Freeport Plans to Sell More Copper in 2012

“We are continuing to advance our growth projects which are expected to result in meaningful increases to copper and molybdenum production in future peri-ods. Our exploration programs continue to identify opportunities to grow our reserve base. We ended the year with significantly more cash than debt and have a positive outlook for the future prospects of our busi-ness,” said Richard C. Adkerson, president and CEO.

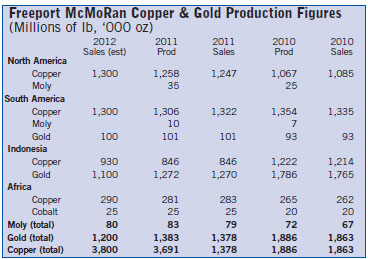

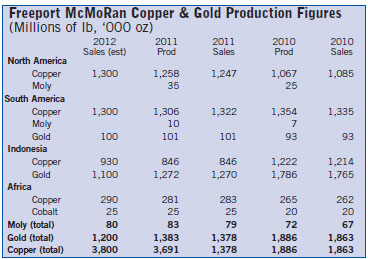

Consolidated sales for 2011 totaled 3.7 billion lb of copper, 1.4 million oz of gold and 79 million lb of molybdenum, compared with 3.9 billion lb of copper, 1.9 million oz of gold and 67 million lb of molybdenum in 2010. The estimated impact of the labor and pipeline disruptions, net to PT Freeport Indonesia, totaled 235 million lb of copper and 275,000 oz of gold for 2011.

Consolidated sales from mines for 2012 are expected to approximate 3.8 bil-lion lb of copper, 1.2 million oz of gold and 80 million lb of molybdenum. FCX’s pro-jected 2012 copper sales volumes are expected to be higher, compared with 2011, primarily because of higher produc-tion from North America and Indonesia, partly offset by slightly lower production in South America. Gold sales in 2012 are projected to be lower than 2011 sales because of mine sequencing in Indonesia. Molybdenum sales in 2012 are expected to be similar to 2011, with higher produc-tion from primary molybdenum mines off-set by lower production from FCX’s North and South America copper mines.

In 2010, the company initiated plans to increase production at its North America copper mines, including restarting milling operations and increasing mining rates at Morenci and Chino, and restarting the Miami mine. The Morenci project is com-plete, with an incremental impact of 125 million lb of copper per year, and ramp-up activities at Miami and Chino are continu-ing. Production at Miami totaled 66 mil-lion lb of copper in 2011 and is expected to be similar in 2012. Production at Chino, which produced 69 million lb of copper in 2011, is expected to increase to approximately 200 million lb of copper per year by 2014.

FCX expects 2012 sales from North American copper mines to total 1.3 billion lb of copper, compared with 1.2 billion lb of copper in 2011.

In South America, FCX began produc-tion from El Abra’s newly commissioned stacking and leaching facilities to transi-tion from production of oxide to sulphide ores. Production from sulphide ore approx-imates 300 million lb/y of copper, replac-ing the depleting oxide copper production. The aggregate capital investment for this project is expected to total $725 million through 2015. FCX is also engaged in pre-feasibility studies for a potential large-scale milling operation at El Abra to process additional sulphide material and to achieve higher recoveries.

At Cerro Verde, plans for a $4-billion concentrator expansion continue to be advanced, including expansion of concen-trator capacity from 120,000 to 360,000 mt/d of ore, leading to incremental annual production of approximately 600 million lb of copper and 15 million lb of molybde-num beginning in 2016.

FCX expects South America’s 2012 sales to total 1.3 billion lb of copper and 100,000 oz of gold, similar to 2011 sales of 1.3 billion lb of copper and 101,000 oz of gold. Lower projected ore grades at Cerro Verde and Candelaria in 2012 are expect-ed to be partly offset by higher production at El Abra.

FCX expects 2012 sales from its Indonesian operations to total 930 million lb of copper and 1.1 million oz of gold for the year 2012, compared to 2011 sales of 846 million lb of copper and 1.3 million oz of gold. Gold sales in 2012 are projected to be lower than in 2011 because of min-ing in a lower grade section of the Grasberg mine in 2012.

FCX operates the Tenke Fungurume copper and cobalt mining concessions in the Katanga province of the Democratic Republic of Congo (DRC). Mining rates at Tenke have been increased to boost origi-nal mine capacity of 250 million lb per year to approximately 290 million lb per year. A second phase of the project will include expanding the mill rate to 14,000 mt/d of ore and construction of related pro-cessing facilities to add another 150 mil-lion lb of copper per year.

FCX expects Africa’s sales to approxi-mate 290 million lb of copper and 25 mil-lion lb of cobalt for the year 2012, com-pared with 283 million lb of copper and 25 million lb of cobalt for the year 2011. FCX’s capital expenditures are currently estimated to approximate $4 billion for the year 2012.