A prefeasibility study for Newcrest Mining’s Golpu copper-gold project proposes that the deposit be mined by

A prefeasibility study for Newcrest Mining’s Golpu copper-gold project proposes that the deposit be mined by

block caving, using mining methods similar to those employed at Newcrest’s Ridgeway and Cadia East mines

in New South Wales, Australia. Capital costs for the project are estimated at $4.8 billion.

Newcrest Mining reported in late August

2012 a very significant increase in the ore

reserve estimate for the Golpu porphyry

copper-gold deposit in Morobe province,

Papua New Guinea, following completion

of a technical prefeasibility study. The

deposit forms part of the Wafi-Golpu pro-ject in which Newcrest and Harmony Gold

each have a 50% interest.

The Golpu prefeasibility study supports

an updated ore reserve estimate containing

12.4 million oz of gold and 5.4 million mt

of copper, an increase of 11 million oz of

gold and 4.7 million mt of copper from the

previous estimate. The study also confirms

an expected mine life of more than 25

years and projected unit cash costs at the

bottom of the industry cost curve.

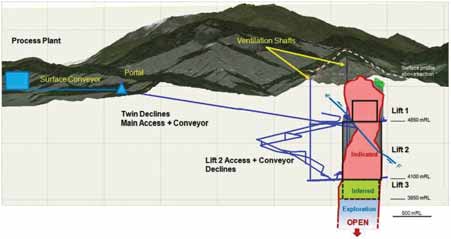

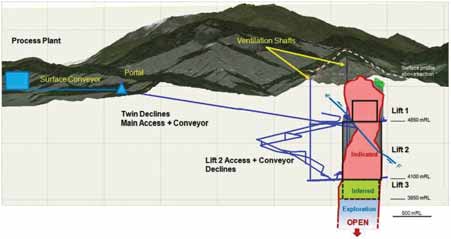

The prefeasibility study proposes that

the Golpu deposit be mined by block cav-ing, using mining methods similar to those

employed at Newcrest’s Ridgeway and

Cadia East mines in New South Wales,

Australia. Ore would treated by flotation to

produce a copper-gold concentrate.

Capital cost to establish the Golpu mine

and achieve first commercial production is

estimated at $4.8 billion. The mine is

anticipated to reach commercial produc-tion around 2019. Mine life is estimated at

26 years, with projected annual production

of up to 550,000 oz of gold and 300,000

mt of copper.

Before the Golpu project proceeds to

feasibility study, the joint venture partici-pants will engage with key stakeholders,

including government and landowner rep-resentatives, to ensure alignment on the

planned project development and key ele-ments of the next phase of work.

A concept study into the development

options for the nearby, high-sulphidation

epithermal Wafi gold deposit is continuing

and is expected to progress to prefeasibili-ty study later in 2012.

As featured in Womp 2012 Vol 10 - www.womp-int.com