The topic of mine planning has bubbled

to the surface recently on Internet mining

discussion groups. There’s one major

theme, surrounded by a galaxy of related

questions: Is mine planning—specifical-ly, long-term planning—a dying art,

squelched by industry-wide focus on

short-term results? Associated questions

range from ‘Does long-term planning

receive adequate management support?’

and ‘Does faster management turnover at

the operational level risk short-circuiting

any long-term plans in place?’ to ‘Should

the same personnel be responsible for

both short-term and long-term planning?’

and ‘Are planners being overwhelmed by

floods of raw exploration and operational

data, and do they have the time,

resources or training to separate the

wheat from the chaff?’

A brief example of how misapplication

or misinterpretation of data can cost a

mine is offered by software and services

supplier Ventyx (formerly Mincom,

recently acquired by ABB): Under-estimating coal thickness by 6 in. (152

mm) over an area as small as 11 acres

(4.45 ha) will result in a planned pro-duction shortfall of one unit train. If coal

is selling at $50/ton, that’s $500,000 of

revenue lost by the mine.

Bill Wilkinson, Ventyx’s product man-ager for MineScape, recently addressed

the formidable problem of staying afloat

in the rough waters of current mine-plan-ning demands in a paper titled Top Five

Challenges in Mine Planning . According

to Wilkinson: “Geologists and mining

engineers must account for a staggering

array of variables—geological samples

and data from the mine, the production

capacity of available equipment, machin-ery and manpower availability, customer

demand and commodity prices, product

cost assumptions, and the health and

safety of workers.

“Traditionally, the time and resources

required to continually collect this data

meant that no one could keep pace with

the reality of what’s happening at the

mine site. Furthermore, the process of

developing mine plans may utilize dis-parate systems, which introduces ineffi-ciencies in the process and more oppor-tunity for error. Additionally, inefficien-cies can be introduced by the technology

being employed, especially for geologi-cally complex areas and where large

amounts of data are being modeled.”

His ‘top five’ challenges include:

• Capturing the true complexity of miner-al deposits

Geological models gener-ated for initial feasibility studies are

often not detailed enough to provide an

accurate picture of a mine suitable for

creating detailed production plans—

and the software used to develop mod-els in a feasibility study may not be suit-able for the production environment.

• Updating mine plans with new data

from the field

Mine planning and

scheduling has traditionally been such

a time-consuming, labor-intensive pro-cess that it prohibits the timely genera-tion of new or updated plans as quick-ly as new data is received. This is com-pounded by staff turnover and a short-age of skilled mine planners and geolo-gists to execute planning.

• Generating accurate production and

budget forecasts

Managing natural

variations in an orebody is extremely

difficult, often leading to educated

guesses and “fudge” factors based on

past experience. Process inefficiencies

and technology deficiencies delay or pro-hibit the inclusion of the latest mine data

into the geological models and mine

plans in time to stay ahead of operations.

• Capitalizing on quick changing market

and operational conditions

Because

of the length of time required to per-form some of the geological modeling

and mine planning tasks, planning frequency may not be keeping pace with

the frequency of change. Mine plans

and schedules are difficult to adapt to

the changing conditions of a company’s

resources, such as its people, plant or

equipment.

• Streamlining the flow of information

between the geological modeling, mine

planning and mine scheduling process-es

If mine planning and scheduling

are not run from a single integrated sys-tem, geological and mine planning and

scheduling data must be moved and re-entered, increasing the likelihood of

introducing errors and decreasing mine

planning turnaround time.

In the final analysis, the right mix of

short- and long-term planning is a thorny

matter, hard to resolve because it

involves so many separate facets of an

operation’s structure. Concerning one

related issue, though, there is no ambi-guity: Software developers and ‘solutions

providers’ are providing a steady flow of

new or upgraded tools claimed to make

data handling and analysis, production

control and planning easier, with more

meaningful results.

A quick scan of recent product-implementation announcements, as fol-lows, provides a glimpse of how compa-nies are employing these products

in all phases of the exploration/develop-ment/mining sequence to meet their

specific data management and reporting

demands.

High-speed Core Scanning

All planning is based on data collection

and interpretation, and the quicker these

two phases are accomplished, the more

time available for formulating valid plans

and schedules. A new imaging tool devel-oped by a small Quebec, Canada-based

company is claimed to allow drill core

analysis to proceed at higher levels of

speed and accuracy. An interesting side

note is that, in most cases, the latest

data collection-and-analysis upgrades

and innovations offered to the industry

are based on the latest programming and

hardware technology; in this example,

however, the application traces its roots

back to 1960s-era science.

Photonic Knowledge says its Core

Mapper hyperspectral imaging applica-tion is a derivative of technology original-ly developed 50 years ago for remote

sensing from aircraft and satellites that

captures and analyzes information from

across the entire electromagnetic spec-trum. Much as the human eye sees light

in three bands (red, green and blue),

spectral imaging divides the spectrum

into many more bands—and Core Mapper

adapts this technology for use at drill-core scale with significantly higher reso-lution. The wavelength differences of

absorbed and reflected light from core

samples is analyzed in hundreds of very

narrow bands down to a resolution of 2

nanometers, or 2 billionths of a meter of

the visible and near infrared light spec-trum. This technological application has

a spatial precision of one square millime-ter, much greater than a square meter as

usually found in remote sensing.

According to Photonic Knowledge

President Eric Roberge, two junior com-panies—Northern Gold Mining Inc. and

Armistice Resources Corp.—recently be-gun using Core Mapper in their drilling

programs.

Northern Gold Mining, a Canadian junior company, has applied Photonic Knowledge’s Core Mapper

Northern Gold Mining, a Canadian junior company, has applied Photonic Knowledge’s Core Mapper

hyperspectral imaging technology to achieve quicker analysis of core samples taken from the company’s

Garrison gold property, where mineral-ization occurs primarily as native gold in in stockwork quartz

carbonate veins, as shown here.

Northern Gold Mining has retained

Photonic Knowledge to provide and oper-ate the Core Mapper technology to

enhance the determination of mineral and

metal content in drill core samples from

Northern Gold’s Garrison gold property, 90

km east of Timmins, Ontario. Near-term,

NGM plans to use Core Mapper to analyze

approximately 100,000 m of drill core

from previous operators on the property

with the expectation that several hundred

thousand meters of past, current and

future core drilling, and possibly includ-ing reverse circulation drill cuttings, will

be mapped using the technology.

Armistice, moving forward to begin

production at its McGarry gold mine in

the Kirkland Lake area of northeastern

Ontario, entered into a long-term service

agreement with Photonic Knowledge fol-lowing an extensive evaluation process

over the past year; the application will

involve scanning of about 6,100 m of

new and historic core.

Armistice expects the technology to

allow it to obtain an understanding of the

mineralogy and hydrothermal alteration

facies associated with historical re-sources more quickly and efficiently than

with the visual method normally used by

Armistice.

Also, in this structure of highly altered

volcanics, Armistice believes the new technology will allow it to better under-stand the mineralized system of the

prospective area, specifically, the two

types of gold-bearing environments with-in the alteration zone: green carbonate

and pyritic mudstone.

Core Mapper results can be integrated

with geological modeling allowing visual-ization in 2-D or even 3-D, and is capa-ble of mapping and analyzing up to

2,000 meters of core per day, said

Roberge, who also noted, “The major ad-vantage of this technology is its ability to

provide a picture to geologists with a

field of view that is 1,600X larger from

the conventional handheld spectrometer

and 900X more precise.”

Counting the Coal

Australia-based mining software provider

Micromine reports that a varied spectrum

of mineral producers have recently

applied products from its solutions port-folio. The list of clients has expanded to

include Endocoal, an Australian coal

exploration and development company;

and two Nevada gold mines belonging to

Newmont Mining Corp.

Endocoal, an ASX-listed company, is

one of the larger holders of EPC tene-ments in Queensland’s Bowen Basin,

with 11 tenements across approximately

5,200 km

2

. Endocoal’s stated intention

is to become a long-term, sustainable

supplier of diversified coal products to

global markets. Its two main projects are

Orion Downs and Rockwood: At Orion

Downs, the company reports 36 million

mt JORC resource of export-quality,

direct-ship thermal coal and is planning

a “flagship” surface mine at the proper-ty’s Meteor Downs South location; a

bankable feasibility study is currently

under way for this project, and the com-pany is tentatively planning first produc-tion from the mine during the second

half of 2013.

At the Rockwood project, Endocoal

reports a 312.5-million-mt JORC

resource of high rank, low volatile, PCI

coal, minable by underground methods,

and has set its next exploration target

at delineating 400- to 900-million-mt

of resources.

In the early stages of its exploration

program, Endocoal recognized it had no

data management software system in

place and had a clear need for data con-trol, validation and a ‘single truth’ data

source. Second, the company didn’t have

the capacity to create data models and

the cost to outsource resource estima-tions was deemed too expensive.

The company’s first step was to con-duct an assessment of the different soft-ware products in the Australian market.

By January 2011, Endocoal decided that

it was going to invest in two Micromine

products: Micromine for resource estima-tion and Geobank, a data management

software solution that provides an envi-ronment for capturing, validating, storing

and managing data from diverse sources,

using a scalable data model that can be

tailored to meet specific exploration and

mining requirements.

Endocoal began implementation of

the software in February 2011. Micro-mine reported that Endocoal made strong

progress in refining their Geobank data-base to ensure a validated and consistent

overview of their exploration activities.

They were then able to move swiftly into

the phase of using Micromine’s resource

estimation capabilities to build a portfo-lio of their coal reserves.

Endocoal believes that with the

Micromine software running internally, it

will receive long-term benefit from being

able to undertake resource modeling in-house. “We believe it will be simpler,

faster and cheaper to format prior to being

forwarded to external consultants to devel-op the resource models,” said Charles

Lord, Endocoal resource geologist.

“We now have a formatted database,

so we are able to achieve quicker turn-around times and to track data from the

field to the database more accurately.

Our internal and external workflows are

more sound and consistent, and most

importantly we have total confidence in

the quality of our data,” said Lord.

Controlling Costs, Pumping Up Production

Newmont’s Midas and Leeville under-ground gold mines in Nevada, USA,

recently installed Micromine’s Pitram

Control solution.

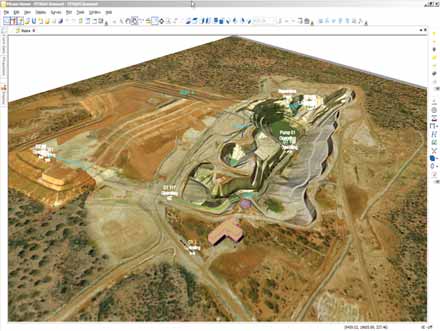

Fortescue Metals Group is using Mintec’s MineSight software suite to assist in planning the evolution of

Fortescue Metals Group is using Mintec’s MineSight software suite to assist in planning the evolution of

its rapidly expand-ing iron ore operations in Western Australia.

Both mines are located in the Carlin

Trend near Elko. Midas began production

in the late 1990s, under the ownership

of Franco-Nevada Mining Corp. In May

2001, Normandy Mining purchased

Midas from Franco-Nevada. Six months

later, Newmont became owner of the

mine following its merger with both

Normandy and Franco. The Leeville mine

began production in 2006. It was

Newmont's first underground mine in

Nevada accessed via a shaft.

Leeville employs around 250 workers

on a typical shift and has 11 haul trucks

in the mine fleet. The Midas mine

has low and high grade ores, both of

which are trucked to the surface by its

truck fleet.

Pitram, according to Micromine, is a

mine control and management reporting

solution that records, manages and

processes mine site data in real-time, pro-viding an overview of a mine site’s activi-ties by converting data into meaningful

information. The mine benefits from its

implementation though improved mana-gerial control that provides the potential

for managers to reduce costs, increase

production, and improve safety and busi-ness intelligence capabilities.

Pitram Control is one of four products

that comprise the Pitram product suite.

The Pitram suite provides an upgrade

path from the entry level Pitram Report

solution, through to the fully automated

Pitram Optimum solution.

System implementation at the two

Newmont mines began in December

2010 and was completed in September

2011. Keith Preston, head of monitoring

and dispatch at the Leeville mine, report-ed to Micromine that, “After considering

a variety of mine control solutions,

Newmont decided to introduce Pitram

Control, and include some functionalities

specific to Pitram Optimum. Following

the implementation, both sites are

already beginning to see the benefits that

the solution has to offer.

“Pitram Control has improved safety

by consistently monitoring miners and

mobile equipment. The solution also pro-vides detailed and real-time production

data that is vital to maintaining efficient

underground operations,” said Preston.

Micromine’s North America Manager,

Colin Smith, said, “Safety is very impor-tant to Newmont, therefore Pitram

Control’s safety capabilities were a

major consideration for the company.

Eventually, Pitram Control will interface

with Mine Site Technologies’ tagging sys-tem at both mines. This interface will

ensure that personnel in the control room

know the exact location of equipment

and miners at all times.”

Into the Iron

In April 2011, Tucson, Arizona, USA-based Mintec Inc. announced Fortescue Metals Group, Australia’s third largest

iron ore producer after BHP Billiton and

Rio Tinto, had selected MineSight soft-ware for mine planning.

MineSight Applications’ Perth manag-er, Glenn Wylde, said at the time, “This

sale represents a significant break-through for us in the Pilbara region.

Along with the sale to BC Iron last year,

and headway at other major sites, we are

pushing hard into one of the largest grow-ing mining regions in the world.”

Previous to the Fortescue announce-ment, in December 2010, MineSight

Applications announced it had landed a

deal in Mongolia, winning a contract to

supply software for open-pit operations at

the massive Oyu Tolgoi copper project.

In November 2011, Mintec intro-duced MineSight 7.0. According to

Mintec President John Davies, “The inte-gration of the tools in our short-term

planning suite—MineSight Interactive

Planner, MineSight Haulage, MineSight

Schedule Optimizer and Material

Manager—provides a formidable tool for

rapid schedule evaluation.

“MineSight Version 7.0 removes the

limits on block model sizes,” said

Davies. “Geologists and engineers using

block models to make mine plans and

production schedules can create mod-els without constraint, using the latest

version of MineSight 3-D. They can pro-duce a more detailed block model,

while maintaining the original block

model extents.”

The latest version provides 64-bit

support for drillhole management pro-grams, MineSight Data Analyst, (MSDA)

and MineSight Torque. “We have various

multithreaded critical engines for per-formance, and the new 64-bit applica-tions will run faster and have unlimited

memory footprints,” said Davies. “Some

of our MineSight Economic Planner runs

are 70 times faster than older versions

prior to 64-bit technology.”

Davies said that for clients, the im-provements mean easier modeling and

integrated mine planning. “And we are

continuing to develop new tools and

applications that will serve clients with

underground and stratigraphic deposits.”

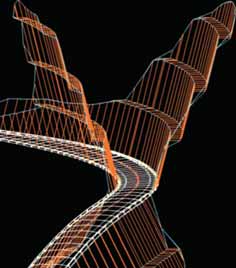

Among four new plug-in modules for Ventyx’s latest

Among four new plug-in modules for Ventyx’s latest

version of MineScape is a module that allows engineers

to quickly plan mine haulage roads and dragline routes.

New Name, New Version, New Features

The latest release of enterprise software

provider Ventyx’s MineScape product

suite, Version 5.2, includes multi-lan-guage support, greater performance

improvements to increase mine-planning

speed, new design features, and other

enhancements that further increase

usability, according to the suite’s devel-oper Mincom, which was acquired by

ABB in mid-2011 and merged with

ABB’s Network Control business group

under the Ventyx name.

Additionally, MineScape 5.2 intro-duces four new plug-ins:

• Haulage Roads, which guides engi-neers through the process of planning

mine-haulage roads and dragline paths.

Complex road designs can be complet-ed in minutes, according to Ventyx,

allowing engineers to compare multiple

design concepts, including horizontal

and vertical alignment and cut-and-fill volumes.

• Ring Design, which provides an inter-active, three-dimensional Computer

Aided Design (3-D CAD) environment

from which users can perform under -ground ring drill mine design and blast-ing. Visualization and design tools en-able users to take into consideration

both planned and prior mining at differ-ent levels, and generate complex under-ground mine designs within minutes.

• Underground Survey is specifically

designed for underground surveying,

which provides storage, management

and processing of large quantities of

survey-point data, as well as standard

survey and orthogonal measurements.

The 3-D CAD visualization tools enable

users to view any selection of survey

points and measurements stored in the

database, with the capability of draw-ing schematic drives for which ortho-gonal measurements exist.

• Schedule 3-D is an extension of the

MineScape Schedule tool, which pro-vides 3-D visualization of mining

blocks. Typically used for underground

mine scheduling, Schedule 3-D en-ables users to create, visualize and

select designed underground stoping

blocks, giving engineers a clear under-standing of the scheduling steps, thus

stream-lining the process.

Other improvements include the abil-ity to integrate third-party plug-ins, new

CAD dimension and measuring tools,

improvements in plotting capabilities to

make design time faster and more intu-itive, and support for Microsoft Windows

XP/7 64-bit operating systems.