The first eight years of this century saw

rapid growth in the consumption and production

of nickel and related commodities.

In response to growth in the BRIC

countries, especially China, new projects,

many in underdeveloped countries, were

initiated. Nickel pig iron, produced in

aging Chinese blast furnaces, unexpectedly

emerged. Simultaneously, scientists

concluded that global warming is

“unequivocal” and human activity is the

main driver, “very likely” (>90%) causing

most of the rise in temperatures since

1950.1 These factors point to a future in

which sustainable development becomes

of paramount interest to the mining and

metallurgy industry.

To the practicing metallurgist and

operator, “sustainability” may appear as

keeping employees safe, meeting prevailing

environmental regulations and contributing

to social programs contractually

agreed to, while maintaining a low-cost

operation that meets production and

financial targets. But this is a highly simplified

view that ignores many of the sustainability

concepts.

Sustainability attempts to capture the

entire value of ecosystems and divides

this value into three segments: direct,

the value that can be generated by the

animals, plants and other resources; indirect,

the value generated by items such

as erosion control, water purification and

pollination; and intangible, the value to

humans derived from beauty and religious/

spiritual significance. While a traditional

economic evaluation frequently

concentrates on the direct benefits, often

the indirect benefits have significant economic

value that are difficult to quantify

and are only realized after the fact.

Examples are fertile soils and coastal and

inland wetlands.2

The mining and mineral processing

business often feels unfairly targeted by

environmentalists and proponents of sustainable

development. After all, it creates

wealth in developing countries and provides

the developed world with the

resources it needs to grow. Algie3 and

Twigg-Molecey4 highlighted six fundamental

features of mining that make it a

crucible for the sustainability forces:

• Metal and mineral resources are

non-renewable.

• Economic mineralization often occurs

in remote areas that are rich in biodiversity

with many sites of cultural

importance to indigenous inhabitants.

The mining company develops essential

infrastructure. Its activities irreversibly

alter both the natural and

social environments.

• The mining sector is diverse in size,

scope and responsibility. It comprises

government and private organizations,

major corporations and junior miners

and exploration companies.

• The mining industry has a poor legacy.

• The risks and hazards in production,

use and disposal are not well understood

by the public and are often poorly

communicated.

• In contrast to manufacturing, which involves

primarily physical change, the

processing of metals involves chemical

change, which inherently is more

polluting.

To engineers, social sustainability

may be the most difficult concept to

fathom. Negotiations with native peoples

whose mores and values may differ from

those of typical mining enterprises, may

be a frustrating, non-productive exercise.

But in a mining endeavor, a large proportion

of the benefits accrue globally while

the major environmental effects are felt

locally. Frequently, indigenous people are

closely tied to the local environment and somewhat remote from the global market.

Martin5 defined social sustainability

as processes, systems, structures and

relationships that actively support the

capacity of current and future generations

to create healthy and livable communities

and identified five components

that are necessary for a successful social

sustainability project:

• Diversity—modern mining is not labor

intensive; only a small proportion of the

aboriginal population will be employed

at the operation. Additionally, many

people may choose a lifestyle that does

not fit the manufacturing mode. They

have to feel welcome in the community.

The sustainability program has to

take this into account, for example support

for pastoral communities.

• Equity—the community provides equitable,

but not equal, opportunities

and outcomes for all of its members,

particularly the poorest and most

vulnerable.

• Interconnectedness—aboriginal groups

have to be connected both internally

and externally.

• Quality of Life—commitments to improve

the quality of life must include

(a) employment and training, (b) small

business development, (c) individual

capacity development and (d) support

for diversity in lifestyles and aspirations

• Democracy and Governance—the quality

of self-governance directly affects

the outcome of the process. Agreements

must be aimed at achieving a

high quality of self-governance and

independence from the state.

Successful completion of these activities

requires a continuing commitment of

time and resources on the part of the mining

company and success typically costs

almost two times the original estimate.

Tailings, residues and wastewater

generated from milling and processing

facilities present visible threats to local

water supplies and to the health of the

natural environment, the local economies

and ways of life. In people’s minds,

social sustainability and water quality

become inextricably linked.

Moving forward, the industry will be

pressured in the areas of energy consumption

and greenhouse gas emissions,

water usage, residue disposal and effluent

quality, and the sustainability of the

communities in which it operates. Many

of the issues will be confounded; successful

resolution will require strategies

and visions of the final outcomes.

Looking at our past and present with a

view to projecting into the future provides

a valuable exercise for the sustainable

development of the mining industry.

Beginning the winter of 1956-1957, “Snowball Express” tractor trains ran 24 hours a day,

Beginning the winter of 1956-1957, “Snowball Express” tractor trains ran 24 hours a day,

seven days a week to

move 30,000 tons of material and supplies over snow-covered muskeg

and frozen lakes to the new town site at

Thompson, Manitoba.

The Thompson Project6

Nickel mineralization in the northern part

of Manitoba was first identified in the

1920s. Lynn Lake was staked in 1945

and the Inco aeromagnetic exploration

efforts began in 1947. With the onset

of the Korean War, nickel demand was

growing at a 10% per year rate. In 1955,

Inco constructed a test shaft at Moak

Lake, just south of present-day Thompson,

where geologists had intersected

disseminated material assaying 0.7% Ni.

The big discovery was made in January

1956 when intersections containing

massive pentlandite were discovered.

Intense drilling and staking followed. By

summer the results were confirmed and

the company had acquired enough property

for mine development, news of the

discovery had begun to appear in the

press and negotiations had started with

the U.S. government to secure a market.

Conversations were ongoing with the

Manitoba government to secure operating

permits.

Production was projected at 34,000

metric tons per year (mt/y) Ni—23,000

mt from the Thompson deposit and

11,000 mt from Moak. Six major requirements

for the project had been identified,

each requiring provincial approval and/or

assistance: a hydro-electric plant; railway

spur; adequate land for a mine and plant

site; smelter smoke easement; a town site

agreement; and access to timber.

Inco’s goal was to move material to

site during freeze-up in January 1957.

Formal negotiations started in August

1956. Specific sticking points and their

resolution included:

1.There were no public funds for the

hydro-electric plant. Inco agreed to

provide $20 million in advance funding

and be repaid over 20 years at 4%

interest, considerably below market

rate. In exchange, Inco received a guarantee

of 102 MW until 2000.

2. Construction of a Canadian National

Railway (CNR) spur to the mine site

needed to start in early winter 1957.

However, approval required a Federal

Act of Parliament and a land appropriation,

processes that would take one

year. To expedite, Inco negotiated a verbal

agreement with CNR that allowed

Inco to start construction, paying the

bills in advance. Upon approval, CNR

would reimburse the nickel giant.

3. The Manitoba mining law provided for a

21-year mineral lease with the proviso

that the leases “may be renewed for

another 21 years.” This language was

unacceptable and was a deal breaker;

however, an agreement was reached

and the regulation was amended to

allow 63-year leases on claims that

were contiguous to a producing mine.

The final deal was signed in December

1956. Provisions included: a 100-mile

easement exonerating the company from

smoke damage in this corridor; surface

rights for the requisite land would be

granted at $1/acre; timber rights; the

right to divert, de-water and drain Mystery

Lake and Thompson Lake for mining purposes;

the right to take water for both the

operation and town site at no charge; and

regional telephone service.

In exchange, Inco agreed to construct

a town site including, roads, town offices,

schools, sewer and water, hospital and

electric light and power distribution for

8,000 people. In lieu of property taxes,

Inco would initially pay 85% of the cost

of local schools and town government,

with a sliding scale to 55%.

July 28, 1968: Indonesia’s Minister of Mines and Inco Chairman Henry S. Wingate sign the Contract of Work for PT

July 28, 1968: Indonesia’s Minister of Mines and Inco Chairman Henry S. Wingate sign the Contract of Work for PT

Inco’s Sorowako project.

The first tractor trains reached Thompson

on January 6, 1957. The first furnace

matte was tapped on August 23, 1960,

and the first Bessemer matte poured on

September 9. In 1961, the operation produced

41,000 mt nickel, 20% greater

than the designed 34,000 mt.

In 2009, successful completion of a

project the size of Thompson in 4-1/2

years seems incredible. Success factors

that led to this achievement include:

• The deposit was rich and the nickel

market was in true growth mode—time

was money. Inco had the financial and

human resources to lift the barriers and

fund the project fully.

• The Thompson location was remote

from population centers. Development

promised to open the area creating

additional jobs and wealth.

• Only two parties were at the negotiating

table, the province and the company.

Both were business oriented and

fundamentally in favor of the project.

• There were minimal environmental

regulations and minimal technology

step-outs.

Today, the Thompson operations

annually produce 50,000–55,000 mt of

nickel cathode, highly prized for its applications

in electroplating. Thompson has

a population of some 13,000 people;

40% are aboriginals. It serves as the

regional trade and service center.

Federal and provincial government agencies

have offices in Thompson and the

city boasts a relatively large retail sector.

There are 1,700 employees in the Vale

Inco operations; 15% describe themselves

as aboriginal. The Thompson and

nearby Birchtree mines have been major

ore sources. Disseminated deposits,

while plentiful, have played a small role.

The hydro-electric plant remains a constant

source of greenhouse gas-free

power. Over the years, environmental regulations

have been progressively tightened.

To date, sulphur dioxide (SO2)

emission rates and ground level concentrations

have been met by adjusting concentrate

composition and throughput,

and by short-term shutdowns based on

weather conditions. In 2015, Federal

regulations mandating maximum SO2

emissions of 22,800 mt/y are scheduled

to come into effect. Sustaining the smelting

operation will necessitate major capital

expenditure for gas capture and fixation.

The PT Inco Indonesia (Sorowako) Project

Inco started research on laterite processing

in the 1940s. In the 1960–70s,

experimental work was intense; many

projects were planned, and a number

were developed. The 1973 energy crisis

undermined the economics of some

operating plants and dampened enthusiasm

for new projects. The reader is

referred to the 1979 TMS volume for further

reference.7

The original contract of work (CoW) for the Soroako

The original contract of work (CoW) for the Soroako

project was signed in July 1968 for 30 years, from the

start of commercial production on April 1, 1978, to

March 31, 2008. The 1968 CoW was modified and

extended in January 1996 for an additional 30 years

through 2025, subject to further extensions. Shown

here is its approximate location on the Indonesian

island of Sulawesi.

To cope with the ever-increasing energy

prices, the scope of the Indonesian

project was enlarged part way through construction to triple its original size and

to include a hydroelectric power plant.10

Today, PT Inco’s Sorowako project is the

largest integrated producer of nickel from

laterites in the world but is fully dependent

on low-cost hydroelectric power for

sustaining the operation.

Dutch traders first visited Indonesia

in the late 16th century and in 1799 the

islands were overtaken as a colony of the

Netherlands government. Iron-nickel laterite

deposits at Sorowako on the Island

of Sulawesi were identified in 1901. In

1937, Inco was invited to study the

deposits further. From 1942–65, the

deposits were episodically investigated

with some being developed as the country

went through a succession of

changes—Japanese military occupation

from 1942-45, proclamation of independence

in 1946, recognition of independence

in 1949 and “rebel” occupation

of Sulawesi from 1949-65.

In 1967, the government of Indonesia

formulated its first Foreign Investment

Law and issued invitations to 12 mining

companies to bid for exploration and

development rights. Inco Ltd. was the

successful bidder. In 1968, P.T. International

Nickel Indonesia (PT Inco), a

foreign investment joint venture company,

and the Republic of Indonesia agreed

on a concise 29 page Contract of Work

(CoW) that allowed PT Inco to explore

and develop minerals on 66,000 km2 of

land for 30 years. The relevant provisions

provide a view of the sustainability issues

of the time:11

• The company was appointed sole contractor

for the area. Rights and responsibilities

included exploration, evaluation,

development, processing and marketing

of all minerals, excluding

radioactive materials and hydrocarbons.

• The company agreed to progressively

decrease the contracted area to no

more than 25% of its original size during

the first five years.

• A five-year development was envisaged;

12 months for general surveys, 36

months for exploration and 12 months

for evaluation. Land rent was nominal

at first but increased to $1/hectare/year

after the start of production. Royalties

were based on price of nickel FOB Port

Colborne, Ontario. The company was

exempted from local taxes.

• The ultimate objective was construction

of a commercial plant in Indonesia

for the metallurgical transformation of

ore into a nickel product(s) for sale.

The facilities would comprise the mining

and metallurgical plant and other

required facilities, have a capacity of

11,500 to 23,500 mty/y nickel per

year and cost not less than $75 million.

• The company agreed to use Indonesian

goods, services and products to the

extent that they were available on a

competitive time, cost, quality and

quantity basis.

• The company agreed to issue regular

reports and to endeavor to coordinate

its infrastructure requirement with

those of the government. Inco would

reserve at least one seat on the board

of directors for Indonesian nationals,

train Indonesian nationals to occupy

“responsible positions in the company,”

implement a comprehensive

training program, annually donate

$50,000 to Indonesian educational

institutions and employ Indonesian

nationals in all employment classifications.

After five years of operation 75%

of positions in all classifications were

to be filled by Indonesians. Employees

in the same job classification would be

treated equally regardless of nationality.

• Financing of the project was the

responsibility of the company. To

ensure Indonesian participation, 20%

of the shares would be made available

for sale in rupiahs and one fifth of the

directors would be appointed by Indonesian

owners.

• All domestic costs were to be met

through conversion of foreign currency

into rupiahs. It was contemplated that

there would be little or no need to

transfer rupiahs into foreign currency.

• The company would be domiciled in Jakarta

and subject to the laws of

Indonesia.

• The CoW would expire after 30 years of

commercial production and sympathetic

consideration would be granted to a

request to extend the term based on

continuing or expanding operation.

• The company was required to submit

plans for development of all facilities in

the contracted area. The government

would impose no rents or royalties other

than those specified in the CoW and

agreed to arrange for resettlement of

indigenous inhabitants, with the company

paying reasonable compensation.

• Under royalty provisions the company

was granted the rights to water and

construction materials in the contracted

area as necessary or convenient for

the project.

The first year of exploration concentrated

on coastal areas and immediate

land relinquishment obligations. In

1969, drilling commenced in the

Sorowako area. In 1972, a feasibility

study recommended construction of a

facility to produce 14,000 mt of nickel in

a 75% nickel matte at a capital cost of

$135 million.11 Sufficient ore had been

identified to provide a smelter life of at

least 20 years, the upgradeability of the

ore had been demonstrated, the feasibility

of smelting ore to matte had been

shown in tests using two 50-mt bulk ore

samples and a financing plan involving

six Japanese partners coupled with loans

from banks and export development corporations

had been concluded.

The feasibility study implicitly dealt

with environmental issues through the

provision of engineering standards. Two

stacks were proposed, one for the dryer

and reduction kiln and one for the converter

and power plant. Ontario air pollution

standards were to provide the basis

for stack height and dust capture.12

In 1973, Dravo Corp. was contracted

to provide engineering and construction

of the first line. In 1974, Bechtel Corp.

was engaged to assume responsibility for

overall project management, including design and construction of the town site

and hydroelectric facilities. At the end of

1974, the projected capital cost of Stage

1 was $247 million, and the project was

behind schedule. These difficulties were

attributed to lower than expected labor

productivity, unexpected delays in recruiting

expatriates, delays in delivery of

construction equipment and structural

steel and “unprecedented worldwide

escalation experienced and forecast on

equipment, oil products and oil cost sensitive

materials, ocean freight, and

salaries and wages.”13

In early 1974, as a response to the oil

crisis, PT Inco began talks with the

Indonesian government concerning the

development of a 165 MW hydroelectric

facility on the Larona River. To justify the

added cost, to lower the unit cost of production

and to match the power plant

output, a total of three reduction kilnelectric

furnace lines would be built trebling

capacity. The original CoW had

established the legal basis for the expansion

but did not include terms by which

PT Inco could utilize the river. Negotiations

started in early 1974 and were concluded

by year end. The Indonesian

Minister of Public Works and Energy

approved the project in February 1975.

The company agreed to pay a royalty

based on installed capacity and nickel

price, to implement a design that did not

jeopardize the overall hydroelectric

development of the Larona River, to keep

the minister informed about the design,

construction and operation of the facility,

to provide 5 MW of power and to provide

buy-back provisions for the government.

The company further agreed to “have

regard to the well-being of people and

the preservation of the environment.”13

By the end of 1976, mineral rights in

more than 95% of the land in the original

contract area (more than 6 million

hectares) had been explored, evaluated

and then all but about 3% of the original

area was relinquished to the government.

The enlarged project had a capital cost

of $900 million and financing was

obtained from commercial banks and government

supported export agencies. The

plant was dedicated by President Soeharto

on March 31, 1977, and the first export

shipment followed in April 1978.14

The plant went through a slow start-up

and production ramp-up. A number of

production issues were addressed.15, 16 The most important was the determination

that the planned SiO2/MgO ratio of

2.4 in the high-grade (2.4% Ni) West

Block ore was causing rapid slag attack

on the furnace refractory, and successful

smelting required a blending of low-grade

(1.9% Ni), low SiO2/MgO (1.45) East

Block ore. This resulted in a significant

decrease in ore grade from 2.4% Ni to

2% Ni and a restating of plant capacity

from 45,000 mt/y to 35,000 mt/y.

Reaching the original stated production

rate was not achieved until 1990 and

required an $83-million expansion comprising

a fourth kiln line, new mobile

equipment, equipment and process

improvements in all areas and replacement

of existing 46-MVA transformers

with 60/65-MVA transformers.

By 2000, the laterite ores were

becoming more complex and daily ore

blending demanded more detailed resource information. Over a two-year period,

PT Inco conducted a massive program

of core drilling until the complete

geological database was re-constructed

to allow sustainable mine planning and

ore blending to the process plant.

The impact on the local and regional

population has been significant. In

1971, the village of Sorowako had a

population of several hundred people

which rapidly expanded to 5,000 as construction

commenced. At the peak of

construction, fall 1973 to summer

1978, approximately 7,000 people were

employed of which 6,200 were

Indonesian nationals. To support the

project PT Inco constructed housing for

both expatriate and national staff. The

formation of two new satellite towns,

Wawondula and Wasuponda was supported

through loans and rental purchase

agreements. By 1978, both towns

had populations of 4,500. Supporting

infrastructure comprised an airport,

schools, a 36-bed hospital, markets,

sewage treatment and recreational facilities.

In 2008, the 11 local communities

had grown to 219,000 and the company

and contractor employees numbered

some 7,000.

PT Inco has negotiated an extension

to its CoW to 2025. The terms reflect the

desire of Indonesia to (1) have extractive

industries conduct their operations with a

minimum of waste and maximum of safety;

(2) provide government a voice in

project changes when there is a probability

of negative environmental impact; (3)

have the company cooperate with central

and regional governments in infrastructure

plans and activities and future

regional projects; (4) have the mining

company prepare an annual local

Business and Community Development

Program; and (5) have the mining company

pay additional regional levies in

support of development.

Indonesia has evolved over the past

40 years and nationalist and regional

powers have brought new stakeholders to

the table. The future of the mining industry

is passing to a great extent from central

to regional government control. In

response to the devolution of powers, a

new mining law was passed in January

2009. PT Inco will need to comply with

new regulations within five years.

The New Caledonia Project

The slow dance between New Caledonia

and Inco to develop properties actually

began in the first decade of the 20th century

when Inco subsidiaries gained control

of properties in southern New Caledonia—

properties which were sold or

abandoned in the 1920–30s. During

World War II, Inco refined matte from

New Caledonia at the Sudbury operations

on a not-for-profit basis. Discussions

aimed at creating a new project started in

the 1950s and 60s and resulted in a

joint proposal made by Inco and

Pechiney in 1966 that was rejected by

the government of France. In 1969, Inco

and the French Bureau de Recherches

Géologiques et Minières (BRGM) joined

in a consortium to develop a fully integrated

nickel project in southeastern New

Caledonia, the Cofimpac project. In July

1970, Inco presented a proposal for a

45,000 mt plant at a capital cost of

some $500 million utilizing an Inco

developed carbonyl extraction and refining

process named the Inco Carbonyl

Process for Laterites. Production was to

start in early 1974. The proposal was

rejected by the French consortium.

Another proposal (1973), envisaged a

reduction and acid leaching process to

produce 18,000 mt Ni and 1,300 mt Co

at an expected capital cost of $275 million.

This proposition, based on the Goro

orebody that was held in trust by BRGM,

failed when the government decided to

split the rights to Goro in two, with the

better part optioned to Pétrole d’Aquitaine. By this time, Inco had

drilled 85,000 m of holes, had sampled

11,000 mt of ore for pilot testing and

had spent $21 million on the effort.17, 18

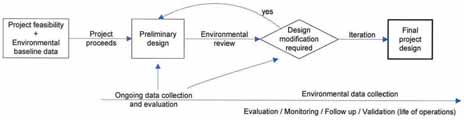

Environmental considerations and assessments played an important role in the design and engineering of the New

Environmental considerations and assessments played an important role in the design and engineering of the New

Caledonia (Goro) operations. The iterative process employed by the company for embedding environmental concerns

in the project is illustrated in this diagram.

In 1989, Inco initiated discussions

with BRGM about acquiring all of the

mineral rights in the south of New

Caledonia. Agreements were signed in

1991 and governmental approvals received

in August 1992. This saw the creation

of Goro Nickel S.A., the operating

company of the project, 85% owned by

Inco and 15% by BRGM. Inco also

obtained rights to and patents for the

pressure leach technology developed by

AMAX and BRGM during the 1970s and

80s and tested at a 15-mt/d pilot plant.18

Development proceeded rapidly. In

1998, Hatch and Associates conducted a

bankable feasibility study, and in Q2

2001 a consortium of companies was

assembled to build and design the project.

Due to increasing costs, the project

was suspended in December 2002.

Projected capital costs had increased

from $1.45 billion to $2.1 billion. The

suspension negatively impacted numerous

local businesses and public relations

in general. Renewed efforts were required

to regain public support.

Construction recommenced in 2004, and

in 2006, CVRD (now Vale) purchased

Inco for $17 billion cash. In 2008, after

further project reviews and negotiation of

a sustainable development agreement

with the Kanak people (Le Pacte Pour le

Développement Durable du Grand Sud),

the Vale board confirmed that the project

would be completed. Total capital cost

was identified as $4 billion.

From the start, environmental considerations

and assessments have been crucial.

Two intensive environmental baseline

data campaigns were conducted.

Site specific studies were undertaken for

each environmental component, atmosphere,

geology and hydrogeology, hydrology,

marine biophysical environment and

terrestrial biophysical environment.

Social impact and socio economic studies

were also completed. Once a sufficient

environmental data base was collected,

the environmental effects of the

process were estimated and elements of

the project were modified or redesigned

to mitigate deleterious impacts.

Examples of the redesign include:

Discharge of treated waste water to

the ocean—during the pilot plant operation,

effluent was discharged into a local

pond. Environmental data and modeling

predicted that river discharge would

cause significant adverse effects on the

estuary and bay because of elevated alkalinity

and gypsum concentrations. A suitable

discharge location, 4 km offshore,

where the bottom substrate is barren and

tidal and current activity high, was subsequently

identified.

Air modeling and the siting of major

process plant circuits—air dispersion

modeling was used to locate the required

stacks, assess potential effects of stack

emissions and develop design criteria. A

primary objective was to protect Forêt

Nord, a forest reserve less that 2 km from

the plant.

Protection of the Planchonella tree—

during a forest inventory a previously unrecorded

variant of the Planchonella

species was identified. The original

design of the tailings dam was modified

to move the southern section 50 m west

at an estimated cost of $10 million.

Subsequently, another stand of this tree

was located in an adjacent watershed.

Reduction of manganese in the treated

effluent—in the initial design a 100

mg/l Mn concentration in the treated

effluent was proposed. Modeling indicated

that the effluent would be rapidly

diluted and at 20 m from the discharge

point, Mn levels would be near background.

On the basis of French standards,

the public raised concern that a 1 mg/l

Mn level would be required. However,

reducing Mn to this level by conventional

lime treatment would require large quantities

of lime, increase tailings volume

and increase CO2 emissions by 250,000

mt/y. A proprietary process to reduce Mn

to 1 mg/l was developed in a joint effort

by Vale Inco technical staff in

Mississauga and New Caledonia and

added at a cost of $60 million.

Overall, Vale Inco spent $600 million

on environmental compliance and

responsibility.

On behalf of UNESCO, the International

Union for Conservation of Nature

and Natural Resources assessed the

lagoons, islands and the areas around the

project. It found no incompatibility

between the project and creation of a

Heritage site. In June 2008, UNESCO

declared natural areas neighboring the

project a World Heritage Site.

Water quality and the impact of the

project on the ocean environment has

been a flash-point for community relations.

In February 2008, construction of

the effluent pipe was put on hold after

Rheebu Nuu, a committee representing

environmental interests of segments of

the Kanak population, asserted that the

effluent pipe would contaminate the

lagoon. Rheebu Nuu had organized two

four day blockades against the project in

2005. Rheebu Nuu’s main claims concerned

environmental protection, aboriginal

rights and lack of compensation to

indigenous peoples for exploitation of

the land.

In April 2008, representatives from Vale Inco and leaders from indigenous groups, together with community leaders

In April 2008, representatives from Vale Inco and leaders from indigenous groups, together with community leaders

and representatives from the Customary Senate, opened a new round of discussions concerning the Goro project.

On September 27, an agreement was signed to assure sustainable development in the areas of environment,

education, training and socio-cultural activities. Participants in the signing of “Le Pacte Pour le Developpement

Durable du Grand Sud” between Vale Inco and the Kanak tribe are shown in this photo.

The September 27, 2008, agreement

represented the culmination of activities

that included development of 200 community

development projects and participation

in various multi-party committees

designed to enhance participation of

local contractors and businesses, inform

local communities about training and

employment opportunities, involve small

companies and owner-operators in the

work and discuss and define elements of

the workplace operation, including conflict

resolution mechanisms. As a result,

the project is moving forward in a consensual

environment.

The UN High Commission on Human

Rights has lauded the agreement as an

example of a best practice and benchmark

in the relationship between resource companies

and aboriginal communities.19

The Voisey’s Bay Project20

The Voisey’s Bay project was conceived

and planned during the same period as

the New Caledonia project. Similar

techniques of process development and

environmental planning were involved.

However, in terms of discovery, mineralogy

and grade, and acquisition of mineral

rights, the two projects could not

be more dissimilar.

The value of the Ni-Cu-Co containing

gossan outcrop was identified in

1993 by two prospectors, Chislett and

Verbisky, who were grub-staked by

Diamond Fields Exploration, a junior

mining company whose major activity

was a diamond-exploration play in

Africa. When drilling in January 1995

yielded 104 m of core containing nearly

4% Ni as massive sulphide, a feeding frenzy for Diamond Fields’ stock and

the property ensued. Robert Friedland,

a promoter of junior mining companies

and a principal of Diamond Fields,

orchestrated a flawless bidding competition

among Teck, Falconbridge and

Inco. There was considerable uncertainty

about the size of the deposit.

Falconbridge geologists estimated that

it contained 87.8 million mt of

resource. The number at Inco was

131.7 million mt. When concluded in

August 1996 Inco had acquired the

property in a $4.3 billion deal, the

largest single mining property acquisition

up to that point in time.

The exchange of funds and the fortunes

created by the discovery and subsequent

trading are staggering. When

the deal closed, Friedland’s individual

share in Diamond Fields was worth $600

million; Verbisky and Chislett together

were to receive $300 million in royalties;

Falconbridge received $100 million for

losing the deposit, and a small Texas

firm that had previous dealings with

Diamond Fields received $25 million in

exchange for dropping a lawsuit that

might scuttle the proceedings. Diamond

Fields, which flirted with insolvency in

1994, had a share price of $43.50.

Inco was anxious to proceed with

development. A management team was

quickly assembled and mine startup

was projected for 1999. Production

rates of up to 122,000 mt/y nickel were

envisioned. However, sustainability

issues remained. Land claims by the

Innu Nation and the Labrador Inuit

Association (LIA) had to be resolved.

Inco and these First Nations had to

negotiate conditions for the project to

continue. Environmental impact statements

and approvals had to be

obtained. Inco and the Newfoundland

government had to agree on terms by

which the deposit would be exploited.

Additionally, the impact of the development

on Federal transfer payments to

the province had to be determined.

From the start, relations between

Diamond Fields and the First Nations

had been strained. Protests of the

exploration were staged in February

1995 and a nasty standoff with the

Royal Canadian Mounted Police

ensued. Protests and blockades would

follow. Finding a common understanding

required lengthy and contentious

negotiations. Impact and Benefit

Agreements, covering issues such as

environmental protection, protection of

social and cultural values, education,

training and employment and business

opportunities for native people, were

ratified by the Innu and LIA memberships

in June 2002.21, 22

The environmental impact statement

for the mine/mill operation was issued

in 1997 23 but not approved until 2002

after ratification by the native groups.

Among its many provisions are measures

to protect the habitats of caribou,

an important source of meat, and bear,

a creature of spiritual and cultural significance;

implementation of a rotating

schedule to allow workers extended

periods of absence in their home communities

where they can participate in

traditional activities such as hunting

and fishing; creation of a compensation

plan for the loss of fish and fish habitat;

and an operating schedule that

sees suspension of shipping during

freeze-up and early spring.

Reaching an agreement with the

province was especially vexing. The province insisted that a commercial

smelting and refining facility be built

and operated within Newfoundland and

Labrador. In 1998, buffeted by low

demand and poor nickel prices, Inco

determined that the smelter and refinery

as previously proposed were not feasible.

Talks broke down and the project

was indefinitely delayed. Some three

years later, negotiations resumed, and

in the summer of 2002 the parties

signed a Development Agreement that

allowed early construction and operation

of the Voisey’s Bay mine/mill to be

followed by construction of a refinery at

Argentia. Inco agreed to develop a new

hydrometallurgical process for treating

Voisey’s Bay concentrate, construct and

operate a demonstration plant in the

province and build and operate this

refinery in the province if “technically

and economically feasible.” The agreement

stipulated that before the end of

mine life, Inco must begin processing

as much contained nickel in concentrate

or intermediate form as was

shipped out of the province.

Construction of the mine/mill began

in 2003; first production was achieved

in the fall of 2006, in time to take

advantage of metal prices that were at

historic highs. In 2009, ground was broken

for a new hydrometallurgical plant

at Long Harbor. One of the last barriers

was obtaining regulatory approval to use

Sandy Pond, a fish habitat near the

process plant, as a disposal area for the

hydrometallurgy tailings. Scheduled for

operation in 2013, completion of the

50,000-mt/y Ni refinery will bring a set

of complicated, multi-party negotiations

to fruition and see implementation of a

new technology specifically developed

for the Voisey’s Bay concentrate.

During development of the Voisey’s Bay project in eastern Canada, a negotiated shipping agreement established

During development of the Voisey’s Bay project in eastern Canada, a negotiated shipping agreement established

rules and procedures to allow the native Inuit to use the Anaktalak Bay area for hunting, recreation and transportation

while also meeting the company’s need for year-round shipping to sustain operations.

In terms of mineral development projects,

a sustainability initiative may be thought

of as any action or expense that subtracts

from the direct value of exploiting the

resource in order to enhance human safety,

improve or stabilize the human and

natural environments or contribute to the

well-being of the community at large. All

the projects reviewed encompassed sustainability

issues of the time. In 1956-57

construction of a live-in community,

removal of noxious SO2 from the local

environment, and local refining were

linchpin issues for the Manitoba government.

Some 10 years later Indonesia was

anxious to establish ownership of the

resource, procure hard currency and

insure equity for its nationals in the workplace

and in management of the enterprise.

Again, home refining to a semi-finished

product figured into the discussion.

In both cases, two parties were at the bargaining

table, the government and the

company. Bargaining was relatively quick,

and the company was granted significant

latitude in its stewardship of both the

project and the resource.

By the mid-1990s there had been a

sea change in sustainability requirements.

Non-governmental organizations

(NGOs) advocated for environmental legislation

and served as watch-dogs over

the process. Environmental regulation

had found its way into every aspect of a

project, and elaborate environmental

impact statements, requiring significant

pre-engineering, were mandated. The

Precautionary Principle, formulated in

1992, placed the onus of uncertainty on

the developers of the project. The principles

of social sustainability gave native

people a voice at the bargaining table, a voice presented effectively through both

conventional negotiations and acts of

civil disobedience. Native groups gained

economic participation in projects, protections

for their traditional ways of life

and guarantees to insure the quality of

water and sanctity for wildlife and land.

The presence of multiple stakeholders at

the bargaining table and the multiplicity

of regulations slowed the project development

process, making it more susceptible

to delays from shifts in economic

conditions and changes of project champions.

In 2009, receiving just the environmental

approvals and a license to

operate for the Thompson project could

easily consume the 4-1/2 year elapsed

time from conception to completion

required a half-century ago.

Looking forward, sustainability requirements

will not diminish but will

continue to grow. Obtaining a social

license to operate has become a fundamental

requirement for a project to move

forward. Sustainability must become core

business for project proponents, especially

in underdeveloped countries. In

April 2000, nine of the world’s largest

mining companies initiated a project to

examine the role of the minerals sector in

contributing to sustainable development,

and how that contribution could be increased.

The Mining and Minerals and

Sustainable Development Project

(MMSD) was launched and progressed

over a two year period to establish a

framework of sustainable development

principles for the sector. In its report

“Breaking New Ground” the MMSD project

identified governance as a fourth

sphere of critical importance for sustainable

development.24

Continuing emphasis will be placed

on water quality and safe disposal of tailings and residues. Regulations limiting greenhouse gas emissions

will be promulgated and enforced. Only in small, potentially

unstable, segments of the globe can developers possibly

be exempt from international standards of environmental protection

and social sustainability criteria. International scrutiny

and transparency on projects in developing countries demand

high levels of environmental and social protection, even in

regions where local governments may not. Under these conditions

the nickel industry will be stressed as it attempts to find

and develop new deposits. Hydrometallurgical processing of

plentiful lateritic ores will be constrained by disposal of residues

and waste water. In turn, smelting will be limited by energy

availability, cost and greenhouse gas emissions. Additionally all

projects will need to critically analyze how the risks and benefits

are shared in ways that are widely regarded as equitable.

Today, scientists, engineers and social scientists are

engaged in a “rational interpretation” of both the natural and

human needs connected with the exploitation of natural

resources. The ways of the past are obsolete; the future beckons.

For those who take on the challenge of new projects, their

endeavors will be replete with surprise, frustration and joy.

These adventurers will continue to refine the mission, intensify

programs that protect the environment and the common good,

while at the same time shed practices and beliefs that do little

to advance sustainability. By doing so, companies will create

projects of which they can be proud, pay back to Mother Earth

what is owed and give to future generations a place that is economically,

environmentally and socially sound and sustainable.

The principal author, Dr. Sam Marcuson (Sam.Marcuson@

valeinco.com) is vice president, business improvement for Vale

Inco Limited, Mississauga, ON, Canada. This article was adapted

from a plenary speech made at the CIM Conference of Metallurgists

held August 2009 in Sudbury, Ontario. The full paper

is available from the author or the conference proceedings.25

References

1. R. Alley, T. Berntsen, N. Bindoff et al., “Summary for Policy

Makers”, Climate Change 2007: The Physical Science

Basis. Contribution of Working Group 1 to the Fourth

Assessment Report of the Inter-governmental Panel on

Climate Changes, S. Solomon, D. Qin, M. Manning et al,

Eds., Cambridge University Press, Cambridge, New York,

USA, 2007, 1-18.

2. United Nations Development Programme, United Nations

Environment Programme, World Bank and World Resources

Institute, “A Guide to World Resources 2000-2001:

People and Ecosystems: The Fraying Web of Life”, World

Resources Institute, Washington DC, USA, 2000, 1-12.

3. S.H. Algie, “Global Materials Flows in Minerals Processing,”

Green Processing 2002, Australasian Institute of Mining

and Metallurgy, Carlton, Australia, 2002, 39-48.

4. C. Twigg-Molecey, “Approaches to Plant Design for Sustainability”,

Green Processing 2004, Australasian Institute

of Mining and Metallurgy, Carlton, Australia, 2004, 47-52.

5. D.F. Martin, “Enhancing and Measuring Social Sustainability

by the Minerals Industry: A Case Study of Australian

Aboriginal People”, Sustainable Development Indicators in

the Mineral Industry, Aachen International Mining Symposia,

Verlag Gluckauf, Essen, Germany, 2005, 663-679.

6. H.S. Fraser, A Journey North: The Great Thompson Nickel

Discovery, Inco Limited, Thompson, Manitoba, Canada, 1985.

7. D.J.I. Evans, R.S. Shoemaker, H. Veltman, Eds.,

International Laterite Symposium, Society of Mining

Engineers, New York, New York, USA, 1979.

8. T.T. Toomver, “Development of Inco’s Selective Reduction

Smelting process for Nickel Laterite Ores”, International

Laterite Symposium, D.J.I. Evans, R.S. Shoemaker, H.

Veltman, Eds., Society of Mining Engineers, New York, New

York, USA, 1979, 252-271.

9. M.D. Sopko, “The Exmibal Nickel Project”, International

Laterite Symposium, D.J.I. Evans, R.S. Shoemaker, H.

Veltman, Eds., Society of Mining Engineers, New York, New

York, USA, 1979, 272-291.

10. R. Musu and J.A.E. Bell, “P.T. Inco’s Indonesian Nickel

Project,” International Laterite Symposium, D.J.I. Evans,

R.S. Shoemaker, H. Veltman, Eds., Society of Mining

Engineers, New York, New York, USA, 1979, 300-322.

11. Indonesia. Ministry of Mines, Contract of Work Between

Republic of Indonesia and P.T. International Nickel

Indonesia, 27 July 1968.

12. Vale Inco internal report, P.T. International Nickel Indonesia

Soroako Nickel Project, August 1972.

13. Vale Inco internal report, Feasibility of PTI Expansion, April

1, 1975.

14. P.T. International Nickel Indonesia, 25 Years of Progress:

1968 - 25 July – 1993, PT Inco, Jakarta, Indonesia, 1993.

15. A.D. Dalvi and J.D. Guiry, “P.T. Inco’s Indonesian Nickel

Project: An Update”, International Journal of Mineral

Processing, Vol. 19, No. 1-4, May 1987, 199-214.

16. A.D. Dalvi and Andre Daenuwy, “P.T. Inco Indonesia Recent

Development and Expansion,” Presented at World Metal and

Steel Conference, Bali Indonesia, February 26-27, 1991.

17. Vale Inco internal report, New Caledonia, History of Inco

Involvement in New Caledonia, 1973.

18. Vale Inco internal report, Goro Nickel Project, Bankable

Feasibility Study, “Project History and Current Status,”

26-31, 2001.

19. Vale Inco Limited Corporate Affairs, “Vale Inco Nouvelle-

Caledonie: Goro has a new name and a new Sustainable

Development pact securing its future”, The Exchange, Vale

Inco Limited, Toronto, Canada, Fall Winter 2009.

20. J. McNish, The Big Score, Doubleday Canada, Toronto, ON,

Canada, 1998.

21. Inco Limited Public Affairs, “Voisey’s Bay – it’s a deal!”,

Exchange, Inco Limited, Vol. 3, No. 5, Summer 2002.

22. Voisey’s Bay Nickel Company Limited, Nickel on the Big

Land: The Voisey’s Bay Development, Inco Limited, Toronto,

Canada, 2006.

23. Voisey’s Bay Nickel Company Limited, Voisey’s Bay

Mine/Mill Project Environmental Impact Statement:

Summary and Conclusions, Vol. 1, 1997.

24. J. Starke, Ed., Breaking New Ground: Mining, Minerals and

Sustainable Development: The Report of the MMSD Project,

Earthscan Publications Ltd, London, England, 2002.

25. S.W. Marcuson et al, “Sustainability in Nickel Projects: 50

Years of Experience at Vale Inco”, Pyrometallurgy of Nickel

and Cobalt 2009, J. Liu, J. Peacey, M. Barati et al Eds.,

Canadian Institute of Mining, Metallurgy and Petroleum,

Montreal, Canada, 2009, 641-658.

As featured in Womp 2009 Vol 10 - www.womp-int.com