more power than other commonly used transmitters, and in likefor- like comparison tests on the same site provides at least three-times better signal- to-noise ratios.

Last year, HPX used the Typhoon 2 system at its joint-venture San Matias copper- gold project with Cordoba Minerals in Colombia. The first phase survey, covering 7.5 km2 of the project area, involved the acquisition of 681 line-km of high-quality DC resistivity and IP data. The 3D conductivity and chargeability models generated from the data were integrated with existing geological information, helicopter- and ground-based magnetometer surveys and 3D-magnetic models to generate new drill targets. According to Cordoba, the results showed some of the strongest chargeability anomalies ever mapped with a Typhoon IP survey, at depths ranging from 50 m to 500 m.

In a second phase of the joint venture, HPX later undertook a 10,000-m drilling program to test targets identified from the initial Typhoon IP survey, as well as extending the Typhoon coverage of the property by a further 14 km2.

When it comes to interpreting exploration data, block modelling remains a foundation for all planning tools, according to Hexagon Mining. Earlier this year, the company introduced Geo- Logic which, it says, leverages the power of implicit modeling by sequencing surfaces and solids to create an airtight geological model. The outcome is an entirely reproducible, auditable geological model that can be quickly updated with new information.

Hexagon claims that GeoLogic saves time by allowing geologists to explore numerous interpretative scenarios, and build complex shapes directly from drillholes, rapidly and accurately. It allows a geologist to build a timeline of geological events to produce a series of interconnected MineSight solids and surfaces, ready to code into a block model.

Fully integrated with the company’s MineSight Planning Suite, GeoLogic features a smart vein-set creation and strata- layer stacking methodology based on MineSight’s true thicknesses functionality. It also automatically manages fault blocks and unconformities, while offering an intuitive approach to geomodelling, maintaining a fine balance between user control and guidance, Hexagon says.

On Show at MinExpo

A number of companies featured exploration-

related equipment and capabilities

at last year’s MinExpo in Las Vegas. For

example, the Atlas Copco display included

two exploration drill rigs on its stand,

where the focus was on operating safety.

Powered by a 160-kW (215-hp) Cummins engine, the rig is capable of drilling vertically to depths of up to 1,540 m (5,050 ft.) using standard-wall B core tube. For additional operator safety it can also be equipped with the Christensen rod-handling system. This provides hands-free rod tripping throughout the drilling cycle, meaning that there is no need to add or remove rods by hand.

The company’s other exploration exhibit there, the Diamec Smart 8, is the largest exploration rig in the Diamec range. Capable of taking cores at depths of up to 2,000 m, the rig has an advanced control system that allows all drilling, and rod and core-barrel handling, to be carried out automatically, allowing the operator to work from a safe distance.

Another Swedish company, Minalyze, exhibited its XRF-technology Minalyzer CS drill core scanner, which can analyse between 12 and 20 m of core per hour. Processing of the spectral data is done locally as scanning progresses, providing immediate assays on-site together with high-resolution core photographs, specific gravity data, RQD and digital structural logging.

In March the company reported that the Independence Group has become the first company to integrate a Minalyzer unit on site for routine data collection. Installed at Independence’s Nova nickel- copper-cobalt operation in Western Australia, where the first concentrates were shipped at the end of last year, the instrument is being used for target generation, geometallurgy, and resource and geotechnical domaining.

Part of the Australian Imdex group, Reflex launched its IQ-LOGGER last year. The company claims that core logging can now be done in one-tenth of the previous time, with results proven to be accurate and available in real-time. According to Reflex, the IQ-LOGGER is designed to ease the usually time-consuming and repetitive logging process, while the direct transfer of logging data to a cloud-based data platform provides a reliable digital audit trail.

Data can be transferred in real time to the cloud-based REFLEXHUB-IQ, where it is integrated with data from survey and orientation tools and is then made available for further analysis. At the time of the launch, prototype units were being rolled out to a number of resource companies for evaluation.

Irish drilling equipment company Mincon reported gaining a lot of attention at MinExpo for its new premium lines of DTH, RC and rotary drill rods along with related drill string components, as well as for its reverse circulation DTH hammers and drill bits. Mincon states that the productivity and reliability of the tooling used is key to success in exploration drilling. With more efficient hammers and bits, penetration is faster and higher quality sampling is obtained, resulting in lower overall costs per meter drilled.

Beginning the Upturn

If the gold sector is anything to go by,

the exploration business has turned the

corner and is beginning to pick up again.

Whether this newfound optimism can be

transferred to the search for other commodities

this year remains to be seen.

There is no question, however, that spending will have to increase before long, if for no other reason that resource depletion will become a driving force. Again, it is unclear whether companies will continue to focus mainly on near-mine work, or will be prepared to resume their quest for greenfield opportunities — which, of course, will be key in the longer term.

Stronger commodity prices will help. A quick look at spot price charts for the past year show all of the non-ferrous metals trading higher than they were six or nine months ago, with copper up nearly 20% and zinc doing even better. Gold, by contrast, is still struggling, although that does not seem to be a deterrent to higher exploration spending.

As Richard Schodde pointed out in his PDAC presentation: “The long-term outlook for exploration is positive. We are now at the bottom of the business cycle and subject to an expected moderate improvement in commodity prices, global exploration expenditures are set to rise by 60% over the next four years. “It’s now time to get back out in the field and start drilling!”