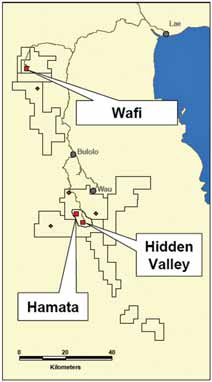

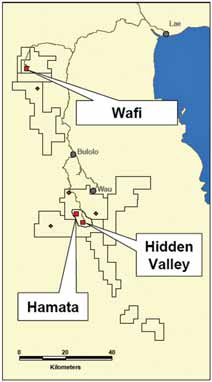

Map showing Harmony Gold’s Papua New Guinea

gold property locations

Newcrest, Harmony Partner to Develop PNG Gold Assets

The joint venture includes the Hidden Valley mining operation, the Wafi-Golpu gold/copper deposit, and 3,400 km2 of Harmony’s exploration leases in Morobe province, 300 km northeast of Port Moresby. Hidden Valley is a gold and silver project, expected to produce more than 250,000 oz/y gold and 3.6 million oz/y silver over a 14-year mine life, peaking at more than 300,000 oz/y gold in 2011.

In total, the PNG assets have a significant resource inventory, with a JORCcompliant resource base of approximately 31 million oz of contained gold equivalent. Current resources total 15.2 million oz gold, 90 million oz silver, 1.8 million metric tons (mt) copper, and 22,000 mt molybdenum.

Newcrest will earn its 50% interest in the new joint venture by contributing a maximum of $525 million. The commitment will be in two stages: an initial $180-million payment to acquire 30.01% interest by June 30, 2008, together with a reimbursement to Harmony of $45 million in project expenditure (Stage 1 Completion), and a farm-in commitment for the remaining 19.99% of approximately $300 million to fund project expenditure up to the commencement of mining operations at Hidden Valley. Newcrest will fund the deal from internal cash flows. Harmony and Newcrest will jointly operate the PNG assets from the date of Stage 1 Completion. As a 30.01% interest holder, during the earn-in period, Newcrest’s approval will be required for major decisions in the joint venture.

Harmony announced some time ago that it was evaluating strategic alliances with qualified companies that had relevant experience and resources to help develop and optimize the mining of the PNG assets. For Harmony, the creation of a joint venture facilitates significant capital investment into the PNG assets and substantially removes Harmony’s obligation to continue funding the development of these assets during the arm-in period.

Moreover, the two companies believe the introduction of Newcrest with significant technical skills, particularly in copper mining and bulk underground mining techniques including block caving will provide additional expertise to the existing Harmony team in PNG and will add to the development of the PNG assets. “The combination of Harmony and Newcrest in PNG creates a unique team with the right skills, relationships, and people to enhance the development of these assets,” said Graham Briggs, CEO, Harmony.

Newcrest’s CEO Ian Smith said the transaction provided Newcrest with the opportunity to enter a new and prospective mining province—one of the largest undeveloped gold resources in the Australasian region—alongside a respected partner with substantial experience in PNG. “The near-term production and cash flow from Hidden Valley, combined with the significant upside potential of Wafi-Golpu and the regional exploration leases make this portfolio of assets very attractive to Newcrest,” said Smith.