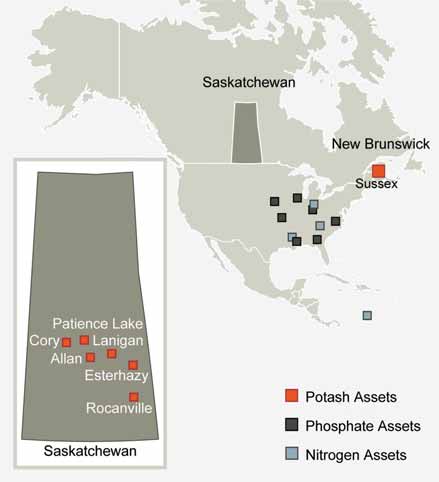

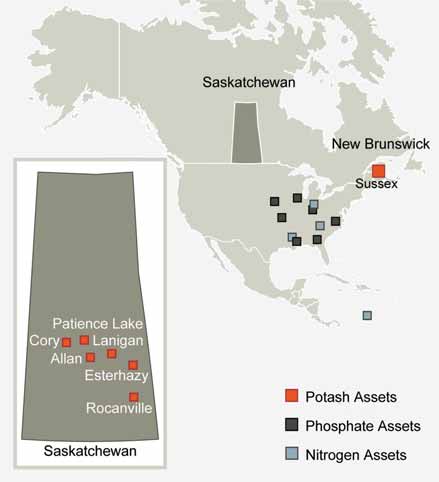

PotashCorp’s North American assets.

PotashCorp Board Rebuffs BHP Billiton; BHP Takes Offer to Shareholders

Subsequently, on August 20, BHP Billiton took its offer directly to PotashCorp shareholders, saying the offer would remain open for acceptance until October 19, 2010, “or such later date or dates as may be fixed by the offeror unless the offer is withdrawn.”

In announcing the PotashCorp board’s rejection of the BHP Billiton offer, PotashCorp Chairman Dallas J. Howe said, “The PotashCorp board of directors unanimously believes the BHP Billiton proposal substantially undervalues PotashCorp and fails to reflect both the value of our premier position in a strategically vital industry and our unparalleled future growth prospects.”

Further, the PotashCorp statement said, “PotashCorp is uniquely positioned as the premier global producer, with unparalleled potash assets in an industry characterized by substantial barriers to entry, few producers and no known product substitutes. The BHP Billiton proposal fails to adequately compensate Potash- Corp shareholders for this strategic position and scarcity value. In addition, the BHP Billiton proposal does not reflect Potash-Corp’s substantial recent and ongoing investments to increase capacity, the value of PotashCorp’s strategic equity investments in China, Chile, Jordan and Israel, and its unmatched ability to meet the needs of North American customers and growing offshore potash markets.”

Notwithstanding PotashCorp’s position, BHP Billiton said it would welcome the opportunity to work with PotashCorp to complete the transaction. “We firmly believe PotashCorp shareholders will find the certainty of a cash offer, at a premium of 32% to the 30-trading day period average, very attractive, and we have therefore decided to make this offer directly to those shareholders,” BHP Billiton Chairman Jac Nasser said.

On August 23, PotashCorp responded with a statement that said, “Since the announcement of BHP Billiton’s unsolicited approach on August 17, 2010, the PotashCorp common shares have consistently traded above the offer price. PotashCorp believes the performance of the common shares during this period is a strong indicator that the market believes the BHP Billiton offer undervalues the common shares.”

The August 23 statement also said, “PotashCorp has been approached by, and has initiated contact with, a number of third parties who have expressed an interest in considering alternative transactions. Discussions are being pursued with several of these third parties in order to generate value enhancing alternatives.”