Barrick Gold’s Lagunas Norte mine in Peru is a low-cost gold operation.

Gold Miners Invest in Operations as Profit Margins Grow

Major gold producers struggle to maintain production levels during a period of high prices

By Steve Fiscor, Editor-in-Chief

The second half of 2011 was a wild ride for gold prices. A third quarter rally pushed the price of gold to a record of $1,921/oz. Gold ended 2011 at $1,563/oz, up 10% with an average price of $1,590/oz for the year. The possibility of an American default as politicians debated an increase in the U.S. debt ceiling, prompted a downgrade of U.S. debt, which took gold prices higher. Gold prices fell by 15% after politicians reached a temporary fix. Soon afterward, Eurozone financial concerns emerged, gold prices fell further as investors fled from commodities in a massive sell-off. Gold quickly regained its upward momentum as 2012 began.

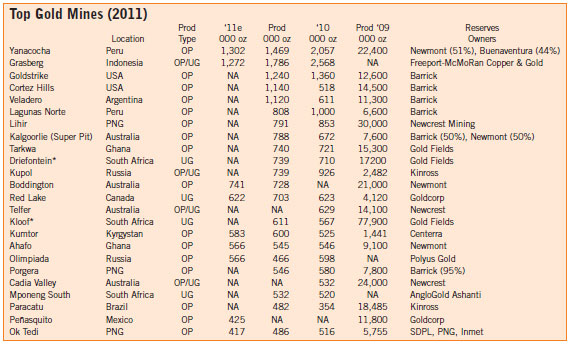

Despite problems in both Indonesia and Peru, it’s believed that gold miners will pro-duce approximately 2,800 metric tons (mt) of gold in 2011, or about 100 million oz, an increase of around 4% over 2010. In general, mines are going deeper and ore grades are declining, which means miners must extract and process more ore. On top of these conditions, discovery rates are also declining. Gold miners are investing heavily in exploration programs, and in increasing capacity and optimizing existing operations.

Barrick Discovers More Nevada Gold

Barrick Gold will produce 7.6-7.8 million

oz of gold in 2011 at a total cash cost of

$460-$475/oz. The leading gold producer

recently announced two significant gold

discoveries on the Cortez property in

Nevada, Red Hill and Goldrush. The devel-opment of the Pueblo Viejo and Pascua-Lama mines continues to advance with first

production anticipated in mid-2012 and

mid-2013, respectively. The two mines

should average 1.4-1.5 million oz/y in gold

production during the first five years of

operation at a relatively low cash cost.

“We remain on track to achieve our tar-gets, one of which is to have one of the low-est cash cost profiles among the senior gold producers,” said Aaron Regent, president and CEO, Barrick Gold. Recent drilling con-tinues to expand the mineralization at the two discoveries in Nevada, Regent ex-plained. Infill drilling between the two de-posits is advancing the possibility that they will merge into a single deposit.

Barrick’s North America region contin-ued to perform well during 2011. It is expected to produce 3.3-3.4 million oz in 2011, at $425-$450/oz. The Cortez Hills open-pit mine was in a higher waste strip-ping phase and is now entering a higher grade area. The Goldstrike operation tran-sitioned to a higher stripping phase in the second half of 2011.

The company’s South American busi-ness unit performed ahead of plan, produc-ing 1.85-1.90 million oz at a cash cost of $360-$380/oz. As a result of mine sequencing, Lagunas Norte’s production exceeded plan. Veladero also met the com-pany’s production and cost guidance ranges. In the South Pacific, the Porgera mine was impacted by lower underground production, primarily due to equipment availability issues and unplanned maintenance.

During 2011 exploration, Barrick in-vested $370-$390 million in exploration with most of the activity weighted toward resource additions and reserve conversion at and around mine sites mostly in Nevada.

At the Pueblo Viejo project in the Dominican Republic, first production is anticipated in mid-2012. Barrick’s share of annual gold production in the first full five years of operation is expected to average 625,000-675,000 oz at total cash costs of $275-$300/oz. Total mine construction capital is estimated at $3.6-$3.8 billion.

Project construction is more than 85% complete following a delay caused by dam-age to the partially constructed starter tail-ings dam facility due to a heavy rainfall event in May 2011. Remediation of the starter tailings dam continues to progress. The mine has received all of the necessary approvals to allow construction of the dam to its full height. Brick lining of all four autoclaves was completed. Nearly all of the concrete has been poured, about 95% of the steel has been erected and more than 7.6 million mt of ore has been stockpiled. As part of a longer-term, optimized power solution for Pueblo Viejo, a plan is under way to build a $300 million dual-fuel power plant. The new plant is expected to provide lower cost, longer term power to the project.

Sitting on the border between Chile and Argentina, Pascua-Lama is expected to achieve first production in mid-2013. Average annual gold production is expect-ed to be 800,000-850,000 oz in its first full five years of operation at negative total cash costs of $225-$275/oz, assuming a silver price of $25/oz. Average annual sil-ver production for the first full five years is expected to be about 35 million oz.

Barrick has targeted growth in produc-tion to approximately 9 million oz of gold within the next five years.

Newmont Brings Gold Quarry Back Online

Newmont Mining Corp. expects to produce

5.1 to 5.3 million oz of gold at $560-$590/oz during 2011. Potentially lower

grades due to mine sequencing at Gold

Quarry and lower grades at Exodus in

Nevada are impacting production and the

Boddington mine in Australia has seen an

increase in operating costs.

In North America, gold production from Newmont’s Nevada operations decreased 6% due to lower mill grade ore and throughput, partially offset by higher leach placement and recoveries. Open-pit ore tons mined increased 167% as the reme-diation of the Gold Quarry pit slope failure was completed.

The Yanacocha mine in Peru is expect-ed to produce 650,000 to 670,000 oz at a cost of $560-$600/oz.

Boddington produced 166,000 oz dur-ing the third quarter. Gold production decreased due to lower mill grade, but was partially offset by higher mill throughput. Costs continue to increase due to the lower gold grade, higher royalty costs and diesel prices. Some of the increase was partially offset by higher by-product credits.

Batu Hijau in Indonesia produced 66,000 oz during the third quarter, a decrease of 37% from the same period last year. The company attributed the decrease to lower mill grade, throughput and recov-ery as a result of processing more stock-piled material compared to higher grade Phase 5 ore in 2010 and the completion of mill motor replacements. Waste tons mined increased 104% as Phase 6 waste removal continues as planned.

Newmont expects 2011 attributable gold production for Batu Hijau of approxi-mately 140,000 to 160,000 oz at CAS of between $440 and $460/oz.

The Ahafo in Ghana produced 146,000 oz at cash cost of $501/oz dur-ing the third quarter, a 6% decrease. Again, lower mill grades were partially off-set by higher recovery. In addition to the lower production, costs were also pushed higher by increased labor, diesel and royal-ty costs. Newmont expects Ahafo to pro-duce 560,000 to 590,000 oz in 2011 at a cost of $470-$500/oz.

Newmont invested nearly $3 billion in operations in 2011 much of it (40%) asso-ciated with major project initiatives, including further development of the Akyem project in Ghana, the Conga project in Peru, Hope Bay in Canada, and the Nevada project portfolio.

Drought continued to impact produc-tion at Cripple Creek in Colorado, while Sunrise Dam’s recovery from Australian flooding in the first half of the year was again slower than anticipated, as was the ramp-up of production following the five-day wage-related strike at the South African operations. In addition, winter power tar-iffs, higher wages, increased royalties and lower by-product credits also contributed to cost pressure in South Africa.

Tragically, three fatalities were recorded in South Africa. The company continues to invest in improving its long-term safety per-formance, with the benchmark all injury fre-quency rate of 9.51 per million hours, the lowest in the company’s history. All of this this translated to a fourth quarter estimated production of approximately 1.1 million oz at a total cash cost of approximately $790/oz.

Given the increased safety stoppages in South Africa, the ongoing water shortages at Cripple Creek and the slower ramp up at Sunrise Dam, full year 2011 production is now estimated to be around 4.3 million oz in 2011. Total cash costs are estimated at between $735-$745/oz on the basis of slightly weaker local operating currency assumptions for the year.

Gold Fields Suffers Production Disruptions

Gold Fields Ltd. expects to produce 3.5

million gold equivalent oz (geo) in 2011.

Total cash costs are expected to be about

$800/oz. Production decreased during the

fourth quarter of 2011 as a result of dis-ruptions in Ghana due to power outages

and a slower milling rate at Tarkwa. In the

South Africa region, production was im-pacted by stop and fix interventions at

Beatrix and a lower underground grade at

South Deep due to changes in the mining

mix needed to increase flexibility. Gold equivalent production at Cerro Corona, in

Peru, was adversely impacted by lower

copper prices relative to the gold price.

The company experienced an interrup-tion in South African production in July that occurred during the five day national indus-trial action over the wage negotiation process. During the second quarter of 2011, two significant seismic related accidents at the Kloof Driefontein complex resulted in production stoppages due to safety interven-tions. In the Australasia Region, production was affected by a week-long, unplanned mill-outage at St Ives. Remedial actions in respect of the seismic-related accidents and the unplanned mill-outage were satisfactori-ly completed during the latter part of the second quarter of 2011.

Newcrest Dewaters Pits After a Tough Second Half

Newcrest Mining Ltd. recently reduced

gold production guidance to 2.4–2.6 mil-lion oz/y due to continuing production dis-ruptions at Cadia Valley and Lihir, and

lower feed grades and recoveries at Telfer.

This is around 6% below the original mini-mum guidance level. Increased costs at

Gosowong resulting from a higher exchange

rates and additional costs associated with a

tragic helicopter accident in August are

expected to be offset by lower than planned

site costs at Cadia Valley and Telfer.

Newcrest’s two major projects at Lihir and Cadia Valley remain on schedule and within budget. At Lihir, production for the first two quarters of FY 2011-12 is expect-ed to be approximately 100,000 oz lower than planned and it is unlikely this pro-duction will be recovered during the remainder of this financial year. The lower production is a result of the extended time required to complete the total plant shut down during August and the extreme rain-fall during September which impeded pro-duction from high grade positions in the open-pit until mid-November. Water pump-ing capacity in the pit has now been dou-bled with a further upgrade planned soon.

At Telfer, production for the first two quarters is expected to be approximately 50,000 oz lower than planned which is unlikely to be recovered this financial year. Mill throughput rates have been in line with plan, according to Newcrest, however lower feed grades and material movement from main dome open-pit, coupled with lower metallurgical recoveries associated with the commencement of west dome ore feed have impacted production. The scheduled commissioning of Jamieson Cells in January and planned installation of an Isa Mill later in FY2011/12 are expect-ed to improve ore recoveries.

Cadia Valley production for the second half of 2011 is expected to be approxi-mately 30,000 oz lower than planned, primarily due to a ground slip in the open-pit and heavy rainfall. The slip occurred low on the south-east wall of the open-pit and blocked a turn on the haul road pre-venting access to the bottom of the pit. Access to the pit has been re-established. The pit needed to be dewatered and min-ing was expected to resume in mid-January 2012. The mill continues to operate at capacity using low grade stock-piles. The company says recovery of the lost production is unlikely.

The Lihir Million Ounce Plant Upgrade (MOPU) is progressing to plan. A major tie-in to the existing process was completed in August. There are no major project plant shut downs scheduled at Lihir during the remainder of the 2011/12 financial year.

A new 70 MW fuel oil power plant was energized in November and is now supply-ing power from the first two of its 9 MW generating sets. This has occurred to plan and commences the sequential start-up of the expansion project during calendar year 2012. The new crushing circuit is expect-ed to be energized in February, followed by the milling circuit and the new oxygen plant and autoclaves which enable design throughput to be achieved. The project remains within budget (US$1.3 billion) and on time for completion by the end of calendar year 2012.

Development of the Cadia East panel cave remains on track with the hydro-frac-turing of panel cave ore successfully com-pleted and pre-conditioning blasting con-tinuing. The next phase of delivery for Cadia East remains the completion and commissioning of the underground convey-or, with undercut and draw bell develop-ment which will occur sequentially over calendar year 2012.

In 2011, Kinross produced approxi-mately 2.6 million geo. The company’s average 2011 production costs were approximately $600/geo. In 2012, the company expects to produce approximate-ly 2.6-2.8 million geo from its current operations. Production costs are expected to be in the range of $670/oz-$715/oz for 2012. Higher consumable and labor costs, and an expected decline in grades at cer-tain existing mines will increase costs.

The company’s three major growth pro-jects at Tasiast, Fruta del Norte (FDN) and Lobo-Marte will require significant capital expenditures over the next several years. In light of cost escalation, and a better under-standing of the Tasiast orebody and poten-tial for alternative mining and processing rates and sequences, Kinross has elected to conduct a comprehensive optimization process with the aim of improving capital efficiency, project sequencing and invest-ment returns. As a result, previously dis-closed scoping and pre-feasibility level assumptions and forecasts could be revised, including those related to project sequencing and start-up dates. The com-pany expects the timetables for the Lobo-Marte, FDN and Tasiast feasibility studies will be extended.

As far as original Tasiast scoping study, various ore processing options have emerged following a recent infill drilling program, which provided a better understanding of the geology and distribution of the gold min-eralization. The drilling program identified a higher-grade core and significant amounts of lower-grade halo material which may be better suited to a heap leach. Some of the near-surface lower-grade material may be more profitably developed with less capital intensive heap leaching in combination with carbon-in-leach milling. Engineering analy-sis indicates that heap leaching may offer significant benefits if developed early in the Tasiast expansion sequence.

Goldcorp Starts to See the Full Potential at Peñasquito

Goldcorp produced 2.5 million oz in 2011

and the company believes it will reach 2.6

million oz in 2012. Increased production

at Peñasquito will be offset by lower pro-duction at Marlin as the mine transitions to

100% underground mining. As part owner,

they will also reap the benefits from the

launch of Pueblo Viejo.

Consistent production levels at other mines throughout the portfolio will create a stable foundation for the years ahead, explained Chuck Jeannes, president and CEO, Goldcorp. “Peñasquito met its pro-duction target and continued to emerge as the linchpin of our asset base in 2011, with strong operating cash flow in just its first full year of production,” Jeannes said.

Also in Mexico, the Los Filos mine achieved record production of 336,500 oz while continuing with its excellent safety performance. Red Lake in 2011 remained the anchor of Goldcorp’s overall gold pro-duction at very low cash costs while Porcupine and Musselwhite mines in Ontario provided stable production and exciting exploration results. In Guatemala, the last year of open-pit mining in the high-est grade portion of the pit at Marlin result-ed in record gold production of 382,400 oz.

At the Red Lake mine in Canada, pro-duction is expected to benefit from an increase in tons mined from lower-grade zones consistent with a long-term initiative to use excess milling capacity. The focus in the year ahead will remain on enhancing the overall flexibility of the High Grade Zone through continued in-vestments in development.

Construction of the 5-km haulage drift to connect the Cochenour shaft with the Red Lake mine on the 5400 foot level is about one-third complete and targeted for two-thirds completion by year-end 2012. Upon completion, the drift will enable ore from the Cochenour/Bruce Channel deposit to be hauled directly to the Red Lake mine for processing at the existing mill facilities. Forecast life-of-mine gold production from Cochenour is approximately 250,000 to 275,000 oz/y at low cash costs commenc-ing near the end of 2014.

At Peñasquito, both 50,000 mt/d SAG lines are routinely operating at capacity. During the month of December throughput reached an average of 107,000 mt/d and reached a new record of 140,000 mt on December 26. The supplemental ore feed system to supply pebble feed to the 30,000 mt/d high pressure grinding roll circuit will be completed shortly and hauling of addi-tional material to the tailings dam walls is now complete. Ramp-up to full 130,000 mt/d design throughput remains on track for the end of the first quarter of 2012.

With mining progressing deeper into the heart of the sulphide ore body, higher grades and throughput rates are expected to drive a significant production increase in the year ahead. An in-pit crushing and con-veying system will be commissioned in the second half of 2012. With expected pro-duction of 425,000 oz of gold, Peñasquito is forecast to become Mexico’s largest gold producer and the company's largest gener-ator of cash flow in 2012.

The Los Filos mine in Guerrero state will continue to be a major contributor to Goldcorp’s overall production profile in 2012. Gold production is forecast to in-crease slightly to 345,000 oz. Exploration success continues to support the potential for significant additions in gold reserves at Los Filos over the longer term.

At Marlin in Guatemala, production in 2012 will decline consistent with the planned transition to an exclusively under-ground operation as mining in the primary open-pit is now complete. Stockpiled material with an average grade of approxi-mately 1.1 g/mt is expected to make up approximately 40% of the mill feed at Marlin in 2012. The development of recent high grade discoveries in the West Vero zone will continue, with first production expected in the second half of 2012. Exploration success continues at the Delmy vein discovery adjacent to current underground mining operations. Access to the vein has been developed at three levels and two ventilation raises to the surface have been completed. Mining of the Delmy vein, which remains open along strike and at depth, began in late 2011 and is expected to contribute to Marlin produc-tion throughout 2012.

The high grade Cerro Negro deposit is positioned to be the next source of new gold production for the company in 2013. The project includes several high-grade veins located on the low-elevation Patagonian plains of southern Argentina. With production expected to average approximately 550,000 oz of gold in its first five full years of production, Cerro Negro is well-positioned as Goldcorp’s next cornerstone gold mine.

Goldcorp’s production profile is forecast to grow approximately 70% over the next five years to 4.2 million oz in 2016.

Polyus Gold Invests in More Production

Polyus Gold is the leading gold producer in

Russia and one of the major producers of

gold in Kazakhstan. For 2011, the compa-ny’s total refined gold production increased

by 8% year-on-year to 1.5 million oz—the

fourth consecutive year of increased produc-tion. The company reported that its

Blagodatnoye mine operated at its designed

efficiency (85% recovery rate) and exceeded

throughput capacity. The Verninskoye mine

was commissioned in December. Ongoing

modifications to Mill-2,3 at Olimpiada

resulted in higher recovery. The development

work for the Natalka mine is on track: pro-curement started (mills and plant equip-ment under way), camp construction to be

completed by March 2012. Commissioning

of the mine is expected in December 2013.

Polyus Gold’s flagship mine, Olimpiada, implemented a series of measures aimed at increasing the recovery efficiency of sul-fide ore and improving the bio-leaching process. A delay in the commissioning the final concentration step ofprimary concen-trate from gravity concentrate for Mills-2,3 (completed in December 2011) and diffi-culty encountered in the commissioning of the second stage centrifuges introduced to dewater the biopulp at hydrometallurgical circuit of Mill-3, resulted in the expected recovery rate not being achieved.

In 2012, Polyus Gold plans to spend $594 million to construct the Natalka mine. Of this figure, $314 million is expect-ed to be spent on procurement of the equip-ment for the plant and the mining fleet. As of late January 2012, the company already signed agreements for the delivery of the equipment for the total sum of approxi-mately $143 million. The group plans to complete contracting of the equipment in April 2012, so that key construction fleet to be delivered in April-June 2012.

In 2011, the Olimpiada mine produced 566,000 oz of refined gold, compared to 585,000 oz in 2010. Gold output de-creased primarily due to the decline in aver-age grade. Mills-2,3 of Olimpiada mine were processing primary sulphide ore with an average grade of 3.43 g/mt, compared to ore with an average grade of 3.76 g/mt in 2010. The Blagodatnoye mine produced 363,000 oz of gold, compared to 253,000 oz in 2010. The 44% year-on-year increase in gold output reflects successful ramp-up of the mine, which was commissioned in July 2010.

The construction of the Verninskoye mine was performed in difficult conditions, according to Polyus Gold, when the princi-pal supplier of the project, FLSmidth Wiesbaden GmbH, failed to deliver equip-ment in time (flotation equipment, gravity concentrators, thickeners, etc). The 6 month-delay in shipment resulted in the mine’s commissioning in a short circuit mode, which was not planned initially.

During the first half of 2012 the plant is expected to produce gravity concentrate, which will be processed at an existing plant at the Zapadnoye mine. As of late January 2012, 98% of the project equipment had been shipped and is expected to be on mine site in March 2012-

Harmony Sells Evander

South Africa’s Harmony Gold Mining Co.

Ltd. posted record profits in 2011. “The

strength of the gold price together with

improved operational efficiency supported

our results,” said Graham Briggs, CEO,

Harmony Gold. “As our growth projects

come on stream, and our existing mines

operate to tailored business plans, we

remain confident of reaching our long-term targets.”

It was not all smooth sailing in 2011 for Harmony. Production was negatively impacted by a wage strike in August 2011, which resulted in approximately 500 kg being lost. Higher electricity (due to winter tariffs) and labor costs eroded profit margins.

During January 2012, Harmony decid-ed to sell its interest in Evander Gold Mines Ltd. to a consortium comprised of Pan African Resources plc and Wit-watersrand Consolidated Gold Resources Ltd., for R1.7 billion ($225 million). The Evander operations consist of the Evander 8 shaft, located in Mpumalanga. It also includes several potential development projects namely Rolspruit, Poplar, Evander Southand Libra. Harmony positioned the sales as move to further optimize its asset portfolio. The proceeds from the transac-tion will be used toward funding the devel-opment of Wafi-Golpu.

Pre-feasibility studies at Wafi-Golpu are progressing according to schedule. Key strategy milestones were reached in the selection of preferred strategies for mining, underground access, processing, port and power infrastructure. This has allowed work to commence on detailed engineering, cost estimates and schedules for procurement and construction for early works. At the end of the December 2011 quarter, seven drill rigs were operating with six engaged on extension of the Golpu orebody to the north and infill of deeper sections. One drill continued with geotechnical investiga-tion drilling along the access decline route.

Disruptions Impact Gold Production at Grasberg

32

Freeport McMoRan Copper & Gold reached

a new two-year labor agreement for PT

Freeport Indonesia in mid-December

2011. Repairs to the damaged pipelines

were completed and PT Freeport Indonesia

has begun ramping up production. PT

Freeport Indonesia is working cooperative-ly with the Government of Indonesia to

address security issues. The production

disruption from the labor issues (including

the eight-day work stoppage in July 2011)

and the damaged pipeline totaled

275,000 oz of gold for the year.

Freeport is projecting 2012 gold sales of 1.1 million oz, which would be lower than 2011 sales of 1.3 million oz because of mine sequencing at the Grasberg mine, as it transitions to a large-scale, high-grade underground ore bodies located beneath and nearby the Grasberg open-pit. In aggregate, these underground ore bodies are expected to ramp up to approximately 240,000 mt/d of ore per day by 2016.

The Deep Ore Zone mine, one of the world’s largest underground mines, has been expanded to a capacity of 80,000 mt/d of ore and a feasibility study for the Deep Mill Level Zone (DMLZ) has been completed.

The high-grade Big Gossan mine, which began producing in fourth quarter 2010, is expected to reach full rates of 7,000 mt/d of ore by mid-2013. Substantial progress has been made in developing infrastructure and underground workings that will enable access to the underground ore bodies. Development of the terminal infrastructure and mine access for the Grasberg Block Cave and DMLZ ore bodies is in progress. Over the course of the next five years, Freeport will invest $700 million per year on underground development activities.