Gold Fields Spin-off Plan: Two Distinct, Focused Companies

Outlining the economic rationale for splitting Gold Fields into two distinct com-panies, Gold Fields CEO Nick Holland point-ed out that the share prices of major gold mining companies, including Gold Fields, have been flat or down over the past seven years, while “We’ve seen a gold price that has gone way beyond our wildest dreams.”

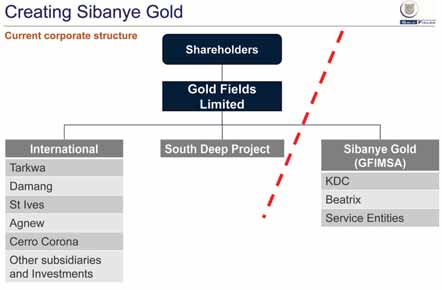

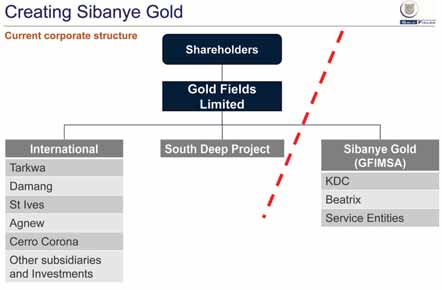

Looking for a way to deal with this dis-connect, Gold Fields focused on the fact that it has two distinct types of mining assets: 1) mature, deep-level, narrow-vein, tabular orebodies in South Africa, typically dipping at 30° to 35°, mining 1- to 3-m reef packages, which means they are typically labor intensive; and 2) open-pit and shallow underground international operations, the exception being the massive, deep-level South Deep development in South Africa, which will be a fully mechanized operation.

A decision was made to separate these asset types into two companies, rather than trying to manage their sometimes competing needs under a single corporate umbrella.

KDC and Beatrix are mature operations that mine deep to ultra-deep, narrow-vein, tabular orebodies. Mining depths range from 600 m to 3,345 m below surface at KDC and from 600 m to 2,155 m below surface at Beatrix.

In calendar year 2011, KDC produced 1.1 million oz of gold at total cash cost of $946/oz; Beatrix produced 347,000 oz at total cash cost of $957/oz. Production at both mines has declined steadily over recent years, and production costs per ounce have risen sharply. As of December 31, 2011, the two mines had a combined total of 22 million oz of gold in reserves and 79 million oz of gold in resources.

Spinning off KDC and Beatrix into Sibanye Gold will create a company that can focus on the specific requirements of these operations and that will not have to compete with other Gold Fields operations for capital. Cash flows from KDC and Beatrix will stay with Sibanye Gold. Goals for the new com-pany include reversing the declining pro-duction trend at the mines, extending the life of the mines, and ensuring the long-term sustainability of the company.

Sibanye Gold will have more than 35,000 employees; nearly 26,000 at KDC and 9,250 at Beatrix.

Neal Froneman, who was CEO of Gold One International, will become CEO of Sibanye Gold, and Charl Keyter, currently head of finance for Gold Fields’ interna-tional operations, will become the CFO. Froneman was at one time vice president and head of operations at Gold Fields.

Matthews S Moloko, currently a non-executive director of Gold Fields and exec-utive chair and founder of the Thesele Group, will become the non-executive chair of Sibanye Gold and will step down from the Gold Fields board.

Peter Turner, executive vice president for Gold Fields’ South Africa region, as well as the rest of the executive team for the region (excluding those dedicated to South Deep), and the senior operational management teams of the KDC and Beatrix gold mines will remain with Sibanye Gold.

Commenting on the future of Sibanye Gold, Froneman said, “These are not short life assets. On their current trajectory, if we do nothing else, they have 16 years of production left. There are a number of projects that will extend the life of these assets considerably, and they are not proj-ects that are going to consume a huge amount of capital.”

Asked if South African authorities have a positive view of the creation of Sibanye as an independent South African gold pro-ducer, Froneman said, “They do view this as positive.

“The unbundling itself does not lead to any job losses. I think one of the benefits that you’ve seen is that the cash flows out of KDC and Beatrix are ring-fenced and can be plowed back into those assets either in the form of capital or to share-holders in the form of dividends.So that is indeed positive. It certainly provides a lot more sustainability. So, on the whole I think it has been very well received.”

Following the unbundling, Gold Fields Ltd. will focus on cash flow generation, more predictable dividend payouts, and growth through the expansion and life extension of its remaining mines. “The South Deep project is core to our expansion plans, and we will continue to invest in this operation to secure the ramp-up to 700,000 oz/y,” Gold Fields CEO Nick Holland said.

Mineral reserves at South Deep totaled 40 million oz at year-end 2011.

Gold Fields’ international mines are Tarkwa and Damang in Ghana, Cerro Corona in Peru, and St. Ives and Agnew in Australia. During 2011, these mines pro-duced 2.2 million gold-equivalent oz, and at year-end 2011, their mineral reserves totaled 24 million oz.

Subject to approval by the JSE and the NYSE, Sibanye Gold will be listed as a separate and independent company on both exchanges in February 2013.