Coping with Success: PDAC Presenters Suggest

Methods for Managing Boom-Cycle Issues

Almost 18,000 people converged on Toronto, Canada, in early March

to attend the 75th International Convention, Trade Show and Investors Exchange

sponsored by the Prospectors & Developers Association of Canada. With the

current mining boom showing no signs of weakening, the prevailing attitude of

attendees and speakers was upbeat—but as with any thriving enterprise, success

can spawn problems that would be of little concern during mining’s periodic

down cycles.

For example, at the convention’s keynote session Frontier Strategy

Group Managing Director Alex Gorbansky discussed how to achieve, and maintain,

success in the face of increased nationalistic tendencies. According to Gorbansky,

today’s market environment has strong parallels to that of the 1970s, including

high commodity prices, uncertainty about new sources of supply, global economic

growth and mineral demand fueled by a new economic powerhouse—China (Japan

was the major catalyst in the 70s), and a global resurgence in the desire of countries

to gain greater control and economic benefits from their natural resources—an

approach commonly described as “resource nationalism.”

Gorbansky emphasized

that responding to resource nationalism is critical for industry growth and highlighted

the upside opportunities created by the trend. “While traditionally seen

as a downside risk, the cyclical nature of resource nationalism can provide companies

and investors with unique upside opportunities for growth,” he explained.

“Resource nationalism is not cause for despair, but rather, provides companies

and investors that respond strategically and proactively with access to new reserves

and opportunities to acquire assets not available to their competitors.

“The

character and nature of resource nationalism varies significantly and successful

firms will develop context-specific responses.” He described a framework

highlighting four types of resource nationalism: State Domination, Balanced State

Participation, Geopolitical Expediency, and Greater Economic Participation (see

accompanying table).

He outlined three strategies that companies can employ to

respond to resource nationalism: “New and creative partnerships that align

economic and political incentives between foreign investors and host governments

over the long-run, branding the company as a local national player versus a foreign

entity, and social development programs that have clear and measurable impacts

at the local and national levels.”

As an example of “incentive alignment,”

Gorbansky pointed to Rio Tinto’s effort to gain a foothold in Russia. To

accomplish this, Rio Tinto and Russian metals producer Norilsk created a joint

venture exploration company called RioNor; Norilsk owns a 51% stake and Rio Tinto

owns the minority share. The company is focused on exploration in the highly prospective

regions of southern Siberia and the Far East Federal district.

The arrangement

served to align the interests of both companies; i.e., no upfront financial commitment

was made by either party and most issues concerning ownership of discovered assets

were deferred. From Rio Tinto’s perspective, the JV represented a low-cost

way for the company to gain its desired foothold; while for Norilsk and the Russian

government, the JV provided capital and technical expertise to examine under-explored

regions with high economic potential. Rio Tinto, explained Gorbansky, was willing

to trade legal certainty for a limited up-front financial commitment because it

realized that paper agreements were unlikely to be respected anyway.

As another

example, BHP Billiton has successfully branded its South African operations as

local, rather than foreign, said Gorbansky. “Foreign mining firms operating

in South Africa have faced a number of challenges as black empowerment requirements

and increased resource nationalism has threatened to erode already shrinking profits.”

BHP Billiton is well-positioned to survive these challenges, he noted, by initiating

efforts aimed at “localizing” its operations. The BHPB Development

Trust funds scholarships, health programs and other highprofile projects that

make the benefits of the company’s presence clear to a broad cross-section

of the population. BHPB also has appointed South African executives to head its

local subsidiaries giving these companies a local face. And, the company has created

relationships with local companies to align their interests with BHPB’s;

for example, BHPB’s energy- coal operations are the largest supplier of

coal to South African utility Eskom.

Moving outside the mining sector, Gorbansky

named Exxon Mobil as an example of a company that has effectively dealt with resource

nationalism: “Exxon has successfully made Africa— where its operations

account for more than 1 million barrels of crude oil production per day—a

foundation of its growth, while avoiding the high-profile mishaps that have plagued

Shell and others through strategic social development programs and communications

strategies that clearly demonstrate Exxon’s positive economic and social

contributions to the places where it operates.” Exxon, which has discovered

more than 25% of its petroleum resources in Africa over the past eight years,

also has been the most successful at fending off strong competition from Chinese

firms in Angola, Nigeria and Chad, Gorbansky said.

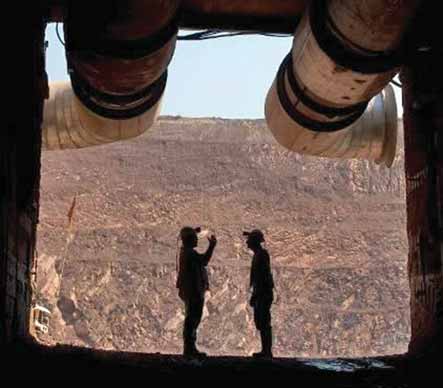

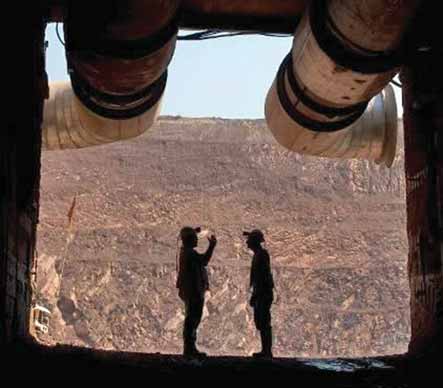

Anvil Mining’s Dikulushi copper mine in the Congo will go underground later this year.

Anvil Mining’s Dikulushi copper mine in the Congo will go underground later this year.

The $7-million project will initially

use sublevel caving to produce 20,000 mt/y Cu and

1.8 million oz/y Ag. Photo: Anvil Mining Ltd.

Increased risk of adverse political events

fueled by a nation’s perception of exploitation without adequate compensation

can be a major issue during periods of strong metals markets, and in no place

is this concern more evident than in the Democratic Republic of Congo. This central

African nation is struggling to regain stability after years of political upheaval

and civil war, and has made significant strides in that direction by implementing

a new mining code in 2003 and installing a democratic government. During the PDAC

conference a panel discussion involving four mining companies active in this area

highlighted the level of local involvement needed to build the trust and cooperation

necessary for successful long-term operations in the southern DRC/northern Zambia

region.

The four companies—Anvil Mining Ltd., Equinox Minerals Ltd., Katanga

Mining Ltd. and Tenke Mining Corp.—are at different stages of development

in projects scattered along the Central African Copper Belt, a highly mineralized

zone 400 km long and 50 km wide straddling the border of Zambia and DRC, estimated

to contain more than 200 million mt of copper metal.

Perth, Australia-based Anvil

Mining was an early entrant in this region, having commissioned the Dikulushi

openpit mine in October 2002. According to Bill Turner, president and CEO, Dikulushi

contains a high-grade resource base of 169,000 mt of contained Cu and the deposit

is open at depth. Average grade is 7.2% Cu with 6.7 oz/t Ag, while concentrate

grade is approximately 59% Cu and 1,700 g/t Ag. The surface mine was designed

to produce 20,000 mt/y of Cu and 1.6 million oz/y Ag, at a total capital cost

of about $17 million. Underground production at Dikulushi is slated to begin in

the third quarter of 2007, with an estimated minimum production life of six years.

Anvil also has three other copper belt projects: Its Kulu mine, in operation since

late 2005, is a joint venture with Gécamines to recover copper from 4.9

million mt of coarse rejects and tailings grading about 4.4% Cu. Under a lease

agreement with Gécamines, it has developed the Kinsevere copper/cobalt

project 27 km north of Lubumbashi, containing an estimated total resource of 1.6

million mt of Cu, and plans to commission the mine during the second quarter of

2007. It also is conducting an extensive exploration program under way on lands

surrounding the closed Mutoshi copper mine.

According to Turner, Anvil is “strongly

committed” to pursuing community engagement and improvement goals. Its 1,800-person

African workforce is 95% Congolese. The company has engaged Washington, D.C.-based

Pact and other international NGOs to design and implement a range of community

development activities, and under the mining convention Anvil signed with the

DRC government in 1998, earmarks 10% of its earnings— amounting to roughly

$3 million in 2006, slightly more expected in 2007— for community development

in the Dikulushi region. To date, Anvil has invested in a new school and teaching

staff at Dikulushi, an upgraded medical center at Kilwa, new water service at

Dikulushi and several other social initiatives.

London-based Katanga Mining is

rehabilitating a mine complex near Kolwezi in the DRC, comprising the Kamoto underground

mine and the openpit mines of Dikuluwe, Mashamba East and Mashamba West (together

known as DIMA) and Musonoie-T17. Ore will be processed in the Kamoto concentrator

and refined in the Luilu metallurgical plant. The mine site covers an area of

more than 15,000 hectares.

Katanga Mining President and CEO Arthur Ditto said

total reserves and resources at the company’s DRC properties now stand at

200 million mt ore. At an average copper grade of 3.29%, this equates to 6.58

million mt of Cu. Because exploration has not been carried since the early 1980s,

there is significant potential for new discoveries.

The company plans a phased,

$427- million rehabilitation project stretching over a period of four years. Once

fully operational, production will be 150,000 mt/y of copper and 5,000 mt/y of

cobalt. Total operational cost per pound of copper over the life of the project

is predicted to be $0.22. Production from the $80.3-million underground mine project

was scheduled to start in April 2007, with first copper produced in December.

The Kamoto concentrator is being refurbished at a cost of $55.2 million to handle

7.5 million mt/y ore, which will be sufficient capacity for all production phases,

and is scheduled for commissioning in July 2007. Concentrates from the mill will

be delivered via pipeline to a similarly renovated metallurgical plant at Luilu

that features separate copper and cobalt leach circuits, roasting facilities and

electrowinning tankhouses, and a new tailings facility. This plant, when commissioned

at an estimated capex cost of $150.1 million in September 2007, will be capable

of producing 175,000 mt/y copper and 8,000 mt/y cobalt.

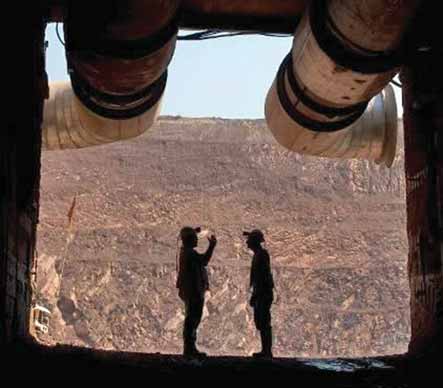

At Katanga Mining’s Kamoto project, the route for the

concentrate delivery pipeline has

At Katanga Mining’s Kamoto project, the route for the

concentrate delivery pipeline has

been cleared and work is under

way to install pipes in anticipation of a September startup.

Photo: Kantanga

Mining Ltd.

Tenke Mining is partnered with U.S. copper producer

Phelps Dodge in development of the Tenke Fungurume project located in DRC (E&MJ,

January/February 2007, p. 4), one of the world’s largest, highest grade

undeveloped copper-cobalt deposits.

During mine operations, a special social development

fund has been committed by the project whereby 0.3% of net sales revenue will

provide annual funding to local and regional social development projects. This

fund and its projects will be managed by a board of trustees with involvement

by the operator, community leaders, local government authorities and specialist

program advisors. Current social development programs are aimed at improving living

conditions for the communities within the Tenke Fungurume mineral concessions.

These programs are also being managed by Pact, which in turn supervises specialist

NGO’s administering the projects.