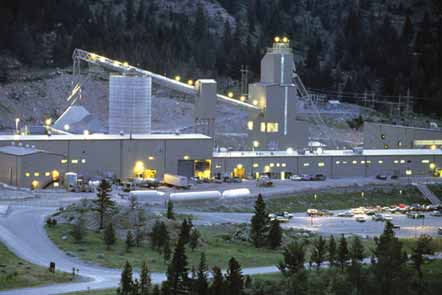

Stillwater Mining, which operates two

mines and a platinum group metals processing

complex in southern Montana, is

dealing with the fallout of a U.S.

Bankruptcy Court decision that allowed

General Motors to back out of a palladium

and rhodium supply agreement with

the company. Stillwater executives met

briefly with General Motors on August

13, 2009, but board Chairman and CEO

Francis R. McAllister said the meeting

did not yield any positive results for

Stillwater, its employees and other stakeholders,

or the communities in which it

operates.

Addressing the impact of the court

decision on Stillwater in the company’s

report of its second quarter 2009 results,

dated August 5, 2009, McAllister said,

“On July 7, 2009, General Motors filed a petition with the bankruptcy court seeking

approval to reject our executory supply

agreement with them. We filed an

objection with the court, but following a

hearing on July 22, 2009, the judge

approved the GM request, thereby effectively

voiding our supply contract with

GM.

“While we will still be able to sell the

metal that previously would have been

delivered to GM—there are well-established

terminal markets for platinum and

palladium that we access frequently—

going forward we will lose the benefit of

the floor prices in the GM supply agreement.

The financial effect of losing these

floor prices depends on what happens to

market prices for PGMs in the future, but

at price levels prevailing during the second

quarter, we estimate that the loss of

the floor prices will cost us in the range

of $5 million to $10 million per year.

“In view of our current liquidity position

and the progress we have made to

date in bringing down our cost structure,

I believe that we positioned ourselves to

reduce the full brunt of this financial setback.

Even without the GM filing, we

have recognized for some time now that

our automotive supply agreements have

finite life, and consequently we have

been trying to position the company for

viability after they expire. Our other

remaining automotive supply agreement

is with Ford Motor Co., which is scheduled

to expire at the end of 2010. While

the specific commercial terms of that

agreement are confidential, it also contains

floor and ceiling prices that have

been beneficial to the company during

periods of low PGM prices.

“Many of the steps we have taken to

restructure our operations are designed

to better position the company for the

period after these contracts have expired.

As a result, we are not badly positioned

for this unexpected early termination of

our GM contract. However, loss of the GM

agreement somewhat increases the company’s

vulnerability to a prolonged decline

in PGM market prices.”

Stillwater reported a net profit of $4.2

million for the

second quarter of

2009, down from

$16.3 million

during the second

quarter of

2008. Mine production

of palladium

increased

to 106,000 oz

during the quarter,

up from

97,000 oz a year

earlier, while

mine production

of platinum during

the quarter

increased to

32,000 oz from

29,000 oz.

As featured in Womp 2009 Vol 07 - www.womp-int.com